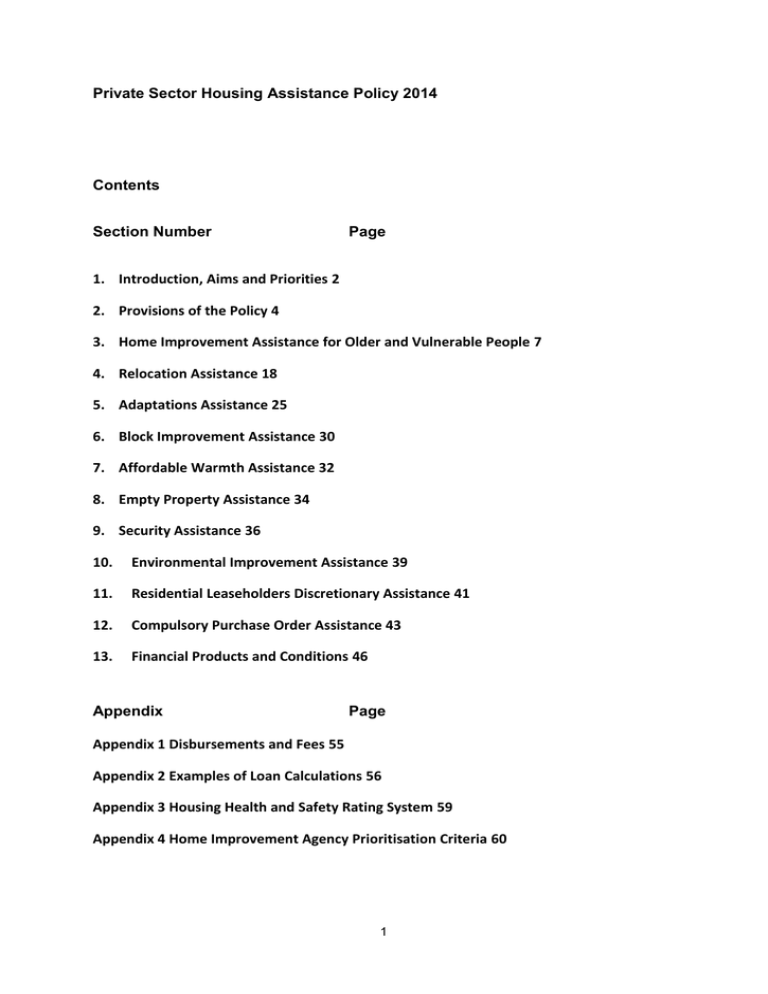

Private Sector Housing Assistance Policy 2014 Contents Section Number

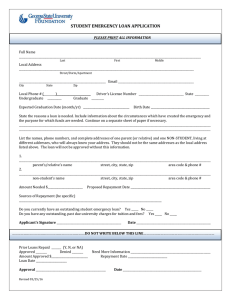

advertisement