Vermont Senate Finance Committee Written testimony

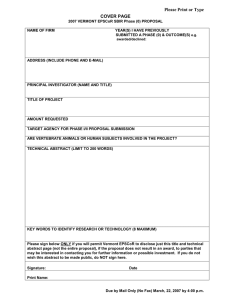

advertisement

Vermont Senate Finance Committee Written testimony Revenue for a Sustainable Economy: Green Taxes, Common Assets, and Subsidy Reform Gary Flomenhoft, MPA Faculty/Department of Community Development and Applied Economics, and Fellow at Gund Institute, UVM January 26, 2011 I would like to thank Senator Ann Cummings and Steve Klein of the JFO for inviting me to testify today, and Rachel Levin for making the arrangements. I would also like to thank the 18 students who did the research for these two reports. You might be wondering who I am and what axe I’m grinding. My background is very diversified including a degree in mechanical engineering and a master in public policy and ecological economics. Prior to coming to UVM I worked in the private, government, and nonprofit sectors, and also started 3 businesses. I teach macroeconomics, renewable energy, and international development courses at UVM, and do research on public finance. I love Vermont and see it as a laboratory of democracy where good ideas can be implemented through open government. I am politically independent, and believe that everyone has part of the truth. My interest is in making Vermont a better place. Introduction My presentation can be divided into three sections which can be summarized with the following three phrases: GREEN TAX SHIFT: “TAX BADS, NOT GOODS” COMMON ASSETS: "PAY FOR WHAT YOU TAKE, NOT FOR WHAT YOU MAKE" SUBSIDY REFORM: “STOP SENDING GOOD MONEY AFTER BADS” GREEN TAX SHIFT A Green Tax shift means a shift in taxes without an overall increase. This changes the incentive structure without changing revenue potential. Everyone wants a green economy, but there is one big obstacle. Prices push us in the opposite direction. It is almost always cheaper to do the wrong thing environmentally than the right thing. For example, at $6/ton in Vermont it is much cheaper to take solid waste to a transfer station than to deal with recycling or composting it. A hybrid car having higher mileage and lower emissions costs $5-7,000 more than an equivalent gasoline car. A coal burning powerplant spewing mercury, sulphur, and nitrogen oxides into the air drifting over Vermont produces power cheaper than renewable energy such as solar, wind, biomass, or hydro. Phosphorus and nitrogen from farm chemicals and lawn fertilizers turn parts of Lake Champlain into “dead zones”, and farming with pesticides which endanger human health, is generally more profitable than organic farming. In every case, the massive environmental and social costs are pushed off onto society, and are not reflected in prices, or paid for by producers or consumers. We have to get prices to tell the truth. No business will ever impose additional costs on itself so it is up to government to make prices tell the truth through taxation, and make polluters and depleters pay. Economic Efficiency At the same time we want jobs, investment, innovation, start-ups, and business expansion but our tax system discourages it. Taxes on income and capital, are generally considered inefficient for several reasons. “The most obvious cost is that people are left with less money to meet their 1 needs for food, clothing, housing, and other items, and businesses are left with fewer funds to invest and build the economy. Deadweight losses are created by taxes distorting the market economy by changing relative prices and altering the behavior of workers, investors, businesses, and entrepreneurs” (Crane, Boaz 2005) Taxes on income and wages also increase the cost of labor to business, thereby decreasing the supply of jobs. This is true of income taxes, payroll taxes, and workers compensation payments. Since “investment flees taxation” taxes on labor or capital also discourage innovation, job creation, and risk-taking. Taxes generally add to production costs, thereby raising prices and reducing consumption of the item taxed. For example, taxes on cigarettes or gasoline decrease consumption of these items by raising their price. Taking housing as an example, do we really want to increase the cost and restrict the supply of housing, when housing costs are already through the roof in Vermont? Taxes on building improvements have this effect. A green tax shift can replace taxes on productive activities such as building construction with taxes on the use of depletion, land use, and pollution. Throughput To understand a Green Tax shift we have to understand throughput. All economic activity starts with materials and energy extracted from the source of nature creating depletion, transformed by labor and capital into products, with waste energy and materials going back into the sink of nature as pollution. “Throughput is the entropic flow of matter-energy from nature’s sources through the human economy and back to nature’s sinks” (Daly 1993, p326). But where does this activity take place? There has to be a location or site where economic activity takes place. All economic activity takes place on land sites with the exception perhaps of shipping or air travel. So throughput comes from sources, is transformed on sites, and ends up in sinks. Throughput is the flow of resources and energy through the economy resulting in products as well as pollution and waste. Resource depletion, land use, and pollution are external costs that are not accounted for in normal market transactions. Standard economic indicators such as GDP, stock market level, housing starts, business profits, etc. provide no indication of social and environmental externalities. GDP, for example, measures the total dollar value of goods and services in the economy. Maximizing GDP therefore also maximizes throughput. Wouldn’t it make more sense to maximize GDP per unit of throughput? This would be an efficient economy rather than a wasteful one; smart growth instead of dumb growth. Failure to account for external costs in prices also violates the “polluter pays principle”. A green tax shift can begin to internalize some of these external costs and help make polluters pay. With green taxes resources will be conserved, land will be used more efficiently, and pollution will be reduced. Whatever you tax you get less of, therefore we should tax depletion, land use and pollution more. We should tax value added by capital and labor less such as wages, income, profits, investment, buildings, entrepreneurs, etc. Wall Street Over the last several decades we have witnessed the transformation of the productive economy into the financial or casino economy on Wall St. We saw the results last year in the financial collapse. The entire edifice of Wall St. investments was based on financial instruments connected to the land bubble of the last decade. When the real estate market collapsed, all the related investments of Wall Street such as mortgage backed securities, Collateratalized debt obligations, Credit default swaps, derivatives, and all the other obscure mortgage based investments also collapsed. Perhaps we should encourage productive investment and not gambling on asset bubbles? 2 Green Tax shift Existing Green taxes In order to design a Green Tax shift we first looked at existing green taxes in Vermont. We looked at 2004, but the sources of revenue haven’t changed since then, so the information is still valid. Looking at 2004 we find the following main sources of revenue: Property taxes comprising. . . . . . 35% personal income . . . . . . . . . . . . . . 20% sales and use . . . . . . . . . . . . . . . . . 12% energy taxes . . . . . . . . . . . . . . . . . .12% But if you divide property taxes into taxes on land and buildings separately we find that 2/3 of property taxes fall on buildings, and therefore we get the following breakdown: Buildings . . . . . . . . . . . . . . . . . . . 24% Personal income . . . . . . . . . . . . . 20% Sales and use . . . . . . . . . . . . . . . .12% Energy taxes . . . . . . . . . . . . . . . . 12% Land . . . . . . . . . . . . . . . . . . . . . . .11% So this means that nearly a quarter of instate revenue is coming from taxes on buildings. It is worth considering if this negative incentive structure is worth keeping in a state where there is a severe lack of affordable housing, and large wage gap between income and housing costs. If we define green taxes as taxes on throughput: either resource depletion, land use, or pollution we find that approximately 25% of current Vermont instate revenue comes from Green taxes. These taxes and fees include energy taxes such as gasoline and diesel fuel, fees on solid and hazardous waste, chemicals such as pesticides, air and water emissions including cigarettes, and the land portion of the property tax. Sales tax is colored light green due to the fact that sales taxes do tax consumption, but they tax the labor and capital value added portion in addition to the resource portion. We feel that taxing resource use directly is more effective and doesn’t provide a disincentive to labor and capital as a sales tax does. sting Green Taxes in Vermont Main Features existing 2004 Revenue Energy. . . . . . . . . . . . . . . . . . . . varies. . . . . . . . . . . . . . . . . . . . . . . .$259,269,147 Property. . . . . . . . . . . . . . . . . . 2/3 on buildings, 1/3 on land. . . . . . . .$782,118,363 Waste . . . . . . . . . . . . . . . . . . . . $6/ton on haulers. . . . . . . . . . . . . . . . . $5,901,672 Air and Water. . . . . . . . . . . . . . . . $1170 impervious surfaces. . . . . . .$1,201,769 Chemicals. . . . . . . . . . . . . . . . . . . $100 pesticides fee . . . . . . . . . . . . . .$932,100 General . . . . . . . . . . . . . . . . . . . . . . .varies. . . . . . . . . . . . . . . . . . . . . $1,012,614,704 Other fees. . . . . . . . . . . . . . . . . . . . varies. . . . . . . . . . . . . . . . . . . . . . . $56,585,608 TOTAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,118,623,363 New Revenue for Green Tax Shift It is important to note that the recommendations in this report are just three examples of applying the principles of “tax bads, not goods” and many other options are possible. We made the following major recommendations. Details can be found in the report. Energy. . . . . . . . . . . . . . . . . . . . Carbon @ $100/ton. . . . . . . . +$262,270,853 Property. . . . . . . . . . . 1/3 on buildings 2/3 on land in growth centers . . . . . . . . same Waste . . . . . . . . . . . . . . . . . . . $2/bag PAYT. . . . . . . . . . . . . . . . . . .+$149,103,672 3 Air and Water. . . . . . . . . . . . . . . . . . $.01/gal >100gals . . . . . . +$89,851,516 Chemicals. . . . . . . . . . . . . . . . . . . $300 pesticides fee. . . . . . . . . +$ 2,215,900 Total Increase. . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . ~$500 million As a result of our recommendations we were able to estimate $500 million in additional revenue. Keeping to our theme of revenue neutrality, the next step was to choose which taxes to reduce with the additional revenue. All of the following were reviewed and considered: Sales and Use tax, Meals and rooms, individual income tax, Corporate/business income tax, Fed payroll tax, or even to eliminate all other taxes. Green Tax Shift Option 1 Cut personal income, corporate income, and telecommunication taxes, 2004 revenue ~$500 million Taxes reduced: Personal income tax. cut.. . . . . . . . . . . .-$429,488,824 Corporate income. cut. . . . . . . . . . . . . . . -$55,497,257 Telecommunication. cut. . . . . . . . . . . . . .-$15,000,000 Total Reduction . . . . . . . . . . . . . . . . . . .$499,986,081 Analysis – Elimination of personal and corporate income taxes, and telecommunication taxes. Vermont is often accused of having an unfriendly business environment, particularly in comparison to neighboring New Hampshire which has no income tax. This reduction could help to silence critics. However, state income tax is already progressive so lowest income filers have little or no liability. Offsetting income tax may not help compensate for higher fuel costs. Telecommunications is a high tech industry that should be promoted in Vermont, and reduction of taxation on this industry could be beneficial to job creation. While property tax revenue was not changed, a shift of the ratio is recommended from 2/3 on buildings to 2/3 on land. This reform could start in designated Growth Centers, Village Centers and Downtowns if the state passed enabling legislation allowing taxation of land at a higher rate than building improvements. These changes would result in state revenue 3/5 based on green taxes. Green Tax Shift Option 2: Decrease federal payroll tax by $500 million starting with wage earners below $35,000/year Analysis-$500 million reduction in federal payroll tax: Payroll tax burden is much higher than income tax for low-income taxpayers and business as shown on table above. Reduction of payroll tax is therefore much more progressive and better for business who pay half. This amounts to a 7.65% tax break for employees and employers of these individuals. The total payroll taxes paid in Vermont in 2004 was calculated to be $1,852,073,396, which nearly equals the instate revenue of $2.1 billion. To reduce payroll taxes 4 by $500 million it is possible to eliminate payroll taxes on all employees in Vermont making below $35,000, and allow the reduction to be tapered-in for incomes above that amount, or provide an equal rebate for all. The Economic Benefits of FICA Reduction are multiple including returning income to those most likely to spend it, and aiding businesses as well as workers. It provides an incentive for employment by reducing the cost of labor, thereby boosting the Vermont economy. This option results in half of state revenue coming from green taxes, as well as $500 million in payroll taxes paid. This option was the recommended plan by MPA students at UVM. German Eco-Tax Reform 1999 This is exactly what Germany did in 1999 with their Eco-Tax Reform. Fuel taxes were increased by 55% and payroll taxes were reduced. The result was that Germany reduced their GHG emissions, and developed the largest renewable energy industry in the world, with 18% of world wind and 40% of world PV installations. By 2006 Germany had 150,000 jobs in renewable energy compared with 107,000 in traditional energy. Green tax shift Option 3: Let’s go all the way 100% Green tax shift $2.6B revenue. Increase energy, waste, air, water, chemicals, and land tax. Eliminate all other taxes in Vermont, and reduce federal payroll tax by$500 million. Analysis A 100% Green tax shift is feasible, and could simplify taxation and revenue generation enormously by shifting to a few broad-based green taxes. Green taxes imposed in this plan are the same as option 1&2 above with the following two changes: Carbon tax is increased from $100 to $300/ton, and taxes on buildings are eliminated and replaced with a 9.6% tax on land only. This would simplify taxes enormously with a “single tax” on nature, and none on income, sales, or any other productive activity in Vermont. Summary The recommendations in this report would have resulted in additional revenue of over $500 million dollars in fiscal year 2004, by increasing fees on energy, air and water use and emissions, solid and hazardous waste, and chemicals and pesticides. This demonstrates the viability of the green tax shift, and the possibility of reducing taxation of productive activities, while increasing taxation of resources, land, and pollution. Regulatory approaches to the environment have been effective in the past, but face the obstacle of economic incentives working against them. A green 5 tax shift allows prices to more accurately reflect the environment cost of products, creating market incentives for environmental protection. Simultaneously, it allows taxes on production to be reduced, resulting in a “greener” more productive economy. By joining the popular movement for Green Taxes the broader goal of payment for use of natural opportunities, and exempting private effort can be achieved more readily. Revised Recommendations to Tax Commission Dec. 30, 2009 Carbon tax In considering the art of the possible I have made a few changes to the recommended Green Tax plan. The carbon tax was reduced from $100/ton to $20/ton. This is based on the estimated increase in the price of gasoline of 89c per $100/ton carbon tax (based on molecular weight of carbon). This would result in an increase in gasoline prices of 18c, which is comparable to the price of gasoline in neighboring New York State. The 2008 carbon emissions as stated by the Governors Commission on Climate change were 8.44 million metric tons (excluding power plants). At a tax of $20/ton this would generate $168,800,000 in revenue. This is not much less than the previous estimate of $216,200,000 based on a tax of $100/ton since this figure was calculated in 2000 (See Taxing Pollution, Rebecca Ramos, Fair Tax Coalition). Carbon containing fuels subject to current or future carbon permits in a regional or national cap/trade system could receive a tax credit on the permit amount to avoid double taxation. Therefore, I did not count carbon emissions from power plants currently enrolled in RGGI, although the permit price was only $3.50 last year. Heating and transportation fuels are not currently part of RGGI. Due to the regressive effects of energy prices on rural Vermont drivers and other residents, I propose that 100% of the carbon tax be rebated, as recommended by climate scientist James Hansen of NASA. If rebated equally to every one of an estimated 623,000 residents, this would result in a per capita rebate of $271. Due to our nearly complete dependence on petroleum it is advisable to provide incentives for alternative fuel vehicles and more efficient petroleum fuels vehicles. A 20c per gallon increase in fuel costs will help that effort. Bottled Water The other major change in the recommendations is to charge rent to bottled water companies for the use of ground water rather than the previous recommendation to charge all water users. The recent ANR estimate is that 99 million gallons of water were extracted for bottling in 2008. At a retail price of $6.78 per gallon based on the price of a liter bottle, estimated revenue in 2008 was $671 million dollars. At a royalty rate of 12% this would result in $80.5 million in revenue. Total Revenue The total increase in revenue under this system is $448,756,931 as compared with the previous estimate of $503,441,940. Deducting the $168,800,000 carbon tax rebate leaves $279,956,931 to offset other taxes. Based on our analysis of income and payroll taxes we continue to believe that a rebate of federal FICA payroll taxes would be of greater benefit than reducing income, sales, or other taxes. The substantial benefits have been demonstrated by the German eco-tax reform of 1999. Property Taxes Vermont has unique real estate tax in the land gains tax which taxes short term land speculation. Currently the minimum size property is 10 acres for residential and 25 for agricultural land. There are also many exemptions that would be worth reviewing. Considering the role of the land 6 bubble in the financial crisis of 2008, it might be worth considering changes to the land gains tax to reduce land inflation and speculation. Many people do not realize the property tax is a tax on land and building improvements combined, and that in some locations these items are taxed separately. Our primary recommendation for property is to consider a revenue neutral shift by taxing land more and buildings less. It would be advisable to start with enabling legislation that would allow municipalities to use this option in designated “Growth Centers”, “Downtowns”, and “Village Centers”. It has similar results as a TIF, but without any loss of revenue. Capital Gains and Speculation taxes. Due to the financial crisis, there is considerable discussion of financial speculation taxes both at the national and international level. Prime Minister Gordon Brown of Great Britain and PM Nicolas Sarkozy of France have both proposed an international speculation tax of .25% as we previously recommended. In the US Congress Representative Peter DeFazio and Senator Tom Harkin have proposed a bill called "Let Wall Street Pay for Wall Street's Bailout Act of 2009” also based on a rate of .25%. If these measures do not pass, Vermont could consider a state financial speculation tax. The disadvantage of a federal tax is that Vermont does not receive any of the revenue. Capital gains taxes do not differentiate between productive investments in goods and services and gambling in financial securities or real estate. It would be beneficial to exempt the job producing investments from capital gains taxes and maintain them fully on speculative investments. Exemptions could include entrepreneuers, venture capital and angel funds, investments in IPOs and new stock offerings, small business loans, housing construction, or any other productive investment and not a paper profit with no equivalent good or service provided. These productive investments could also be exempted from any speculation tax imposed. State Bank One state that has emerged with minimal damage from the financial crisis is the state of North Dakota. In the early part of the 20th century, North Dakota farmers were squeezed financially by out-of-state bankers. Determined to avoid this loss of autonomy in the future, the state legislature created the Bank of North Dakota in 1919. All state funds and funds of state institutions are deposited with Bank of North Dakota, as required by law. The Bank administers several lending programs that promote agriculture, commerce and industry in North Dakota. Vermont would be well advised to follow the example of North Dakota and consider the formation of a Vermont Sovereign State Bank. In the case of a crisis due to the declining value of the US dollar, the state bank would be in a position to create bills of credit or state currency to maintain the operation of the state economy and state government. Revised summary of Green Tax shift measures: ITEM Carbon tax $20/ton Pay as you Throw Solid Waste $2/bag Bottlers-groundwater rent Property shift: 2/3 land, 1/3 buildings Chemicals Other new revenue New Revenue $168,800,000 $149,103,672 $80,546,400 0 $2,215.900 $50,304,643.10 7 TOTAL NEW REVENUE Carbon tax rebate Payroll tax rebate $448,756,931 $168,800,000 $279,956,931 8 Captive Insurance 1% Telephone Company 0% Bank Franchise 0% Insurance 1% Beverage 0% Tobacco Products 0% 2004-2009rev-w/offsets Other general taxes 0% Cigarette 2% Other fees 2% Telephone Property 0% Telecommunications 1% Corporate Income 2% TOTAL ENERGY 18% Total water 3% Meals & Rooms 4% TOTAL WASTE Sales & Use 10% TOTAL CHEMICALS Estate Tax 1% current use property 0% Current Use Penalty Tax 0% Personal Income 17% Speculative Gains Tax 0% land-NICU 20% eee property tax (PROP68) 0% Property Transfer Tax 1% buildingsNICU 2004-2009rebates $20/ton carbon tax rebate: $168,800,000=$27 1 each Fed Payroll tax rebate $280,000,000 9