Topic

12

s

Insurance and Benefits

Questions to Think About:

What is the difference between an insurance deductible and an insurance premium?

What are the different types of insurances? How do you choose the right insurance?

What are some public benefits available?

Learning Objectives:

Understand how insurance helps to manage risk and the role it plays in providing for

family

Identify contingent needs for yourself and family in the event of injury, disability,

death, accident or property damage

Understand what the different types of insurance policies cover

Topic 12 I Insurance I 147

Topic 12 I Insurance I 148

Topic 12 I Insurance I 149

HEALTH INSURANCE

What is Covered?

Covered services listed under policy as are services not covered

Covered services may not include what doctor thinks is “medical necessity”

because service is not among “covered services”

“Usual and customary expenses”: charge for health care consistent with average

rate or charge for identical or similar services in geographical area

Sometimes referred to as “reasonable” charges

What if my insurance company refuses to pay for treatment or a

prescription recommended by a doctor?

If the treatment is not covered, the patient will have to pay for it

The client may file an appeal of claim but the outcome will be dependent on the

contract terms

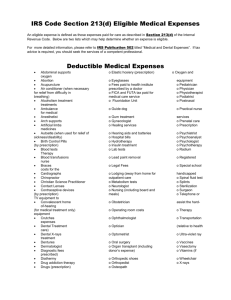

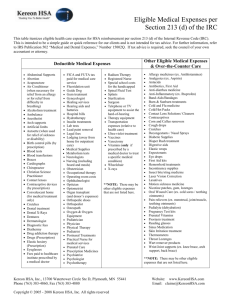

Flexible spending plans – Pre-tax dollars set aside to pay for expenses not

covered by insurance

May be used to cover deductibles

Cover expenses generally deductible as medical expenses under IRC

No IRS cap-employer sets cap

Use it or lose it

Topic 12 I Insurance I 150

BASIC COSTS COVERED BY HEALTH INSURANCE POLICY

Basic Hospital Services – Semiprivate room, food, emergency room, nursing,

intensive care, ambulance service, medicines, X-rays and lab tests. Cost of private

room not covered unless it’s a “medical necessity”

Surgery – Surgeons, assistant surgeons, anesthesiologists, and outpatient surgery;

Plan covers “usual and customary” costs

Outpatient Care – Procedures previously needing hospitalization now done on

outpatient basis. To avoid infections and other unforeseen complications, policy

should provide adequate home healthcare support.

Home Health Care – Will cover part of home health care costs only if it’s ordered by

a doctor

Most Doctor Bills – Full or part where charges are “usual and customary”

Coverage for Children – Include stepchildren and foster children if policy-holder is

responsible for their support. Remain covered up to age 19; up to 21 or up to 25 if

full-time students.

Children with Mental or Physical Disabilities – If the children are unable to

support themselves, they should be covered permanently, if disability occurred while

they were insured.

Care for Infant From Moment of Birth – Required to notify insurer of birth within

30 days — most plans provide infants with major medical coverage from birth; may

not cover therapy for all birth defects

Convalescing in Nursing Home – Will cover part of cost; After hospital stay, but

nursing care still required

Prescription Drugs – May cover part of the cost of prescription drugs

Mental ,Drug & Alcohol Abuse Treatments - May cover part of the cost of

treatments

Most Incidental Expenses – Physical therapy, oxygen, durable medical equipment

(DME), e.g. wheelchairs, walkers

Topic 12 I Insurance I 151

Topic 12 I Insurance I 152

NOTE:

72 million American adults (41%) of adults under the age of 65 had problems related to medical

bills or accrued medical debt

49 million American adults under age 65 had medical debt – 28% of the population

The vast majority of those with medical debt (61%), had insurance at time of the medical

incident

- The Commonwealth Fund, Health Insurance Survey 2007

Majority of non-credit related bills in collection are associated with medical bills (52%)

Bills in collection considered to be a type of major derogatory

Such bills have an important effect on consumer’s ability to obtain credit

- An Overview of Consumer Data and Credit Reporting – Federal Reserve Bulletin 2003

Topic 12 I Insurance I 153

LIFE INSURANCE

Benefits are paid to designated “beneficiary” in case of death of insured, i.e. “death

benefit”

Provide for loved ones as an income replacement

Provide for funeral and burial costs

Types of Life Insurance

Whole Life – Level death benefit and a level premium; has cash value and pays

dividends

Universal Life – Permanent life insurance based on a cash value, i.e. policy

established with insurer and premium payments above the cost of insurance are

credited to the cash value

Term Life – Coverage for specific period of time

For term of employment

SBLI – Savings Bank Life Insurance may be source of affordable term life

insurance

Topic 12 I Insurance I 154

OTHER TYPES OF INSURANCE

1. Disability Insurance – Replaces income in event of disability

Usually a percentage

Short-Term: 6 months

Long-Term: over 6 months

2. Long Term Care Insurance Coverage Provides for:

Nursing-home care and/or home-health care

Personal or adult day care usually for individuals above age of 65 or with chronic

or disabling condition needing constant supervision

Offers more flexibility and options than many public assistance programs

3. Renters Insurance – Covers damage and loss of contents of rented premises

4. Homeowners Insurance – Covers damage, fire, liability and loss of property

including theft. May also apply to “away from home” losses such as a child’s loss

from a college dormitory room

AUTO INSURANCE

No-Fault (Personal Injury Protection) – Medical expenses and lost earnings for

driver, passenger, or pedestrian injured in vehicular accident

Liability – Covers damage to car – driven by owner or another driver with owner’s

permission

Uninsured Motorists – Covers injuries to owner, driver or passengers in hit-and-run

accident or in an accident with an uninsured vehicle

Optional: Collision, coverage above required minimums

NOTE: USED CAR DEALERS

Through the years, used car dealers who cheat their customers typically do so in multiple ways which

are illegal, including the following, to list just a few:

“Bait and switch” advertising of cars that already had been sold

Advertising cars for less than they were actually being sold

Advertising car prices that are in truth only available with dealer-specific financing or that aren’t

the actual total selling prices

Misrepresenting customer credit scores as low to increase up finance rates

Adding additional options and costly items to a contract without asking the buyer or getting

buyer’s consent

Refusing to return deposits on cancelled orders

Charging illegal so-called “auction fees”

Misrepresenting contract terms to customers with limited English skills

Topic 12 I Insurance I 155

BENEFITS

Referrals to services such as child care, elder care, etc.

Employee benefits:

Child Care Savings Accounts – Funds put away for child focused expenses

such as school related costs

Transit Benefits – Pre-tax purchase of public transportation fares

Direct Deposit – Electronic deposit of paychecks to allow immediate access to

funds

Retirement Savings – Employer contributions

GOVERNMENT BENEFITS

Cash Programs

Cash Assistance (CA) – Formerly Public Assistance

Federal/state needs-based cash benefit program. You can use the "Am I

Eligible" option on the WashingtonConnection.org web site.

TANF

Diversion Cash Assistance (DCA)

Monthly cash benefit through an EBT card, also called at "Quest Card"

which works similar to a debit card. To learn more, go

tohttp://www.dshs.wa.gov/pdf/Publications/22-310.pdf

Supplemental Security Income (SSI)

Federal needs-based cash entitlement program administered by SSA

Provides a uniform cash benefit to eligible, low-income elderly, disabled or

blind persons

Social Security Disability Insurance (SSDI)

Federal insurance-based cash entitlement program administered by SSA

Provides a monthly cash benefit to disabled workers and their dependents

Benefit amount is based on the worker’s contribution over his/her lifetime

Social Security Retirement & Survivors Insurance (RSI)

Federal insurance-based cash entitlement program administered by SSA.

Provides a monthly cash benefit to retired workers and their eligible

dependents/survivors

Benefit amount depends on the worker’s contribution over his/her lifetime

RSI recipients at age 65 are entitled to Medicare.

*Individuals may be entitled to receive both SSI & SSDI or SSI & RSI, if they meet the

eligibility criteria of both programs.

Topic 12 I Insurance I 156

Health Benefit Programs

Medicare

Insurance-based health benefit program for the elderly, disabled or blind,

or individuals with End Stage Renal Disease, administered by SSA

Provides hospital and medical insurance, and prescription drug coverage

Applicant must be legally present in the U.S. with a valid SSN

Medicaid

Needs-based health benefit program that pays for a comprehensive range

of medical services for persons with low income. Starting January 1, 2014

Medicaid coverage will be expanded to 138% FPL.

Undocumented immigrants are not eligible unless they have a medical

emergency and/or are pregnant as long as they and meet all other

eligibility criteria.

Topic 12 I Insurance I 157

Food Programs

Food Stamps

The US Department of Agriculture (USDA), Supplemental Nutrition

Assistance Program (SNAP), called Basic Food in Washington, helps low

income people make ends meet by providing monthly benefits to buy food.

Eligibility is based on immigration status, available resources, and income.

Legal immigrants who are not eligible for federal basic food solely due

their immigration status may be eligible for the state Food Assistance

Program (FAP).

Apply on-line by using WashingtonConnection.org.

Topic 12 I Insurance I 158

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

Topic 12 I Insurance I 159

Topic 12 Exercise #1

Given the following information about Marta and Bobby’s family, what guidance

would you want to give them regarding insurance and benefits?

Marta (age 34) and Bobby (age 37) are married with 2 children, a girl, Elena (age 7) and

a boy, Martin (age 10). Bobby has employer-provided health insurance, but it does not

cover dental and has an annual $500 deductible, and no prescription coverage. Marta

only works part-time and has no benefits.

Marta’s mother, Cecilia (age 59) emigrated from her native country a few years ago

and lives with Marta and Bobby. Cecilia has just started a job. She has no savings and

no health insurance.

Topic 12 I Insurance I 160