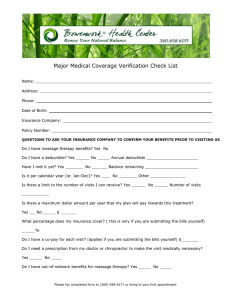

Learn Important Insurance Terminology

advertisement

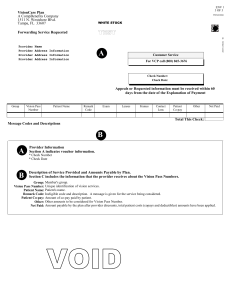

Learn Important Insurance Terminology Benefits The types of services and costs that your insurance policy covers. For example, some policies have no outpatient mental health benefits, or require a referral/approval in advance, or have a "cap" or upper limit of payment, or require that you use only their "preferred" providers. You must determine the benefits of your policy by contacting your insurance company or by reading your policy carefully. Claim The request submitted to your insurance company by either you or your provider, asking them to help pay for the services you receive. Some policies require that the provider submit the claim and be reimbursed directly by the insurance company; other policies require that you pay your provider and then submit a claim. Co-pay The amount you pay for a service in addition to whatever your insurance company pays. For example, your insurance company may require that you co-pay a certain amount (e.g., $20) or a certain percentage (e.g., 20% of the bill) per visit, while the company pays the rest. Deductible The amount you must pay out-of-pocket before your insurance company will begin to help cover your bills. For example, if your policy has a $100 deductible, you must pay the first $100 of the fees you incur for that benefit year. Out-of Network A provider who has no contract agreement with your insurance company is considered out of network. Pre-Certification A process of pre-approval from your insurance company to activate your mental health benefits. Single Case Agreement When your provider is not contracted with your insurance company, they will sometimes file a single case agreement with your insurance company. These are usually filed in special circumstances, e.g. the provider is a specialist, out of state coverage, or limited availability of providers. All providers and insurance companies vary on this practice. R:\Counseling\Staff\Resource Referral\Referral Handouts