Chapters 13 & 14: Brokerage Real Estate Principles: A Value Approach

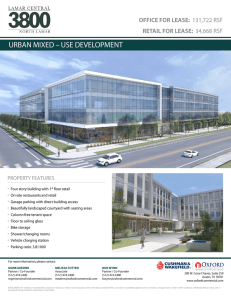

advertisement

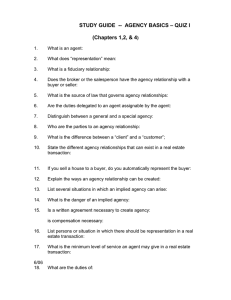

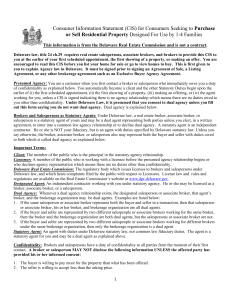

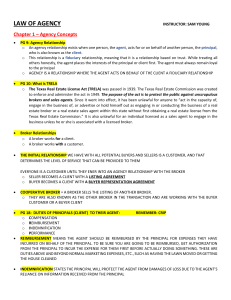

Chapters 13 & 14: Brokerage Real Estate Principles: A Value Approach Ling and Archer Outline Brokerage functions Agency relationship RE sale The economic functions of brokerage Bring buyers and sellers together. In real estate needs. Physically. Emotionally. Collect commission for a successful transaction. Usually, percentage of price. What a broker can add: Prices and terms in current market. Marketing approaches that work. Legal obligations of buyers and sellers. Properties in market. Potential customers and their needs. Procedures and requirements of transaction. Law of agency RE brokers and salespersons (agents) operate under the law of agency. Under the Law of agency: The agents must look out for the best interests of the principal. Agents have a fiduciary relationship with their principals. Duties: disclosure (open and honest); confidentiality; accounting (keep the principals informed); obedience to legal and ethical limits; loyalty; skill and care. Principals need to be open, honest, and fair. Brokers vs. salespersons RE Broker: an agent who can operate his/her own brokerage agency. RE salesperson: an agent who must work for a broker. This license is earlier to obtain than broker. They must be licensed by states to provide RE estate transaction services for others: buying, auctioning, renting, selling, appraising, leasing, exchanging. Usual requirements for licensing Minimum age (18 for both broker and salesperson in VT), high school diploma (not this in VT), good reputation. Pre-licensing education requirement (40 hours in VT from many providers, e.g., Brokers Institute, South Burlington). Pass state licensing exam. Minimum experience (2 years and 8 transactions for broker’s license). The licensing administration authority in VT is: http://vtprofessionals.org/opr1/real_estate/ Listing contract An agency relationship is created between a seller and a broker (not just with a salesperson) when both parties agree to a listing contract. A contract for services, not for real estate. Frequently involves subagency through a multiple listing service (MLS). Brokers have access to each other’s listings in a MLS. Thus, all other members are a member’s subagents. Buyer agency agreement In a buyer agency agreement, a broker agrees to use his/her best efforts to find properties meeting the requirements of the buyer. Increasingly between buyers and brokers. When a buyer agent is a member of MLS and use the MLS to identify a property, the agent is also a subagent of the listing (seller) agent. This is a dual agency in which the buyer agent represents both the buyer and the seller. Conflict of interests? Commission splitting Sale of Property $100,000 Commission 6.0% $6,000 Listing Broker Firm 50% of Commission $3,000 Listing Salesperson 50% of Firm’s Commission* $1,500 Selling Broker Firm 50% of Commission $3,000 Selling Salesperson 50% of Firm’s Commission* $1,500 *These Percentages can vary from 50 percent to 90 percent depending on such factors as the length of time the sales person has been with the firm and whether he or she is an officer of the firm. Internet marketing Residential www.realtor.com Commercial www.costar.com RE sales: 2-step process 1. Once the buyer and the seller identify each other, they first reach an agreement on the contract for sale. Contract for sale is the most important document in RE sales: it specifies the rights and the type of deed to be delivered by the seller and, in return, the purchase price. 2. Sometime later, the 2 parties complete the sale at a meeting called the closing. Contract for sale Determines price and terms of the transaction. Defines property interest being conveyed. Determines the grantee. Determines other conditions of the transaction: Financing. Date of occupancy. Any repairs or other conditions of the sale. Handling of funds Broker normally handles funds for a transaction. Broker must put deposits in escrow. Escrow account: an account holding funds dedicated for a particular purpose. Must be with insured institution or title company. At closing, money is disbursed in accordance with a closing statement.