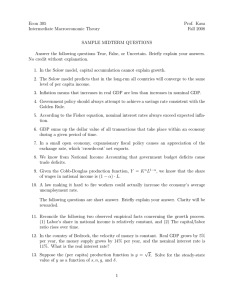

Rational expectations theory suggests that people

advertisement

Rational expectations theory suggests that people (A)do not estimate future inflation rates because it is impossible to do so (B)believe that current inflation should be the same as last year’s (C)assume that current inflation will be the same for next year (D)use all available information in forming their expectations about future inflation (E)assume that current inflation will be equal to the average inflation of the past decade If wages and prices are perfectly flexible and inflation is correctly anticipated, then an expansionary monetary policy will affect the real output and price level in which of the following ways? (A)Real Output = Increase ; Price Level = Increase (B)Real Output = Increase ; Price Level = Decrease (C)Real Output = Increase ; Price Level = Not change (D)Real Output = Not change ; Price Level = Increase (E)Real Output = Not change ; Price Level = Not change An increase in inflationary expectations will most likely affect nominal interest rates and bond prices in which of the following ways in the short run? (A)Nominal Interest Rate = Increase ; Bond Prices = No change (B)Nominal Interest Rate = Increase ; Bond Prices = Decrease (C)Nominal Interest Rate = No change ; Bond Prices = Increase (D)Nominal Interest Rate = Decrease ; Bond Prices = Increase (E)Nominal Interest Rate = Decrease ; Bond Prices = Decrease A simultaneous increase in inflation and unemployment could be explained by an increase in which of the following? (A)Consumer spending (B)The money supply (C)Labor productivity (D)Investment spending (E)Inflationary expectations If economic agents perfectly anticipate policy changes and if all prices, including wages, are completely flexible, which of the following will be true in the long run? (A)The price level will be constant. (B)There will be no trade-off between inflation and unemployment. (C)The unemployment rate will be less than the natural rate of unemployment. (D)The unemployment rate will be greater than the natural rate of unemployment. (E)Changes in the money supply will not lead to changes in the price level. When the Federal Reserve increases the money supply to stimulate aggregate demand, workers believe that this action will cause inflation in the future and ask for higher wages to offset the expected increase in inflation. This is an example of (A)adaptive expectations (B)rational expectations (C)the velocity of money (D)the real balance effect (E)the money multiplier Under rational expectations, an announced expansion in the money supply will change nominal and real gross domestic products (GDP) in which of the following ways? (A)Nominal GDP = Increase ; Real GDP = Increase (B)Nominal GDP = Increase ; Real GDP = Decrease (C)Nominal GDP = Increase ; Real GDP = No change (D)Nominal GDP = No change ; Real GDP = Decrease (E)Nominal GDP = No change ; Real GDP = No change According to the theory of rational expectations, a fully anticipated expansionary monetary policy will (A)increase potential output (B)increase unemployment (C)have no impact on real output (D)promote the production of consumer goods over capital goods (E)result in deflation