Administrator’s Weekly Report Economy April 24-April 30, 2004

advertisement

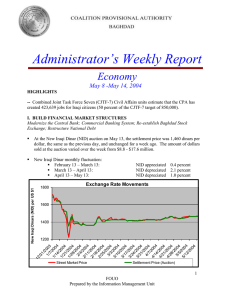

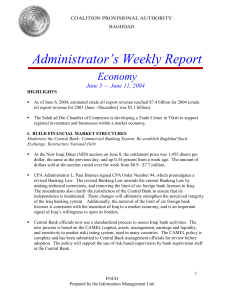

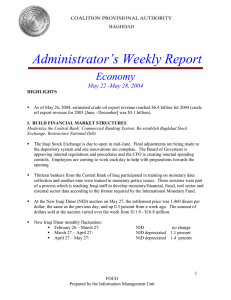

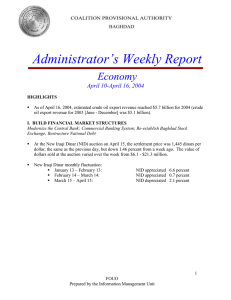

Administrator’s Weekly Report Economy April 24-April 30, 2004 HIGHLIGHTS As of April 25, 2004, estimated crude oil export revenue reached $5.1 billion for 2004 (crude oil export revenue for 2003 [June - December] was $5.1 billion). I. BUILD FINANCIAL MARKET STRUCTURES Modernize the Central Bank; Commercial Banking System; Re-establish Baghdad Stock Exchange; Restructure National Debt Training for employees of the Iraq Stock Exchange has begun in earnest, with the recent arrival of Bearing Point technical experts. All equipment has been installed in the new site, and renovations are nearly complete. Outfitting the site for security is also nearing completion. CPA staff has hired a prominent Arab accounting firm to manage all of the Exchange's financial records. Ernst & Young was selected in late February to provide services related to the reconciliation of Iraq’s sovereign debt. Their team arrived in Baghdad and commenced work this week. At the Central Bank of Iraq auction for the New Iraqi Dinar (NID) on April 29, the settlement price was 1,440 dinars per dollar, the same as the previous day, but up 1.03 percent from a week ago. The amount of dollars sold at the auction varied over the week from $14.0 - $22.2 million. New Iraqi Dinar monthly fluctuation: January 29 – February 29: February 29 – March 29: March 29 – April 29: NID depreciated 4.1 percent No change NID appreciated 1.3 percent 1 FOUO Prepared by the Information Management Unit 1800 1600 1400 Saddam Rate (250 per $) Street Market Price 4/29/2004 4/22/2004 4/15/2004 4/8/2004 4/1/2004 3/25/2004 3/18/2004 3/11/2004 3/4/2004 2/26/2004 2/19/2004 2/12/2004 2/5/2004 1/29/2004 1/22/2004 1/15/2004 1/8/2004 1/1/2004 1200 12/25/2003 New Iraqi Dinars (NID) per US $1 Exchange Rate Movements 2000 Old Saddam Rate (10K per $) Settlement Price (Auction) Source: CPA Senior Advisor to the Central Bank of Iraq Annualized Weekly Volatility of the NID 16.00% 14.00% 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 2/ 14 /2 00 4 2/ 21 /2 00 4 2/ 28 /2 00 4 3/ 6/ 20 04 3/ 13 /2 00 4 3/ 20 /2 00 4 3/ 27 /2 00 4 4/ 3/ 20 04 4/ 10 /2 00 4 4/ 17 /2 00 4 4/ 24 /2 00 4 2/ 7/ 20 04 0.00% Settlement Price NID Volatility Street Market Price NID Volatility The annualized weekly volatility of the New Iraqi Dinar this past week was 1.00 percent. FOUO Prepared by the Information Management Unit 2 II. DEVELOP TRANSPARENT BUDGETING AND ACCOUNTING ARRANGEMENTS Redrafting and Execution of 2004 Budget As of April 30, the balance in the Development Fund for Iraq (DFI) was $10.4 billion, comprised of $9.3 billion in the original Federal Reserve Bank of New York (FRBNY) account, and $1.1 billion on deposit in DFI-Baghdad. Of this, $2.9 billion is already committed to projects, and the remaining $7.5 billion is slated for projected 2004 budget items. Since establishment, the DFI investment program at FRBNY earned $23 million in interest. As of April 30, the total payments out of the DFI amounted to $7.5 billion. The Program Management Office (PMO) intends to commit $10.4 billion (56 percent of the $18.4 billion supplemental) toward contracts by July 1, 2004. As of April 28, $6.5 billion are committed to Iraq relief and reconstruction efforts, 63 percent of the July 1 goal. As of last week, $2.69 billion of funds are obligated with contractors (26 percent of the committed fund’s goal). The following shows the money committed by sector as of April 28 against the July 1 target. PMO: Supplemental Money Committed by July 1 6000 5000 Millions of Dollars 4000 3000 2000 1000 0 Oil Electricity Security Water Transport/ Telecom ED & Human Rights Roads/ Bridges Private Sector Justice & Public Safety 2207 Report 1701 5539 3243 4148 500 259 370 184 1038 793 451 July 1 Target 1701 2079 3057 861 601 618 4 131 540 325 458 Updated Apportionment April 21 1701 2538 2976 816 467 259 270 136 825 512 451 Total Committed April 28 1366 1824 1576 510 219 37 211 54 350 31 326 Health Care Democracy Source: Program Management Office Section 2207 of the Emergency Supplemental Appropriations Act for Defense and for the Reconstruction of Iraq and Afghanistan, FY 2004 (Public Law 108-106) enumerates the allotments granted to CPA for each sector and levies a quarterly reporting requirement to Congress detailing PMO’s spending. III. PRIVATE SECTOR INITIATIVES Streamline Existing Commercial Codes/Regulations; Facilitate Lending to Private Businesses; Technical Assistance for Small and Medium Enterprises (SMEs); Encourage Iraqi Participation in Reconstruction Subcontracts; Facilitate Business Development FOUO Prepared by the Information Management Unit 3 On April 29th, the PMO held a training seminar for Iraqi companies on how to successfully compete for PMO contracts. Attended by approximately 100 business persons at the Baghdad Convention Center, the seminar included a step by step approach on preparing bids for the PMO and its prime contractors. The next seminar is scheduled for Thursday, May 6th and will incorporate feedback from this first pilot session. Microfinance assets nation-wide now total almost $4 million, with over 2,000 clients. These loans aim to stimulate growth in the private sector and create employment by providing credit services to financially viable micro and small businesses. IV. DESIGN OIL TRUST FUND Proposal for Oil Trust Fund As of April 25, 2004, estimated crude oil export revenue reached $5.1 billion for 2004 (crude oil export revenue for 2003 [June - December] was $5.1 billion). V. LAY FOUNDATIONS FOR AN OPEN ECONOMY Provide IG Staff Capability; Trade Bank; WTO Observer Status; Draft Intellectual Property law to IGC by April 15, 2004; Develop Framework for Collateralizing Movable and Immovable Property Since opening in December, the Trade Bank of Iraq has issued 200 letters of credit totaling US$767.5 million in imports from thirty-two countries. These numbers include 30 letters of credit totaling US$ 123.4 million pending issuance and 21 letters of credit totaling $37.6 million under the oil for food program. CPA Administrator L. Paul Bremer III signed CPA Order 80, the Trademark and Geographical Indications Law. The order revises and amends the existing Iraqi Trademark and Descriptions Law (renaming it the Trademark and Geographical Indications Law) to provide for its modernization and increase protections for those individuals, companies, lenders, and entrepreneurs who create and utilize trademarks, service marks, collective marks, and certification marks in the course of their business affairs. The order brings the current Iraqi Trademark and Geographic Indications Law into accordance with internationally-recognized standards of protection. Administrator Bremer signed CPA Order 81, the Patent, Industrial Design, Undisclosed Information, Integrated Circuits and Plant Variety Law. This order brings current Iraqi Patent and Industrial Design Law into accordance with internationally-recognized standards of protection. The order increases protections for those individuals, companies, lenders, and entrepreneurs who create innovative products, manufacturing processes, or solve specific problems in a field. FOUO Prepared by the Information Management Unit 4 V. PURSUE NATIONAL STRATEGY FOR HUMAN RESOURCES DEVELOPMENT Begin to employ workers in Public Works programs around the country Ongoing security problems have reduced the reliability of data on Iraqi employment by CPA and CJTF-7 this week. Where data is available, it indicates a small decline in the jobs identified as created by CPA/CF. However, until the employment numbers are confirmed in official reports, no new employment figures will be reported. FOUO Prepared by the Information Management Unit 5