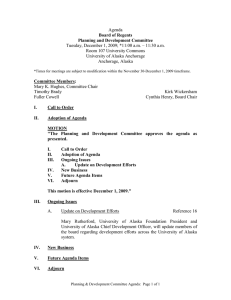

Alaska Permanent Fund Dividends: Basic Income from “the People’s Portfolio”

Alaska Permanent Fund Dividends:

Basic Income from

“the People’s Portfolio”

Voz Alternativa, Mexico City, 6 November 2007

Steve Colt

Institute of Social and Economic Research

University of Alaska Anchorage

Outline

Introduction to Alaska

History of the Alaska Permanent Fund and the dividend program

Economic importance of the dividend

Looking ahead

Introduction to Alaska

Alaska population = 670,000

Source: U.S. Census, Alaska Dept. of Labor.

July 1, 2006 estimates.

Subsistence

Remains a Vital Part of the

Economy

Total subsistence harvests about 25 million kilos

In some places, people consume 250 kilos of wild foods per person

Size of the Alaska Economy year 2005

Gross state product $39 billion

Personal income $25 billion

Employment 437,000

Retail sales $7.4 billion

U.S. Bureau of Economic Analysis, U.S. Census

Sources of personal income

everything else: about one-third petroleum and petroleum $$: about one-third federal spending: about one-third

rest of economy

Petroleum oil production oil revenues permanent fund dividends

ISER analysis of sources of personal income, year 2000

Federal government spending rest of economy civilian military

ISER analysis of sources of personal income, year 2000

personal assets /

"mailbox economy" air cargo tourism timber mining fish

Everything else rest of economy

ISER analysis of sources of personal income, year 2000

Resource booms have fueled growth and migration

Salmon

Gold

Pulses of migration shown in yellow

WW2 / Military

Pipeline

Oil money

History of Permanent Fund and

Dividend

1968

– Prudhoe Bay oilfield discovery: 9.6 billion barrels.

– Alaska population = 300,000

– State budget is very small ($100 million = $300 per person)

Alaska constitution Article VIII:

– The legislature shall provide for the utilization, development, and conservation of all natural resources belonging to the State, including land and waters, for the maximum benefit of its people.

Alaska oil is a one-time source of wealth

2,500,000

2,000,000

1,500,000

Oil Production 1969 - 2022

NPRA

Other NS

Northstar

Colville R

Badami

Duck Island

GPMcIntyre

Milne Pt

KRU.IPA+Sat

PBU.IPA+Sat

Cook Inlet

1,000,000

Prudhoe Bay Kuparuk

500,000

0

1969 1974 1979 1984 1989 1994 1999 2004 2009 2014 2019

Source: Alaska Department of Natural Resources

Year

history...

1969

– Prudhoe Bay lease sale provides $900 million in lease bonus payments to the State

Treasury.

– Economist Dr. Arlon Tussing proposes to give the money directly to individuals

1970

– New revenues lead to many new state programs – many feel money is wasted

– First bill to establish a Permanent Fund introduced in the Legislature.

history...

1973

– Oil price increases from $3 to $16 per barrel

– Pipeline construction begins

1976

– Alaska Permanent Fund created by people of

Alaska (constitutional amendment)

Article 9: Section 15. Alaska Permanent Fund.

At least twenty-five percent of all mineral lease rentals, royalties, royalty sale proceeds, federal mineral revenue sharing payments and bonuses received by the

State shall be placed in a permanent fund, the principal of which shall be used only for those income-producing investments specifically designated by law as eligible for permanent fund investments. All income from the permanent fund shall be deposited in the general fund unless otherwise provided by law [Effective February 21, 1977].

history...

1977

– Oil production begins and first deposits are made into the Permanent Fund

– Four years of debate begins about whether the Permanent Fund should be managed as a public trust or as an economic development bank.

– In 1980, the Fund is established as a public trust -- to maximize cash income

History of Dividend

1976 – Dividends were mentioned by some legislators when the fund was created

1977 – Poll: people do not like dividends

– Only 15% of people strongly in favor

– 50% of people are strongly opposed

– People in rural Alaska are more in favor than people in cities

history of dividend

1980

– Governor Jay Hammond is the main supporter of dividends ;

– First dividend law makes the size of dividend depend on years of residency

– U.S. Supreme Court says “no!”

1982

– New dividend law passed with equal annual dividends for everyone

– One-year residency requirement

– No changes since then!

Dividend formula

One-half of the average realized earnings from the previous 5 years

Realized earnings to be calculated based on “generally accepted accounting principles”

See:

– http://www.apfc.org/fundlaw/Incomelaw.cfm

Permanent Fund balance

(billions of dollars)

45

40

35

30

25

20

15

10

5

0

19

78

19

80

19

82

19

84

19

86

19

88

19

90

19

92

19

94

19

96

19

98

20

00

20

02

20

04

20

06

1

N ov

20

07

Fund wealth per person

(dollars)

50,000

45,000

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

0

$180,000 for a family of four

19

80

19

82

19

84

19

86

19

88

19

90

19

92

19

94

19

96

19

98

20

00

20

02

20

04

20

06

5

4

3

7

6

-2

-3

0

-1

2

1

Components of change in fund balance

(billions of dollars) other change dividends special deposits oil revenue required oil revenue

$2,500

Annual dividend amounts adjusted for inflation – year 2006 dollars

$2,000

$1,500

$1,000

$500

$0

1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006

Dividend as a percentage of per capita personal income

Average = 4% of per capita personal income

4%

3%

2%

1%

0%

7%

6%

5%

1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006

Remote Alaska is Different

Northwest

Arctic

Interior

Southwest

Southcentral

Southeast

Unemployment is higher

Alaska DOLWD

Monthly wages are lower

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

0

Wade

Hampton

Bethel Yukon-

Koyukuk

Anchorage

Year 2005 average monthly wages in covered employment, Alaska DOLWD

Costs are much higher

Electricity from diesel:

25 – 50 cents per kWh

Gasoline:

$6.00 - $8.00 per gallon

Running water

– is not available in many homes

Importance of dividend in remote rural Alaska

Per capita income can be $5,000 -

$8,000

For these families, dividends = 20% –

40% of cash income

Dividends are used as an input to subsistence work

(fuel, firearms)

Alaska has low inequality

G ini coefficients

(

0 = complete equality

100 = complete inequality)

Mexico 54.6

Alaska 41 without dividends

Alaska 38.0 with dividends

(based on household income)

Alaska estimated by author from US Census

American Community Survey 2004 – household income

UN Human Development Report 2005 Chap 2 – per capita income

Other forms of social income in

Alaska

Alaska Native corporations

– formed after 1971 land settlement

– received $1 billion (= $2.5 billion today)

– received 18 million hectares of land

– Have produced very small dividends compared to Permanent Fund

– Many have created their own trust funds similar to Alaska Permanent Fund

Other forms of social income in Alaska

Community development quotas (“CDQ”)

– shares of the pollock fish catch were given by the U.S. federal government to 65 communities near the ocean

– They can catch the fish or sell the rights

– In 2003, the value of these permits held by the community groups was $250 million

– CDQ groups do not pay dividends

– http://www.dced.state.ak.us/bsc/CDQ/cdq.htm

Looking ahead:

Predictions are hard – especially about the future

Dividend program will continue everyone is treated equally the money belongs to the people, not the government

There is plenty of additional oil money for “government,” at the moment

Previous attempts to create an education fund failed

John Locke

However, oil money will not last forever

Government should provide:

– education

– health care

– public safety

Dividends do not accomplish this

There is no income tax in Alaska, no VAT, no sales tax

Jean-Jacques Rousseau

What is the social contract?

More information

Alaska Permanent Fund Corporation

– www.apfc.org

Institute of Social and Economic

Research, University of Alaska

– www.iser.uaa.alaska.edu

– steve.colt@uaa.alaska.edu

Thank you for listening!

www.iser.uaa.alaska.edu