EX-TYCO OFFICERS GET 8 TO 25 YEARS

advertisement

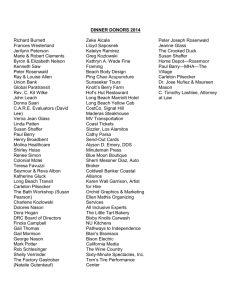

EX-TYCO OFFICERS GET 8 TO 25 YEARS By ANDREW ROSS SORKIN; JENNIFER BAYOT CONTRIBUTED REPORTING FOR THIS ARTICLE. (NYT) 1757 words Published: September 20, 2005 L. Dennis Kozlowski, the former chief executive of Tyco International who was convicted of looting the company of $150 million, was sentenced yesterday to 81/3 to 25 years in a New York State prison, the latest corporate figure to be handed a lengthy prison term in a corruption case. Mark H. Swartz, his chief lieutenant, received the same sentence for his role in the thefts and fraud. The two men were convicted in June after a four-month retrial. Judge Michael J. Obus of State Supreme Court in Manhattan also ordered Mr. Kozlowski to pay $167 million in restitution and fines. Mr. Swartz was ordered to pay $72 million in fines and restitution. The sentencing follows a parade of other substantial terms imposed on former chief executives convicted of white-collar crimes, most notably Bernard J. Ebbers of WorldCom, who received a prison term of 25 years, and John J. Rigas of the cable operator Adelphia Communications, who was sentenced to 15 years. Those sentences -in federal courts -- were seen as sending a message to deter huge corporate frauds in the future. The Tyco sentencing may be the last high-profile corporate misconduct before the most prominent one of them all: the trial next year of Kenneth L. Lay and Jeffrey K. Skilling of Enron. Handing down the sentence in a packed courtroom, Judge Obus said yesterday: ''The crimes at issue here were violations of the defendants' positions of trust and their fiduciary duty on a grand scale. They caused damage to Tyco and to others, including the shareholders who are Tyco's owners and who, like the investing public, generally should be able to rely on the integrity of the management of publicly traded companies.'' Mr. Kozlowski, 58, became a symbol of corporate greed for a $6,000 shower curtain, as well as a $2 million birthday party in Sardinia for his wife that was partly paid for by the company. He stared straight ahead, overwhelmed, as the sentence was read aloud. Mr. Swartz, 45, looked down at the floor. The two men, both dressed in gray suits and starched-white shirts, were then handcuffed behind their backs and led away by court officers. Mr. Swartz wistfully winked at his wife and parents. Mr. Kozlowski's wife, wearing sunglasses, wiped away tears that had run down her face as his two daughters, also crying, consoled each other. Lawyers for Mr. Kozlowski and Mr. Swartz said they planned to seek bail pending appeal from an appellate court today or tomorrow. The two men spent last night in the Bernard 1 B. Kerik Complex near the courthouse. If their lawyers are unsuccessful, the two men will be transferred to Rikers Island by the end of the week to be processed and will most likely serve their time in a maximum-security state prison like Attica. The State Department of Correctional Services will determine where they serve their time. Other former executives recently convicted in federal courts -- including Mr. Ebbers -- remain free pending their appeals. Most legal specialists said yesterday that the sentence imposed by Judge Obus on Mr. Kozlowski and Mr. Swartz was measured but fair. ''It would be a mistake to confuse this with leniency,'' said Robert A. Mintz, a former federal prosecutor and now a partner at McCarter & English. ''For these two former executives, even several years in a state prison will be a very long stretch of time.'' The two men will be eligible for parole after eight years and four months, and could be put in a work-release program after serving at least six years, according to State Department of Correctional Services guidelines. Still, they may yet fare worse than their white-collar counterparts in federal prisons because New York generally requires that criminals with sentences longer than six years go to maximum-security prisons, to be mixed among men convicted of murder and other violent crimes. An assistant Manhattan district attorney, Owen E. Heimer, had asked the judge to impose the maximum of 15 to 30 years, contending that Mr. Kozlowski ''should not be shown any leniency,'' as Mr. Heimer compared Tyco to Enron. In perhaps the most dramatic moment of the hearing, Mr. Heimer read aloud from a letter Mr. Kozlowski had written in 1995 to a Houston judge overseeing the sentencing of a Tyco employee who had been convicted of stealing from the company; Mr. Kozlowski urged that a maximum sentence be imposed. Mr. Heimer said of Mr. Kozlowski, ''What the defendant said on that occasion applies on this occasion.'' But Judge Obus rejected the harshest sentence and explicitly tried to distance this case from corporate corruption cases against executives at Enron and WorldCom. Unlike Tyco, a conglomerate whose products include security systems and medical devices, those two companies were forced to file for bankruptcy as a result of the accounting frauds. ''It is worth repeating, as the jury panel was instructed at the outset, that this is not about any other case,'' Judge Obus said. ''This is not a matter in which the fraudulent distortion of the records reflecting the financial health of the company have been shown to have been so distorted as to precipitate the company's collapse. That apparently is some other case, perhaps more than one other case, but that is not the case that was before us here.'' 2 Before being sentenced, Mr. Kozlowski asked the judge for mercy, pointing to more than 130 letters submitted on his behalf by friends and family. In explaining why he did not give the maximum sentence, Judge Obus cited the letters and said: ''I think the letters are genuinely sincere and they show aspects of the defendants' lives that are at odds with the conduct which has brought them before this court. They certainly make it all the more difficult to fully grasp, even with hindsight, how the defendants, with all they had going for them, managed to get themselves into this disastrous position, but that is what they have done.'' While the two men's sentences are lower than Mr. Ebbers's, they are still much higher than those of many of the high-profile executives convicted of white-collar crimes in the 1980's. Michael R. Milken of Drexel Burnham Lambert, for instance, was sentenced to three and a half years and served less than two years for securities fraud. ''The concern that too many executives were misbehaving has caused prosecutors and judges to want to send a much stronger warning signal than they felt the need to send before,'' said Jennifer H. Arlen, a law professor and expert in business crime at New York University. Mr. Kozlowski still faces charges of evading more than $1 million in state sales taxes on artwork. Judge Obus scheduled a hearing for Oct. 21. It is unclear whether prosecutors will continue to pursue that case. The men also face a barrage of civil suits, claiming billions of dollars in damages, from Tyco and shareholders. The men made hundreds of millions of dollars while at Tyco, but it is unclear how much money either Mr. Kozlowski and Mr. Swartz will have left after paying restitution and fines. In the two years before his fall in 2001, Mr. Kozlowski made more than $330 million in profits from exercising stock options and selling stock grants, in addition to his salary and bonus of about $5 million a year. But his lawyers have suggested that after the civil litigation, on top of the fines and restitution ordered yesterday, he could be bankrupt. There is also a civil dispute between Mr. Kozlowski and Tyco over whether tens of millions of dollars of deferred compensation should still be paid. The first case against Mr. Kozlowski and Mr. Swartz was declared a mistrial in April 2004, when a juror holding out for an acquittal made whatappeared to be an ''O.K.'' signal to the defense and subsequently received a threatening letter from a stranger, upending the trial. Yesterday, as the gallery of courtroom spectators spilled into the hallway, that juror, Ruth B. Jordan, shuffled out. She said she had come to watch the sentencing. ''It's not as bad as he could have done,'' she said, ''but I still think it's unduly harsh.'' 3 Photos: L. Dennis Kozlowski, left, and Mark H. Swartz arriving at a Manhattan court. The two ex-Tyco executives were sentenced to 81/3 to 25 years. (Photo by Keith Bedford for The New York Times); (Photo by Michael Nagle/Getty Images)(pg. C11) Chart: ''Sentencing Roundup'' The sentences L. Dennis Kozlowski and Mark H. Swartz received yesterday in New York State court are comparable in length to the terms given to other high-profile executives in federal court in the last four years. Bernard J. Ebbers WorldCom Chief executive CASE: Masterminding an $11 billion accounting fraud SENTENCE, IN YEARS: 25 L. Dennis Kozlowski Tyco Chief executive CONVICTED: Looting the company and deceiving investors SENTENCE, IN YEARS: 8.3-25 Mark H. Swartz Tyco Chief financial officer CONVICTED: Looting the company and deceiving investors SENTENCE, IN YEARS: 8.3-25 Jamie Olis Dynegy Midlevel executive CONVICTED: Falsifying the company's books to hide a $300 million loan SENTENCE, IN YEARS: 24 Timothy J. Rigas Adelphia Chief financial officer CONVICTED: Looting the company and lying to investors and regulators SENTENCE, IN YEARS: 20 Martin R. Frankel Financier PLEADED GUILTY: Looting insurance companies and racketeering SENTENCE, IN YEARS: 16.7 John J. Rigas Adelphia 4 Founder and chairman CONVICTED: Looting the company and lying to investors and regulators SENTENCE, IN YEARS: 15 Reed Slatkin Money manager PLEADED GUILTY: Stealing hundreds of millions from investors SENTENCE, IN YEARS: 14 Alan B. Bond Albriond Capital Money manager PLEADED GUILTY: Stealing from investors and taking kickbacks from brokers SENTENCE, IN YEARS: 12.5 Franklin C. Brown Rite Aid Vice Chairman CONVICTED: Played a leading role in accounting scandal SENTENCE, IN YEARS: 10 Andrew S. Fastow Enron Chief financial officer PLEADED GUILTY: Inflating the company's value and defrauding the company SENTENCE, IN YEARS: 10 E. Kirk Shelton CUC International Vice Chairman CONVICTED: Conspiracy and fraud to inflate the company's value SENTENCE, IN YEARS: 10 Robert E. Brennan First Jersey Securities Founder CONVICTED: Money laundering and bankruptcy fraud SENTENCE, IN YEARS: 9.2 Martin L. Grass Rite Aid Chief executive CONVICTED: Accounting scandal that inflated the value of the company SENTENCE, IN YEARS: 8 John M. Rusnak 5 Allfirst Financial Currency trader PLEADED GUILTY: Hiding $691 million in trading losses over five years SENTENCE, IN YEARS: 7.5 Samuel D. Waksal ImClone Systems Founder, chief executive PLEADED GUILTY: Securities fraud and perjury SENTENCE, IN YEARS: 7 Scott D. Sullivan WorldCom Chief financial officer PLEADED GUILTY: Leading role in $11 billion accounting fraud SENTENCE, IN YEARS: 5 Ben F. Glisan Jr. Enron Treasurer PLEADED GUILTY: Manipulating the company's financial statements SENTENCE, IN YEARS: 5 6