Input to HLPE consultation on the V0 draft of the... Investing in smallholder agriculture for food and nutrition

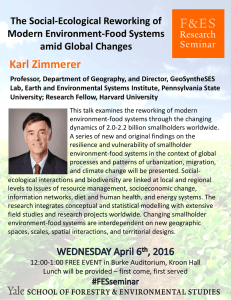

advertisement

Input to HLPE consultation on the V0 draft of the Report: Investing in smallholder agriculture for food and nutrition security From The Royal Norwegian Society for Development (Norges Vel), and The Development Fund (Utviklingsfondet), Norway. The document on Investing in smallholder agriculture for food and nutrition security is extremely timely and a precious contribution to the current approaches. It brings invaluable ideas, concepts and definitions which will greatly contribute to the work of those working in this field. Below we first give some overall comments and then some more detailed comments and suggestions for improvement of the document. Some overall comments The subject is crucial and needs dedicated attention. It also needs additional work with special purpose platforms that can be geared towards bringing together the existing knowledge from different horizons and putting forward a range of possible alternative and innovative paths that could be proposed in different environments. It needs those primarily concerned to be at the heart of the debates. The paper is very good in that it opens a door in that direction. Good and important points It’s very good that the draft report underlines and give facts about the importance of small scale agriculture; that about 85-90% of all farmers are smallholders, that they produce most of the food in the world, that they themselves by far are the biggest investors in agriculture and that they produce more per area than large scale farmers. The descriptions of the situation for small sale farmers and the main challenges they face are also basically good. The document is good in its summary, with : an excellent definition up-front on what a smallholding is (point 1, 2 p.8), and highlight on the collective side (point 3 p.8); emphasis/rectification on wrong assumption: that smallholders are outside markets, and this is a very powerful part of the content of this paper. and it is good in its recommendations: for a typology with Assets, Markets and Institutions the suggestion to undertake implementation at territorial level. Para 3 which presents a very useful analysis of investments made by smallholder themselves. The issues in capital formation of hope, security and remunerative price levels are very relevant and well explained. The paper should be improved: The document does not focus enough on investing per se and is too general in too many domains related to smallholder agriculture. Because of this the document looses power. Most of the recommendations are not for investing but for everything related to SMALLHOLDER agriculture. By being too general, the recommendations lose impact on the reader. Fair to say that there is a need to have a National Vision and Strategic Framework for Smallholder Agriculture but this seems to go beyond investing per se , and while necessary, is too vague. Even if we agree that it is important to develop a National Vision and Strategic Framework for Smallholder 1 Agriculture, we think it should be underlined that this is not a prerequisite for starting up or increase responsible investments benefitting small-scale farmers. It should also be mentioned that such development of such frameworks have been tried in the past decades without much success. The paper would gain in being very specific in what can really achieved in practice and what is new either in approach or content, as well as what works and what doesn’t in the realities of territories, and why. There is no real evaluation of what kind of investments and credit schemes which are functioning and not, and no concrete proposals for how credit schemes, private investments and governmental programs could be set up to benefit small scale farmers. By saying for example that “Specific priority to be given at Banking and financing system to support smallholder agriculture” (para 26 p.12) does not bring much to the reader, because the question is how and which type of financing systems, the current ones? Or new ones? And who is working on these, where is innovation in this field? What are the steps? And how to make it work? Which are the conflicts of interest? What are the approaches of the different banks? what are the drawbacks? The paper is also missing a clear section on who are the investors for SMALLHOLDERS (in addition to the smallholder themselves and the governments) and how do they operate. It also misses a section on the evolution in recent years and how the focus has shifted radically, with a totally different financial landscape and new players on the ground who knew nothing about agriculture and even less about SMALLHOLDER ag. The paper would also gain by dropping the generalities and the visions and frameworks that already invade the shelves of the ministries of agriculture around the world, and by being more focused on the way ahead for INVESTING, that can be useful for smallholders. In the recommendation section there should be a heading of technology introduction, partnerships and use that benefits smallholders. One example is how many smallholders bow use mobile phones for market information and banking. This element should be stronger emphasized in the report as a key infrastructure that is needed to keep farmers informed, organized, linked to market and with the banking services attached to mobile phone networks there is large savings in transaction costs that benefit small scale farmers very much. Warehouse receipt systems that are linked with farmer associations should be explained and explored in the document. There are some very good experiences on how warehouse receipts systems can benefit small-scale farmers. Soil management is not sufficiently discussed in the report. The most valuable asset of smallscale farmers is being depleted by production methodologies and lack of bio value return to the soil. Composting and the return of other bio values are not sufficiently underlined in the report. In production of all commodities there is a vast quantity of bio materials that should be brought back. Investments in composting and in using nutrients from sanitation should be looked into in the report. (In Uganda the nutrient value from sanitation that today is wasted or released as pollution represents 13 times the import of chemical fertilizers.) The report underlines the need for peasants to have a strong organizations and a strong voice, but in stead of giving the small scale farmers a voice and to give their views and proposals on how to strengthen the organizations, lessons learned by the World Bank on building capacity of rural producer organizations is quoted. 2 Some more comments Below are some more comments, first some general comments and then in chronological order. The structure and table of contents (page 3) of the report could be improved with less titles on general knowledge on SMALLHOLDER agriculture and more titles on information on the available knowledge on investments. It would be good to have more sections and sub-sections on investing with presentations of different types of investments, different actors, and how they work and where, with criteria etc. The report gives sometimes the impression of being a justification for the relevance of SMALLHOLDER agriculture. In this regard, the Chap 1 and in particular 1.2 how small is small, 1.3 diversity, 1.3.2 policy concerns, 1.4 time and demography, the Chap 2, significance of smallholder agriculture, with 2.1 role in food security etc. while being very interesting, seem a bit too detailed for a report on investing. Maybe some of this information could be in an annex. Page 12, para 29: Regarding the 3 coordinated pillars; these seem very general and go beyond investing (e.g. increase in productivity and resilience etc). Page 13: Figure 1 would benefit by being more on investment. Just looking at it, one cannot say for what is the graph. The question of the reader is : can there be investing in SMALLHOLDER agriculture outside a well functioning National Policy for smallholder Agriculture , National Vision and Strategic Framework, etc.? From the graph the answer could be no, in reality despite non-enabling environments, some do work, and the graph could give tools, processes and ideas towards new forms of investing for SMALLHOLDER. It seems a bit strange to have SMALLHOLDER being reduced to triangles and circles. The 3 columns wellbeing, productive and public goods are not clear or useful. Page 28-35 The sections related to market are very relevant and perhaps their connection to the investing part could be strengthened. The boxes in p. 30,31, 32 etc. are very interesting but could be better connected to the implications of these findings to the creation of enabling investing environments. And the paper would very much benefit from bringing some answers to the questions raised at the end of para 2.3. (i) how can the conditions for smallholders market integration be improved including technical issues? (ii) different agricultural markets will require different types of investments. Page 32: Para 2.4 ( energy efficiency, p.32) comes here without really being related to the rest and may not be necessary in the paper, or just as a justification for SMALLHOLDER ag, but not directly for investing and the how to for it. Page 33-34: The same as above; 2.5 Smallholders are highly heterogeneous does not seem to flow from the prior sections. It is interesting to read box 4 p.34 but the implications of heterogeneity on investments is not made and the text appears more as a personal belief (see last sentence “ we believe that they represent the best bet..”). 3 Page 36: In para 3 it would be useful to define drudgery and utility. Page 37: Under 3.2 , SRL should be written in full. Page 38: An interesting point on the widespread mythology that investment is good (under 3.3.1). This could be more elaborated in the report to distinguish smallholder types of investments and their implications for SMALLHOLDER with clear cut separation when they are favorable or unfavorable. Physical capital and financial capital should be defined. Page 45: In Box 5 it would be good to have the voice of the communities rather than the voice of the World Bank. Page 46-47: Perhaps rather than a section of persistent poverty (section 4.2), it would be good to have a full section on Micro finance and not only a box (Box 6) and the pros and cons and how it has worked in different contexts. Page 48-49: Para 4.3: Rather than the risks of SMALLHOLDER agriculture, it would be interesting to have a chapter on the risks of different types of investments. Page 51: Box 8, needs some introductory line and not start with “this study.” Page 54: Box 9 is a useful table with the typology. Interesting opening of the range of aspects which require investment usually not being considered such as improving organization of work, management of collective resources, reduction of drudgery, transport etc. and the collective investments. Page 57 The first recommendation (5.1 Smallholder agriculture: the way ahead) is a good illustration of the bias of the document which is that it puts more emphasis on the justification of SMALLHOLDER agriculture rather than on investments for SMALLHOLDER with clear proposals on possible lines of work to move into investments that favor SMALLHOLDER. It would be good in page 57 after the last line to list briefly the five recommendations and the four strategic recommendations. Page 58-61: The title of Section 5.2.2.2 increasing access to investments and capacity to invest is very good and interesting. This issue could be much more developed and be at the center of this paper. It could become a whole chapter in itself. The example of Rabobank (box 11 p.61) is highly relevant and there could be many other such examples that can inform on how to go about investments on the basis of lessons learned. Unfortunately this section is just a few lines long and the last ones seem to come out of the blue. 4 It is the case of the sentence just under the box 11 (Research and extension for development have to give the highest priority to smallholder agriculture) which is out of context and it is a statement which could be better formulated. The following sentence also is out of context. The statement seems arbitrary, why to increase access to improved seeds and fertilizer, is this what the local community is asking for? Where are the negotiating platforms described for local consultation on what is most needed and adapted? Page 63: In 5.2.4 it is a list of “have to”, “is needed”, “ should be” which sounds more like a wish list than something that can be applied with success. There are no proposals on how to proceed to reach these goals. Page 63-64 Para 5.3 first sentence “..need access to resources under favorable conditions that make investment profitable..” Yes but what are these favorable conditions? And what makes it profitable? These sound like just statements. And “...today a very limited share of the smallholder population has access to financial and banking services” it would be interesting to know who has access to financial and banking services and under which circumstances. In para starting Major players (p.63); “… smallholder often need to improve and upgrade their ways of farming…” One should be careful with using the word “improve”. What is an improvement? Page 65-67: Section 5.3.1 is welcome and could come earlier in the report. Oslo, Norway January 29th 2013 The Royal Norwegian Society for Development (Norges Vel), and The Development Fund (Utviklingsfondet), Norway Contact person: Aksel Naerstad Senior policy adviser, The Development Fund, Norway (www.utviklingsfondet.no) International coordinator of the More and Better Network (www.moreandbetter.org) E-mail: aksel@utviklingsfondet.no Skype: akselnaerstad Phone: +47 23 10 96 00 / 23 10 95 91, Mobile phone: +47 48 25 82 85, Fax: +47 23 10 96 01 5