Truthful Randomized Mechanisms for Combinatorial Auctions Speaker: Michael Schapira

advertisement

Truthful Randomized

Mechanisms for Combinatorial

Auctions

Speaker: Michael Schapira

Joint work with Shahar Dobzinski and

Noam Nisan

Hebrew University

Algorithmic Mechanism Design

Algorithmic Mechanism Design deals with designing

efficient mechanisms for decentralized computerized

settings [Nisan-Ronen].

Takes into account both the strategic behavior of the

different participants and the usual computational

efficiency considerations.

Target applications: protocols for Internet

environments.

Combinatorial Auctions

m items for sale.

n bidders, each bidder i has a valuation

function vi:2MR+.

Common assumptions:

Normalization:

vi()=0

Monotonicity: ST vi(T) ≥ vi(S)

Goal: find a partition S1,…,Sn such that the

total social-welfare Svi(Si) is maximized.

Challenges

Computer science: compute an optimal

allocation in polynomial time.

Game-theory: take into account that the

bidders are strategic.

Computer Science: The Complexity of

Combinatorial Auctions

For any constant e > 0, obtaining an

approximation ratio of min(n1-e, m½-e) is

hard:

– NP-hard even for simple valuations

(“single-minded bidders”).

– Requires exponential communication

(Nisan-Segal).

Several O(m½)–approximation algorithms

are known.

Game Theory: Handling the Strategic

Behavior of the Bidders

Our solution concept: dominant

strategy equilibrium.

–

Due to the revelation principle we limit

ourselves to truthful mechanisms.

Implementable using VCG!

Are we done?

A Clash between Computer Science

and Game Theory

VCG requires finding the optimal allocation,

but it is hard to calculate this allocation!

Why not use an approximation algorithm for

calculating (approximate) VCG prices?

–

Unfortunately, incentive-compatibility is not

preserved (Nisan-Ronen).

We need other techniques!

Deterministic Mechanisms

We know how to design a truthful m½-approximation

algorithm only for combinatorial auctions with single-minded

bidders (Lehmann-O’callaghan-Shoham).

–

This approximation ratio is tight.

Only two results are known for the multi-parameter case:

–

–

A pair of VCG-based algorithms: for the general case [Holzman-Kfir

Dahav-Monderer-Tennenholtz] and for the ”complement-free” case

[Dobzinski-Nisan-Schapira]. Both are far from what is computationally

possible.

A non-VCG mechanism for auctions with many duplicates of each

good [Bartal-Gonen-Nisan].

Theorem (wanted): There exists a polynomial time

truthful O(m½)-approximation algorithm for

combinatorial auctions.

Randomness and Mechanism Design

Randomness might help.

–

Nisan & Ronen show a randomized truthful 7/4approximation mechanism for the makespan

problem with two players. They also show that

any deterministic mechanism can not achieve an

approximation ratio better than 2.

On Randomized Mechanisms

Two notions for the truthfulness of randomized

mechanisms:

– “universal truthfulness”: a distribution over

truthful deterministic mechanisms (stronger)

– “Truthfulness in expectation”: truthful

behavior maximizes the expected profit

(weaker)

Risk-averse bidders might benefit from

untruthful behavior.

The outcomes of the random coins must be

kept secret.

Previous Results and Our Contribution

Lavi & Swamy presented a randomized O(m½)approximation mechanism that is truthful in

expectation. We prove the following theorem:

Theorem: There exists an O(m½)-approximation

mechanism that is truthful in the universal

sense.

–

Actually, our result is stronger (details to follow).

Our Mechanism: An Overview

We will describe our mechanism in several

steps.

First, assume that the value of the optimal

solution, OPT, is known.

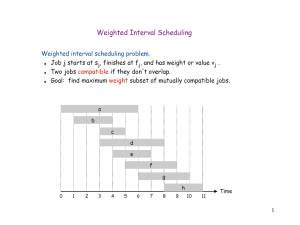

Two Possible Cases

Fix an optimal solution

(OPT1,…,OPTn).

Value

OPT/m½

Two possible cases:

– There is a bidder i

such that

vi(M) ≥ OPT / m½.

– For all bidders

vi(M) < OPT / m½

1

2

3

4

OPT1

OPT2

OPT3

OPT4

Value

OPT/m½

We will provide a different

O(m½)-mechanism for each case. Later we

will see how to combine them.

The First Case (A “Dominant Bidder”)

is Easy

The “second-price” mechanism: Bundle all items together. Assign

the new bundle to bidder i that maximizes vi(M). Let the winner pay

the second highest price.

50

32

40

Winner

pays 40!

The Second Case (There is no

“Dominant Bidder”):

The “fixed-price” mechanism:

1.Define a per-item price p=OPT / 2m

2.For every bidder i=1…n:

• Ask i for his most demanded bundle,

Si, given the per-item price p.

• Allocate Si to i, and charge him p|Si|.

The Second Case (No “Dominant

Bidder”):

A

B

C

D

E

p$ p$

p$

p$

p$

The Second Case (No “Dominant

Bidder”) :

Blue bidder takes

{A,D} and pays 2p.

A

B

C

D

E

p$ p$

p$

p$

p$

The Second Case (No “Dominant

Bidder”) :

Red bidder takes

{C} and pays p.

B

C

E

p$

p$

p$

The Second Case (No “Dominant

Bidder”) :

Green bidder takes

{B,E} and pays 2p.

B

E

p$

p$

Proving the Approximation Ratio of the

Fixed-Price Auction (if there is no dominant

bidder)

The fixed-price auction is clearly truthful.

Lemma: If for each bidder i, vi(OPTi) < OPT/m½,

then we get an O(m½)-approximation.

Proof:

Claim: Let PROFITABLE={i | vi(OPTi) – p * |OPTi| > 0}.

Then, S PROFITABLE vi(OPTi) > OPT/2.

i

–

Informally, this means that “most” bundles in OPT are

profitable given a fixed item-price of p.

Proving the Approximation Ratio of the

Fixed-Price Auction (if there is no dominant

bidder)

Proof (of claim):

SiN \ PROFITABLE vi(OPTi) < SiN \ PROFITABLE p * |OPTi| ≤

(OPT / (2m) ) * m = OPT / 2

Proving the Approximation Ratio of the

Fixed-Price Auction (if there is no dominant

bidder)

If the mechanism gets to bidder iPROFITABLE, and all

items in OPTi are unassigned then bidder i will purchase

at least one item.

Whenever we sell a bundle S to bidder i, we gain a

revenue of |S|*p. Clearly, vi(S) > |S|*p = |S| * OPT/(2m).

In the worst case, each item jS is given to a different

bidder in OPT. Hence, we “lose” (compared to OPT) at

most |S|*OPT / (m½) by assigning the items in S to i.

We also lose a value of at most OPT / (m½) by not

assigning i the bundle OPTi.

This leads to a O(m½)-approximation to the social

welfare of the bidders in PROFITABLE (> OPT/2).

Choosing between the Second-Price

Auction and the Fixed-Price Auction

We flip a random coin.

–

With probability ½ we run the second-price

auction, and with probablity ½ we run the fixedprice auction.

Still truthful.

Still Guarantees the approximation ratio

(in expectation).

Getting Rid of the Assumption:

It is hard to estimate the value of OPT:

–

–

Recall that any approximation better than

m½ requires exponential communication.

Estimating OPT requires information from

the bidders.

We use the optimal fractional solution

instead.

We get the information in a careful way.

The Linear Relaxation

Maximize: Si,Sxi,Svi(S)

Subject To:

– For each item j: Si,S|jSxi,S ≤ 1

– For each bidder i: SSxi,S ≤ 1

– For each i,S: xi,S ≥ 0

Despite the exponential number of variables, the LP relaxation can

still be solved in polynomial time using demand oracles (Nisan-Segal).

OPT*=Si,Sxi,Svi(S) is an upper bound on the value of the optimal

integral solution.

Two Possible Cases

Two possible cases:

–

bidder i such that

vi(M) ≥ OPT* / m½.

Value

OPT*/m½

OPT*1 OPT*2

–

For all bidders

vi(M) < OPT*/m½.

OPT*3

OPT*4

Value

OPT*/m½

The mechanism for the first

case remains the same.

OPT*1 OPT*2 OPT*3

OPT*4

The Second Case (No “Dominant

Bidder”) :

The key observation: A randomly chosen set, that

consists of a constant fraction of the bidders, holds

(w.h.p.) a constant fraction of the total social

welfare.

This idea is similar to the main principle in randomsampling auctions for “digital goods”. [Fiat-GoldbergHartline-Karlin-Wright]

By partitioning the bidders into two sets of equal

size, we can use one set to gather statistics that will

determine the per-item price of the other.

The Second Case (No “Dominant

Bidder”) :

The mechanism:

–

Randomly partition the bidders into two sets of

size n/2: FIXED and STAT.

–

Calculate the optimal fractional solution for STAT,

OPT*STAT.

–

Conduct a fixed-price auction on the bidders in

FIXED with a per-item price of p=OPT*STAT/(2m).

Proving the Approximation Ratio of the

Fixed-Price Auction (if there is no dominant

bidder)

The mechanism is clearly universally truthful.

Theorem: If for each bidder i, vi(M)<(OPT*/m1/2)

then the fixed-price auction guarantees an O(m1/2)approximation.

Claim: With probability 1-o(1) it holds that:

OPT*STAT ≥ OPT*/4 and

OPT*FIXED ≥ OPT*/4

Proving the Approximation Ratio of the

Fixed-Price Auction (if there is no dominant

bidder)

Corollary: With high probability

p ≥ OPT* / (8m)

– Reminder: p = OPT*STAT / (2m) and

OPT*STAT > OPT*/4

Claim:

Let PROFITABLE={(i ,S)| iFIXED and vi(S) –

p*|OPT*| > 0}.

Then S(i,S)PROFITABLE xi,Svi(Si) > OPT* / 8.

Proving the Approximation Ratio of the

Fixed-Price Auction (if there is no dominant

bidder)

Claim:

For each item we sell at price OPT* / (8m), we

“lose” a value of at most OPT* / O(m½)

compared to the total social welfare of the

(fractional) bundles in PROFITABLE.

Since S(i,S)PROFITABLE vi(S) > OPT*/8, we obtain an

O(m½)-approximation mechanism for this

case (no dominant bidder).

Final Improvement: Increasing the

Probability of Success

The expected value of the solution provided by

the mechanism is indeed O(m½).

However, it only succeeds if it guesses the

“correct” case. This occurs with a probability of

½.

Success probability can be increased by running

both mechanisms and choosing the allocation

with the maximal value, or by using amplification.

However, truthfulness is not preserved.

Theorem: For any e>0, there exists a truthful

mechanism that achieves an O(m½ / e3)approximation with probability 1-e.

A Truthful Mechanism for General Valuations:

Phase I: Partitioning the Bidders

Randomly partition the bidders into three sets: SEC-PRICE, FIXED,

and STAT, such that |SEC-PRICE|=(1-e)n, |FIXED|=(e/2)n, and

|STAT|=(e/2)n.

Phase II: Gathering Statistics

Calculate the value of the optimal fractional solution in the

combinatorial auction with all m items, but only with the bidders in

STAT. Denote this value by OPT*STAT.

Phase III: A Second-Price Auction

Conduct a second-price auction with a reserve price for selling the

bundle of all items to one of the bidders in SEC-PRICE. Set the

reserve price to be (OPT*STAT/m1/2). If there is a “winning bidder”

allocate all the items to him. Otherwise, proceed to the next phase.

A Truthful Mechanism for General Valuations:

Phase IV: A Fixed-Price Auction

Conduct a fixed-price auction with the bidders in FIXED and a peritem price of p=(eOPT*STAT/8m).

Correctness of the Final Mechanism

If there is a “dominant” bidder i, then he will be

in SEC_PRICE with probability 1-e.

–

With probability of at most e the mechanism fails.

Since OPT*STAT ≤ OPT* the reserve price is at

most OPT* / m½.

Therefore, we will have a winner in the secondprice auction. The social welfare value we

achieved is at least vi(M) > OPT* / m½.

Handling the Case when there is no

Dominant Bidder

Claim: With probability 1-o(1) it holds that:

OPT*STAT ≥ OPT*/ 4e and OPT*FIXED ≥ OPT* / 4e

– With probability of at most o(1) the mechanism

fails

If there is a winner in the second-price auction

then we are done.

Otherwise, we have a good estimation of OPT* (up

to O(e)), and the fixed-price auction will provide a

good approximation to the total social welfare.

Other Results

Using the same general framework we

design a universally truthful O(log2m)approximation mechanism for combinatorial

auctions with XOS bidders.

The XOS class includes all submodular

valuations.

–

–

Submodular: v(ST) + v(S T) ≤ v(S) + v(T).

Semantic Characterization: Decreasing Marginal

Utilities.

Open Questions

Designing a truthful deterministic mechanism

for combinatorial auctions that obtains a

O(m1/2) approximation ratio.

truthful

approximations:

computationally

achievable:

Submodular valuations:

e/(e-1)-e

log2m

(Feige, Vondrak)

Complement Free valuations:

m1/2

(Dobzinski-Nisan-Schapira)

2

(Feige)