ISLaMic Economics: Monetary and Fiscal Policy

advertisement

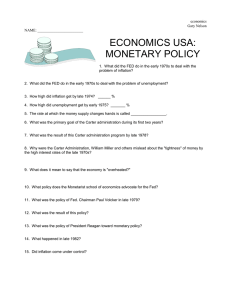

ISLaMic Economics: Monetary and Fiscal Policy Headlines ➲ ➲ ➲ ➲ ➲ ➲ ➲ ➲ Obama Plans Major Shifts in Spending To Pay for Health Care, Obama Looks to Taxes on Affluent Reports Show More Signs of Downturn Preparing for a Flood of Energy Efficiency Spending Home Sales and Prices Continue to Plummet Now Is No Time to Cut Research Bernanke Again Rejects Bank Takeovers California Drought Drives Up Joblessness What is ISLM economics? ➲ ➲ ➲ ➲ Discussed real sector of economy: production and income Discussed monetary sector How do the consumers, savers, lenders, borrowers, and monetary authorities interact to determine level of national income and rate of interest? Rough model. “Economics is a two-digit science” Macroequilibrium in Real Sector Equilibrium in Monetary Sector ➲ Levels of income (Y) and interest (r) at which demand for money = supply of money Reality Check ➲ ➲ Do you think Ben Bernanke and Geithner know what the hell is going on? I will try to explain the model that they more or less follow. What Determines S and I? ➲ What happens to savings as income (Y) increases? ● ➲ What happens to savings as interest rates (r) increase? ● ➲ Would you save more in a hedge fund at 20% or in government bonds at 2%? What happens to investment as income increases? ● ➲ Who saves more, the poor or the rich? Will firms invest more when people are buying lots of stuff or nothing? What happens to investment as interest rates increase? ● Would you be more likely to start your own business with interest rates at 1% or 20%? (Both rates exist today) What Determines S and I? ➲ ➲ ➲ S=S(r,Y) I=I(r,Y) Equilibrium in real sector occurs when S(r,Y)=I(r,Y) ● ● ➲ ➲ One equation, two unknowns Multiple solutions Depicted by IS curve Assumption is that economy is always moving towards equilibrium Equilibrium? Chapter 7: Efficiency and Exchange Slide 11 IS Curve r Why downward sloping? ➲ ➲ ➲ Low interest = more profitable investment opportunities => more investment => more income Higher income = more savings Higher interest = more savings? ● ➲ Do poor people carry credit card debt at 20%? When savings are high, interest rates must be low for sectors to balance. Why do people demand money instead of real assets? ➲ ➲ Avoids inconvenience of barter Transactions demand for money ● ➲ ➲ ➲ More income = more transactions = more transactions demand for money Liquidity preference: we prefer liquid assets to frozen ones. Cash is most liquid What is the cost to holding cash? What is the cost of holding non-liquid assets? How is Demand for Money Related to Income and Interest? ➲ ➲ ➲ ➲ ➲ What happens to your demand for cash money as interest rates increase? As income increases? DM=L(r,Y) Equilibrium occurs when DM=SM What determines SM? ● ● ➲ Discoveries of silver and gold? Ben Bernanke? Equilibrium occurs when L(r,Y)=M LM Curve Why does LM slope upwards? ➲ More income = greater demand for money. Less money available to lend. Higher r required for equilibrium Moving Towards Equilibrium in LM ➲ M>L ● ● ● ● ● ● More money available than people want Use excess to buy non-liquid interest bearing assets, e.g. Bonds Demand for bonds increases, price increases, interest rate on bond goes down. Increase in supply of money drives interest rate down Lower r = lower opportunity cost of holding money, higher demand for money Lower r = greater Y = higher demand for money Combining IS and LM ➲ ➲ ➲ ➲ Two simultaneous equations with two unknowns One unique combination of r and Y for which I=S, L=M Equilibrium in real and monetary sector We do not assume that economy is in equilibrium, but rather that it is moving towards it. ● Perhaps better to assume that economy is never in equilibrium, but that monetary and fiscal policy are likely to push it in specific directions under certain circumstances Combining IS and LM How do we use this? ➲ Comparative statics: How do r and Y respond to exogenous changes? ● ● ● ➲ Changes include monetary and fiscal policy as well as liquidity preferences, propensity to save, efficiency of capital investment, etc. How does the economy move towards equilibrium when policy pushes it away? Doesn't look at dynamic path Was current crisis an exogenous change? In the US? Internationally? Non-Policy Changes: IS ➲ Propensity to Save What has happened to US propensity to save? ● ● ● ● ● ● ➲ ➲ In last 50 years? In last 50 weeks? S>I for all I, injection into economy (I) < leakage (S) for all Y and r on old equilibrium Income decreases until I=S again, new equilibrium Higher savings rate, but lower income. Less expenditure deters investment. IS curve shifts to left Paradox of thrift How can policy counter this? Non-Policy changes: LM ➲ Increase in liquidity preference ● ● ● ● ➲ ➲ L>M Higher r required to induce lending Each level of Y associated with higher r on new LM Shift upward Same thing occurs from decrease in M (monetary policy) How can policy counter this? r Monetary Policy: 3 tools Fed can use: Reserve requirements (within bounds set by congress) ● ● Allows private banks to create more or less money Interest rates (discount window) ● ● Rate at which Fed loans money to banks Open market operations: buying and selling government securities (bonds) ● ● ● Changes money supply. Goal typically is to increase or decrease overnight interest rates for banks loaning to one another (Fed funds rate) Current Monetary Policy ➲ ➲ Discount window from 5.75% August 2007 to ~0% today; Fed funds rate shows similar plunge NYT Headlines from last year: ● A Rate of Zero Percent From the Fed? Some Analysts Say It Could Be Coming Monetary Policy ➲ Increase in M shifts LM curve downwards (to right) ● ➲ ➲ Decrease in M shifts LM curve upwards (to left) Why would we want to decrease M? ● ● ➲ Higher income, lower interest Real M=nominal M/P Any other reasons? Liquidity trap ● ● When demand is inadequate, firms have excess capacity, increasing money supply (reducing r) has no impact on investments. 'Pushing on a string' Fiscal Policy ➲ Taxation ● ➲ Government expenditure ● ● ➲ Reduces demand, contracts economy, drives down interest rates Stimulates investment, expands economy Drives up interest rates if competing with private sector Crowding out ● ● When economy is at full capacity, government expenditure simply displaces private sector expenditure This was dominant belief until last year 3 Ways for Government to Spend ➲ Tax and spend ● ● ➲ Borrow and spend ● ● ● ➲ Spending more than counteracts equal tax Surplus = taxes > expenditures Greater short term impact than tax and spend Deficit = expenditures > taxes Borrowing now = taxes in future Print money and spend ● ● ● Does not increase interest rates Threat of inflation We could increase reserve requirements, give government more control NYT description ➲ “The Federal Reserve, through its power to raise and lower interest rates, exercises more influence over economic growth and the level of employment than any other government entity. That unusual role dates from the 1970s, when the executive branch and Congress pulled back from the use of fiscal tools — vast New Deal spending and targeted tax cuts — as a means of regulating prosperity.” Is this true? Real World Fiscal Policy: the Federal deficit Who Controls the Fed? ➲ ➲ ➲ The governors appointed by the president, approved by Congress Chair appointed for 14 years Regional bank presidents “selected by leaders of their communities, particularly bankers.” (NYT) What is the goal of the Fed? ➲ ➲ ➲ Officially to target unemployment and inflation “Their main thrust has been to limit inflation, even at the risk of a recession — although they have cut rates when the nation seemed in danger of one, as the Bernanke Fed has recently done.” The Task Ahead: First on To-Do List: Tame Inflation by DAVID LEONHARDT Inflation, Disinflation, Deflation ➲ Is inflation a problem? Good for debtors, bad for creditors ● ● ● ● ● ● ➲ Facilitates price adjustments Predicted vs. unpredicted Moderate inflation vs. hyperinflation Disinflation ● ➲ 2% inflation x 7 trillion debt (at fixed interest) = 140 billion “inflation tax” Also tax on those who hold money (reduce L). Predicted vs. unpredicted Deflation ● ● More feared than inflation Creates incentive not to spend money Deflation ➲ ➲ NYT Headline (Nov. 1) Fear of Deflation Lurks as Global Demand Drops NYT 2005, calling Bernanke a safe choice: “The lessons of the Depression sometimes seem to hover behind much of his thinking. Shortly after becoming a Fed governor in 2002, for example, Mr. Bernanke argued forcefully for tough action to head off a possible epidemic of deflation, or downward spiraling prices.” Fighting Deflation ➲ Bernanke’s remedies ● ● ● Buying treasury securities with longer maturities Buy up privae debt, e.g. corporate bonds “In effect, the Federal Reserve would be printing more money and injecting it into the economy — a strategy of “quantitative easing,” in Fed jargon.” Fighting Inflation ➲ ➲ Increase supply Reduce demand (typical approach) Fiscal policy ● ● ● ● Monetary policy ● ● ● ● ● Increase taxes Decrease spending Can be targeted Raise interest rates: bad for debtors, good for creditors, bad for farming, construction Decrease money supply Blunt instrument Either one can increase unemployment, reduce wages Unemployment and Inflation ➲ ➲ NAIRU and Phelps Bargaining power of labor vs. capital ● ● ➲ Black death Wage push or Profit push inflation? Impact on wages ● Does this work in global economy? Unemployment and National Income ➲ ➲ Positive feedback loops (vicious circles) Fiscal policies and stability ● ● Welfare payments Unemployment insurance What Does Fed Target? ➲ Bernanke ● ● ● “he is trying to establish himself as an inflation fighter” “speaking out on a wide array of topics about the economy as well as about the central bank's need to become more open and to peg policy to publicly stated inflation targets.” “As both an academic and former Fed governor, he focused on the importance of the Fed's antiinflation credibility.” Why does Fed Target Inflation? ➲ Who are the Fed's constituents? Not elected Where do Fed reserve governors come from? Why do stock markets dislike inflation? ● ● ● ● ● Inflation increases uncertainty Fear of higher interest rates ➲ ➲ ➲ “In settling on Mr. Bernanke, President Bush ... chose a candidate who would satisfy others -- investors on Wall Street, lawmakers in Congress -- more than himself or his Republican base.” ''They needed somebody that everybody, including the financial markets, would react positively to.'' “But Mr. Bernanke had what many outsiders wanted: a world-class reputation among economists; credibility on Wall Street” Impact of Policies on Scale, Distribution and Allocation ➲ What should our goals be? ● ● ● ● ● ● Sustainable Scale Just Distribution Efficient allocation Stability How do we reduce consumption without increasing unemployment, while making poor better off? What is appropriate balance between market goods and public goods? Monetary Policy ➲ Only affects market goods directly ● ● ➲ ➲ Difficult to simultaneously address scale and distribution Poor at dealing with public goods, including ecosystem services Changing reserve requirements Blunt instrument Fiscal Policy ➲ Taxes ● ● ● ● Can be targeted: 'tax bads, not goods'; 'tax what we take, not what we make' Reduces overall consumption Stabilize economy Can have important impact on scale Fiscal Policy ➲ Subsidies ● ● Research and development Activities that provide positive externalities: 'subsidize goods, not bads' Fiscal Policy ➲ Government expenditures ● ● ● ➲ Can be targeted: welfare for corporations or for the poor? Public goods or private goods? What offers highest marginal benefits? Investments in human made vs. natural K Crowding out in a full world