International Employee Document Checklist

advertisement

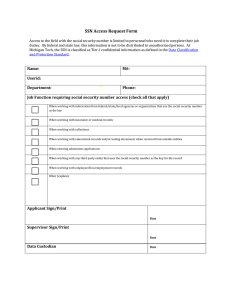

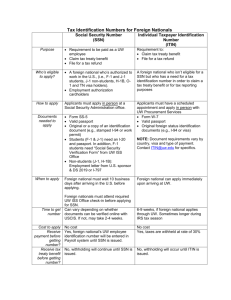

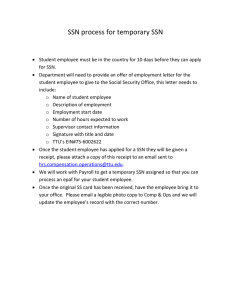

International Employee Document Checklist This checklist is intended to provide additional guidance for PPAs, when gathering the documents needed for all non-U.S. citizens and non-permanent resident alien New Hire/ Rehire., i.e., supplemental to standard NEW HIRE and REHIRE Checklists: http://www.uaf.edu/uafhr/personnel Form I-9 (This usually requires 3 documents, most common examples are below.) For additional guidance on completing Form I-9 visit http://www.uscis.gov/i-9-central and/or the Handbook for Employers http://www.uscis.gov/sites/default/files/files/form/m-274.pdf ☐ Foreign Passport (copy of the Passport photo page) ☐ Form I-94 or I-94A (Employee goes to www.cbp.gov/I94 to print their electronic I-94 for air and sea arrivals. A paper Form I-94 is still issued at the land border ports of entry – this is usually attached inside the passport.) ☐ Form I-20 (F-1 Student)/ Form DS-2019 (J-1 Exchange)/ Form I-797 (H-1B) OR ☐ Employment Authorization Document (Card) only Social Security Number *Note: ITINs are not valid numbers for employees. When your employee does not have a SSN… they may work while the Social Security Number application is being processed. But be sure to follow-up with the SSN shortly thereafter. Employers are required to obtain each employee’s name and SSN and to enter them on Form W-2. Your new employee should make an appointment with the International Programs office before going to the Social Security Administration (SSA) to ensure they have all the necessary evidence and documentation needed to apply for a social security number. They should apply no sooner than 10 days after arrival in the U.S. After they have applied; they should supply you with a receipt notice. (Hold on to this as proof and as a reminder to get the SSN later.) When the employee receives their SSN… ***See the instructions on the next page. GLACIER Nonresident Alien Tax Compliance ☐ Set-up an Individual Record by filling out the GLACIER Access Request Link at www.uaf.edu/uafhr/onboarding or http://www.uaf.edu/uafhr/personnel (Please allow two business days for processing, but if immediate assistance is needed contact UAF Personnel Team by phone.) *Note: A GLACIER Admin 3 may complete this themselves. Revised: 7/12/2016 Document1 Page 1 ☐ GLACIER Tax Summary Report (should indicate Bi-weekly Payroll Check or Compensation/Wages) ☐ GLACIER generated Form W-4 If Resident Alien, make sure the employee fills out the form completely. If Nonresident Alien, the W-4 will be completed by GLACIER (Single, 1, NRA) sign & date Exceptions: American Samoa, Canada, Mexico, Northern Mariana Islands – Line 5 additional withholding allowance for spouse/dependents Must still claim Single in Box 3 and have NRA on dotted line before box 6 South Korea – Line 5 additional withholding allowance for spouse and/or each dependent living in the U.S. India – Line 5 additional withholding allowance for each spouse and/ or each dependent living in the U.S. – must be married with dependents Line 6 should be left blank Must still claim Single in box 3 IMPORTANT: Additional writing on the Form W-4, other than that made by the employee invalidates the form. Always request a new form if something is incorrect. ☐ Other “Required Forms” generated by GLACIER *Optional Examples of other forms are: Form 8233, Treaty Attachment, Form W-9, and Statement Letter. These forms are related to Tax Treaty Benefits, (they are actually optional and require annual renewal each calendar year in order to continue). ☐ A copy of the Visa Sticker/Stamp (in Passport) This is listed in the Required Document Copies on the Tax Summary Report, but is often forgotten because it is not needed for Form I-9. *Note: There are instances when this cannot be provided. If that is the case, provide a brief explanation on a sticky note. ☐ Social Security Number in GLACIER Ensure that the number indicated on the SSN / ITIN field of the GLACIER Tax Summary Report is, in fact, a Social Security Number. *Note: Students who previously engaged in a fellowship or scholarship relationship with the University might have their ITIN (IRS individual taxpayer identification number) listed here. Do not accept an ITIN in place of a SSN for an employee. If your employee is in the process of applying for a SSN, you should see either “ApplyForSSN” or “AppliedForSSN” in the SSN / ITIN field. Revised: 7/12/2016 Document1 Page 2 ***When your employee receives their SSN… They must login to GLACIER to update their individual record. They will print, sign, and date the new Tax Summary Report and Form W-4. It is also possible that GLACIER will now extend Tax Treaty Benefits that were not available prior to the SSN being entered. You don’t need to provide copies of the I94, Visa Passport Sicker/Stamp, etc. again if no other status updates are happening. Simply staple a sticky note on top, “SSN obtained, no other update” or similar message. You may also call us with the SSN so we can enter this into Banner and verify with SSNVS, (do not email this sensitive information). *Note: The Status Immigration Expiration Date on the GLACIER Tax Summary Report must match the end date (expiration date) that is on the I-797, I-20 or DS2019. This should also match the An alien authorized to work until (expiration date, mm/dd/yyy) ________ in Section 1 of Form I-9. *Note: The Most Recent Date of Entry on the I-94 and the Visa Sticker/Stamp (in Passport) should match each other. However, the Date of Entry to U.S. in GLACIER may not match because this date should reflect the very first time the individual entered the U.S. Revised: 7/12/2016 Document1 Page 3