Part One Open to ITEM NO.7 the Public

advertisement

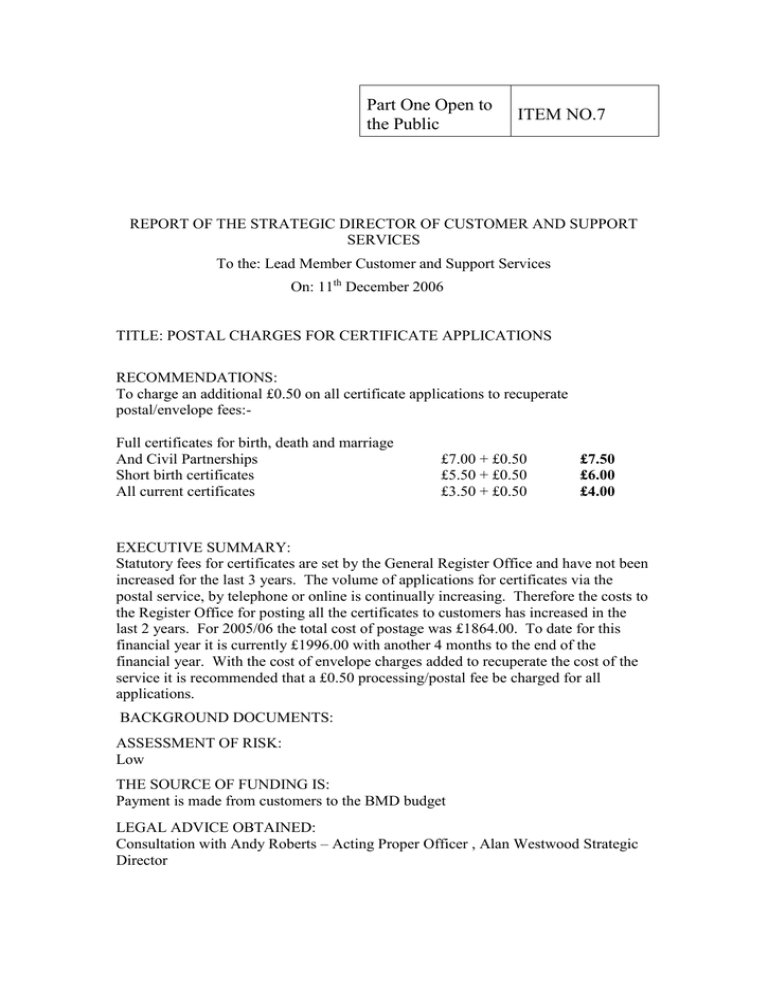

Part One Open to the Public ITEM NO.7 REPORT OF THE STRATEGIC DIRECTOR OF CUSTOMER AND SUPPORT SERVICES To the: Lead Member Customer and Support Services On: 11th December 2006 TITLE: POSTAL CHARGES FOR CERTIFICATE APPLICATIONS RECOMMENDATIONS: To charge an additional £0.50 on all certificate applications to recuperate postal/envelope fees:Full certificates for birth, death and marriage And Civil Partnerships Short birth certificates All current certificates £7.00 + £0.50 £5.50 + £0.50 £3.50 + £0.50 £7.50 £6.00 £4.00 EXECUTIVE SUMMARY: Statutory fees for certificates are set by the General Register Office and have not been increased for the last 3 years. The volume of applications for certificates via the postal service, by telephone or online is continually increasing. Therefore the costs to the Register Office for posting all the certificates to customers has increased in the last 2 years. For 2005/06 the total cost of postage was £1864.00. To date for this financial year it is currently £1996.00 with another 4 months to the end of the financial year. With the cost of envelope charges added to recuperate the cost of the service it is recommended that a £0.50 processing/postal fee be charged for all applications. BACKGROUND DOCUMENTS: ASSESSMENT OF RISK: Low THE SOURCE OF FUNDING IS: Payment is made from customers to the BMD budget LEGAL ADVICE OBTAINED: Consultation with Andy Roberts – Acting Proper Officer , Alan Westwood Strategic Director FINANCIAL ADVICE OBTAINED: CONTACT OFFICER: Rebecca Wardley WARD(S) TO WHICH REPORT RELATES: All KEY COUNCIL POLICIES: DETAILS: During the last financial year – April 2005 to March 2006, and from April 2006 to September 2006 the following applications were processed where additional postal costs were incurred by the Registration Service. April 2005 to March 2006 TYPE OF APPLICATION NUMBER OF APPLICATIONS Postal 3079 Online 725 Telephone Payments 2355 April 2006 to September 2006 TYPE OF APPLICATION NUMBER OF APPLICATIONS Postal 1691 Online 535 Telephone Payments 1355 The table above demonstrates the preferred method of our customers is increasing towards telephone payments as this is seen as a speedier and easier system to use. . As the target for issuing certificates applied for by telephone or on line is one working day from receipt of the application form by the Register Office, and within 2 working days for postal applications (although these are usually processed within one day) an extra fee could be charged for postal/administration processes to reflect these targets. As Royal Mail have now increased their postal charges based on weight and size of envelope, it makes sense that now we are incurring extra costs on postage that this too should be added to the cost of the certificates. Many customers apply for more than one certificate at any given time, and therefore the postal fees to return the applications are increasing. It is therefore recommended that an extra £0.50 be added to all applications. Should these increases be introduced the extra revenue generated by the service would have been £3079.50 in 05/06 and £1790.50 for the first 6 months of this year (see below): TYPE OF APPLICATION Postal Online Telephone Payments Total Revenue Generated April 2005 to March 2006 NO. OF APPLICATIONS 3079 725 2355 EXTRA REVENUE £1539.50 £362.50 £1177.50 £3079.50 April 2006 to September 2006 TYPE OF APPLICATION NO. OF APPLICATIONS EXTRA REVENUE Postal 1691 £845.50 Online 535 £267.50 Telephone Payments 1355 £677.50 Total Revenue Generated £1790.50 The Register Office is a public service which generates income for the local authority. As other Registration Districts and public services within the private sector charge administration fees for various processes, it is an opportunity for Salford to increase their revenue, whilst still offering a highly efficient turn around on certificate applications. Experience has shown that customers are willing to pay a small additional fee if they receive a high standard of service and Salford has an excellent reputation for issuing certificates within its exacting targets compared to other districts who have a much slower turn around. The increased revenue will add to savings required by the Local Authority, and it is therefore recommended that this be introduced at the beginning of the next financial year for accounting purposes i.e. April 2007.