Document 15504192

advertisement

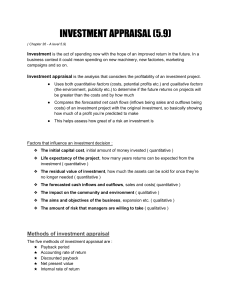

Once the stream of costs and benefits for a project is defined in the form of cash flows (or accounting figures as is sometimes done), the attention shifts to the issue of project worthwhileness. A wide variety of appraisal criteria (or evaluation methods) have been suggested to judge the worth whileness of capital projects. More than thirty criteria have been proposed, in the extensive literature on this subject, to guide investment decision making. Some are general and applicable to a wide range of investments; others are specialized and suitable for certain types of investments or industries. The more important and popular of these can be classified into two broad categories as follows: Discounting Criteria Non-discounting Criteria Net present value Urgency Benefit-cost ratio Payback period Internal Rate of return Accounting rate of return This chapter discusses these criteria in some detail. In addition, it looks at how investment appraisal is done in practice, both in India as well as abroad