Corruption and Competition Franklin Allen Jun “QJ” Qian

advertisement

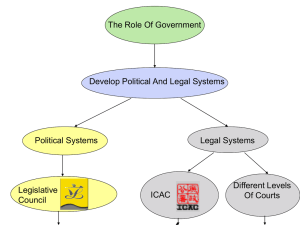

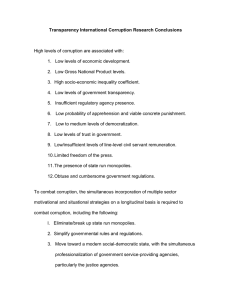

Allen & Qian Pacific-Symposium-06 Corruption and Competition Franklin Allen Jun “QJ” Qian Wharton School Carroll School of Management University of Pennsylvania Boston College Symposium on “Rethinking Corruption” McGeorge School of Law, University of the Pacific October 27, 2006 Updated version of the paper can be downloaded at: http://www2.bc.edu/~qianju/research.html 1 Allen & Qian Pacific-Symposium-06 Motivation • Damaging effects of corruption: – Distortion of incentives and misallocation of resources; – At its worst, corruption is theft and robbery committed by high-rank government officials; – Ample evidence on the damaging effects at micro-levels; – It is also a pervasive and persistent problem • Corruption and economic growth: – How to measure corruption: Indexes produced by international agencies based on surveys (e.g., Transparency International); – Is the elimination of corruption a necessary condition for economic growth in developing countries? • Paul Wolfowitz (President of the World Bank) vs. Hilary Benn 2 Allen & Qian Pacific-Symposium-06 Motivation (cont’d) (Svensson 2005, JEP) 3 Allen & Qian Pacific-Symposium-06 Motivation (cont’d) Table 1 The Largest 20 Economies in the World as of 2005 Rank Country 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 U.S. Japan Germany U.K. France China Italy Spain Canada Korea Brazil Russia Mexico India Australia Netherlands Belgium Switzerland Sweden Turkey GDP in 2005 GDP (US$bil.) 12,452 4,672 2,800 2,197 2,113 1,910 1,719 1,124 1,106 800 789 772 758 746 684 623 365 365 354 353 Annual growth rate (%; 90-05) 5.2 2.9 4.0 5.4 3.6 11.2 3.0 5.2 4.4 7.7 3.6 n/a 7.4 6.0 5.5 5.1 4.2 2.9 2.6 5.9 Country /Region U.S. China Japan India Germany U.K. France Italy Russia Brazil Canada Korea Mexico Spain Indonesia Australia Taiwan Turkey Iran Thailand GDP in 2005 using PPP* GDP Annual growth (Int’l $bil.) rate (%; 90-05) 12,332 9,412 4,009 3,603 2,498 1,826 1,812 1,695 1,585 1,553 1,112 1,099 1,065 1,026 864 639 630 571 560 559 5.2 12.1 3.7 7.9 3.7 4.6 4.0 3.6 1.4 4.6 5.0 7.6 5.1 4.8 6.2 5.5 7.4 5.7 6.8 6.9 Notes: *The PPP conversion factor is from the World Bank Development Indicator (Table 5.6, World Bank. For details on how to calculate the indicator, see “Handbook of the International Program.” United Nations, New York, 1992). Source: IMF World Economic Outlook Database 2006. 4 Allen & Qian Pacific-Symposium-06 Motivation (cont’d) Table 2-A Corruption, Taxing Ability and Economic Growth The Corruption Perception Index for a country is the average value (0 to 10; lower score means more corrupt) of Transparency International from 1995 to 2005. GDP data, starting from 1980 to 2005, are all based on PPP (purchasing power parity) and from IMF World Economic Outlook Database. Tax/GDP variable, starting from 1990 to 2000, is the percentage of tax revenue over GDP and from United Nations Online Network in Public Administration and Finance. Statistics Least Corrupt Countries Moderately Corrupt Countries Most Corrupt Countries Mean Stdev. Mean Stdev. Mean Stdev. Corruption Perception Index 7.31 3.95 2.46 Tax/GDP 21% 8% 17% 9% 14% 11% GDP Growth Rate per year (1981-2005) 6.40% 1.53% 6.22% 1.39% 6.14% 2.13% Per Capita GDP (1981) GDP per capita (2005) 9,708 4,764 3,560 2,618 1,648 1,411 14,602 6,363 8,706 5,650 3,636 2,974 5 Allen & Qian Pacific-Symposium-06 Motivation (cont’d) • In large and regionally diversified countries: – Such as China and India, corruption has not slowed down economic growth (Allen, Qian and Qian 2005; Allen et al. 2006) • In many African and South American countries: – Corrupt officials seem to have severely retarded growth • What about Russia? – Composition of industries 6 Allen & Qian Pacific-Symposium-06 Research Goals • Re-examine the reasons for the occurrence of corruption: – Linking corruption with government’s ability to raise tax revenues; • Develop a new rationale: – To explain the different impact of corruption on growth across countries; • Provide new empirical predictions: – Impact of corruption on different countries/regions; – Impact of corruption on different industries and firms; – Impact of corruption and the degrees of competition among officials; • Policy implications: – How to set up the provision of government goods and services; – How to link the efforts to control corruption with other types of regulations; – How to measure the performance of local government officials. 7 Allen & Qian Pacific-Symposium-06 Related Work • Literature on “efficient” corruption: – Leff (1964) and Huntington (1968); – Competition among economic agents (e.g., Lui 1985; Bliss and Di Tella 1997; Ades and Di Tella 1999) • Shleifer and Vishny (1993) • Literature on central vs. local government officials: – Principal-agent relationship first developed by Becker and Stigler (1974); – How to motivate agents to implement socially optimal goals • Literature on institutions and economic growth: – Rajan and Zingales (2003a,b); – Acemoglu and Johnson (2005) • Empirical literature on corruption: – Corruption and economic growth (e.g., Mauro 1995; Svensson 2005); – Corruption and provision of government goods and services (micro). 8 Allen & Qian Pacific-Symposium-06 Main Results • In our model corruption occurs when: – Government cannot raise sufficient tax revenues to finance the (costly) provision of goods and services; • Long-run solution is to increase government’s taxing ability; • In the short-run, bribes can be regarded as user fees • Impact of corruption on economic growth depends on: – Degree of competition among officials providing the same good/service • Perfect (Bertrand) competition: User fees are competitively determined and damaging effects of corruption are minimized; • Monopoly: Much higher user fees => provision of goods and services below socially optimal level; • Imperfect (Bertrand) competition: Relocation costs of agents affect the quantity of goods and services provided. 9 Allen & Qian Pacific-Symposium-06 Empirical Predictions • Corruption and government’s taxing ability • Corruption and the degree of competition in the provision of government goods and services: – Negative impact of corruption depends on regional competition: • Large and diverse countries (e.g., China and India); • Small and homogeneous countries (African and South American countries) – Negative impact of corruption also depends on firm and industry characteristics: • Relocation costs are lower for small firms and industries require less (immovable) fixed assets; • Empirical literature on the size of “Underground economy” • China/India vs. Russia 10 Allen & Qian Pacific-Symposium-06 Policy Implications • Eliminating corruption during early stage of development: – Unlikely to be effective; – Long-term solution is to increase government’s taxing ability • How to limit the negative impact of corruption: – Set up provision of goods and services in a competitive environment: • This can be implemented even in small and homogeneous countries; – Encourage regional competition: • Inter-regional trade (Imports/exports over GDP; Svensson 2005); • Lower regulation of entry and costs of relocation (Djankov et al. 2002) – Evaluating performance of government officials: • Performance measures based on economic growth and amount of activities from non-local sources (see Li (1998) for example on China). 11 Allen & Qian Pacific-Symposium-06 Ongoing and Future Work • Model extensions: – Costs of providing the good/service: • • • • Different across officials; Fixed and variable costs; Asymmetric information in cost structure Literature on defense procurement; – Different types of government goods and services: Externality • More empirical evidence on corruption, finance and growth – Law, institutions, finance and growth in Africa • Direct empirical tests of the model 12 Allen & Qian Pacific-Symposium-06 Summary • Despite evidence of the damaging effects of corruption at the micro-level, there is no significant relation between corruption and growth at the aggregate level; • We argue that the degree of competition in the provision of government goods/services can explain cross-country differences of corruption’s impact on growth; • More effective way to control corruption and promote growth would be to increase competition among officials rather than punishing corrupt officials. 13