Presentation to the President's Advisory Panel on Federal Tax Reform May 11, 2005

advertisement

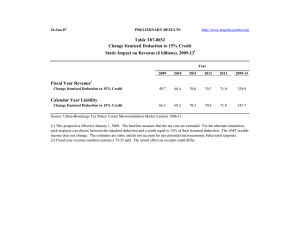

Presentation to the President's Advisory Panel on Federal Tax Reform May 11, 2005 Roland Boucher United Californians for Tax Reform Overview United Californians for Tax Reform A PROPOSAL TO REDUCE THE TOP TAX RATE TO 20% BY ELIMINATING THE PERSONAL EXEMPTION AND DEDUCTION FOR STATE TAXES Proposal Benefits of the Proposal Simplification Fairness Administrative Ease Promotes Economic Growth Other Effects of the Proposal Transition Costs Revenue Impact 2 A Proposal to Reduce the Top Tax Rate to 20% United Californians for Tax Reform The Proposal The seven key points of our proposal are as follows: 1) Eliminate all deductions for state and local income, sales, and property taxes 2) Retain all other deductions, including home mortgage interest and charitable contributions 3) Eliminate all personal and dependent exemptions. 4) Increase the standard deduction to $7950 for single tax filers and $15,900 for joint tax filers 5) Retain the maximum tax rate of 15% for income from qualified dividends and capital gains 6) Replace the 25% tax rate with a 20% tax rate and eliminate the 28% 33%, and 35% tax rates 7) Retain all other tax code provisions, including adjustments to gross income (AGI) (such as IRA contributions and alimony payments) and tax credits (including the child tax credit) 3 A Proposal to Reduce the Top Tax Rate to 20% United Californians for Tax Reform Benefits of the Proposal Simplification 1) Reduce the number of tax brackets from six to three 2) Reduce the number of taxpayers who claim itemized deductions from 40M to under 10M 3) Withholding easier to compute 4) Record keeping not necessary for most taxpayers Fairness 1) Reduce the disparity of the Federal tax burden for taxpayers at the same income level 2) Reduce the disparity of the Federal tax burden between taxpayers from different states 3) Raise taxes for no taxpayer who now claims the standard deduction 4 A Proposal to Reduce the Top Tax Rate to 20% United Californians for Tax Reform Benefits of the Proposal (continued) Administrative Ease 1) Withholding easier to compute, for employers and financial institutions 2) A simple tax table with single 20% rate above it will reduce taxpayer filing errors 3) Reduce the number of taxpayers who claim itemized deductions from 40M to under 10M Promote Economic Growth 1) Lower the top marginal tax rate by nearly 50 percent from 35% to 20% 2) Reduce disincentive to work 3) Reduce marginal tax rate for many small business owners 5 A Proposal to Reduce the Top Tax Rate to 20% United Californians for Tax Reform Other Effects of the Proposal Transition Costs 1) None expected Our Proposal is Revenue Neutral 1) Eliminating the deduction for all state and local income, sales, and property taxes will increase revenue by $73 billion 2) $73 billion is twice the revenue that was collected by the 28%, 33%, and 35% tax rates making it possible to drop them entirely and reduce the 25% tax rate to 21.4% 3) Eliminating the $3100 dependent exemption, and folding it into the standard deduction, allows the top tax rate to be further reduced to 20% Revenue analysis performed on computer model of US taxpayer developed by UCTR 6

![-----Original Message----- y [mailto:] Sent: Sunday, March 20, 2005 10:30 AM](http://s2.studylib.net/store/data/015586056_1-af2b92be55dbb8701da543bb8083866c-300x300.png)