—J W O

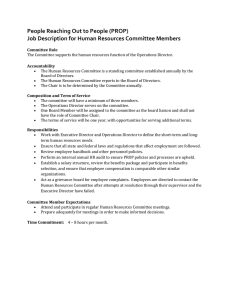

advertisement