COURSE SYLLABUS – Income Tax Fundamentals ACCT 255.D1 online

advertisement

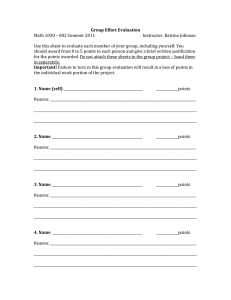

COURSE SYLLABUS – Income Tax Fundamentals ACCT 255.D1 online Spring Quarter, 2009, North Seattle Community College Instructor: Larry Hopt, J.D. Registration Item # 9418 ACCT 255.D1 Course Website: http://facweb.northseattle.edu/lhopt/acc255online/ACC255HomePage.htm Course Discussion Tool: Courseware used is First Class: To access the courseware please go to http://fc.northseattle.edu. To find out more information about using and setting up your computer for FirstClass go to the FirstClass Index page. When installing FirstClass software on your computer please be sure to complete Step 2 which will install the correct server address in your login screen. For more information about this go to the First Class Installation page. UserID = your first initial and entire last name (all lower case and one word). Password = last 6 digits of your Student ID number. Please note: Student accounts will not be available until the first day of the quarter. Registering after the first day of the quarter your account may take 24 to 48 hours to be activated. If you have any technical problems, e-mail to distance@sccd.ctc.edu for the North Seattle Community College Distance Learning Office. Instructor’s Office: IB 2417B This is in the Business Engineering and Information Technologies Division (BEIT), on the second floor of the Instruction Building. Office Hours: I have official office hours on Mondays & Wednesdays from 11 am to 1 pm. However, I am on campus many more hours than the hours listed here. If you want or need to meet in person, and cannot make one of these times, I’ll be happy to set up an appointment for other times or days that work for you. Phone: (206) 528-4529 There is Voice-Mail if I am not able to answer when you call. I try to check this daily, but may not be able to get back to you for a day or so. FAX: (206) 527-3735 Note that this is the fax machine for the whole Business , Engineering & Information Technologies Division, and your message will NOT be private. e-mail: my campus e-mail address is lhopt@sccd.ctc.edu. I usually try to respond to e-mail each day (unless it is a weekend and I am away). I would expect my maximum response time to be 48 hours. Class Discussion: Note - I will be reading and monitoring your posts and the discussions, but not necessarily responding to each posting. I encourage you to support each other and exchange ideas and questions amongst the class membership. Each student will be expected to post to the class discussions several times each week, at a minimum. “Posting” does not include merely acknowledging another student’s comments. There will be a series of icons on the FirstClass website, for various topics – such as “Dependents” or “Standard Deductions” or “Filing Status”, where you can pose questions to your classmates, or try to get clarification on how the tax rules work. You must read and understand our rules of "Netiquette and Privacy" outlined here. Also please read below on how to use the discussion rooms and class blog to earn points as well as some practical hints on managing the discussion setup. Netiquette and Privacy Words can mean many things and what we intend to say is not always what others hear. This is especially true of "online communication" during which other students do not have the opportunity to see your "body language" and therefore have a greater possibility of misunderstanding what you truly mean. Please, follow these guidelines in all your online responses and discussion groups. RESPECT. We would like to suggest respectful exchanges as a basic ground rule. We feel that informational errors should be pointed outrespectfully (even if stated strongly...). Disagreements that honor the viewpoints of the various contributors are productive and can lead to new learning and understanding. PRIVACY. Keep in mind not only your own privacy rights but others as well. Do not reveal any information that you deem private. BE CONSIDERATE of grammatical/spelling errors. REMEMBER that humor and satire are often misinterpreted online. Communication is more than words. So, be prepared for some misunderstanding and requests for clarification. BE SUPPORTIVE. We are all still learning. Our job is not to judge or condemn or even praise, although genuine encouragement is a necessary ingredient. We are here to provide information, to address topics in a discussion forum, and to provide assistance in helping each participant use her/his own unique learning style. Reflection generally precedes growth. So reflect upon what is said, provide sincere comments, and hopefully, we will all grow. One good way to avoid problems is to reread your postings before sending them. Something written in haste may be misread. Created by Val Donato, Sandra Looper, Diane Hostetler and Tom Braziunas Text: This quarter, we will be using Essentials of Federal Income Taxation for Individuals and Business, 2009 Edition, by Linda Johnson & Herbert Sieg, published by CCH. The ISBN is: 978-0-8080-1965-7. This book is available in the college bookstore – or you may also be able to pick it up online or from another source for less money!! Additional or Substitute Text: IF you have not yet purchased your text, or if we have any delays in receiving the text from the publisher – this sometimes happens during a Winter Quarter class, as Congress sometimes changes tax laws very late in the year – you can download Publication 17 (Your Federal Income Tax) from the IRS website as a starting point. (www.irs.gov) This is about 300 pages long, and contains a wealth of information and instructions. We will also be using a variety of other publications & forms that you can download from the IRS website, and handouts that I will be providing you . COURSE OBJECTIVE: The objective of this course is to introduce the student to Federal individual income tax law and income tax form preparation. No previous knowledge of income tax or accounting is required for this class. APPROACH: We will approach these questions from the point of view of the income-tax practitioner - the preparer. Note that as an introductory survey course in taxation, it will not be possible to cover every topic in comprehensive detail. NSCC GENERAL EDUCATION OUTCOMES MET BY COURSE: Outcome 1. Think critically in reading and writing. Outcome 4. Access, evaluate, and apply information from a variety of sources and a variety of contexts. READING REQUIREMENTS: All students are expected to keep up with the reading for this class. We will have at least 100 pages of reading each week, counting the text assignments, articles, webpages, etc. Please budget your time so you can read at least 20 pages per day! There will be numerous other articles, books and websites to refer to. A facility in English speaking, listening, reading and writing will be essential to successful completion of this class. GRADING POLICIES I have attached a scoring guide which will be used for assigning grades. 1,000 points total are possible, to be earned as follows: Work-Together Exams. I will give you three work-together exams, that you will have at least a week in which to complete. You can work on these together, and I will give you some time in class in which to compare notes with other students. (150 Points possible for each exam; 450 total) Final Exam – on campus, or proctored at another location. The last exam will be on campus (or proctored through a local college testing center – you will need to make those arrangements). For the final, you will be expected to complete the exam on your own, with no opportunity for you to talk or compare notes with other students, although it will be open-book and open notes. (250 Points possible) HAND-IN HOMEWORK. There will be several homework assignments to send in, for a total of 200 points. On-Line Class Discussions. Each student will be expected to participate (regularly and substantially) in on-line discussions in the "class discussion rooms," on the WebCT website. That means at least 3 or 4 "postings" on the class discussion rooms each week. See each week's assignments for guidelines on assigned discussion topics. You are also invited to post comments and questions on an "open-topic" discussion page anytime. Points Sheet Exam 1 Exam 2 Exam 3 Exam 4 Take-Home due 1/31/09 Take-Home due 2/21/09 Take-Home due 3/14/09 Last Exam on 3/21/09 Subtotal for Exams On-line Class Discussion Room POSSIBLE EARNED POINTS POINTS 150 _____ 150 _____ 150 _____ 250 _____ ____________________ 700 _____ 100 _____ Hand-In Homework HW1 HW2 HW3 HW4 HW5 HW6 HW7 HW8 HW9 HW10 Subtotal for Homework: Total points possible: POSSIBLE POINTS EARNED POINTS 20 20 20 20 20 20 20 20 20 20 _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ 200 _____ 1,000 TOTAL Points EARNED: GRADE: _____ _____ GRADING SCALE: At the end of the quarter, your total score will be compared to the following table to determine the grade you have earned for the class. This scale may require higher scores than other classes you have taken or are taking now. This reflects the fact that many of the exams/projects in this class are “takehome,” and “open-book” in nature. Percentage 96 – 100% 95 94 93 92 4.0 Grade Scale 4.0 3.9 3.8 3.7 3.6 91 90 89 88 87 3.5 3.4 3.3 3.2 3.1 86 85 84 83 82 3.0 2.9 2.8 2.7 2.6 81 80 79 78 77 2.5 2.4 2.3 2.2 2.1 76 75 74 73 72 2.0 1.9 1.8 1.7 1.6 71 1.5 70 1.4 69 1.3 68 1.2 67 1.1 No credit is given for ending scores with less than 67%. ACCT 255.D2 Individual Income Tax Reading Schedule This is the tentative schedule for reading assignments – we may need to skip around a little bit, but this will give you a basic plan. Please check back on this, and check the weekly lecture pages for much additional information. Winter 2009 WEEK 1 1/5 – 1/10 Material to Read Chapter 1, Johnson text – Overview WEEK 2 1/11 – 1/17 Chapter 2, Johnson text – Payments & Reporting WEEK 3 1/18 – 1/24 Chapter 3, Johnson text – Gross Income Inclusions WEEK 4 1/25 – 1/31 Chapter 4, Johnson text – Gross Income Exclusions & Deductions WEEK 5 2/1 – 2/7 WEEK 6 2/8 – 2/14 Chapter 5, Johnson text – Personal Itemized Deductions Chapter 6, Johnson text – Other Itemized Deductions Chapter 7, Johnson text – Self Employment WEEK 7 2/15 – 2/21 Chapter 8, Johnson text – Depreciation & Amortization WEEK 8 2/22 – 2/28 Chapter 9, Johnson text – Rental Activities WEEK 9 3/1 – 3/7 Chapter 10, Johnson text – Property Basis WEEK 10 3/8 – 3/14 Chapter 11, Johnson text – Capital Gains & Losses WEEK 11 3/15 – 3/21 Chapter 12, Johnson text – AMT, Tax Credits Chapter 13, Johnson text (Estimated Taxes & Late-Payment Penalties Only) STUDENT SUPPORT SERVICES: Students are encouraged to seek campus support services when necessary to support their learning and academic progress. Refer to student handbook, brochures/flyers, or college website for information about: Educational Access Office (accommodations) Tutoring Services Library LOFT Writing Center Plus Counseling Women’s Center Multicultural Services Office Wellness Center POLICY ON COURSE WITHDRAWAL: The instructor may initiate administrative withdrawals of students who do not start class during the first week of the quarter, in order to accommodate other students seeking entry into the class. Official withdrawal at other times of the quarter is the responsibility of the student. AMERICANS WITH DISABILITIES ACT: If you need course adaptations or accommodation because of a disability; please contact the Educational Access office as soon as possible, and let your instructor know what accommodations are needed. “CLASSROOM” RULES: Please respect the opinions expressed in class by your classmates. If you disagree with their opinion, state so respectfully, and not as a personal attack. Students are expected to comply with NSCC student conduct policy and procedures. Information on student responsibilities and rights is available at the following website: www.seattlecolleges.com/services. ACADEMIC HONESTY: Academic honesty is highly valued at NSCC. A student must always submit work that represents his/her original words or ideas. ACADEMIC DISHONESTY COULD INVOLVE: 1. Having a tutor or friend complete all or a portion of your assignment. 2. Having a reviewer make extensive revisions to an assignment. 3. Copying work submitted by another student. 4. Using information from online information services without proper citation. 5. Taking exam answers from another student’s paper. 6. Using materials not allowed, to answer exam questions. EXAMINATION CONDUCT: Students are expected to complete examinations without the unauthorized use of reference materials, notes, or classmates. CLASSROOM DIVERSITY STATEMENT: Respect for diversity is a core value of NSCC. Our college community fosters an optimal learning climate and an environment of mutual respect. We, the college community, recognize individual differences. Therefore, we are responsible for the content and tone of our statements and are empathetic speakers and listeners. RESPECTFUL AND INCLUSIVE ENVIRONMENT: The instructor and student share the responsibility to foster a learning environment that is welcoming, supportive, and respectful of cultural and individual differences. Open and respectful communication that allows for the expression of varied opinions and multicultural perspectives encourages us to learn freely from each other.