Econ 201 Lecture 5.3 Summer 2009 Market Failure:

advertisement

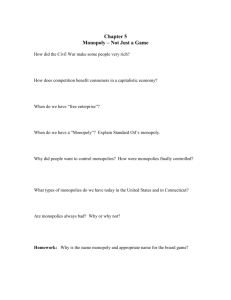

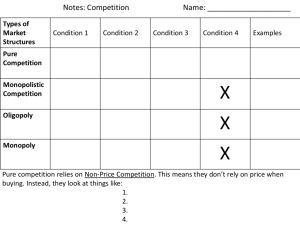

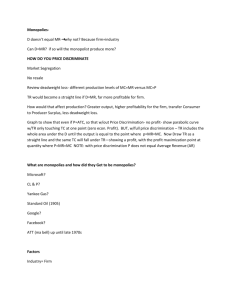

Econ 201 Lecture 5.3 Summer 2009 Market Failure: Monopoly Departures from Perfect Competition • Market structural problems – Monopoly: single supplier/seller – Monopsony: single buyer – Oligopoly: few sellers • Externalities – Public goods: positive externalities (free riders) – Negative Externalities Departures from the Competitive Market Assumptions • No buyer or seller has market power • Information costs are minimal • Product quality is known and products are homogenous • No legal/cost barriers to entry • No close substitutes • No externalities – positive or negative Monopoly • Features – Single seller, i.e., a “price-searcher” – May be the result of: • Legal barriers to entry, e.g., “med school” • Economies of scale, i.e., efficient for only 1 firm to operate (e.g., public utilities) • Information costs are high • determining product quality is costly Wikipedia’s Definition • A monopoly (from Greek mono(μονό), alone or single + polο (πωλώ), to sell) • Only one provider of a product or service in a particular market. • Lack of economic competition for the good or service that they provide and a lack of viable substitute goods. [1] • Monopoly should be distinguished from monopsony, in which there is only one buyer of a product or service; • A monopoly may also have monopsony control of a sector of a market. • Likewise, a monopoly should be distinguished from a cartel (a form of oligopoly), in which several providers act together to coordinate services, prices or sale of goods. • A government-granted monopoly or legal monopoly is sanctioned by the state, often to provide an incentive to invest in a risky venture. The government may also reserve the venture for itself, thus forming a government monopoly. What’s Different? • The profit maximizing rule for both a monopolist and a competitive firm is the same – Choose output level such that MRev = MCost • Difference is: – For a competitive firm: price = MRev • As it takes price as given – For a monopolist: • Each successive unit supplied/sold lowers the price (avg rev) and marginal revenue (MRev) An Example Monopoly Price Marg Rev Quantity 19 16 13 10 Tot Rev 7 $120 $100 $80 $60 $40 $20 $0 ($20) ($40) 4 Rev Marg Rev $20 $20 $38 $18 $54 $16 $68 $14 $80 $12 $90 $10 $98 $8 $104 $6 $108 $4 $110 $2 $110 $0 $108 ($2) $104 ($4) $98 ($6) $90 ($8) $80 ($10) $68 ($12) $54 ($14) $38 ($16) $20 ($18) 1 $20 $19 $18 $17 $16 $15 $14 $13 $12 $11 $10 $9 $8 $7 $6 $5 $4 $3 $2 $1 Qty Dem Tot 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Price Price In Words • For a price-searcher – Amount supplied has a negative effect on the price received, i.e., average (or per-unit) price falls with each additional unit sold – Therefore, if Average Revenue (Demand Curve) is falling, then Marginal Revenue is falling and is falling faster than AR – MR is below AR What’s the Impact on Market Efficiency? • DWLoss as higher P; lower Q • Transfer from CS to PS Monopolies and Market Efficiency • A monopoly will sell: – a lower quantity of goods – at a higher price than firms would in a purely competitive market. • Monopoly will secure monopoly profits by appropriating some or all of the consumer surplus: A Couple of Questions • Is the monopolist earning an economic profit? A Couple of Questions • What is the demand elasticity at the Monopolist’s Profit-Max? Demand Elasticity • As long as the price elasticity of demand for most customers is less than one in absolute value, – firm increases its prices: it then receives more money for fewer goods. – With a price increase, price elasticity tends to rise, and – in the optimum case above it will be greater than one for most customers. A Couple of Questions • Since the Monopolist is earning an economic profit, why aren’t other firms entering the market and dissipating the “economic rent”? Possible Answers • Barriers to entry – Legal barriers – entry is prohibited by legislation • Medical Profession – Accreditation – contrast to law schools/entry • Pharmaceuticals – Patents • Airline hubs – Regulated number of gates Possible Answers • Unique Costs – High fixed costs • Generally industrial: e.g., automotive (“big 3” before globalization), airlines – Economies-of-scale are so large • “natural monopolies” – public utilities (telecomm, electricity, energy) Possible Answers • No/few close substitutes – “unique” resources • diamonds, mining industries Examples of Monopolies • • • • • • • • • • • • • Examples of alleged and legal monopolies The salt commission, a legal monopoly in China formed in 758. British East India Company; created as a legal trading monopoly in 1600. Dutch East India Company; created as a legal trading monopoly in 1602. U.S. Steel; anti-trust prosecution failed in 1911. Standard Oil; broken up in 1911. National Football League; survived anti-trust lawsuit in the 1960s, convicted of being an illegal monopoly in the 1980s. Major League Baseball; survived U.S. anti-trust litigation in 1922, though its special status is still in dispute as of 2007. United Aircraft and Transport Corporation; aircraft manufacturer holding company forced to divest itself of airlines in 1934. American Telephone & Telegraph; telecommunications giant broken up in 1982. Microsoft; settled anti-trust litigation in the U.S. in 2001; fined by the European Commission in 2004, which was upheld for the most part by the Court of First Instance of the European Communities in 2007. De Beers; settled charges of price fixing in the diamond trade in the 2000s. Apple Inc., Accused of forming a Vertical Monopoly, with iPod, iTunes, iTunes Music Store, and the FairPlay DRM System. The Downside to Monopolies • Negative aspects – monopolies tend to become less efficient and innovative over time, • "complacent giants", do not have to be efficient or innovative to compete in the marketplace. – Loss of efficiency can raise a potential competitor's value enough to overcome market entry barriers, or provide incentive for research and investment into new alternatives. – The theory of contestable markets argues that in some circumstances (private) monopolies are forced to behave as if there were competition because of the risk of losing their monopoly to new entrants. • This is likely to happen where a market's barriers to entry are low. • Availability in the longer term of substitutes in other markets. For example, a canal monopoly, while worth a great deal in the late eighteenth century United Kingdom, was worth much less in the late nineteenth century because of the introduction of railways as a substitute. Upside to Monopolies? • Positive aspects • Some argue that it can be good to allow a firm to attempt to monopolize a market, since practices such as dumping can benefit consumers in the short term; and once the firm grows too big, it can be dealt with via regulation. When monopolies are not broken through the open market, often a government will step in, either to regulate the monopoly, turn it into a publicly owned monopoly, or forcibly break it up (see Antitrust law). Public utilities, often being natural monopolies and less susceptible to efficient breakup, are often strongly regulated or publicly owned. AT&T and Standard Oil are debatable examples of the breakup of a private monopoly. When AT&T was broken up into the "Baby Bell" components, MCI, Sprint, and other companies were able to compete effectively in the long distance phone market and began to take phone traffic from the less efficient AT&T.