What Did the 1990s Welfare Reform Accomplish? Rebecca M. Blank December 2003

advertisement

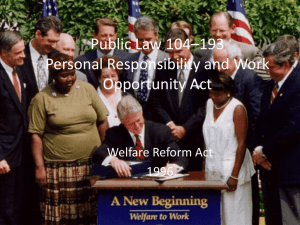

What Did the 1990s Welfare Reform Accomplish? Rebecca M. Blank December 2003 (A topic closely related to Gene Smolensky’s past research and concerns) What Did Welfare Reform Do? 1996 legislation followed waiver experimentation Created TANF Funding stream, not a program Ended entitlements Block Grants Other provisions (immigrants, food stamps) State Responses Welfare-to-work efforts Earnings disregard changes Sanctions enforcement Time limits establishment Few cash benefit changes Result: State and federal welfare dollars for noncash assistance rose from 23% in 1997 to 56% in 2002; proportion of money spent on direct cash assistance fell from 77% to 44%. Other Program Changes Child care subsidies rose Declines in AFDC led to declines in Food Stamp and Medicaid usage (although other Medicaid changes had delinked it with cash assistance) EITC increases Minimum wage increases Economic Changes Important Unemployment rates fell and stayed low Wages rose Figure 1 Total AFDC/TANF Caseloads 5,000,000 4,000,000 3,000,000 2,000,000 1996 Welfare Reform 1,000,000 20 02 20 00 19 98 19 96 19 94 19 92 19 90 19 88 19 86 19 84 19 82 19 80 19 78 19 76 19 74 19 72 0 19 70 Number of Households Receiving AFDC/TANF 6,000,000 Year Note: 2003 data is through March of 2003. Source: Website for Agency for Children and Families, Department of Health and Human Services (http://w w w .acf.dhhs.gov) Figure 2 Total Caseloads 2,000,000 Number of Households Receiving AFDC/TANF 1,800,000 1,600,000 Waiver States 1,400,000 1,200,000 Non-Waiver States 1,000,000 800,000 600,000 400,000 200,000 0 -6 -4 -2 0 2 4 Year Relative To Year of Implementation of Waivers or TANF Source: March Current Population Survey and Table A1 from "The Effects of Welfare Policy and the Economic Expansion on Welfare Caseloads: An Update" by the Council of Economic Advisers. August 3, 1999. 6 Figure 3 Percent of Single Mothers Reporting Work During the Year 100% 90% More than High School Diploma 80% 70% Only High School Diploma 60% 50% No High School Diploma 40% 30% 20% 10% 0% 1988 1990 1992 1994 1996 Year Source: Author's tabulations of the March Current Population Survey 1998 2000 2002 Figure 4 Percentage of Single Mothers on Public Assistance in Previous Year Who Report Working in March 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% 1990 1992 1994 1996 1998 Year Source: Author's tabulation of the March Current Population Survey 2000 2002 2004 Table 1 Single Mothers' Income Composition Total Income (in 2000 dollars) Percent of Total Income Public Assistance Own Earnings Other Earnings Other Income 1990 $18,563 23.08% 53.21% 4.30% 19.41% 1991 18,383 24.37 53.20 3.76 18.67 1992 17,882 23.22 52.73 3.50 20.55 1993 18,401 23.26 51.94 3.34 21.46 1994 19,296 20.06 54.73 3.78 21.43 1995 20,523 17.13 56.31 4.07 22.49 1996 20,512 15.43 57.98 4.16 22.43 1997 20,979 12.47 61.21 3.95 22.37 1998 22,054 9.37 64.93 4.43 21.27 1999 23,498 7.60 65.92 4.77 21.71 2000 24,318 5.74 68.39 4.54 21.33 2001 25,195 4.97 67.29 4.62 23.12 Note: Total income is the mean dollar value (in 2000 dollars) before taxes, and it does not include EITC subsidies. Public Assistance is composed primarily of AFDC and TANF benefits and does not include the inputed value of Food Stamps or Social Security Income. Source: Author's tabulations of the March Current Population Survey Key missing information in these calculations: Work expenses Tax and transfer benefits Cross-household transfers Did some groups gain more than others? Table 2 Changes Among Single Mothers: 1995 to 2001 Earnings as a share of Family Income (1995) Change from 1995 to 2001 Public Assistance as a share of Family Income (1995) Change from 1995 to 2001 Ratio of Column (2) to Column (4) (1) (2) (3) (4) (5) 0.564 0.110 0.171 -0.122 -0.903 No High School Diploma 0.366 0.191 0.342 -0.224 -0.854 Only High School Diploma 0.582 0.097 0.173 -0.115 -0.840 More than High School Diploma 0.647 0.066 0.084 -0.066 -0.989 White (non-Hispanic) 0.612 0.078 0.105 -0.077 -1.013 Black (non-Hispanic) 0.529 0.149 0.232 -0.172 -0.868 Hispanic 0.479 0.160 0.284 -0.190 -0.841 No Preschooler 0.604 0.064 0.100 -0.070 -0.917 Preschooler(s) (less than 6) 0.510 0.171 0.265 -0.186 -0.917 Infants(s) (less than 2) 0.451 0.208 0.331 -0.229 -0.909 Part 1. All By Education By Race By Age of the Youngest Child Source: Author's tabulation of the March Current Population Survey Table 2 Changes Among Single Mothers: 1995 to 2001 Percent on Welfare (1995) Change from 1995 to 2000 Ratio of Column (2) to Column (4) (2) (3) (4) (5) 0.735 0.081 0.274 -0.175 -0.461 No High School Diploma 0.487 0.160 0.465 -0.281 -0.568 Only High School Diploma 0.752 0.059 0.272 -0.161 -0.367 More than High School Diploma 0.854 0.037 0.173 -0.120 -0.307 White (non-Hispanic) 0.818 0.044 0.197 -0.130 -0.338 Black (non-Hispanic) 0.671 0.126 0.356 -0.229 -0.551 Hispanic 0.599 0.139 0.369 -0.236 -0.591 No Preschooler 0.808 0.035 0.188 -0.123 -0.285 Preschooler(s) (less than 6) 0.646 0.133 0.381 -0.235 -0.567 Infants(s) (less than 2) 0.560 0.163 0.425 -0.244 -0.665 Part 2. All Percent Working (1995) Change from 1995 to 2000 (1) By Education By Race By Age of the Youngest Child Source: Author's tabulation of the March Current Population Survey Table 2 Changes Among Single Mothers: 1995 to 2001 Percent Working (1995) Change from 1995 to 2000 Ratio of Column (2) to Column (4) (2) (3) (4) (5) 0.402 -0.078 0.735 0.081 -0.970 No High School Diploma 0.682 -0.105 0.487 0.160 -0.656 Only High School Diploma 0.413 -0.053 0.752 0.059 -0.898 More than High School Diploma 0.241 -0.054 0.854 0.037 -1.463 White (non-Hispanic) 0.291 -0.045 0.818 0.044 -1.021 Black (non-Hispanic) 0.510 -0.118 0.671 0.126 -0.934 Hispanic 0.566 -0.145 0.599 0.139 -1.043 No Preschooler 0.305 -0.047 0.808 0.035 -1.346 Preschooler(s) (less than 6) 0.522 -0.106 0.646 0.133 -0.794 Infants(s) (less than 2) 0.584 -0.098 0.560 0.163 -0.604 Part 3. All Percent Below Poverty Line (1995) Change from 1995 to 2000 (1) By Education By Race By Age of the Youngest Child Source: Author's tabulation of the March Current Population Survey Did some groups gain more than others? Little evidence that single mothers who were more disadvantaged in the labor market (I.e. lower skill; minority; younger children) had greater difficulty finding work. Striking similarity in changes between public assistance and income shares. More disadvantaged groups better able to increase their work share relative to their declines in welfare participation More disadvantaged groups had greater difficulty translating employment increases into poverty declines. Welfare Leaver Studies Very useful descriptive information Not very useful in providing an overall evaluation of welfare reform. No information on other populations. Not useful in helping separate policy changes from other changes. Regression Estimates from of Existing National Data Samples Used to estimate caseload changes, employment changes, income changes, etc. Major reviews of these: Blank (2002), Grogger, Karoly and Klerman (2002) Most show BOTH policy and economy mattered; but large amounts unexplained Particularly promising approaches Compare differential effects among more and less educated women Look at flows rather than levels in caseload change Find a good instrument for a policy effect (EX: Grogger’s use of age of children to study time limtis) Yet, all of these estimation approaches have limits – identification of a policy effect is extremely difficult TANF was implemented everywhere within a year’s time. TANF implementation occurred as the economy boomed and EITC was expanded nation-wide Individual policy components within TANF are hard to code and not well identified either Experimental Data Very effective for looking at single policy changes; less effective for evaluating multiple changes. No states are running post-waiver experiments on welfare reform programs. Key Results from Experiments Effectiveness of work-first programs Amazing results of financial incentive programs Can increase both earnings and income with combined incentives and mandates Effects of work pgms on children What Big Questions About Welfare Reform Remain Unanswered? • • Interpreting the Caseload Decline and Employment increase Both changes were far greater than anyone would have predicted Uncertainty about why such a large changes occurred * Synergies? * Behavioral shifts? * Misinformation? What Big Questions About Welfare Reform Remain Unanswered? The Effects of an Economic Slowdown in the new Policy Regime? So far very limited effects. * Is this the fulfillment of the promise of welfare reform? * Is this just a mild slowdown? * Are we missing key measures of economic pain? What Big Questions About Welfare Reform Remain Unanswered? Relation of Assistance Programs to Family Composition & Fertility Major goal of welfare reform, but timing of changes doesn’t match timing of policy change Current research investigating policy/marriage/fertility links is still limited and contradictory Figure 5 Birth Rates for Unmarried Women, Age 15-44 Live Births to unmarried women per 1,000 unmarried women 100 90 Black 80 70 60 50 40 All White 30 20 10 0 1980 1982 1984 1986 1988 1990 1992 1994 1996 Year Source: Centers for Disease Control and Prevention. (2002). Births: Final data for 2000 (Table 18). National Vital Statistics Reports, 50(5). 1998 2000 Conclusions 1996 legislation did constitute a major reform (this happens rarely) Transformation of the public assistance system is still a work-inprogress. The arguments between critics and supports remain very unsettled Role of economy remains key