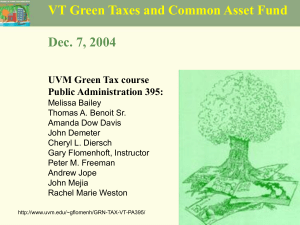

VT Green Tax Shift & Common Asset Fund Dec. 7, 2004

advertisement

VT Green Tax Shift & Common Asset Fund Dec. 7, 2004 UVM Green Tax course Public Administration 395: Melissa Bailey Thomas A. Benoit Sr. Amanda Dow Davis John Demeter Cheryl L. Diersch Gary Flomenhoft, Instructor Peter M. Freeman Andrew Jope John Mejia Rachel Marie Weston http://www.uvm.edu/~gflomenh/GRN-TAX-VT-PA395/ “There is nothing more difficult to carry out, more doubtful of success, nor more dangerous to handle, than to initiate a new order of things. For those who would institute change have enemies in all those who profit by the old order, and they have only lukewarm defenders in all those who would profit by the new order.” ---Nicolo Machiavelli, 1490 WHAT ARE GREEN TAXES? "PAY FOR WHAT YOU TAKE, NOT FOR WHAT YOU MAKE" "TAX WASTE, NOT WORK” Tax Nature, NOT Labor or Capital •Environmental protection •Economic Efficiency •Using market incentives Survey-EU Green taxes EU Types of Green taxes NW GREEN TAX SHIFT Inventory of NE GREEN TAXES Source: Janet Milne, Env. Tax Policy Inst., Vt. Law School NE GREEN TAXES Source: Janet Milne, Env. Tax Policy Inst., Vt. Law School NE GREEN TAXES CURRENT VERMONT GREEN TAXES Captive Insurance Insurance Telephone Company Beverage Cigarette Tobacco Products Other general taxes VT Taxes-2004 TOTAL WASTE Other fees Bank Franchise TOTAL ENERGY TOTAL AIR AND WATER TOTAL CHEMICALS Speculative Gains Tax Telephone Property Telecommunications current use property Corporate Income land-NICU Meals & Rooms Sales & Use Estate Tax buildings-NICU Personal Income Property Transfer Tax GREEN TAX PRINCIPLES What is the goal of government? What is the goal of taxation? Can they be combined? Excludable Non-Excludable Market Good: Food, clothes, cars, land, timber, fish once captured, farmed fish, regulated pollution Open Access Regime: (misnamed: Tragedy of the commons) Oceanic fisheries, timber etc. from unprotected forests, air pollution, waste absorption capacity Potential market good Non-rival} (Tragedy of the “noncommons”)but inefficient: patented information, Pond, roads (congestible), streetlights Private beaches, private Non-rival, gardens, toll roads, congestible zoos, movies Pure Public Good: climate stability, ozone layer, clean air/water/land, Biodiversity, information, habitat, life support functions, etc. Rival} Public beaches, gardens, roads, etc. Taxation + Provision of Public Goods Taxation Public Goods Green Taxes GREEN TAX PRINCIPLES 1.Internalize external costs 2.Behavioral Approach 3.Revenue Generating EXTERNAL COSTS? ECONOMY POLLUTION DEPLETION LAND USE (Not to mention social costs) PRICES LIE Vermont GPI study 20,000 18,000 Burlington Chittenden 16,000 Vermont US $/capita 14,000 12,000 10,000 8,000 6,000 4,000 2,000 1950 1960 1970 1980 Year 1990 2000 GDP AND HAPPINESS 1. Cost Internalization •Pigouvian theory (AC Pigou) •external costs •Polluter pays principle •restoration costs •Least cost abatement- •cost required to abate pollution 2. Behavioral Approach WHATEVER YOU TAX YOU GET LESS OF (WITH ONE EXCEPTION) WHAT DO WE WANT LESS OF? WHAT DO WE WANT MORE OF? TAX ON BUILDINGS - production cost P S1 CS p1 PS D q1 Q TAX ON BUILDINGS - production cost S2 P tax S 1 CS p2 p1 Deadweight loss PS tax D q2 q1 Q Inelastic demand-gasoline (few subs.) P S1 CS p1 PS D q1 Q Inelastic demand-gasoline S2 P S1 CS p2 PS p1 tax tax D q2 q1 Q Elastic demand-movie (many subs.) P S1 CS p1 PS D q1 Q Elastic demand-movie S2 P p2 p1 S1 CS PS D tax q2 q1 Q TAX ON LAND - no production cost P S “Buy land, they ain’t making any more.” -Will Rogers P1 D Q1 Q TAX ON LAND - no production cost P S “Buy land, they ain’t making any more.” -Will Rogers P* P1 tax? D Q1 Q TAX ON LAND - no production cost S P “Buy land, they ain’t making any more.” -Will Rogers P* tax? P1 tax Ps D Q* Q1 Q Modern Economists Right: “Land tax is the least bad tax” ---Milton Friedman Green: “Taxation of value added by labor and capital is certainly legitimate. But it is both more legitimate and less necessary after we have, as much as possible, captured natural resource rents for public revenue.” ---Herman Daly Left: “Usurious rent is the cause of worldwide poverty” ---Joseph Stiglitz 3. Revenue Generating Green tax increase How to spend the money? Deficit reduction: none in VT Dedicated revenues: ~$5 Million Other tax relief: ~$500 Million GREEN TAX CRITERIA 1. ECONOMIC EFFICIENCY 2. DISTRIBUTIVE EQUITY 3. ENVIRONMENTAL PROTECTION 4. EASE OF ADMINISTRATION