Where To live?

advertisement

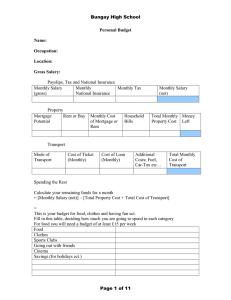

Where To live? Mortgages • What is a mortgage? Discuss Mortgages • A mortgage is a long-term loan which you pay back monthly over an agreed length of time, usually 25 years. The main types of mortgages are: • Repayment – you pay back the interest and some of the money you have borrowed each month so that you will have repaid the entire amount over the period. • Endowment – you pay the interest only over the period of the loan. At the same time, you take out an insurance policy into which you pay enough money to build, with its investment income, a large-enough lump sum to pay off the mortgage at the end of the agreed term. So every month you make an interest payment and an insurance payment. How much to borrow? • Depending on your income and circumstances, you can borrow anything up to 100 per cent (sometimes more) of the value of the property - but if you're a first time buyer you'll usually only be offered up to 90 or 95 per cent. If buying you need to find a deposit to cover the difference between the purchase price and your mortgage. How much to borrow? • A single person would be unwise to borrow more than three times their annual income. If you were buying with another person, a sensible figure would be up to three times your joint income. • In some cases you can borrow more, we are allowing five times your salary. • Fill in Mortgages sheet Three main reasons to buy • It may be less expensive than renting a comparable property (rents tend to go up with inflation). • A home of your own generally offers more in terms of use value; for example, it may offer greater security and the opportunity to ‘do your own thing' in terms of decoration, renovation and house style. • It can be an attractive long-term investment Three main reasons to rent • Can not afford to buy a house. • Upkeep of the property is the landlords responsibility. • You are not tied down to one area. To Rent or to Buy? • You now have an idea of how much money you have to spend and how much a mortgage will cost. • Now its time to find somewhere to live use you homework notes to make a decision as to whether you are going to rent or buy and decide where you are going to live. • Be warned!!!!! Do not use all of your salary as you still have bills to pay. Researching the market… Look at the estate agents advertisements and fill in the details of three houses to buy three houses to rent In your booklet. Property One Location Monthly Cost Salary left Details Tax Band Property Two Property Three Homework • Write down what you think the other costs will be. • Estimate a cost for these.