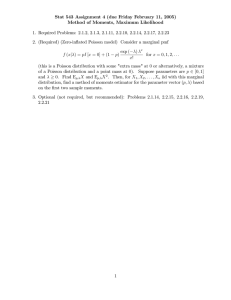

MBS

advertisement

90-786 Intermediate Statistics Assignment 7 MBS 4.57 (30 points) a. E ( X ) 128.6 128.6 11.34 b. z c. x 41 128.6 7.72 11.34 For a poisson random variable, we have: k e k! k 0 So, to calculate the given probability we would have to evaluate the following sum: n P ( x n) 128.6 k e 128.6 k! k 0 Which, incidentally, gives P(x122)0.3 The poisson model requires that the probability of the event occuring in a given unit of time is the same for all units. Thus, if the probability of a bank failure differed from one year to the next between 1988 and 1994, the poisson model would be inappropriate. Also, the number of bank failures in each year must be independent of the number in other years. 122 P( x 122) d. 7.75 (20 points) Because the sample size n is large relative to the population size N, it is necessary to adjust the standard error of the estimator by a finite population correction factor: pˆ x 50 0.694 n 72 ˆ pˆ pˆ (1 pˆ ) N n .694(1 .694) 251 72 0.0458 n N 72 251 Thus a 95% confidence interval is given by: pˆ 2ˆ pˆ 0.694 2(0.046) 0.694 0.092 Page 1 of 4 90-786 Intermediate Statistics Assignment 7 Minitab Macro (25 points) Here is the macro file: GMACRO Poisson # # # # k1=counter k2=number of iterations k3=sample size k4=lambda Let k5=1/k4 Do k1=1:k3 Let C3(k1)=0 Enddo name C2 'Time' name C3 'Event' Do k1=1:k2 Random k3 C1; Exponential k5. Let C2 = PARS(C1) Plot C3*C2; Symbol; Title "Poisson Process"; ScFrame; ScAnnotation. Enddo ENDMACRO It is executed with the following commands in the command line editor: let k2=5 let k3=10 let k4=.83 %d:\90-786\poisson Page 2 of 4 90-786 Intermediate Statistics Assignment 7 Here are the plots: Poisson Process Poisson Process 0.5 Event Event 0.5 0.0 -0.5 -0.5 0 10 20 2 3 4 5 6 7 8 Time Time Poisson Process Poisson Process 9 10 11 0.5 Event 0.5 Event 0.0 0.0 -0.5 0.0 -0.5 2 3 4 5 6 7 8 9 10 Time 11 0 5 10 Time Poisson Process Event 0.5 0.0 -0.5 0 5 10 Time Page 3 of 4 90-786 Intermediate Statistics Assignment 7 Chattergee – Mortgage Rates (25 points) Here are the descriptive statistics by type: Descriptive Statistics Variable Rate 0=Fixed 0 1 N 14 6 Mean 7.357 4.917 Median 7.313 4.750 TrMean 7.354 4.917 StDev 0.404 0.645 Variable Rate 0=Fixed 0 1 SE Mean 0.108 0.264 Minimum 6.750 4.250 Maximum 8.000 6.000 Q1 7.062 4.438 Q3 7.594 5.437 The confidence interval is constructed as: s x t / 2 n Where t/2 is based on (n-1) degrees of freedom. For fixed rate mortgages we have: t / 2 2.160 0.404 C.I. 7.357 2.160 7.357 0.233 14 For variable rate mortgages: t / 2 2.571 0.645 C.I. 4.917 2.571 4.917 0.677 6 Page 4 of 4