LSE Individual exemptions by the individual Programme Specification: BSc Accounting and Finance

advertisement

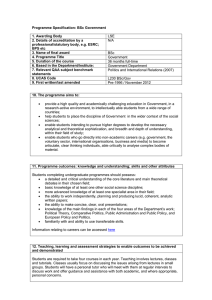

Programme Specification: BSc Accounting and Finance 1. Awarding Body 2. Details of accreditation by a professional/statutory body, e.g. ESRC; BPS etc 3. Name of final award 4. Programme Title 5. Duration of the course 6. Based in the Department/Institute: 7. Relevant QAA subject benchmark statements 8. UCAS Code 9. First written/last amended LSE Individual exemptions by the individual professional accountancy bodies: ICAEW, , CIMA, CIPFA, ACCA. BSc (Hons) Accounting and Finance 3 years Department of Accounting Accounting (2007) NN34 BSc/AccFin March 2001 / November 2012 10. The programme aims to: Set accounting and finance within a broader social science framework in order to: provide an undergraduate education at the forefront of the international field in the study of the theory and practice of financial management, control and accountability in organisations; situate the study of accounting and finance in some of the various contexts (such as the capital markets, the public sector, the appraisal of business efficiency ) within which accounting and finance professionals play a key role; develop in students an understanding that not only is accounting and finance as a discipline concerned with computational skill but, more importantly, it is central to the way in which both management internally, and also various stakeholders externally (including investors, lenders, customers, the government and the public) perceive, understand, and seek to change and control the nature of organisations and the ways in which resources are allocated to and by them; foster in students a critical and flexible approach to accounting and finance issues, within a UK and international context; prepare students for challenging careers in accounting and finance and related sectors, as well as for higher degrees/research; enable students to gain appropriate exemptions from professional accountancy and finance examinations. 11. Programme outcomes: knowledge and understanding; skills and other attributes Knowledge and understanding: At the end of the programme, students will have a thorough understanding of the key aspects of: Financial accounting, analysis and valuation Managerial accounting Principles of finance Quantitative methods Economics plus will have selected from: a range of specialist courses in aspects of management, operational research, organisational theory and behaviour; advanced managerial accounting, auditing governance and risk management, corporate finance and financial markets, commercial law; other social science disciplines. 1 Subject specific skills: At the end of the programme, and to the appropriate extent indicated by their level of award, students should demonstrate: appropriate ability to communicate knowledge and understanding of several of the major contexts within which accounting operates, based on a critical evaluation of related theoretical and conceptual frameworks and of empirical evidence as to its effects; appropriate ability to communicate knowledge and understanding of, and appropriate ability to use and critically evaluate, current and major alternative technical languages and practices of accounting, together with appropriate ability to apply them; appropriate ability to record and summarize financial data and prepare financial statements in outline accordance with major UK regulatory requirements and international financial reporting standards; appropriate ability to manipulate financial and other numerical data and appropriate understanding of and ability to apply mathematical and statistical concepts; appropriate ability to communicate and apply knowledge and understanding of the principles of business information systems management; appropriate ability to analyse business activities and perform financial analyses and projections in appropriate contexts of planning, decision making and control; and to recognize the limitations of these techniques; appropriate ability to communicate knowledge and understanding of financial management, risk and the operation of financial markets, based on critical evaluation of theories and empirical evidence. Cognitive abilities and non-subject specific skills: At the end of the programme, students should be able to demonstrate: appropriate ability to evaluate arguments and evidence critically; appropriate ability to locate, extract, analyse, and draw reasoned conclusions from multiple sources—including electronic sources—of appropriate literature and relevant data; appropriate ability to acknowledge and reference sources; appropriate capacities for independent and self-managed learning; appropriate use of communications and information technology, such as spreadsheets, word-processing and on-line databases; appropriate communication skills such as ability to present quantitative and qualitative information, together with analysis, argument and commentary, in an appropriate form; ability to work in groups and other appropriate inter-personal skills, including oral and written presentation skills. Information relating to careers can be accessed here 12. Teaching, learning and assessment strategies to enable outcomes to be achieved and demonstrated Teaching and learning strategies: Students acquire their detailed knowledge and understanding of the course, and their subject specific skills, through a combination of lectures, problem classes and progression to guided independent study, reinforced by the opportunity to meet teachers and their academic advisers one-to-one in office hours. Course reading lists include not only leading textbooks but references to current research 2 literature and primary sources, including relevant examples from current practice, official and professional policy documents, websites and other electronic data sources. Academic teaching staff are leading-edge researchers who give students an insight into current thinking and recent developments in their fields. Several teachers and academic advisers are also involved in policy advice and formation and give students insights into real-world developments in accounting and finance and the forces that shape them. Professionals working in the field contribute as part-time lecturers and class teachers. Students have the opportunity to acquire hands-on experience of IT and information systems applications as well as familiarity with electronic databases. Assessment strategies: Summative assessment of knowledge and understanding and of subject-specific skills is by 3hr unseen examinations at the end of each year. Formative assessment is through class assignments, including numerical and computer-based exercises, critical essays and commentaries, and individual and group presentations, for example on case studies and mini-projects or in ‘role-plays’. Cognitive and non-subject specific skills are developed in parallel with the development of - and through the same teaching and assessment structures that are designed to achieve the appropriate levels of - the knowledge and understanding and subject specific skills described above. 13. Programme structures and requirements, levels, modules and awards Programme regulations can be viewed here Additional information 14. Criteria for admission to the programme Normal academic entry requirement is AAA at A level or IB diploma with 38 points including 7 6 6 or 6 6 6, or equivalent level of attainment. At least level A at GCSE maths or equivalent; Students seeking direct entry to the second year, and mature students, are given individual requirements according to their particular background and circumstances; LSE General Course students seeking direct entry to the third year must attain 1 mark of at least 70%, 2 further marks of at least 60% and 1 further mark of at least 50% in their year-end examinations. They must have taken at least one accounting paper and one finance paper during the General Course year and attain at least 60% in each of those papers, and the papers taken during the General Course year must meet the requirements of papers 5-12 of the regulations for the BSc Accounting and Finance; Non-English speakers must meet the School's English Language requirements. 15. Indicators of quality Applications for places: (2010) 1,994 for 123 target places; RAE rating (2008): Business and Management Studies: 70% of research outputs graded at 3* or 4* and ranked in top 5 UK HEIs; The department is responsible for the management of the Centre for Analysis of Risk 3 and Regulation (‘CARR’); The academic staff include several professionally-qualified accountants who hold or have held senior positions in their professional bodies; A large proportion of the professors of accounting in the UK are former members of staff and/or former students of the department. Current and former members of staff, and/or former students, have won many of the awards for ‘Distinguished academic of the year’ awarded by the British Accounting Association (‘BAA’); Individual exemptions granted by various professional accountancy bodies including ICAEW and ACCA. 16. Methods for evaluating and improving the quality and standard of teaching and learning The School’s Teaching and Learning Centre is available to monitor and observe teaching and offers constructive advice on how to improve the standard of teaching quality; Departmental TLAC review once every five years; The Teaching Learning and Assessment Committee which regulates all aspects of teaching quality; The Undergraduate Studies Sub-Committee which oversees all undergraduate programmes and ensures that significant changes to programmes and courses pass through a sequence of formal stages, so that curricular changes are appropriate and compatible with other developments; The Department’s additional quality evaluation procedures are coordinated through its Teaching Quality Enhancement Panel. Primary responsibility lies with individual course leaders, course lecturers, class teachers, and academic advisers and their own self-evaluation is focussed primarily through the Department’s annual course reviews and peer-teaching observations, the TQARO student satisfaction surveys and the School’s mentoring and staff appraisal processes. Other Departmental structures and processes include: ad hoc reviews such as the current BSc Review, looking at the degree as a whole; the annual Departmental Examination Sub-Board meetings and the External Examiners’ reports; the termly Departmental meeting; the responsibilities of the Departmental Tutor; student feedback and consultation through the undergraduate staff-student liaison committee (SSLC); annual post-examinations feedback meeting on overall programme with graduating third year students; start and end of session meetings with part-time teachers. 4