15 Income, Inequality, and Poverty

advertisement

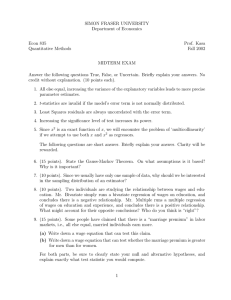

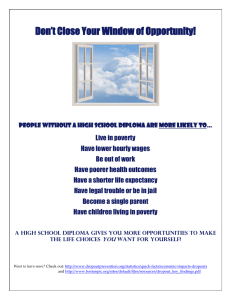

15 Income, Inequality, and Poverty US Distribution of Income 1940-2010 (in 2007$) Comparison of US – World Share of Top 1% Basic Theory of Wages • Demand for Labor is – Derived from the demand for the final good • i.e, labor is one of several inputs into the production process – Labor’s value is determined by its productivity • i.e., how much does each additional unit of labor increase output of the final good Basic Theory of Wages Basic Theory of Wages • Labor’s wage is determined by: – Increase in output, or “marginal productivity” of labor (mpL ), and – the market value of the final product – Wage = poutput * mp L • Represents a “cap” or “ceiling on an employee’s wage Historical Relationship Productivity and Wages Non-Monetary Determinants of Wages Wage Differentials • How do we explain variation in wages between “similar” people? – 1. Compensating Variation • Wage differences resulting from non-monetary characteristics of jobs • E.g. risk, desirability of job – 2. Location – 3. Human capital • Education, job-specific training, experience • $15k-$20k annual salary difference – college grad Wage Differentials • How do we explain variation in wages between “similar” people? – 4. Unions • 10-20% differential • Decreased union membership – Greater unionization in government jobs – 5. Efficiency Wages • Paying above equilibrium wage • Decreases employee turnover, increases productivity, attracts higher skilled employees Wage Differentials • How do we explain variation in wages between “similar” people? – Discrimination • Median black male earns 21% less • Median white female earns 24% less • Educational differences – Median white male 75% more likely to have college – Among whites – men and women equally likely tohave 4year degree; – but men 11% more likely to have graduate degrees – > this has been changing since the last recession (2007) Wage Differentials • How much do these factors explain the differences in wages between “similar” people? – Wage = a + b*mpl + c*location + … – These factors “explain” (account for) only about 50% of the observed variation in wages Factors accounting for “above” equilibrium wages • Unions – Provide a single source of labor for the firm • Reaction to “monopsony” in some labor markets (e.g., coal mines) • Decrease unionization -> larger gaps in income • Union “premium” declined from 20-30% to 8-15% • Efficiency Wages Efficiency Wages • Efficiency Wages – Wages higher than equilibrium – Offered in hopes of increasing worker productivity – Reduce shirking, reduce turnover – Hopefully efficiency gains are greater than the increase in wage costs • Historically – 1914—Henry Ford: $5.00/day for assembly line workers – Daily turnover decreased from 10% to 1% – Increase in willing workers; Ford was able to pick out and hire the most productive workers Wage Discrimination • Wage discrimination – Occurs when workers of the same ability are not paid the same as others because of their race, ethnicity, sex, age, religion, or some other group characteristic – Today, accounts for 3 to 5% of wage differences. Was a much bigger problem 40 years ago. • Legislation to prevent discrimination – Equal Pay Act of 1963 – 2009 Fair Pay Act—gives employees more time to file a complaint with the government Gender Wage Gap • Today – Female workers earn 23% less than males – Mostly due to compensating differentials rather than discrimination • Explanations – Men more likely to work outdoors (road work, construction) or in more dangerous conditions – Women leave the labor force more (child or elder care) • Trends – Wage gap is shrinking – Women have a 3-to-2 majority in college degrees Other Wage Differential Explanations • Cultural differences – Some cultures place more emphasis on education, which leads to higher human capital, higher productivity, and higher wages • Location – Higher costs of living in cities often translate into higher wages • Life cycle – Wages rise, peak, and then fall as a worker ages – Workers near retirement are less likely to learn new techniques or keep up with technology Median Annual Earnings by Group Occupational Crowding • Imagine a community with only two types of jobs: – A small number in engineering and a large number in secretarial services. – Everyone is equally proficient at both occupations and everyone in the community is indifferent to working either job. • Under these assumptions – We would expect the wages for engineers and secretaries to be the same Occupational Crowding • Occupational crowding – The crowding of a group of workers into a small number of jobs – May occur because certain groups may have limited skills or opportunities to enter a larger variety of jobs • Results? – Supply of labor increases in crowded jobs, decreasing wages for those jobs – Supply of labor may decrease in other jobs, increasing wages for those jobs Occupational Crowding • Now imagine that not everyone in the community has the same set of opportunities. – Suppose women were not allowed to be engineers. – Women who wanted to work could only find employment as secretaries. – Also, suppose the number of jobs as engineers was relatively small compared to the number of jobs as secretaries. • Labor market results – Large supply of secretary labor, low wages – Small supply of engineer workers, high wages Occupational Crowding • Occupational crowding is often referred to within the context of wages for men and women – Women may be crowded into jobs – The higher supply of labor lowers wages • With today’s increased opportunities, why don’t more women leave the lower-paying jobs and become engineers? – Rigidity in changing careers – Social customs – Personal preferences Where the Men Aren’t Economics in Anchorman: The Legend of Ron Burgundy • Occupational crowding • Ron Burgundy loses his job . . . to a woman! Winner Take All • Winner take all – Exists when relatively small differences in ability lead to large differences in compensation • Examples – Professional athletes • Major leaguers earn much more than minor leaguers, even though playing abilities are often not that much different – CEOs • Some CEO salaries today are more than 500 times greater than the average worker for the firm Inequality of Income • Income inequality exists when some workers earn more than others. • Caused by – – – – Compensating differentials Discrimination Corruption Differences in marginal product of labor Factors That Lead to Income Inequality • What would it take to equalize wages? – All workers would have to have same skills, ability, productivity – All jobs must be equally attractive – All workers must be perfectly mobile • Would that be good or bad? – If society’s income structure is too equal, the incentive to work is diminished – Free riding would occur Role of Corruption • Corruption – More widespread in less developed countries – Bribes may be more valued than innovation and work – Assets may not be safe from criminals or government seizure • Implications? – Investors less likely to develop a business – Short run gains may be achieved at the expense of long run costs – People may fight back if the corruption becomes too severe Measuring Inequality Measuring Inequality Understanding Observed Inequality • Why does the United States have a higher inequality ratio than Germany or Canada? – Similar poverty rate (26.3%) to other developed countries – However, the top earners in the United States earn much more compared to other countries Understanding Observed Inequality • High-income inequality also occurs in countries that are very poor and less developed – This is due to the lowest income people having much less income (compared to low-income individuals in developed countries) Difficulties in Measuring Inequality • Income inequality numbers can be unreliable and misinterpreted – Data reflects pretax income, rather than disposable income – Does not account for in-kind transfers, (goods and services given to poor rather than cash) – Does not account for unreported or illegal income. Black markets may play a larger role in less developed countries, further skewing this. – No (monetary) value is placed on goods or services produced at home—child-rearing or growing vegetables Difficulties in Measuring Inequality • Are the shortcomings a serious measurement issue? – Each individual year, probably not – Across generations, maybe so • Comparing inequality today to 50 years agp would probably violate many ceteris paribus assumptions. Birth rates, tax rates, population age, and technology all change. • Need to figure out exactly what causes changes in income inequality; tough to do if many things change • Further problems? – Assuming income distribution is a reflection of welfare; we may also value leisure, safety, community, etc. Income Mobility • Income mobility – The ability to move up and down the economic ladder over time • Higher levels of income mobility? – Give workers an incentive to improve human capital and work harder – Workers have increased change of rewards – Poverty may be only temporary Income Mobility in United States Income Mobility • Marginal poor – Poor at a point in time, but have skills to move up the ladder – Low earnings are the exception – Willing to borrow to make a big purchase – Fit well into life-cycle theory model – Student straight out of college • Long-term poor – People who lack the skills to advance to higher income levels Poverty • Poverty rate – Percent of population whose income is below the poverty threshold • Poverty threshold – The income level below which a person (or family) is considered impoverished – Adjusted each year for inflation – Does not include in-kind transfers – Does not include geographic cost-of-living differences Poverty, Historically • Equal Opportunity Act, 1964 • However, poverty rate has remained stagnant for about 40 years. Why? – Gains from growth have accrued to the middle and upper class rather than the poor – Many low-income workers continue to lack skills to earn higher wages • Solution? – Not easy—perhaps long run investment in education and skills aimed at poor – Job retraining for structurally unemployed Poverty Rate for Households Poverty Rate for Various Groups Poverty Policy • Many policies (each with their costs and benefits) have been designed to address poverty • Two conflicting motivations – We want to give generously – We want the poor to become self-sufficient • Policies – Welfare – In-kind transfers – Earned income tax credit (EITC) – Minimum wage Welfare • Not a government program but a series of initiatives – – – – Monetary payments Subsidies and vouchers Health services, housing Examples: TANF, SSI, SNAP • Who receives this? – Unemployed, disabled, veterans, dependent children – Eligibility is often limited by time and only if income is below a cutoff amount In-Kind Transfers • Direct assistance in the form of goods and services – Food banks, housing shelters, private charities, health care through Medicaid • Why give goods and services rather than cash? – Mainly to prevent the misuse of funds – Possibility of cash transfers going to alcohol, gambling addictions, or expensive clothes – In-kind transfers can be targeted at essential services Earned Income Tax Credit • The EITC is a refundable tax credit designed to encourage low-income people to work more – Can lower taxes as much as $6,000 per year – Helps over 20 million families, making it the largest poverty-fighting policy – Benefits are phased out over higher incomes, so there is no sizeable work disincentive at a specific cutoff • The EITC is a form of a negative income tax – This is a tax credit that is paid to poor households out of taxes collected from middle- and upper-income taxpayers A Negative Income Tax Minimum Wage • Discussed previously—a price floor on wages in labor markets • However, the same problems can be discussed – Low-skill people may be less productive – Firms may hire less low-skill workers – Minimum wage doesn’t guarantee employment Problems with Traditional Aid • There is one glaring problem with assistance for low-income individuals. Many welfare programs create work disincentives! – Often when income is increased, many benefits are severely reduced or eliminated – People may consciously work less to keep their benefit eligibility – The EITC does the best at addressing the work incentive problem by having phased-out assistance Problems with Traditional Aid: A Mathematical Example • Family of five earns $20,000 a year, and qualifies for $10,000 in annual welfare benefits – Total income for the year is $30,000 • What happens if earned income rises to $30,000 per year? – $30,000 earned income disqualifies the family from receiving much of the assistance it previously received. Benefits fall from $10,000 to $2,000 – Family earned $10,000, but lost $8,000 in welfare benefits. That’s similar to an 80% marginal tax rate! – That is a strong disincentive to work! Problems with Traditional Aid • Samaritan’s dilemma – Occurs when an act of charity causes the recipient not to work hard on their own to escape poverty – Another example of an unintended consequence • Addressed by Bill Clinton in 1996 as part of welfare reform – As part of TANF, he encouraged states to require employment searches as a condition for benefits – Also put a five-year maximum on benefits – Changed from entitlement to temporary safety net, reducing the samaritan’s dilemma Economics in Million Dollar Baby • Welfare and the samaritan’s dilemma • Can people become dependent on welfare? 100% Inheritance Tax • Would a 100% inheritance tax decrease wealth inequality in our country? What if we combined it with a redistribution policy? • Some normative statements – “It’s not fair. She was born with a silver spoon and she’ll inherits millions while I have to work all day” – “He earned his money. He should be able to give it to his kids if he wants.” – “Why should the government (or anyone else) get to take what I earn? Double taxation!” – “We should all start out on the same footing.” 100% Inheritance Tax • Incentives created from a 100% inheritance tax: – People may start frivolously spending. If I can’t keep wealth in my family after I die, may as well blow it now. – People will “launder” money to their children. Cash and other gifts will be given to avoid the tax. People will have the incentive to do financial planning earlier in their life before its too late. • Currently – You can give anyone $13,000 per year as an untaxed “gift.” Economics in Milton Friedman— Redistribution of Wealth • Watch this Q & A session about wealth distribution and the 100% inheritance tax Conclusion • Income inequality in itself is neither good nor bad – Too equal incomes = work disincentive – Too unequal incomes = political unrest • Welfare policies can help decrease the problem of income inequality – However, they must be designed correctly as not to create work disincentives Summary • Non-monetary determinants of earnings include compensating differentials, human capital, location, lifestyle, unions, and efficiency wages. • Economic studies of wage discrimination have found that the amount of discrimination is relatively small—accounting for 3 to 5 % of wage differences. • Despite recent gains, women still earn significantly less than men. The wage gap can be partially explained by occupational crowding. Summary • Some amount of income inequality is to be expected in a market economy. • Economic mobility reduces inequality over long periods of time. • The poverty rate in the United States has been stagnant for the last 40 years, despite many efforts (welfare, in-kind transfers, and the EITC) designed to reduce it. Practice What You Know Which of the following statements is related to compensating wage differentials? A. Long-term labor contracts may be undesirable for firms B. Education is directly correlated with income C. Workers in dangerous jobs will tend to receive higher pay D. Middle-aged workers tend to earn higher incomes than new college graduates Practice What You Know Why has union prevalence decreased over the last 50 years? A. Firms are using more capital and relocating to avoid high union labor costs B. States have made unions illegal C. Workers no longer feel the need to join a union since most jobs are safer D. The demand for goods produced by union labor has decreased Practice What You Know What is true about the gender wage gap? A. The most likely explanation for the gender wage gap is discrimination against females. B. Economics shows that most of the gender wage gap is caused by nondiscrimination factors C. Women earn less because they tend to choose more dangerous jobs than men D. Men earn more because they tend to choose jobs with more flexible work hours than women Practice What You Know Suppose the United States took the extreme step to enact wealth redistribution programs until income was equal for all people. What is the most likely result? A. High-earners would be supportive of this policy B. Firms would hire more workers C. Most people would work harder since their wealth may get redistributed D. Free riding would occur Practice What You Know Name the key “conflict” with welfare programs. A. We want the rich to pay more taxes but not too much more B. We want to help workers without hurting firms looking for people to hire C. We want to help people in their time of need but don’t want to create work disincentives D. We want to decrease inequality but not decrease it too much