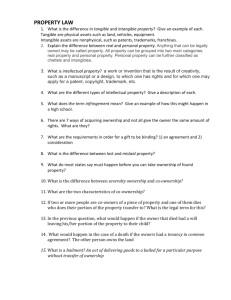

PROPERTY OUTLINE

advertisement