LOYOLA COLLEGE (AUTONOMOUS), CHENNAI –600 034 B.A., DEGREE EXAMINATION - TAMIL

advertisement

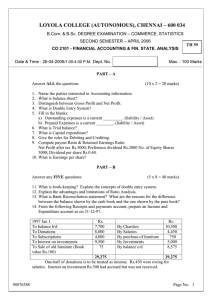

07.04.2004 9.00 - 12.00 LOYOLA COLLEGE (AUTONOMOUS), CHENNAI –600 034 B.A., DEGREE EXAMINATION - TAMIL FOURTH SEMESTER – APRIL 2004 CO 4202/COM 202 - BOOK - KEEPING AND ACCOUNTS Max:100 marks SECTION - A (10 2 = 20 marks) Answer ALL questions 1. 2. 3. 4. 5. 6. 7. 8. 9. What is Book-keeping? Why is a Bank Reconciliation Statement prepared? What is an error of principle? Give any two advantages of double entry system. Who has proposed Double entry theory and is which year was had been published. What are the Accounts that non-profit organization prepare? Give the three rules of Double entry. Why is a Trial Balance prepared? Rectify the following errors. a) Rs.5000 paid for furniture has been charged to purchase A/c b) Salary paid to Mr. Mohan has been debited to his personal A/c 10. Rectify the following errors.. a) Repairs debited to building A/c Rs.250 b) Rs.500 withdrawn by the proprietor of his personal use has been debited to Trade Expenses Accounts. SECTION - B Answer any FIVE questions (5 8 = 40 marks) 11. Petty Cashier Received Rs.600 on April 1, 1999 from the head cashier, Prepare petty cash book on the interest system for the month of April 1999 from the following items: Rs. Rs. 3 Stamps 50 22 Trunk calls 43 5 Taxi fare 100 25 office cleaning 18 6 pencils pads 75 30 courier services 17 7 Registry 25 10 Speed post 45 12 Telegram 35 15 Refreshment 55 16 Auto fare 20 19 Typing paper 60 20 Bus fare 15 12. What is double entry system of Book-keeping? What are the differences between single entry and Double entry? 13. Explain any five fundamental concepts in Accounting. 14. Explain different types of errors with examples. 1 15. Record the transaction given below in the proper subsidiary books. 2001 April 3 Goods purchased form Mr. Roy Rs. 50,0000 on credit. 7 Mr. Roy purchased goods form us at Rs.28,000 for cash 10 sold for cash Rs.22,000 12 sold Rs.75,0000 on credit to Mr.Ram 15 Goods Returned to Mr.Roy Rs.5000 18 Mr. Jain sold goods to us worth Rs.95,000 24 Goods sold to Mr. Das Rs.1,20,000 26 Mr. Dass returned goods worth Rs. 7,000 27 Mrs.Jaya purchased Goods valued Rs.12,550 form us. 16. Prepare a three column cash book from the followings:Rs. 2001 March 1 cash in hand 90,000 cash at bank 75,000 3 cash sales deposited in to bank 3,000 4 sold goods to Rakesh on credit 9,000 6 amount deposited by a customer directly into bank 4,500 8 Received a cheque form Jagan for discount allowed 100 9 paid to vivek by cheque 4,500 11 cash deposited into bank 7,000 15 cash withdrew form bank for office use 8,000 17. Prepare trial balance form the following ledger balances of Mr. Shankaran on 31.12.1997 Rs. Rs. Cash in hand 600 Purchases 1,48,000 Cash At Bank 9,400 Purchase Returns 2000 Capital 40,000 Sales 2,80,000 Building 30,000 Sales Returns 1,000 Salaries 28,000 Debtors 30,000 Rent 8,000 Insurance 800 Machinery 20,000 Discount Allowed 1,400 18. Prepare a Bank Reconciliation statement form the following data as on 31-12-1995 Rs. a) Balance as per cash book 12,500 b) Cheques issued but not presented for payments 900 c) Cheques deposited into bank but not collected 1,200 d) Bank paid insurance premium 500 e) Direct deposit by a customer 800 f) Interest on investments collected by the bank 200 g) Bank charges 2 SECTION - C Answer any TWO questions (2 20 = 40 marks) 19. From the following transactions of Mr. Velmurugan, you are required to pass Journal entries and post the entries in the ledger Accounts. 1999 March 1Velmurugan commenced business with furniture Rs.2000, Stock Rs.12,000 and cash Rs.60,000 5 purchased from satya Rs.12,000 7 goods sold for cash Rs.6,000 9 Returned goods to satya Rs.140 11 purchased goods for cash Rs.6,000 15 sold goods to Anand Rs.8000 19 paid cash to satya Rs.4,120 and he allowed us discount Rs.80 21 paid commission Rs.2,000 26 Velmurugan withdrew cash Rs.200 20. Prepare Trading and profit & Loss A/C and balance sheet form the following Trial balance of Mr. M. Madan Debit Balances Rs. Credit balances Rs Sundry Debtors 92,000 Capital 70,000 Plant Machinery 20,000 Purchase Returns 2,600 Interest Paid 430 Sales 2,50,000 Rent Rates 3,000 Creditors 60,000 Insurance 2,600 Bank overdraft 20,000 Conveyance Charges 1,320 Wages 7,000 Sales Returns 5,400 Purchase 1,50,000 Opening Stock 60,000 Drawings 22,000 Trade Expenses 1,350 Salaries 11,200 Advertising 840 Expenses Discount Allowed 600 Bad Debts 800 Business Buildings 12,000 Furniture 10,000 Cash In Hand 2,060 Total 4,02,600 4,02,600 Adjustments:(i) Stock on hand on 31-12-96 Rs.90,000 (ii) Provide depreciation on building at 20% plant and machinery at 10% and furniture at 10% (iii) Provide for doubtful debts at 5% on debtors. (iv) Outstanding Rent was Rs.500 and outstanding wages Rs.400 (v) Prepaid insurance Rs.300 (vi) Prepaid salaries Rs.700 3 21. The receipts and payments Accounts of friend cricket club for the year ended 31-1291.' Receipts Rs Payments Rs. To Balance b/d 20,400 By Salaries & Wages 13,000 To Subscriptions: by Entertainment Expenses 6,450 1990 850 1991 40,000 1992 1,000 41,850 To Donations 12,000 by Electricity Charges 2,340 To Entertainment Receipts 8,800 by General Expenses 3,500 To Interests form bank 800 by Rent and Taxes 1,200 by Fixed deposit 40,000 by Printing and Stationary 2,410 by Govt. Bonds 10,000 by Balance c/d 4,950 Total 83,850 83,850 Additional information: 1. Capital fund Rs.71,250 2. Fixed assets Rs.5,000 3. There are 450 members each paying Rs.100 annual subscription 4. Half of the donations to be treated as capital receipt. 5. Wages outstandingRs.200 6. Depreciate fixed assets by Rs.2,000 Prepare Income and Expenditure A/C of the club for the year ending 30-12-91 and the balance sheet as at that date. 4