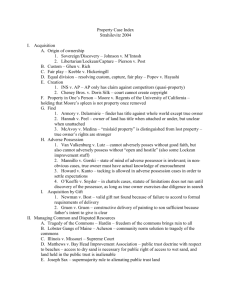

Overall Themes: 1. The Law, Social Institutions and Policy:

advertisement