2014 WASFAA Conference Reno, Nevada Mike Johnson, Director of Financial Aid,

advertisement

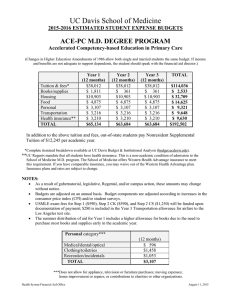

2014 WASFAA Conference Reno, Nevada Mike Johnson, Director of Financial Aid, Pacific University High and increasing cost of college High and increasing student and parent indebtedness Lack of transparency in cost and financial aid information Confusing or incomplete information about true cost and financial aid program details The Higher Education Act of 1965, as amended – Section 472 defines Cost of Attendance Only the COA components mentioned in statute may be used: Tuition and fees, including rental or purchase of equipment and supplies Books and supplies, transportation, and miscellaneous personal expenses, including the rental or purchase of a computer Room and board costs, described differently based on students’ dependency status and whether they live with parents The statute also describes: How to treat less than half-time and incarcerated students How correspondence study, instruction through telecommunications, and study abroad are treated How to include dependent care costs, disability-related costs, cooperative education costs, and loan fees The modern list of components is: Tuition and fees Room and board Books and supplies Transportation Personal and miscellaneous costs When do you use actual amounts in the COA? Average amounts? How do you calculate averages? How and when do you present COA information on award notifications and in other communications? How does the COA at your school affect students’: “Unmet need”? Net price? How do you describe the COA to students and parents? Do you distinguish between direct and indirect costs? How do you determine indirect cost amounts? What do you say about the price (sticker price and net price) that your school charges? Do you find yourself defending it or apologizing for it? Need analysis has two parts: Estimating a student’s costs (COA) Calculating the Expected Family Contribution (EFC) Widely used methodologies for determining students’ need have included: John Monro’s “15% Rule” (1954) Institutional Methodology (1974) Congressional Methodology (1986) Federal Methodology (1992) Federal Methodology is detailed in Part F of Title IV of the Higher Education Act of 1965, as amended Updated tables appear each year in the Federal Register Federal Methodology must be used to determine a student’s eligibility for federal financial aid Other methodologies can be used to determine a student’s eligibility for institutional aid Families – as defined by the FAFSA – have the primary responsibility for meeting postsecondary costs The distribution of financial aid should be based on the family’s ability – not willingness – to pay Need analysis should provide a “snapshot” of the family’s financial circumstances at the time of application Regular formula Parent required to file a 2013 IRS Form 1040, or had 2013 income of $50,000 or more Includes consideration of assets Simplified formula Parent’s household member received a federal meanstested benefit in 2012 or 2013 Parent filed, or was eligible to file, a 1040 A or EZ; or was not required to file a federal income tax return; or is a dislocated worker - and Parent’s 2013 income was $49,999 or less Excludes consideration of assets Automatic zero formula Parent’s household member received a federal meanstested benefit in 2012 or 2013 Parent filed, or was eligible to file, a 1040 A or EZ; or was not required to file a federal income tax return; or is a dislocated worker - and Parent’s 2013 income was $24,000 or less Excludes consideration of income and assets Income: Parent and student information are considered Total income is the sum of taxable income or income earned from work, and untaxed income (including payments to retirement accounts) Additional Financial Information, which reduces reported income, include education tax credits, child support paid, and taxable income from need-based employment Income Allowances against reported income include: U.S. income tax paid State and other taxes Social Security taxes Income protection allowance Employment expense allowance State and other taxes: Amounts come from tables that consider differences in tax rates in different states for families at different income levels Amounts range from 1% to 9% State and other taxes: % of total parent income Alaska Arizona California Hawaii Idaho Nevada Oregon Washington $0 - $14,999 >$14,999 2% 1% 4% 3% 8% 7% 4% 3% 5% 4% 3% 2% 7% 6% 4% 3% Student 0% 2% 5% 3% 3% 1% 5% 1% Income protection allowance: Amounts come from a table that uses Bureau of Labor Statistics (BLS) data for lower budget expenditures, adjusted annually based on the Consumer Price Index (CPI) Amounts increase for each additional family member, decrease for each additional college student Income protection allowance*: Household size 1 2 $17,440 3 $21,720 4 $26,830 5 $31,650 6 $37,020 Number in college 2 3 $14,460 $18,750 $15,770 $23,840 $20,870 $28,670 $25,700 $34,040 $31,070 4 $17,890 $22,710 $28,090 * set at $6,260 for dependent students Employment expense allowance: Amounts represent additional costs that families incur when two parents, or a single parent, work(s) Uses 35% of the lower income, or $4,000, whichever is less Assets Reported on the FAFSA include: Current balances of cash, savings, and checking Net worth of investments, including real estate (excluding retirement accounts and the family’s principle residence) Net worth of businesses and investment farms (excluding small family owned businesses and family farms) Assets Parent contribution from assets: Education Savings and Asset Protection Allowance subtracted from net worth to determine discretionary net worth Contribution is 12% of discretionary net worth Student contribution from assets: Contribution is 20% of net worth Education savings and asset protection allowance: Amounts come from a table that uses the age of the older parent, adjusted for one and two parent households Assets are increasingly protected as parent age increases Education savings and asset protection allowance: Age of older parent 45* 46 47 48 49 Allowances Two-parents One-parent $30,700 $7,100 $31,500 $7,200 $32,200 $7,400 $33,000 $7,600 $33,800 $7,800 * 45 is the default if no date of birth indicated The formula’s use of actual, calculated, and assigned numbers make the EFC a financial aid eligibility index rather than an indication of a family’s true ability to pay. In light of that, how do the following affect a school’s ability to assess a student’s need? A student who earned $6,200 is treated the same as one who did not work Basic annual living costs for families of four with one in college are set at just under $27,000 regardless of where they live Parents are expected to spend no more than $4,000 per year in work-related expenses such as clothing and transportation regardless of where they work Money saved for retirement is not reported on the FAFSA, yet the effect of reported assets on the parent contribution is reduced as the age of the older parent increases At the same age of the older parent, two parents have more than four times the asset amount protected that single parents do How would you explain these aspects of need analysis to families? Would you explain them? Schools’ awarding policies vary according to a variety of factors, including: School size School ownership (public/private) Fund availability Program participation Recruitment goals Retention strategies Policy considerations include: Merit-based vs. need-based aid (level of need met/”gapping”) Price sensitivity of admit pool/school tolerance for ”discounting” Enrollment management goals/leveraging Packaging loans Continuing students’ aid packages What level of detail does your school provide concerning its awarding policies? How is that decision made, and who makes it? What format(s) do you use for award notifications? How do you assess the effectiveness of the format(s)? Do you assess it? Net price calculators Required of all colleges that participate in Title IV programs Financial Aid Shopping Sheet A “model financial aid letter” that schools are encouraged to use Explain and show direct and indirect costs Direct Costs Tuition and fees On-campus housing and meals Total direct costs $38,510 $11,116 $49,626 Indirect Costs Books and supplies Transportation Personal Total indirect costs Cost of Attendance $ 1,050 $ 720 $ 900 $ 2,670 $52,296 Separate aid categories in award notifications Gift aid Presidential Scholarship Federal Pell Grant Oregon Opportunity Grant Pacific Grant Total gift aid $15,000 $ 4,180 $ 2,000 $11,700 $32,880 Self-Help aid Federal Work-Study Federal Direct subsidized loan Federal Direct unsubsidized loan Total self-help aid $ $ $ $ 2,000 3,500 2,000 7,500 Provide information about the full cost of borrowing Average loan debt Adjusted loan debt (1.072% fee) $29,000 $29,314 Monthly repayment (10 years) Total repayment (10 years) $ 295 $35,381 Monthly repayment (20 years) Total repayment (20 years) $ 175 $42,116 Provide estimates of (and justifications for) future cost increases First year Second year (4%) Third year (4%) Fourth year (4%) Tuition and fees $38,510 $40,050 $41,652 $43,318 Total $52,296 $54,388 $56,564 $58,827 Provide financial literacy information, especially to promote the importance of: Weekly budgeting Reducing expenses Developing savings plans Borrowing wisely What concepts do you use to tell students and parents how affordable your school is? Value of higher education/return on investment Comparisons with similar schools Comparisons with regional or national averages Based on certain metrics Cost of attendance Gift aid Net price - Year 1 Annual increase Net price - Year 2 - Year 3 - Year 4 - Year 5 - Year 6 Totals Public 4-year $24,000 $5,000 $19,000 7% $20,860 $22,478 $24,401 $26,459 $28,661 $141,679 Private 4-year $52,000 $20,000 $32,000 4% $34,080 $36,243 $38,493 ----$140,816 Cost of obtaining a Bachelor’s degree More than $140,000 College Scorecard Web tool created to allow easy comparisons between schools based on certain metrics College Navigator More robust college comparison tool that uses information from the Integrated Postsecondary Education Data System (IPEDS) How do you respond when students and parents ask about previous or future price increases? Cost to the institution of educating students Comparisons with similar schools’ patterns Comparisons with regional or national averages Are you comfortable defending your schools’ decisions in this area? Thanks for participating Enjoy the rest of the conference!