Implementing a “Return-Free” Tax Filing Scheme

advertisement

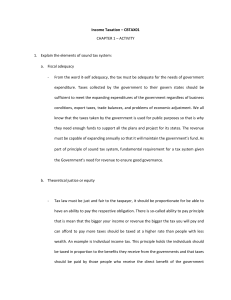

Implementing a “Return-Free” Tax Filing Scheme Presentation to the President’s Advisory Panel on Federal Tax Reform Grover Norquist President Americans for Tax Reform May 17, 2005 The Current System Tax filing is citizen-based – taxpayers tell the government what they earned and owe Under Return-Free Tax filing would be government-based – the burden would be on the taxpayer to challenge the government’s findings -essentially an audit of every single American taxpayer The Fox Would Guard the Henhouse The same agency that collects taxes would be the tax preparer – the motivation to maximize revenue would dominate both ends of the process Return-Free is a Tax Increase The true goal is to increase revenue. The government knows few taxpayers will challenge its findings Taxes Should be Visible Doing taxes keeps citizens aware of the tax burden imposed upon them by the government. A Return-Free scheme would allow the government to raise revenues invisibly The California Example The State would not guarantee the accuracy of the returns it prepared – the taxpayer was removed from the process, but left with the responsibility The pilot program achieved 50% less uptake than planned Comments by CA officials tell us that the true aim was increased revenue