Relevance of Competition Reforms for Development in Africa

advertisement

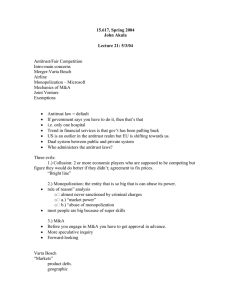

Relevance of Competition Reforms for Development in Africa Presentation by R.Shyam Khemani MiCRA, Washington, D.C. USA Conference on Strengthening Constituencies for Effective Competition Regimes in Selected West African Countries CUTS-7UP4 Project 6-7 August 2010 Dakar, Senegal 1 Some Case Examples of AntiCompetitive Situations • Fishermen and Fish Processors-Tanzania • Fertilizers-Ethiopia • Poultry Farmers and Poultry ProcessorsTunisia • Cement Firms/Sellers-Egypt (and Other Countries) • Trucking and Cut Flower Exporters-Morocco 2 Why Competition? • Competition , broadly defined, refers to rivalry between different businesses for the patronage and purchases by customers. • Businesses engage in rivalry (i.e. ‘compete’ independently) against each other mainly in terms of prices, quality, service, and innovation. • The ‘process of competition’ pressures business to offer customers a wide selection goods and services at lowest possible prices and highest quality. However….benefits of competition are broader than simply lower prices, lower costs, higher quality, wider selection, and innovative products……. 3 Broader Benefits of Competition Competition…and effective laws, institutions and policies that maintain, protect and promote competition foster: • Better corporate, market and public governance. • Promote greater accountability and transparency in business behavior, and government –business relations. • Reduce opportunities for bribery, corruption and rentseeking behavior. • Result in entrepreneurship, risk-taking, entry of new and expansion of existing businesses, increased employment, productivity, competitiveness, broad-based and shared economic development…… Given all these benefits…why is competition lacking in many African and other developing (and also many developed) economies?? 4 Commonly Observed Economic Characteristics in Developing Economies • • • • • • High levels of ownership concentration ‘Missing middle’ sized firms Conglomeration Lack of ‘Market for Corporate Control’ Under-developed equity-debt markets Close government-business relationsconnections…and vested interest groups. • High levels of product (&financial) market concentration. • These factors tend to self re-enforce each other. Plus …lack of political will. 5 The Process of Competition Needs to Be Safeguarded and Sustained • The Competitive Process is Not Automatic. • Competition Can Be Distorted By Restrictive Business Practices and Public Policies. • Public Policy Often Manipulated by Interest Groups Including Private Sector. • Misguided Policies Entrench Anticompetitive Business Practices, and • Discourage Both Domestic and Foreign Investment. 6 Why Competition Policy ? Competition policy is a set of measures by government which protect and promote the process of competition by: (i) Preventing restrictive business practices which artificially restrict supply and raise prices of goods and services, and (ii) Reduce or eliminate unnecessary regulations and government policies which adversely affect the competitive process and raise the cost of doing business. Competition policy generally consists of (a) Competition (Antitrust or Antimonopoly) Law and (b) Regulatory reform measures e.g. trade and investment 7 liberalization, economic de-regulation, etc. Competition Law • 116+ countries and jurisdictions have enacted competition law • Majority of the countries are developing and emerging market economies—most enacted such laws since 1995 • Driven by failure of government ‘interventionist’ policies, planning, deficits, etc. • Competition policy—is/and should not be a matter of ideology 8 Impact of Competition (Antitrust ) Law & Policy • Distinction Between Systemic vs. Industry/Case Specific Impact. • Removing Public Policy Restraints: Tariffs & Non-Tariff Barriers to Trade, Restrictions on Ownership-Investment, Leveling the Field Between State-Owned and Private Sector Enterprises and Other Such Policies Systemic Impact. • Competition (Antitrust) Law--Case by Case Application Against Anticompetitive Business Practices Firm/Industry Impact. • Complementary Buttress Each Other. 9 Figure 1 Figure 1 Competition, Entry and Economic Growth 15 GDP growth rate GDP per capita (USD) 40000 20000 10 5 0 -5 4 5 competition 6 7 3 4 5 competition 6 7 15 40000 GDP growth rate GDP per capita (USD) 3 30000 10 20000 10000 5 0 0 -5 4 4.5 5 entry 5.5 6 4 4.5 5 entry 5.5 6 Source: World Economic Forum and World Bank SIMA Indicators. “Competition” is the average response in each country to the question “In most industries, competition in the local market is (1=limited and price-cutting is rare, 7=intense and market leadership changes over time).” “Entry” is the average response to the question “Entry of new competitors (1=almost never occurs in the local market, 7=is common in the local market).” 10 Figure 2 Per Capita GDP (constant 2000 USD in thousands) and Intensity of Competition in Local Markets High 40 IDA Countries Non-IDA countries 35 30 GDP Per Capita 25 20 15 10 5 Low 0 Low Intensity Intensity of Local Markets Competition High Intensity Source: Global Competitiveness Report 2006-2007 and World Bank DDP, 2005 11 Figure 3 Effectiveness of Competition (Antitrust) Law- Policy and the Extent of Market Dominance High Dominance Non-IDA countries Extent of Market Dominance IDA Low Dominance Low Effectiveness Effectiveness of Competition (Antitrust) Law-Policy High Effectiveness Source: Global Competitiveness Report 2006-2007 12 Figure 4 Business Competitiveness Index and Effectiveness of Competition (Antitrust) Law-Policy Business Competitiveness Index High Low IDA Effectiveness of Competition (Antitrust) Law-Policy Low Effectiveness Non-IDA countries High Effectiveness Source: Global Competitiveness Report 2006-2007 13 Figure 5 Intensity of Local Markets Competition and Effectiveness of Competition (Antitrust) Law- Policy IDA Non-IDA countries Intensity of Local Markets Competition High Low Low Effectiveness Effectiveness of Competition (Antitrust) Law-Policy High Effectiveness Source: Global Competitiveness Report 2006-2007 14 Procedures, Time and Costs of Entry Country Name ( Ease of Doing Business Rank) Number of Procedures Time Cost (% of GNI per capita) Canada (8) 1 5 0.4% France (31) 5 7 0.9% Germany (25) 9 18 4.7% Japan (15) 8 23 7.5% Korea (19) 8 14 14.7% New Zealand (2) 1 1 0.4% United States (4) 6 6 0.7% Botswana (83) 10 61 2.1% Burkina -Faso (115) 4 14 50.3% Gambia (140) 8 27 215.1% Ghana (92) 8 33 26.4% Kenya (95) 12 34 36.5% Nigeria (125) 9 17 76.7% (157) 4 8 63.7 (34) 6 22 5.9% Senegal South Africa 15 Figure 6 High entry costs inhibit FDI inflows Partial correlations controlling for High entry costs inhibit FDI inflows Partial correlations controlling for market size, human capital, macroeconomic market size, human stability capital, macroeconomic stability FDI FDI 3 -2 2 3 1 2 0 -2 -1 -1 -1 0 1 -2 0 -3 -4 Source: DECRG, World Bank 1 -1 0 2 3 1 2 3 -2 Costs Entry -3 -4 Entry Costs Source: DECRG, World Bank 16 Concluding Remarks • Effective competition law and policy benefits both individual consumers and business • It will improve domestic and international competitiveness, broaden participation in the economy, and alleviate poverty • Create opportunities for entry and expansion of SMEs, investment, Technological Change • Foster greater accountability and transparency in government-business relations, reduce opportunities for corruption and bribery, lobbying… 17