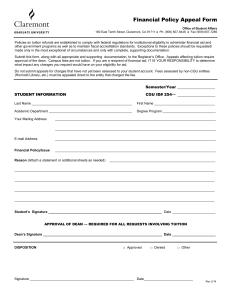

President’s Recommended Budget for The University of Toledo NOTE: ELEMENTS OF THIS

advertisement

President’s Recommended Budget for The University of Toledo Board of Trustees Finance & Audit Committee May 12, 2014 NOTE: ELEMENTS OF THIS PRESENTATION ARE SUBJECT TO BOARD APPROVAL, AND ARE NOT YET FINAL. The Heart of our Structural Issue Net Tui on and Fee Revenue per FTE $11,500 $11,000 $10,500 Growth Rate = - 2.27% $10,000 $9,500 $9,000 Growth Rate = 4.87% $8,500 FY10 FY11 FY12 FY13 Growth Rate = - 5.8% The combination of enrollment declines, strain on State money, tuition inflation, and the need to reinvestment in our infrastructure is a structural issue that we must deal with over the next 3 years. Failure to deal with this would be poor stewardship on our part. Remaining Budget Calendar Items • • • • • • • University Council – April 18 Business Managers – April 23 U. Council Finance & Strategy Subcom. – April 25 Deans and VPs – April 23 President Jacobs – April 30 Board Finance Committee - May 12 Board approval – June 16 FY15 Financial Improvement Target Our target at the start of the FY15 budget process was $18M. We have hit this target, via the following: • • • • • Refined assumptions = $4.5M Administrative cuts = $6.0M Main Campus improvements = $2.7M Health Science Campus improvements = $1.6M UTMC improvements = $3.3M Major Assumptions • SSI increase of 1.8% • 2.39% increase in undergraduate tuition • 0% increase in general fee • 1% increase in graduate / prof tuition (except Law) • 0% change in enrollment, before new initiatives. Overall increase is 1%. • 2% increase in salaries and wages Areas of Investment • Salary increases for faculty and staff • Positions in Engineering, NSM, and Nursing colleges • $ to stimulate growth in externally funded research and development of on-line courses • Additional resources for recruitment of high-ability students • One World Schoolhouse and Schoolcraft College project • Investments in patient satisfaction, quality and safety Risks Contained in the FY15 Budget • Enrollment • State Share of Instruction (SSI) • Outcome of union negotiations • Funding only half of deferred maintenance • Healthcare benefits costs • Healthcare marketplace and ACA Longer-term Risks • Demographic trends • State funding • Changes in pension liability accounting • Growth in regulations and compliance • Pressure on tuition and student debt levels Incentive Plan • Externally funded research: – For incremental externally funded research over current year levels, we will increase the percentage of indirect cost recovery (IDC) returned to the colleges from 30% to 70%. • On-line class development – Additional funding will be available for faculty involved in developing on-line courses and programs. This will be administered by the Provosts’ Office, under the auspices of their current program. Carry-Forwards • We will implement a revised program of carry-forwards. • Reinstate balances from FY10 forward. • Designated funds in colleges only. • Plan by college still required, to facilitate cash flow planning. Plan approved by Dean, Provost, EVP CFO. • Encouraged for use on capital items Routine Capital • State biennial capital bill = $23.7M for UT. • Routine capital on top of State bill = $18M – Provost = $4M – Facilities = $5M – Info Tech = $3M – UTMC = $6M Hiring Process • RCG will no longer be part of hiring process. RCG will continue, with a new charge and group makeup. • Budgeted positions can be filled with Dean / VP approval. • Positions vacated in year will have 30 day wait period for re-engineering before they can be posted. • HRTD will be measured on “time to fill” once a job is posted • New positions will require Dean / VP approval, as well as SLT approval.