Download and complete the form to apply

advertisement

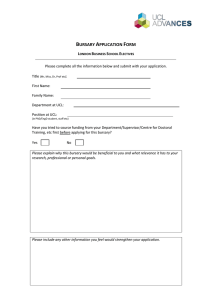

Dr Tessa Homfray Bursary 2015-16 Dr Tessa Homfray Bursary 2015-16 Important: please read these guidance notes very carefully before completing the form. If you still require clarification before submitting your application form please contact funding@kcl.ac.uk What is the Tessa Homfray Bursary? This bursary scheme has been newly established through a generous donation from Dr Tessa Homfray. The bursary is intended to help a first year student undertaking the six year Extended Medical Degree Programme (A101). The award is aimed at relieving financial hardship which might otherwise prevent a student from continuing or thriving in their studies. The award will support one EMDP student with £3,500 per year for the duration of their 6 year programme of study. The amount of the annual bursary may increase after the first year of study. The overall value of the bursary will therefore be a minimum of £21,000. Am I eligible to apply? Eligible applicants must meet the following criteria: be a current, first year EMDP student (EMDP 1A) at King’s College London in 2015-16: be home fee status and permanently domiciled in the UK; be enrolled on the 6 year EMDP programme; not be repeating, re-sitting or returning from a period of interrupted study; be able to demonstrate that you have applied for and taken the full means tested part of your student loan for maintenance; be in receipt of the maximum Maintenance Grant, and a King’s Living Bursary; have a household income of £25,000 or less and have given Student Finance ‘consent to share’ your household income data with the College. . How do I complete the application form? Please ensure you answer all questions and complete all sections of the form. The questions on the form are designed to establish your financial situation and circumstances as clearly as possible. This is to ensure that eligible students in the greatest financial need and with the greatest academic potential receive the available funds. Supporting statements and academic references must be provided as electronic word/pdf files to funding@kcl.ac.uk You will need to supply documentary evidence of your financial circumstances with your application (see checklist below). If these are not supplied, your application will not be considered. The closing date for applications is 14th March 2016. What should I do with my completed application? Completed applications should be handed in or sent to: Student Funding Office, King’s College London, Rm 7.20 James Clerk Maxwell Building, 57 Waterloo Road, London SE1 8WA When will I know the outcome of my application? Provided your application form has been accurately completed and the appropriate documentary evidence supplied, you will be notified of the decision once the committee has met in March. 1 Dr Tessa Homfray Bursary 2015-16 Student Checklist Local Authority Financial Notification Letter Student Loan Company Payment Schedule Letter for 2015-16 Student Loan Company statement of accrued debt (including loans from previous degree, if appropriate) Copy of CDL / Professional Studies Loan Agreement (including loans from previous degree, if appropriate) 3 months of Bank / Building Society statements for all accounts 3 months of credit card statements Evidence of Rent / Mortgage Evidence of benefits claimed Please submit photocopies only, as originals cannot be returned. 2 Dr Tessa Homfray Bursary 2015-16 Part 1: Your Personal Details KCL Student Number Surname Forename(s) (in full) Date of Birth (dd/mm/yyyy) / / E-mail Address Part 2: Current Course Details Full Course Title Qualification (e.g. MBBS) Year of Course 1 Expected Completion Date (mm/yyyy) 2 3 4 5 6 / Part 3: Your Dependants Do you have any financial dependents who are resident with you? Yes Give details Full Name Date of Birth Age No If you need to, continue on a separate sheet and attach it to this form. Part 4: Disability / Special Medical Needs Have you applied for Disabled Students’ Allowance (DSA)? Yes Do you have a disability or chronic medical condition which incurs extra costs? If yes, please give details If you need to, continue on a separate sheet and attach it to this form. Part 5: Financial Details How much are your tuition fees for 2015-16? £ If you have fees outstanding for 2015-16, what amount? £ 3 No Yes No Dr Tessa Homfray Bursary 2015-16 Please indicate below how your fees are being paid, and in what proportion: Self £ LA/SLC £ Parents/Guardian £ NHS Bursary £ Partner/Spouse £ Other £ Please Specify Did you take up your full means tested part of the Student Loan? Yes No If not, please explain why: If you have a Professional / Career Development Loan, what is the total and how much has yet to be paid out to you? Total £ Awaiting Payment £ Accommodation Details: do you live: alone in a Hall of Residence with Partner/Spouse with Parents/Guardian in shared accommodation How many other adults live at this address? Do you pay your own rent, and if so, how much is this? No Yes £ Do you share all household bills? No Yes Part 6: Other costs On a scale of 1 to 3 (1 = not at all; 2 = a little; 3 = a lot), how do you feel that your financial situation impacts upon your academic studies? 1 2 3 Do you work during term time? Y/N If so, for how many hours per week, on average? 0 1-2 3-5 6-10 Do you regularly miss timetabled teaching because you are taking on paid work? Y/N Do you regularly miss timetabled teaching because you are unable to afford to travel? Y/N Do you regularly miss timetabled teaching because of family-linked responsibilities? Y/N 11-15 16+ hours If so, what? Have you considered leaving the course due to financial pressure? Y/N Dr Tessa Homfray is keen to meet and correspond regularly with the student who is chosen to receive this bursary, in a mentoring capacity. If chosen, would you be happy to commit to this? Y/N 4 Dr Tessa Homfray Bursary 2015-16 Student Part 7a: Student and Partner Income (Monthly) Partner Student Loan £ £ NHS Bursary / Maintenance Grant £ £ Professional Studies Loan £ £ Earnings from Work £ £ Parental / Partner Contribution £ £ Child Tax Credit / Child Benefit £ £ Working Tax Credit £ £ Housing / Council Tax Benefit £ £ Income Support £ £ Jobseekers’ Allowance £ £ Disability Benefits £ £ Other Earnings (please specify) £ £ Total Student and Partner Monthly Income £ £ 5 Dr Tessa Homfray Bursary 2015-16 Part 7b: Student and Partner Expenditure (Monthly) Student Partner Food / Household / Laundry £ £ Gas / Electricity / Water £ £ Telephone (landline only) £ £ TV Licence £ £ Contents Insurance £ £ Council Tax £ £ Credit Cards £ £ Rent / Mortgage £ £ Travel Costs (daily travel during term time) £ £ Childcare Costs £ £ Private Vehicle Costs (road tax, fuel, insurance, etc) £ £ Books, Equipment & Other Course Costs £ £ Disability Costs not covered by DSA £ £ £ £ £ £ £ £ Other Costs (please specify) Total Student and Partner Monthly Expenditure Part 8: Supporting Statement Please provide an outline of how you feel this bursary would make a difference to your financial situation and your academic studies (min. 300 to max. 500 words). ** The supporting statement should be sent as a word/pdf file to funding@kcl.ac.uk and named in the format: “Surname, Forename – Tessa Homfray Bursary” Part 9: Report Form Please ask your course tutor to provide a written statement in support of the your application, to include confirmation that you are attending regularly and showing academic effort. ** The reference should be submitted as a word/pdf file directly to funding@kcl.ac.uk and named in the format: “Surname, Forename – Tessa Homfray Reference” 4 Dr Tessa Homfray Bursary 2015-16 Part 10: Bank / Building Society Details You must declare all of your bank / building society accounts below. You must supply copies of your last three months of bank statements and /or savings book relating to each of the below accounts. These statements must show your name, address and bank details – mini statements are not acceptable. Please submit photocopies only, as originals will be kept. Please explain any debits or credits over £100 that appear on your statements by annotation. (a) Name of Bank / Building Society Overdraft Limit £ Type of Account (e.g. Student, Savings, Current) Current Balance £ (b) Name of Bank / Building Society Overdraft Limit £ Type of Account (e.g. Student, Savings, Current) Current Balance £ (c) Name of Bank / Building Society Overdraft Limit £ Type of Account (e.g. Student, Savings, Current) Current Balance £ If you need to, continue on a separate sheet and attach it to this form. Part 11: Declarations • I declare that the information that I have given on this form is correct and complete to the best of my knowledge. • I understand that giving false information will automatically disqualify my application and disciplinary action may ensue. • I give permission for my application form and supporting statements to be viewed by the selection committee. Your Name (in capitals) Your Signature 5 Date