Carbon Tax Andrew Jope PA 395 – Green Tax September 14, 2004

advertisement

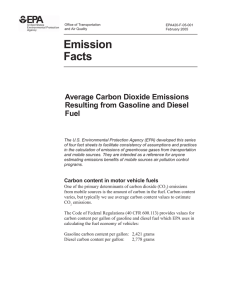

Carbon Tax Andrew Jope PA 395 – Green Tax September 14, 2004 What is a Carbon Tax? • Excise tax levied on fossil fuels in proportion to the CO2 emissions which they produce, roughly equivalent to carbon content. • Assessed as $ per ton of carbon or $ per ton of CO2 emissions. • Currently no carbon tax at the federal or state level in the US. States Considering Carbon Taxes • Maine – convened tax-shifting advisory committee • Michigan – industry tax credits for energy conservation, fleets of alternative fuel cars, purchase/installation of recycling equipment • Minnesota – 1996 Economic Efficiency and Pollution Reduction Act – Pollution tax offset by $1.5 billion/year reduction in payroll and property tax. Defeated in committee. Public support for tax shift , opposed by Teamsters, airline and mining industries. States Considering Carbon Taxes (Cont.) • Oregon – 1998 Governor convenes Environmental Taxation Subcommittee. • Vermont – 1996 – Act 60 adds $.04/gallon in state gas tax to fund education. Policy window in late 1990’s closed with little success. Federal Excise Tax Rates on Fuel FUEL CENTS/GALLON Gasoline 18.4 Ethanol/Gas Blend 13.2 – 15.4 Diesel Fuel 24.4 Ethanol 13.15 Methanol 12.35 Liquefied Petroleum Gas 13.6 Compressed Natural Gas 4.854 Liquefied Natural Gas 11.9 Aviation Gasoline 19.4 Aviation Jet Fuel 21.9 Vermont Fuel Taxes CATEGORY Sales and Use Motor Vehicles Diesel Fuel Gasoline FUEL Gas (Propane/Natural) Electricity Coal RATE .05% .05% .05% Heating Oil/Kerosene Purchase Short Term Rental .05% 6% 5% Vehicles<10,000 lbs. Vehicles>10,000 lbs. $.17 $.26 $.20 Cap + Trade vs. Carbon TaxCase for Cap + Trade • Fixes amount of CO2 emitted, allows price to float. • Enable reductions where least costly. • More appealing to private industry. • Can be designed to deal with all GHG’s defined in Kyoto. • Permit prices adjust automatically to inflation/price shocks. Cap + Trade vs. Carbon TaxCase for Carbon Tax • Taxes externalities directly/sends clear price signals. • Influences broader scope of behaviorsconsumers, transportation + service sectors. • Fewer transaction costs in implementation. • Permanent incentive to reduce emissions and innovate. • Earns revenue / able to be recycled. Northeastern States Approach • 9 States committed to regional strategy to reduce CO2 (NY,CT,VT,NH,DE,ME,NJ,PA,MA,RI) • Will establish emissions trading for power producers. • April, 2005 – agreement to be finalized. Issues – Competitive Disadvantage • Globally – Industrial relocation to developing countries follows labor costs, NOT ENERGY COSTS. • State to State – More problematic. Easier and less costly to relocate to another state Issues – Regressivity • Carbon tax applied in isolation IS REGRESSIVE (transportation/residential costs). • Can be addressed through revenue recycling (progressive income tax restructuring, direct benefit payments, etc.) Issues – Winners and Losers • WINNERS Nuclear Industry (Vermont Yankee) Hydropower (Hydro Quebec) • LOSERS Traditional Industry Agriculture Forgive portion of tax liability? (Scandinavian model)? Issues – Timing and Adjustment • Short term costs to workers and communities. • Phase in over time – allow industry to adjust at rate closer to traditional market conditions. • Recycle revenue to buffer adjustment costsworker retraining, partial compensation, efficiency subsidies. • Index to inflation – tax base shrinks by design. Is it Right for Vermont? • Rural state with little industry and power production. • CO2 Emissions 47% Transportation 20% Residential 33% Commercial, industrial, utilities • 70% of air pollution from gasoline combustion – dispersed sources, hard to regulate. • A new policy window? (VT Yankee 2012 / Hydro Quebec 2016)