Dave Shideler Presentation to the County Officers and Deputies Association

advertisement

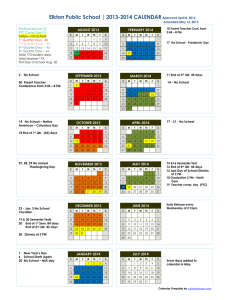

Dave Shideler Presentation to the County Officers and Deputies Association September 17, 2009 Oklahoma City, OK WILL THE OKLAHOMA ECONOMY “STALL OUT”? OUTLINE Current State of the Oklahoma Economy Unemployment Real estate Retail sales Previous Experience Kansas City Fed District vs. other Fed Districts Industrial structure Commodity prices Looking Forward Deflation Diversified economy UNEMPLOYMENT RATES, JULY 2009 Source: Bureau of Labor Statistics, September 11, 2009 http://data.bls.gov/map/servlet/map UNEMPLOYMENT RATE RELATIVE TO US Source: Bureau of Labor Statistics, September 11, 2009 http://data.bls.gov/map/servlet/map UNEMPLOYMENT CHANGE SINCE RECESSION BEGAN Source: Bureau of Labor Statistics, September 11, 2009 http://data.bls.gov/map/servlet/map REAL ESTATE Average New Home Prices, US vs. South, 2005-2009 270 000 250 000 230 000 210 000 United States 190 000 South 170 000 2005 2006 2007 2008 Source: http://www.census.gov/const/quarterly_sales_cust.xls , accessed 9/11/2009 at 9:15 am 2nd quarterp 1st quarterr 4th quarter 3rd quarter 2nd quarter 1st quarter 4th quarter 3rd quarter 2nd quarter 1st quarter 4th quarter 3rd quarter 2nd quarter 1st quarter 4th quarter 3rd quarter 2nd quarter 1st quarter 150 000 2009 Average Price, Homes Sold in Oklahoma, 2006-2009 170 000 160 000 150 000 140 000 130 000 120 000 110 000 100 000 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr 1st Qtr 2nd Qtr 2006 2007 2008 2009 MORTGAGE DELINQUENCY RATES, JUNE 2009 Delinquency rates are defined as the percentage of mortgages that are 90 or more days behind in payments; national delinquency rate was 5.81-9.24%, according to TransUnion LLC and Mortgage Bankers’ Association, respectively. Both are up since the previous year. SOURCE: Federal Reserve Bank of New York, http://www.newyorkfed.org/mortgagemaps/, accessed 9/11/09 at 3:30 pm MORTGAGE DELINQUENCY RATES RATE OF CHANGE, 2008-2009 SOURCE: Federal Reserve Bank of New York, http://www.newyorkfed.org/mortgagemaps/, accessed 9/14/09 at 11:00 am CREDIT CARD DELINQUENCIES, JUNE 2009 Delinquency rates are defined as the percentage of bank cards that are 60 or more days behind in payments; national delinquency rate was 1.17%, according to TransUnion LLC. SOURCE: Federal Reserve Bank of New York, http://www.newyorkfed.org/mortgagemaps/, accessed 9/11/09 at 3:30 pm CREDIT CARD DELINQUENCIES RATE OF CHANGE, 2008-2009 SOURCE: Federal Reserve Bank of New York, http://www.newyorkfed.org/mortgagemaps/, accessed 9/14/09 at 11:00 am PERCENT CHANGE IN RETAIL SALES, AUG 2008-AUG 2009 SOURCE: Oklahoma Tax Commission Looking Back at the 1980s and 2000s Recessions for Clues SO, WHAT SHOULD WE EXPECT GOING FORWARD? Appendix 2. U.S. RecessionsBY by Federal Reserve District, 1957-present U.S. RECESSIONS FEDERAL RESERVE DISTRICT, 1957-PRESENT 234 12 1234 12 1234 1234 1234 1234 34 123 1234 1234 1 1234 1234 1234 1234 34 1234 1234 123 234 1234 1 U.S. 1-Bos 2-NY 3-Phi 4-Cle 5-Rich 6-Atl 7-Chi 8-StL 9-Min 10-KC 11-Dal 12-SF SOURCE: Wilkerson, C. “Recession and Recovery Across the Nation: Lessons from History.” Economic Review, 2nd Q 2009: 5-24. Employment Growth Since the End of the 2001 Recession Percent 15 During expansion 12 During current recession* Total 9 6 3 0 -3 -6 U.S. 1 - Bos 2 - NY 3 - Phi 4 - Cle 5 - Rich 6 - Atl * Through Q2 2009, estimated based upon preliminary state 7 - Chi 8 - StL 9 - Min 10 - KC 11 - Dal 12 - SF -level data. Expansion and recession size is based on actual District ti SOURCE: Wilkerson, C. “Recession and Recovery Across the Nation: Lessons from History.” Economic Review, 2nd ming Q 2009: 5-24. OKLAHOMA EMPLOYMENT, MONTHLY, 1980-JUL. 2009 http://data.bls.gov/PDQ/servlet/SurveyOutputServlet OKLAHOMA UNEMPLOYMENT RATE, MONTHLY, 1980-JUL. 2009 http://data.bls.gov/PDQ/servlet/SurveyOutputServlet MINING 10% 9% 8% 7% 6% 5% 4% 3% 2% 1% 0% Mining Output Percent of Gross State Product Percent of Total Employment Mining Employment 25% 20% 15% 10% 5% 0% MANUFACTURING Manufacturing Employment 12% 10% 8% 6% 4% 2% 0% Manufacturing Output Percent of Gross State Product Percent of Total Employment 14% 20% 18% 16% 14% 12% 10% 8% 6% 4% 2% 0% RETAIL TRADE Retail Trade Employment 16% 14% 12% 10% 8% 6% 4% 2% 0% Retail Trade Output Percent of Gross State Product Percent of Total Employment 18% 12% 10% 8% 6% 4% 2% 0% SERVICES Services Employment 35% 30% 25% 20% 15% 10% 5% 0% Services Output Percent of Gross State Product Percent of Total Employment 40% 25% 20% 15% 10% 5% 0% GOVERNMENT (ALL LEVELS) Government Employment 19% 19% 18% 18% 17% 17% 16% 16% 15% Government Output Percent of Gross State Product Percent of Total Employment 20% 20% 18% 16% 14% 12% 10% 8% 6% 4% 2% 0% COMMODITY PRICES: OIL COMMODITY PRICES: NATURAL GAS COMMODITY PRICES: WHEAT COMMODITY PRICES: CATTLE TAKE AWAY State and local budgets have been/will be hit hard by recession State Level: Gross Production Receipts and Sales Tax Revenues Local Level: Sales Tax Revenues; little impact on ad valorem revenues Though some similarities between ‘81-’83 recession, there isn’t the construction “boom” fall out Plenty of labor, now and in the future; will there be jobs? Which sectors? Change in consumer behavior?