Document 15570191

advertisement

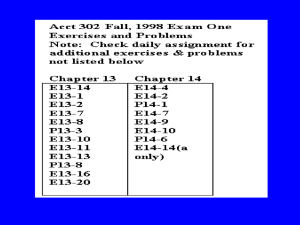

Assignment Due Tues, 2/9 Quiz on Ch. 13-- Text, Study Guide, Ex. & Prob. Read Ch. 14-- Long Term Liabilities Regular vs. Discounted N/P Discounting (removal of interest at inception of transaction) increases the true rate paid. It raises the rate from the bank discount rate to the actual or effective rate. Ex: $5,000 one year 8% Note Eff Rate Regular basis = 400 / 5,000 = 8% Discount basis= 400 / 4,600 = 8.7% 10 • Payroll gives rise to a series of current liabilities. – Withholdings – Unemployment insurance, disability – Employee authorized deductions – Net payroll – Social Security Taxes (FICA plus Medicare) (page 656) • Employee and employer portions (matching). • FICA 6.2% + Medicare 1.45% = 7.65% (will vary over time). • FICA first $65,400; Medicare no ceiling (will vary over time). 20 – Unemployment Insurance: • FUI (Federal Unemployment Insurance) 6.2% first $7,000. • SUI (State Unemployment Insurance), first $7,000, rate by individual company related to employment history. There is a maximum offset to the federal rate of 5.4%. 21 Gross Payroll XX FICA withholdings (employee) (payable) Federal & State withholdings (payable) Other withholdings, stock options, etc. (Pay) Net Payroll Payable Payroll Tax Expense XX XX XX XX XX FICA payable (employer) XX FUI payable XX SUI payable XX Disability payable XX 22 Accounting for Warranties 1. Cash Basis (IRS) vs. Accrual basis (GAAP) 2. Accrual Basis is called the ---------Expense Warranty Approach Ex 10 Expense vs. Cash Basis… Note the Adjusting JE Ex. 11(a) 3. Sales Warranty Approach (Optional Extended Warranty) Ex. 11(b) E13-10 (Warranties) Dookie Company sold 200 copymaking machines in 1998 for $4,000 each. Each unit included a one-year warranty. Maintenance on each machine during the warranty period averages $330. Required: (a) Prepare entries to record the sale of the machines and the related warranty costs, assuming that the accrual method is used. Actual warranty costs incurred in 1998 were $17,000 (b) On the basis of the data above, prepare the appropriate entries, assuming that the cash basis method is used. Contingencies-- Premiums p. 666 Fluffy Cakemix Co offers a mixing bowl for . 25 and 10 box tops The bowls cost Fluffy .75 each 300,000 boxes of cake mix were sold 60,000 boxtops redeemed 1. What is Premium Expense for the year? 2. What is the appropriate balance in Estimated Liability for Premiums at year-end? Do E13-13 Appendix 13A, p. 674-- Computation of Employees’ Bonuses 1. Bonus Depends on Terms of Contract 2. Solving a Set of Simultaneous Equations... See E13-20 Like Agreement Provides for deducting both tax and bonus to arrive at the income figure on which bonus is computed. THE END