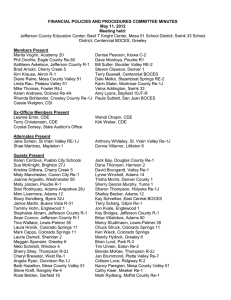

FINANCIAL POLICIES AND PROCEDURES COMMITTEE MINUTES May 13, 2011 Meeting held:

advertisement

FINANCIAL POLICIES AND PROCEDURES COMMITTEE MINUTES May 13, 2011 Meeting held: Jefferson County Education Center; Durango School District; Basil T Knight Center, Mesa 51 School District; Swink 33 School District Members Present Suzi DeYoung, Denver 1 Marita Vogrin, Academy 20 Adrienne Bradshaw, Adams-Arapahoe 28J Molly Janzen, Poudre R-1 Phil Onofrio, Eagle County Re-50 Mark Rydberg, Moffat County Re-1 Bill Sutter, Boulder Valley RE-2 Diane Raine, Mesa County Valley 51 Karin Slater, Montrose County Re-1J Doug Moss, Manzanola 3J Karen Andrews, Dolores Re-4A Ex-Officio Members Present Leanne Emm, CDE Terry Christensen, CDE Crystal Dorsey, State Auditor’s Office Eileen Johnston, James Irwin Charter Alternates Present Terry Kimber, Delta 50J Scott Myers, Littleton 6 Terry Buswell, Centennial BOCES Brad Arnold, Cherry Creek 5 Kim Krause, Akron R-1 Carole Herman, Liberty J-4 Kathleen Askelson, Jefferson County R-1 Denise Pearson, Kiowa C-2 Mike Thomas, Fowler R4J Dale Mellor, Steamboat Springs RE-2 Linda Rau, Plateau Valley 51 Amy Lyons, Bayfield 10JT-R Paula Sublett, San Juan BOCES Adam Williams, CDE Kirk Weber, CDE Wendy Swanhorst, CSCPA Shae Martinez, Mapleton 1 Laine Gibson, Durango 9-R Guests Present Dave Montoya, Poudre R1 Samantha Doney, Sheridan 2 Patty Buckle, Adams 12 Nikki Schmidt, Windsor Re-4 Jan Brummond, Gunnison Re-1J Tim Unrein, Eaton Re-2 Natalie Morin, Cheyenne Mtn. 12 Shelley Becker, Douglas County Re-1 Luke Gonzales, Thompson R2-J Sherry Shay, Thompson R2-J Brenda McKee, Thompson R2-J Joe Davis, Denver 1 Patrick Hickey, Estes Park R-3 Brian Lund, Estes Park R-3 David Brungardt, Valley Re-1 Brenda Johnson, Weld Re-8 DeAnn Queen, Falcon 49 Terry Scharg, Gilpin Re-1 Leslie Mason, Brush Re-2J Donna Holstlaw, Littleton 6 Angie Skalla, Widefield 3 Terry Schueler, St. Vrain Valley Re-1J Jane Schein, St Vrain Valley RE-1J Mike Lee, Fort Morgan Re-3 Ken Wieck, Colorado Springs 11 Mark Capps, Colorado Springs 11 Chuck Struck, Colorado Springs 11 Kay Schreiber, East Central BOCES Meggan Sponsler, Greeley 6 Mandy Hydock, Greeley 6 Jon Kvale, Englewood 1 Tammy Hohn, Englewood 1 Lori Abote, Jefferson County R-1 Kara Drake, Jefferson County R-1 Sean Conner, Jefferson County R-1 Lisa Anderson, Jefferson County R-1 Marci Jasek, Jefferson County R-1 Stephanie Abraham, Jefferson County R-1 Deb Bussey-Peeples, Jefferson County R-1 Chelsey Gerard, Eagle County Re-50 Sherry Murphy, Yuma 1 Joanne Vergunst, Fountain-Ft. Carson 8 Rose Belden, Garfield 16 Jnl Linsacum, Hayden Re-1 Kurt Shugars, Telluride R-1 Teri Arnett, DeBeque 49JT Susan Schoon, Garfield Re-2 Christy Hamrick, Garfield Re-2 Barb Hazelton, Mesa County Valley 51 Nancy Paregien, Mesa County Valley 51 Wendy Winfrey, Ouray R-1 Amanda Wittman, South Central BOCES Patty Venem, Rocky Ford R-2 Velva Addington, Swink 33 Rhonda Bohlander, Crowley County Re-1J Steve Cole, Dolores Re-2 Elizabeth Conway, CDE Steve Plutt, Dazzio & Plutt LLC CPA’s Paul Niedermuller, Clifton Gunderson CPA Members and Alternates Absent Wendi Chapin, Platte Valley Re-7 Susan Doudy, Mancos Re-6 Don Trujillo, Pueblo 70 Dianna Baker, Karval Re-23 Janell Wood, Archuleta 50JT Steve Dazzio, Dazzio & Plutt, LLC CPA’s Steve Clawson, Clifton Gunderson CPA Cassie Walgren, Pueblo City Schools MINUTES FINANCIAL POLICIES AND PROCEDURES COMMITTEE May 13, 2011 I. Call to Order and Introductions Leanne Emm called the meeting to order at 9:30 am. Those in attendance were asked to introduce themselves and their district. II. Approval of Agenda Terry Buswell made a motion to approve the agenda as presented. Phil Onofrio 2nd the motion. Motion carried. III. Approval of Minutes Carole Herman made a motion to approve the minutes from the February 11, 2011 meeting. Marita Vogrin 2nd the motion. Motion carried. IV. Legislative Updates Leanne provided an updated of the past legislative session with a PowerPoint presentation. She spoke to CDE’s Strategic Initiatives that involve standards; assessment; accountability and support; training and awareness; and innovation and choice. She cautioned districts as they go forward that they would be required to implement initiatives with fewer and fewer resources. The Public School Finance Unit (PSFU) fits into these initiatives from the support standpoint in that the unit also has standards, i.e. accounting, financial policy and procedures, assessments, etc. She stated that 43% of the State’s general fund goes to fund K-12 education. The magnitude of cuts that are required at the State level cannot be made without effecting K-12 education. Since the late 1980’s there has been a shift in K-12 funding from 57% local share and 43% State share to current funding of 37% local share and 63% State share. The CASE website has a budget PowerPoint that Bruce Coy has put together that has an excellent explanation of the effects that Tabor, Gallagher and Amendment 23 have had over the years. May 11th was the end of the current legislative session. The School Finance bill, SB11-230, this year was relatively simple. Reductions to the original appropriation were $227.5M, down from the February estimate of $332M. The negative factor applied to the total program calculation is 12.97%. House Amendments that were adopted identified $90M to put into the Act. It is divided into two portions; $22.5M is incorporated into the Total Program appropriation for FY11-12 and $67.5M is identified as potentially available next year based on available excess revenues and will not be available until appropriated. There was a change to the date in which the limit to bonded indebtedness is determined. This will benefit those districts that are hitting their limit and are declining in assessed value. The current base funding for FY10-11 is $5,529.71, an increase of $22.03 from prior year. This is based on inflation of -0.6% plus 1% Amendment 23 = 0.4% increase. For FY11-12 the base is projected to be $5,634.77, an increase of $105.06 from this year. This is based on inflation of 1.9% and the 1% for Amendment 23 is no longer available. The average FY10-11 Total Program per pupil funding per the formula before the negative factor is $7,290 and $6,811 for an average per pupil cut of $479. For FY11-12 the assessed values are projected to decrease by $6.57B causing a decrease in projected property taxes of $1.142B or 7.6%. This was a reassessment year and in two years it is possible that the assessed values could decline again. We may have bottomed out but the recovery is not going to happen quickly. Leanne reviewed other legislation of interest; State Fiscal Stabilization Funds (SFSF), Education Jobs Funds (EdJobs) and Individuals with Disabilities Education Act (IDEA) America Recovery and Reinvestment Act (ARRA) funding; the pilot program for Alternative School Finance Models authorized by HB10-1183 districts may participate in if they are interested and dates for upcoming Grants Fiscal and Exceptional Student Leadership Unit (ESLU)-IDEA professional development webinars. She reviewed the Total Program spreadsheet that shows the difference between this year’s actual funding against next year’s projected in SB11-230 and a sample funding projection worksheet. V. ARRA-SFSF & Ed Jobs Funding Elizabeth Conway from the Grant Fiscal Management Unit (GFMU) at CDE was present to review the process to request funds for ARRA-SFSF and EdJobs and reporting requirements. She thanked the districts for their due diligence in working hard to meet the requirements associated with the funding, she knows it has not been easy and expressed her appreciation. The information she covered was the same as was presented in earlier webinars and there will be one more webinar presentation around the 1st of June for those that have not requested funds and need assistance or have questions. Currently approximately 76% of the EdJobs and 31% of the SFSF funds have been allocated. She encouraged everyone to get their request for funds in by the June 10th deadline. She reviewed the ARRA-SFSF allowable uses, stating that they can be used for a broad scope of expenditures. The guidelines fall within various Federal education acts. PSFU and GFMU are recommending that districts utilize the funds for utilities, benefits, full-time equivalent (FTE), etc. Generally any expenditure that would have been paid out of the general fund can be utilized for ARRA-SFSF funds. The funds may be utilized for new construction but there is additional compliance that must be met. Local Education Agencies (LEA)’s may utilize the fund from the point the assurance form was signed by the district. For example if the form was signed March 14th and a utility bill was for the entire month, only the services from March 14th on can be utilized. Since there is such a short duration for the ARRA-SFSF grant, districts may need to utilize a variety of expenditures to cover the funding. It was recommended when identifying expenditures to allocate to the grant, to stay away from ones that have other funding sources, i.e. e-rate for phone services, State categorical for transportation, etc. Funds in this grant may be obligated through Sept. 30, 2011 but the recommendation is to utilize the funds before June 30, 2011. EdJobs funds have been available since September so there is a longer period of time to utilize the funds. These funds may only be used for school-level employee compensation and benefits and other expenditures, such as support services necessary to retain existing employees; recall or rehire former employees; or hire new employees. If a district has designated FTE for these funds since September but has not requested any funds or coded any of the individuals to the grant code, the ARRA reporting on this grant is definite term. This means that at the point in time when the accounting event occurs in the grant is when the hours are reported. If 100% of the funds are requested on June 7th and the journal entry is made on June 7th, you will need to report 100% of the FTE hours even though they may span multiple quarters. Funds in this grant may be obligated through Sept. 30, 2012 but again the recommendation is to utilize the funds before June 30, 2011. Elizabeth reported that she is working on getting out compliance information on what type of documentation the Federal Government will be looking for. The Department has gotten varying instructions and hopes to have the information out soon. Adrienne Bradshaw asked if any districts were planning on adjusting their general fund budgets downward for the effect of these funds. Scott Myers reported that they planned to expend these funds through the general fund and have created contra accounts within the departments/schools and are moving the actual expenses to a contingency school to preserve the integrity of their year to year comparison data at the school level. VI. Financial Policies and Procedures Issues - Discussion a. Agency Fund Treatment for Federal Grant Activity Leanne reported that this issue was introduced at the February FPP meeting. Two districts were reporting grant funds as an agency fund. The Department did require both of the districts to reissue their audits. The Department did receive strong guidance from the Federal government that we are unable to accept an audit that treat grant funds in an agency fund situation. The districts are the sub-grantee recipient and are responsible for reporting all grant funds on the Single Audit report. A new fatal ADE edit will be implemented for FY2010-11 collection that will not accept any grant codes of 3000 to 9999 in an agency fund (Funds 70 to 79). b. Revenue Recognition This issue was introduced at the February FPP meeting and tabled for more information to be brought back at this meeting. Kirk Weber had a discussion with a GASB representative. The GASB representative would only answer questions related to the actual GASB statements. He did give some guidance in that GASB Statement No. 38 does provide for a great deal of flexibility for the reporting entity to define and disclose their policy for the period of revenue recognition. The Department’s recommendation is that districts are encouraged to adopt appropriate revenue recognition policies of up to 60 days for property tax purposes, and for an extended period of time for all other revenues. They should work with their auditors to define the implementation and enforcement of the policy. PSFU is working with the Grants Fiscal Management Unit on timely distribution of funds since this has also been an issue. [Follow-up: Several districts were contacted and Weld Re-8 provided their new board policy: Example from Weld Re-8 File: DI/DIA-E Revenue Recognition Practice For External Financial Reporting Purposes The Weld School District Re-8 Board of Education accepts that the Revenue Recognition Practice is the cornerstone of modified accrual accounting for governmental funds. This determines the accounting period in which revenues and expenses are recognized. Revenues are recognized as soon as they are both measurable and available. For this purpose, it is the Revenue Recognition Practice of Weld School District Re-8 that receivable revenues are considered recognized in the appropriately identified governmental fund for up to, but not to exceed, one year (365 calendar days) after the end of the current fiscal period except for those identified as property tax receivable revenues which will be identified as up to sixty (60) days after the end of the current fiscal period for receivable revenue recognition purposes. In addition, for cash flow purposes, the management of Weld School District Re-8 will make reasonable attempts to collect all outstanding receivable revenues as soon as it is feasible to do so. We contacted CASB’s policy department and this is the summary of the discussion with them: CASB sample policy DAB discusses the Board’s awareness of expected income against income received and requests information be given to the Board explaining any potential issues affecting revenue inflow. A policy of this nature might serve as an assurance to the auditor that the Board was aware of district practice. The CFO may wish to draft a formal summary for Board approval detailing the practice of recognizing revenues that may not be received until up to 120 days after the budget year concludes. This summary of practice can then be included as a regulation to board-level policy and further clarify the issue. However, during the district’s external audit, further questions may be relevant: if this practice is not inconsistent with law, did the auditor provide an acceptable explanation to the district for not allowing the practice? If the auditor’s response was that it is inconsistent with law, did the district(s) request a legal opinion from their own counsel?] c. Kindergarten Reserve of Fund Balance Leanne reported that she has had questions regarding the .08 funding for kindergarten if a district chooses to suspend full day kindergarten (FDK). In order for the district to utilize the .08 supplemental kindergarten funding, a district must report at least one full day kindergarten student on the October 1 count. If there are no reported full day kindergarteners, then the district must reserve the supplemental FDK funding. This funding may be used as soon as the district enrolls one student in an FDK program – as long as they are on the October count. The statute originally gave districts a one year grace period to use the funds in FY09-10 to plan and implement a program prior to reporting any FDK students. VII. Chart of Accounts Change a. GASB 54 – Fund Balance & Chart of Account Coding GASB 54 has identified specific reporting requirements for fund balance. The current Chart of Accounts does not align with the reporting structure. Kirk Weber presented four options that would align the Chart of Accounts with the GASB 54 requirements. After discussion, Karin Slater made a motion to adopt Option 2 as presented to be effective for FY11-12. Mark Rydberg 2nd the motion. Motion failed. After further discussion it was decided to form a sub-committee to meet this summer to review all of the balance sheet codes and bring back recommendations for changes to the committee for adoption in the fall. Adrienne Bradshaw, Carole Herman, Molly Janzen and Phil Onofrio volunteered to serve on a sub-committee. b. Proposed Expansion of Capital Projects Funds This item was tabled at the February meeting to be brought back for action at this meeting. The original proposal was to look at the Capital Projects Funds coding. Currently, discretionary (nonbolded) Funds 44-49 all roll to Fund 41 (the Building Fund). Fund 41 must be used for projects funded with voter approved debt; however, it may be used for other projects funded with other sources. Fund 43 (Capital Reserve Capital Projects Fund) may be used for projects unrelated to voter approved debt and may be used for sales of lands and/or buildings. Currently, only six Districts are using Funds 44-49. All are using the funds appropriately, based on current Chart of Accounts definitions of Funds 41 and 43. Is there a need to modify and have two of these discretionary funds (47 & 48) roll to Fund 43 or is one Fund 43 enough? This may be a nonissue. After discussion, Brad Arnold made a motion to declare this a non-issue and that no changes to the Chart of Accounts need to be made. Terry Buswell 2nd the motion. Motion carried. c. Non-Voter Approved Debt – Fund 39 Currently State statutes say that non-voter approved debt cannot be held in a bond redemption fund. The Chart of Accounts defines the bond redemption fund to be all funds 31 thru 39. There has been discussion with districts and charter schools that are entering into non-voter approved debt that has certain requirements to accumulate resources outside of a bond redemption fund. The proposal is to designate Fund 39 as a Non-voter Approved Debt Service Fund that cannot be comingled with Funds 31-38. After discussion, Phil Onofrio made a motion to approve the changes to the Chart of Accounts for Fund 39 as presented effective for FY10-11. Kim Krause 2nd the motion. Motion carried. d. Job Class Code Changes PSFU was approached by the HR and Special Education data collection units with a proposal to align and update verbiage between their collections and the Chart of Accounts definitions of job class codes. Leanne highly recommended when these were presented to PSFU that they not get more restrictive. She was comfortable with their recommendations. After discussion, Phil Onofrio made a motion to accept the updates and changes as presented to be effective for FY11-12. Adrienne Bradshaw 2nd the motion. Motion carried. VIII. FPP Membership Nominations for membership to the FPP Advisory Committee are now open. If interested in applying please provide a short background and experience summary to Leanne Emm by Friday, June 3, 2011. The retiring members will act as the nominating committee and submit their recommendations at the June meeting. IX. Other Topics of Interest a. School District Fiscal Health – Crystal Dorsey, Office of the State Auditor Crystal Dorsey from the Office of the State Auditor reported Dianne Ray has been appointed as the new State Auditor and Kerri Hunter as the new Financial Deputy. She also reported that the first draft of the School District Fiscal Health Analysis has been forwarded to Leanne and she will in turn be forwarding it on the listserve to school districts for review. If anyone has questions or concerns they are asked to contact Crystal. It will be presented to the Legislative Audit Committee in August. b. Transportation Fees and Fund 25 Use Districts are reminded that if they intend to begin collecting fees for transportation they need to be accounted for in a transportation fund. Fund 25 is designated as a Transportation Fund in the Chart of Accounts. c. Webinar Training Sessions Leanne reported that she would like to begin hosting monthly webinar training sessions. She is requesting ideas for topics that could be covered by these webinars. d. Future Meeting Dates & Locations - Proposed The proposed meetings dates for next year were presented (September 23, 2011, February 10, 2012, May 11, 2012, and June 22, 2012) and Leanne asked for discussion from the committee on locations. After discussion it was decided to hold the meetings at Jefferson County with remote site links to Centennial BOCES in Greeley, Durango, Mesa and Swink. There being no further business to come before the Committee, the meeting was adjourned.