ROMANIA WEEKLY UPDATE The World Bank Office, Romania

advertisement

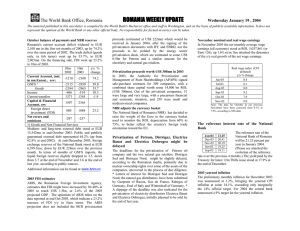

The World Bank Office, Romania ROMANIA WEEKLY UPDATE Wednesday February 11 , 2004 The material published in this newsletter is compiled by the World Bank's Bucharest office and staff in Washington, and on the basis of publicly available information. It does not represent the opinion of the World Bank or any other official body. No responsibility for factual accuracy can be taken Government wants to keep Petrom integrated after privatization The privatization commission is currently negotiating with the short listed bidders clauses related to the future operations of Petrom, according to the Romanian authorities . One of the clauses might bind the investor to keep the oil company integrated after the privatization. The sale consultant and the IFIs have reportedly suggested the government to allow the buyer to split the company after privatization. Most of the seven short listed bidders have voiced preferences for certain parts of Petrom, and not for the company as a whole. According to a survey run by the National Institute for Statistics (INS), industry and trade will continue to expand Based on a survey presented by the National Institute for Statistics (INS), industry and retail trade are expected to register an upward trend in the next quarter, while activity in the construction sector would experience a decline at the general level, according to managers from these three large sectors. 13% of the managers interviewed considered that the expected decline of the construction sector would result in job loses. The opinions of managers were justified by the adverse weather conditions and the fact that volume of contracts will continue to remain at the same level as during the previous period. Baroness Nicholson insists for suspension of the EU accession talks with Romania Baroness Emma Nicholson met on February 9 top Romanian officials including President Iliescu and PM Nastase to discuss cross-border child adoptions and broader political criteria for EU accession. European Parliament raporteur Nicholson openly accused the government of mishandling the cross-border adoptions and the slow reforms in judiciary and public administration and insists for the suspension of the accession talks with Romania. The though unlikely suspension would possibly prevent the government from closing the negotiation chapters this year and, quite possibly, the country from joining the EU in 2007. Nicholson supports several amendments to the Parliament's report on Romania, one of which is for closer monitoring of progress in implementing accession policies. Nicholson mentioned that widespread corruption and limited independence of journalists, as well as cross-border adoptions, are key issues to be addressed. December nominal and real wage earnings In December 2003 the net monthly average wage earnings (all economy) stood at ROL 5,658,065 (or Euro 137), up 12.3% m/m. See attached the dynamics of the y/y real growth of the net wage earnings in the second part of 2003. Jun-03 Jul-03 Aug-03 Sep-03 Oct-03 Nov-03 Dec-03 Real wage index (CPI deflated) y/y % change 8.4 8.1 8.0 9.2 7.9 9.0 9.6 The causes of the wage growth towards the end of 2003 were mainly the yearly bonuses paid from the wage fund, as specified in the collective labor contracts, and the payments for not effected leaves and for extra hours. The highest net wages were paid in December in the financial intermediation sector (insurance and pension activities excluded) 18,468,959 ROL [US$ 559] and in the industry of tobacco products - 15,214,066 ROL [US$ 460]. Banks will apply the new norms on crediting the population starting February 2004 After the publishing by the Romanian National Bank (BNR) of the prudential norms for the consumption and mortgage credit at the end of last year, the banks are expected to apply them starting this month. The conditions required by the norms are: a 25% prepay of the value of a mortgage credit and a monthly installment not exceeding 35% of the net family income; and a warrant or a 25% anticipated payment of the value of the goods bought, and a monthly installment of maximum 30% of the monthly family income for consumption credit.* The banks lent in 2003 to the population the equivalent of ROL 75,000bn (2.2bn USD), with around 10% increase in December alone. More than half of the borrowing was contracted for consumption goods, while the mortgage credit amounted to ROL 19,000bn (572 mil USD). The value of the consumption credit increased by ROL 4,000bn (120 mil USD) during the past month, while mortgage lending expanded by ROL 1,000bn (30 mil USD). Additional information can be found at www.bnro.ro The reference interest rate of the National Bank The reference rate of the National Bank of Romania will be 21.25 percent per year in February 2004, equal to the rate set for January. (Please see attached the evolution of the reference rate over the previous 6 months.) The yield paid by the Treasury for latest 12m T-bills issue stood at 18% at the end of January. Feb-04 Jan-04 Dec-03 Nov-03 Oct-03 Sep-03 21.25 21.25 20.41 20.19 19.25 19.11