Document 15965707

advertisement

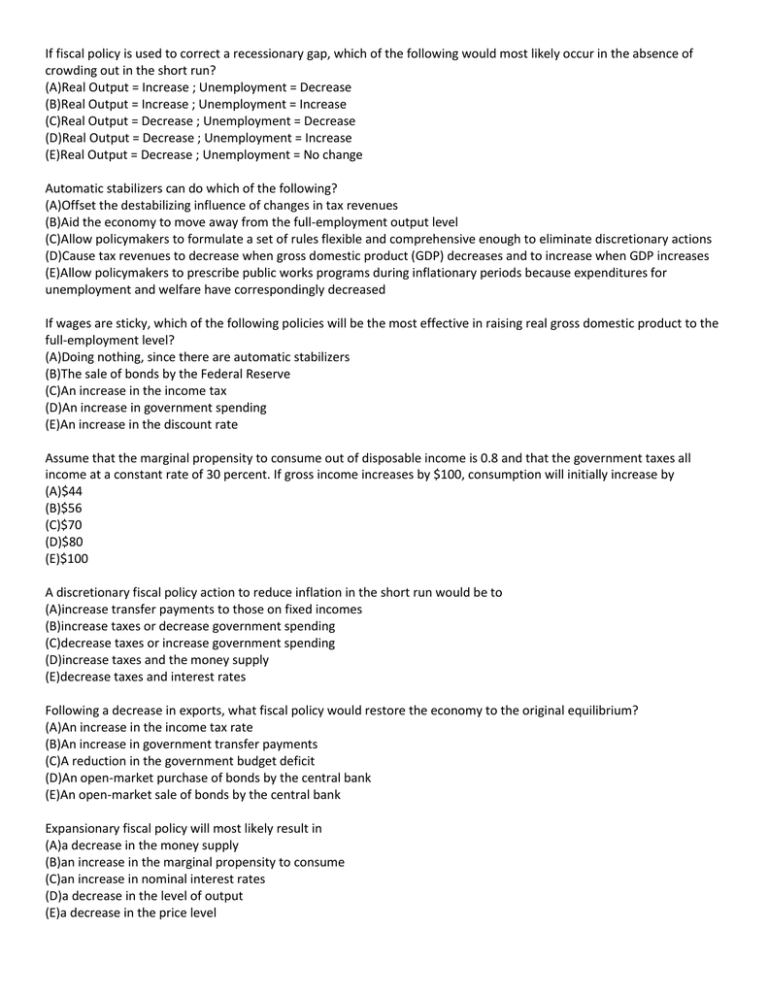

If fiscal policy is used to correct a recessionary gap, which of the following would most likely occur in the absence of crowding out in the short run? (A)Real Output = Increase ; Unemployment = Decrease (B)Real Output = Increase ; Unemployment = Increase (C)Real Output = Decrease ; Unemployment = Decrease (D)Real Output = Decrease ; Unemployment = Increase (E)Real Output = Decrease ; Unemployment = No change Automatic stabilizers can do which of the following? (A)Offset the destabilizing influence of changes in tax revenues (B)Aid the economy to move away from the full-employment output level (C)Allow policymakers to formulate a set of rules flexible and comprehensive enough to eliminate discretionary actions (D)Cause tax revenues to decrease when gross domestic product (GDP) decreases and to increase when GDP increases (E)Allow policymakers to prescribe public works programs during inflationary periods because expenditures for unemployment and welfare have correspondingly decreased If wages are sticky, which of the following policies will be the most effective in raising real gross domestic product to the full-employment level? (A)Doing nothing, since there are automatic stabilizers (B)The sale of bonds by the Federal Reserve (C)An increase in the income tax (D)An increase in government spending (E)An increase in the discount rate Assume that the marginal propensity to consume out of disposable income is 0.8 and that the government taxes all income at a constant rate of 30 percent. If gross income increases by $100, consumption will initially increase by (A)$44 (B)$56 (C)$70 (D)$80 (E)$100 A discretionary fiscal policy action to reduce inflation in the short run would be to (A)increase transfer payments to those on fixed incomes (B)increase taxes or decrease government spending (C)decrease taxes or increase government spending (D)increase taxes and the money supply (E)decrease taxes and interest rates Following a decrease in exports, what fiscal policy would restore the economy to the original equilibrium? (A)An increase in the income tax rate (B)An increase in government transfer payments (C)A reduction in the government budget deficit (D)An open-market purchase of bonds by the central bank (E)An open-market sale of bonds by the central bank Expansionary fiscal policy will most likely result in (A)a decrease in the money supply (B)an increase in the marginal propensity to consume (C)an increase in nominal interest rates (D)a decrease in the level of output (E)a decrease in the price level Which of the following combinations of changes in government spending and taxes is necessarily expansionary? (A)Government Spending = Increase ; Taxes = Increase (B)Government Spending = Increase ; Taxes = Decrease (C)Government Spending = Decrease ; Taxes = Not change (D)Government Spending = Decrease ; Taxes = Increase (E)Government Spending = Decrease ; Taxes = Decrease Which of the following is an example of fiscal policy? (A)Increasing government expenditures to build highways (B)Increasing the money supply to increase income (C)Decreasing the discount rate to lower unemployment and inflation (D)Decreasing the federal funds rate to stimulate investment (E)Decreasing the reserve ratio to increase bank reserves If the economy was in a severe recession, the most expansionary fiscal policy would be to (A)decrease both personal income taxes and government spending by equal amounts (B)decrease both the reserve requirement and government spending by the same proportion (C)decrease personal income taxes and increase government spending by equal amounts (D)increase the money supply and increase government spending by the same proportion (E)increase social security taxes and increase government spending by equal amounts An appropriate fiscal policy to combat a recession would be to increase which of the following? (A)Interest rates (B)The money supply (C)Taxes (D)Government spending (E)The sales of government bonds Which of the following can be expected to cause an increase in gross domestic product in the short run? (A)An increase in the tax rate (B)An increase in the interest rate (C)Equal increases in both imports and exports (D)Equal increases in both taxes and government expenditures (E)Equal decreases in both investment and government expenditures A major advantage of automatic stabilizers in fiscal policy is that they (A)reduce the public debt (B)increase the possibility of a balanced budget (C)stabilize the unemployment rate (D)go into effect without passage of new legislation (E)automatically reduce the inflation rate In the short run, a restrictive fiscal policy will cause aggregate demand, output, and the price level to change in which of the following ways? (A)Aggregate Demand = Decrease ; Output = Decrease ; Price Level = Decrease (B)Aggregate Demand = Decrease ; Output = Increase ; Price Level = Increase (C)Aggregate Demand = Increase ; Output = Decrease ; Price Level = Decrease (D)Aggregate Demand = Increase ; Output = Increase ; Price Level = Increase (E)Aggregate Demand = Not change ; Output = Not change ; Price Level = Not change