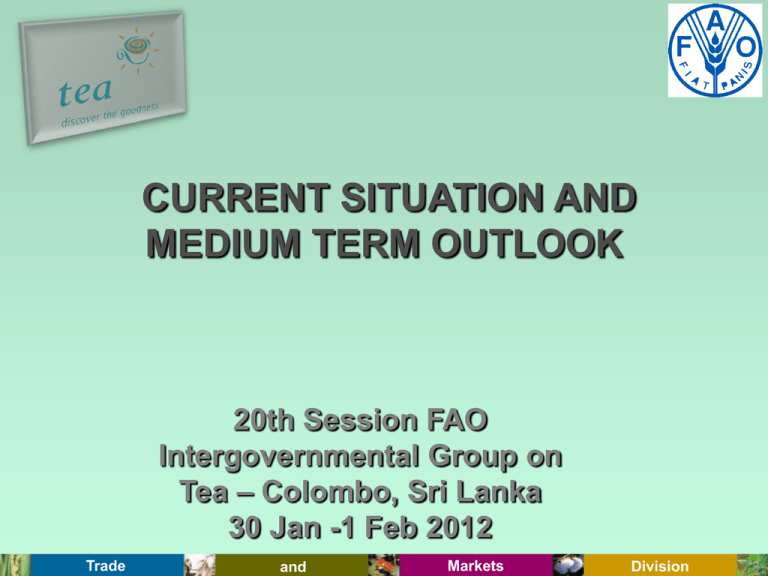

CURRENT SITUATION AND MEDIUM TERM OUTLOOK 20th Session FAO Intergovernmental Group on

advertisement

CURRENT SITUATION AND MEDIUM TERM OUTLOOK 20th Session FAO Intergovernmental Group on Tea – Colombo, Sri Lanka 30 Jan -1 Feb 2012 Trade and Markets Division HIGHLIGHTS • World black tea prices remained firm in 2010 and 2011 as market fundamentals were strong. • After long periods of sustained growth, black tea production actually declined in 2009, and demand for black tea exceeded supply. • This trend continued in 2010 and 2011. • As the FAO Tea Composite Price is an indicator price for black tea, it followed that prices were firm throughout 2009 to 2011. • Early forecast for 2012 indicates a continuation of this trend as adverse weather has been experienced by some major producers. 2 Trade and Markets Division WORLD TEA PRODUCTION (Thousand tonnes) 4120 3600 3499 2004-06 Trade 2006 and 2010 Markets Division PRODUCTION • Growth in world output was due to major recoveries in the two largest black tea exporting countries: Kenya by 18 percent and Sri Lanka by 13 percent. • Other notable increases occurred in Argentina (23.5 percent) and Uganda (16.6 percent). • China remained the largest producing country with an output of 1.4 million tonnes, accounting for 33 percent of the world total, while production in India, the 2nd largest producer, continued to decline and reached 0.97 million tonnes in 2010. 4 Trade and Markets Division WORLD TEA EXPORTS (Thousand tonnes) 1677 1548 2004-06 Trade 1547 1615 2008 and 2009 Markets 2010 Division WORLD TEA CONSUMPTION (Thousand tonnes) 3364 3827 4043 3779 2004-06 Trade 2008 and 2009 2010 Markets Division FAO TEA COMPOSITE PRICE (USD/Kg) 3.30 3.10 2.90 2.70 2.50 2.30 2.10 1.90 1.70 1.50 Dec- Mar- Jun- Sep- Dec- Mar- Jun- Sep- Dec- Mar- Jun- Sep- Dec08 09 09 09 09 10 10 10 10 11 11 11 11 7 Trade and Markets Division Tea Production and Trade to 2021 8 Trade and Markets Division PROJECTED BLACK TEA PRODUCTION (Thousand tonnes) (growth rate 1.87% p.a.) 3286 2727 2011 Trade 2021 and Markets Division PROJECTED GREEN TEA PRODUCTION (Thousand tonnes) (growth rate 7.2% p.a.) 2604 1299 2011 Trade 2021 and Markets Division PROJECTED BLACK TEA CONSUMPTION (Thousand tonnes) (Growth Rate 1.8 % p.a.) 3500 3000 2500 2000 3365 2792 1500 1000 500 0 Trade 2011 and 2021 Markets Division PROJECTED BLACK TEA EXPORTS (Thousand tonnes) (Growth rate: 1.5 % p. a.) 1521 1295 2011 Trade 2021 and Markets Division PROJECTED GREEN TEA EXPORTS (Thousand tonnes) (Growth rate: 5.8 % p. a.) 516 295 2011 Trade 2021 and Markets Division CONCLUDING REMARKS • The review of the world tea market indicates an improvement in the fundamental oversupply situation which has persisted in recent years underpinning current firm prices. • The increase in tea prices resulted in an estimated 2.2 percent increase in export earnings in 2011 at the global level, significantly affecting rural incomes and household food security in tea producing countries. • In the context of food security, tea export earnings in 2009 account for about 36 percent of total agricultural export receipts in Kenya and 62 percent of agricultural export revenue in Sri Lanka. In addition, export earnings from tea paid for about 61 percent of Kenya’s food import bill, while in Sri Lanka tea exports covered the country’s entire food import bill. 14 Trade and Markets Division CONCLUDING REMARKS • The ratio was relatively small for other producing countries, but remained significant. For example, even though domestic consumption accounted for a larger share of total production in Indonesia, export value in 2010 was USD178 million and in Tanzania tea exports earned the country USD 48 million. • In the medium term, the projections suggest that supply and demand of black tea will be in equilibrium in 2021, at a price of USD 2.75 per Kg, if there is no supply overreaction to the current firm prices. 15 Trade and Markets Division Baseline Tea Prices (USD/Kg) 3.00 2.50 2.00 1.50 1.00 0.50 19 89 19 91 19 93 19 95 19 97 19 99 20 01 20 03 20 05 20 07 20 09 20 11 20 13 20 15 20 17 20 19 20 21 0.00 Trade and Markets Division Concluding Remarks • However, if there is an over reaction to recent high prices which, for example, would result in a 5 percent increase in production, the results can be quite different. Here the clearing price would be 17 percent less than the baseline price at USD 2.54 per Kg. • If the reaction to the current high prices is even stronger, resulting in a say 10 percent increase in production over the baseline increase, then prices could be 38 percent lower. Trade and Markets Division Scenario run: Large supply response and impact on Tea prices ( 5 percent simulation) (USD/Kg) 3.00 2.50 2.00 1.50 1.00 0.50 Trade and Markets 21 20 19 20 17 20 15 20 13 20 11 20 09 20 07 20 05 20 03 20 01 20 99 19 97 19 95 19 93 19 91 19 19 89 0.00 Division Scenario run: Large supply response and impact on Tea prices ( 10 percent simulation) (USD/Kg) 3.00 2.50 2.00 1.50 1.00 0.50 Trade and Markets 21 20 19 20 17 20 15 20 13 20 11 20 09 20 07 20 05 20 03 20 01 20 99 19 97 19 95 19 93 19 91 19 19 89 0.00 Division Concluding Remarks • Therefore, caution needs to be exercised. Greater efforts should be directed at expanding demand. For example, there is scope for increasing per capita consumption in producing countries as they are low compared to traditional import markets. • The IGG on Tea has encouraged diversification into other segments of the market, such as organic tea. Trade and Markets Division Concluding Remarks • The health benefits of tea consumption should be used more extensively in promoting consumption in both producing and importing countries. • However, in targeting potential growth markets, recognition of and compliance with food safety and quality standards is essential. 21 Trade and Markets Division Thank you 22 Trade and Markets Division