LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

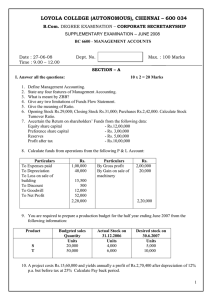

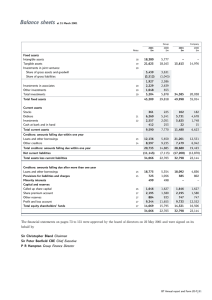

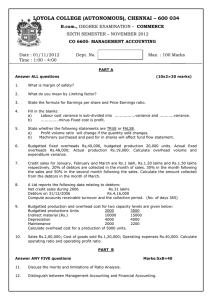

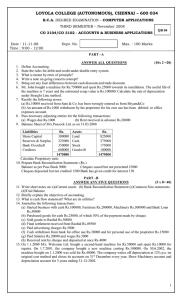

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.Com. DEGREE EXAMINATION – COMMERCE SUPPLEMENTARY EXAMINATION – JUNE 2008 CO 6605 - MANAGEMENT ACCOUNTS Date : 27-06-08 Time : 9.00 – 12.00 Dept. No. Max. : 100 Marks PART A Answer ALL questions 10 x 2 = 20 marks Explain the following 1. Break even sales 2. Margin of safety 3. Zero base budget 4. Cash and cash equivalents 5. Material mix variance 6. Current ratio 7. Cash from financing activities 8. Operating profit 9. Standard cost 10. Working capital PART B Answer ANY FIVE questions 5 x 8 = 40 marks 11. “management accounting is accounting for effective management”. Explain the statement. 12. Explain the uses and limitations of Ratio Analysis. 13. A firm manufactures for product A, details of which are as follows: Selling price per unit Rs.50 Material per unit Rs.20 Labour per unit Rs.10 Variable overheads 100% of labour Fixed expenses Rs.20,000 Calculate a) break even sales in units b) profit if sales are 4000 units c) sales in units, if the company earns a profit of Rs.1 lakh d) If the company should break even at 1000 units, what should be the selling price? 14. The standard cost card for a unit of Product A shows the following: Material 2 kgs at Rs.10 per kg.20 Labor 1 hr at Rs.5 per hour 5 During the month of July 2000 units of Product A were produced and the actual cost comprised of the following: Material 4200 kgs at Rs.9 per kg 37800 Labor 1900 hrs at Rs.6 per hr 11400 Calculate material and labor variances 1 15. The following is budgeted cost per unit for the production of 5000 units at 50% capacity. Material Rs.20 Labor Rs.10 Factory overheads Rs. 5 (20% fixed) Administration overheads Rs. 4 (fixed) Selling overheads Rs. 2 (40% variable) Prepare a budget for a production of 8,000 units and calculate the budgeted profit, if the selling price is Rs.50 per unit. 16. Ratios relating to a company are given below: Stock velocity 8 months Debtors velocity 3 months Creditors velocity 2 months Gross profit ratio 25% Gross profit for the year Rs.4 lakhs Closing stock is Rs.10000 more than the Opening stock Calculate: a) Sales b) Debtors c) Closing stock d) Creditors 17. From the following data calculate fund from operations: Opening balance of P/L account RS.60,000 Closing balance of P/L Rs.30,000 The following items appeared in the P/L account: Interim dividend paid Rs.20,000 Proposed dividend Rs.30,000 Depreciation Rs.50,000 Loss on sale of machinery Rs.3,000 Salaries paid Rs.6,000 Profit on sale of car Rs.8,000 Tax provision Rs.5,000 18. From the following data calculate Cash Flow statement as per AS3, . Profit before tax Rs.30,000 Depreciation provided on machinery during the year RS.15,000 Interest paid Rs.12,000 Machinery having a book value of RS.25,000 was sold for Rs.20,000 Investments costing Rs.8,000 was sold for Rs.8,500. Tax paid during the year Rs.18,000 Increase in stock during the year Rs.4,000. Increase in creditors during the year Rs.3,000. Interest received on investments Rs.6,000 2 PART C Answer ANY TWO questions 2 x 20 = 40 marks 19. The Balance Sheet of XYZ Co. as on 31/12/2005 and 31/12/2006 are given below: 2005 (Rs.) 2006 (Rs.) 2005 (Rs.) 2006 (Rs.) Equity capital 1,00,000 1,50,000 Fixed assets 2,00,000 3,50,000 P/L a/c 40,000 80,000 Investments 40,000 60,000 General Reserve 30,000 50,000 Stock 60,000 50,000 12% Debentures 1,00,000 2,00,000 Debtors 50,000 70,000 Creditors 80,000 50,000 Cash 20,000 30,000 Tax provision 80,000 1,00,000 Bank 60,000 70,000 -------------------------------------4,30,000 6,30,000 4,30,000 6,30,000 a) Fixed assets of the book value of Rs.40,000 was sold for Rs.32,000 b) Depreciation provided on fixed assets during the year 2006 was Rs.48,000 c) Investments costing Rs.26,000 was sold during the year for Rs.30,000 d) Tax paid during the year Rs.70,000 e) Interim dividend paid during the year Rs.25,000 Prepare statement showing sources and application of funds. 20 From the following data prepare a Balance Sheet: Current ratio 1.75 Liquid ratio 1.25 Stock turnover ratio (on closing stock) 9 Gross profit ratio 25% Debt collection period 1.5 months Reserve and surplus to capital 0.2 Fixed asset turnover (on cost of sales) 1.2 Long term debt to share capital 0.6 Fixed assets to net worth 1.25 Sales for the year Rs.12,00,000 21. From the following data forecast, prepare a Cash budget for three months ending 30th June 1998. Month Sales(Rs.) Purchase(Rs.) Wages(Rs.) Sales expenses(Rs.) 1998 February 1,20,000 80,000 10,000 7,000 March 1,30,000 98,000 12,000 9,000 April 70,000 1,00,000 8,000 5,000 May 1,16,000 1,03,000 10,000 10,000 June 85,000 80,000 8,000 6,000 Further information: a) Creditors are paid in the month following the month of supply. b) Debtors are given 2 months credit. c) Wages: 20% paid in arrears in the following month. d) Sales expenses paid in the month itself. e) Income tax Rs.20,000 and dividends Rs.12,000 are payable in June. f) Income from investments Rs.2,000 are receivable half-yearly in March and September. g) Cash balance on hand as on 1.4.98 Rs.40,000. @@@@@ 3