Section VII

advertisement

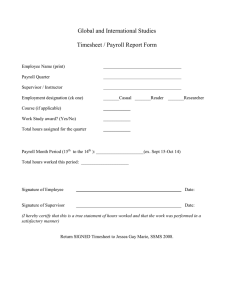

SECTION VII PREPARING REPORTS FOR PAYROLL A. OUT OF CURRENT WEEK ADJUSTMENT FORM The ‘Out of Current Week Adjustment’ form is used to capture all of the missed punches and absences that were not entered within the current week. The form can also be used to journal entry absence codes and position numbers that rolled into history incorrectly. The ‘Out of Current Week Adjustment’ form can be submitted daily. The Payroll Department will date and time stamp each form received. If the report is received before the cut off time, it will be added into the employee’s current paycheck. If it is not received by the cut off time, it will be processed on the next payroll check. Current cut off times and dates can be found on the Payroll Intranet website. Please be sure to email this form to your payroll specialist and follow up with the signed copy through the inter-office mail. Retain copies for the current fiscal year at your site. A.1. Form Information The ‘Out of Current Week Adjustment’ form is the means of getting the employee paid for the time and absences that were not entered in Kronos before it processed and rolled into history. The missed time needs to be paid as promptly as possible. All missed punches or absences reported on this form must have backup signed by the employee. The ‘Kronos Punch Adjustment’ slip is the backup for the missed time/punches. The absence report is the backup for the missed absences. The missed information should be written on the employee’s time card for your records and the employee’s. The employee needs to initial the corrections added to their signed time card. The information on the ‘Out of Current Week Adjustments’ form must be filled out completely and accurately to ensure prompt payment. An explanation would be helpful if it is a complicated entry. The data listed on the report will be researched and entered into the payroll system by the Payroll Department. The following fields must be completed: Name Must be the exact name as in Kronos (no nicknames). Employee Number Must be the employee unique number (not necessarily the badge number). Hourly Position Code Must be the six-digit alphanumeric position number, (not the three-digit transfer code). Only list the position code for hourly records. Date Is the date of the missed absence or missed punch/punch error. Missed Punch Information (Clock In, Begin Lunch, End Lunch, and Clock Out) The missed punch information on this form must be the same as indicated on the ‘Kronos Punch Section VII-1 Revised 7/27/15 Adjustment’ slip signed by the employee. Enter the punches that are missing or incorrect in Kronos. If deleting a punch, enter the punch with parenthesis around it (i.e. (8:30)). Hours to Adjust in History List the actual hours that need to be adjusted. Any time you enter a missed punch or absence on this form, you must enter the hours to adjust. The minutes (.15, .30, .45) must be reported as hundredths / quarter hours (.00, .25, .50, .75). The only time the negative sign (-) is used is when time needs to be reversed or deleted from Kronos. Do not enter the positive sign (+) when entering hours and minutes in this field. The positive sign (+) is implied. Examples: If both lunch punches are missed, the employee would be overpaid and a negative (-) adjustment would be entered. (Refer to page 6, example L.) If time was paid on a pay code or position number in error, a negative (-) adjustment would be made to reverse the time. (Refer to pages 5-6, examples D, E, F, and J.) Absence/Pay Code (if applicable) List all absence adjustments and any missed punches with specific pay codes other than ‘REG’. (Refer to Section II, page 2, Absences/Attendance Pay Codes, and Section VI, page 5, Pay Codes for Generating Pay.) SA Account (if applicable) When turning in time for Student Activities, you must provide the seven (7) digit SA Account number in order for this to be paid. The SA Account number is the 3-digit school number, a dash, and then the 4-digit function code (i.e. 275-1301). A.2. Required Data Needed for Corrections To ensure employees are paid as promptly as possible for the missed punches and absences, fill in all of the required fields accurately and completely. Missed/Absence Corrections All classified and certified absences that are not entered in Kronos in the current week must be submitted on this report form. (Refer to page 5, Examples A, B, and C) The following fields are required: Name - No Nicknames Employee Number – (EIN) Do not use the badge number Hourly Position Code – must be the primary six-digit alphanumeric position number. Do not use the three-digit transfer code. Only list a position code for hourly records. Date - Date of Absence correction Hours to Adjust in History – Use a (–) negative sign to delete from Kronos. Report the time in hundredths (i.e. 4.25, 7.75). Absence / Pay Code Section VII-2 Revised 7/27/15 Missed Time Punches All classified employees’ missed punches that are not entered into Kronos in the current week must be submitted on this report form. (Refer to pages 5-6) The following fields are required: Name – No Nicknames Employee Number – (EIN) Do not use the badge number Hourly Position Code – must be the primary six-digit alphanumeric position number. Do not use the three-digit transfer code. Only list a position code for hourly records. Date – Date of the missed punch Missed Punch Information Only list the punch errors, not each punch for the day. The actual missed punch or the duplicate/double punch is the only punch that needs to be entered on the missed punch information fields. Hours to Adjust in History Only input the adjustment amount. (Take the total for the day from Kronos and subtract the actual hours that should have paid, the difference is the adjustment amount.) Use the negative sign (-) if you want the hours docked. Absence/Pay Code, if applicable Use for anything other than ‘REG’ (i.e. ‘150’ for overtime). SA-Account #, if applicable-Use for Student Activities adjustment (777 transfer code) Journal Entry to Correct Position Numbers All missed transfer code punches that have not been corrected by the editor in Kronos in the current week must be submitted on this report form to ensure proper funding. (Refer to page 5, Example F and J.) The following fields are required: Name – As listed in Kronos No Nicknames Employee Number – (EIN) Do not use the badge number Hourly Position Code – Only list a position code for hourly records. The primary six-digit alphanumeric position number must be used. Do not use the three-digit transfer code. Date – Date the transfer punch was missed Hours to Adjust in History To correct the journal entry information, you will need one line item to reduce the hours in the overstated position number and then another line item to add hours to the correct position number. For the overstated hours, use the negative sign (-). Section VII-3 Revised 7/27/15 Section VII-4 Revised 7/27/15 Section VII-5 Revised 7/27/15 B. S.R.O. PAYROLL REPORT FORM The ‘S.R.O. Payroll Report’ is used to record hours worked by City of Mesa police officers who are not funded through the Safe Schools Grant, but are funded through the District as a School Resource Officer. Generally these will be hours worked at the junior high and success school levels; however, there may be some hours at the high school level that need reported on the S.R.O. form. Hours worked by police officers under school funding and not through the Safe Schools Grant, or reported to Student Activities, or as the usual School Resource Officer position, shall be reported on the ‘Out of Current Week Adjustment’ form. (Procedures for hours reported to the Student Activities Department has not changed as of the revision date listed below.) The ‘S.R.O. Payroll Report’ form is submitted to Payroll once per pay period—prior to the cutoff time listed on the right-hand side of the report. However, it is also acceptable to submit the ‘S.R.O. Payroll Report’ each Friday—prior to the cut-off time listed, and for the current pay week just ended—if this is easier for you. The S.R.O. form should only be submitted to Payroll once you have the timesheet and matching payment invoice. After submitting the form to Payroll, the original/signed copy needs to be sent in to Payroll with all reported timesheets and payment invoices through the inter-office mail. Retain copies at your site through the current fiscal year. B.1. Timesheets A timesheet will be submitted by the officer at the time the officer works. It is to be completed and signed by the officer at the time the officer works. A copy of the completed timesheet is to remain at your site and a copy submitted to the Mesa Police Dept. Once the officer has submitted a copy of the timesheet to Mesa PD, a payment invoice will be generated by Mesa PD and sent to your site either by fax or email. The timesheet will state the following information: Job # Date of Job Location of Job Hours worked Officer’s name Officer’s badge # (Do not use this as the EIN on the S.R.O. Payroll Report Form.) Officer’s phone number B.2. Payment Invoices The Payment Invoice, will state the following information needed for reporting hours worked: the officer’s name the job # the date of the job the time of the job the job to be performed in the ‘Special Instructions’ box Section VII-6 Revised 7/27/15 “SRO Off-Duty Work Request” for hours to be submitted on the ‘S.R.O. Payroll Report’ “Off-Duty Work Request – _______” for hours worked doing other functions (i.e. Dance or Football Game) will be submitted to the Student Activities Department All payment invoice information should match the timesheet information completely. B.3. Form Information The ‘S.R.O. Payroll Report’ must be filled out completely and supported with proper documentation before being submitted to Payroll. Fields that can be entered once and saved are Payroll Clerk, School/Dept., Site Number, and Phone/Ext. Fields that need completed each pay period are: Date: the date the form is completed Pay Period Begins: The current pay date can be found to the right of the main form. Select the current start date by using the drop down arrow in the field. Pay Period Ends: Using the current pay date again, select the corresponding stop date with the drop down arrow in the field. Name: The name should match both the timesheet and the payment invoice (as well as what Human Resources should have on file). Employee Number (EIN): The EIN number is provided by Human Resources. Do not use the officer’s police badge # or Social Security Number on the form. Date Worked: Each day is listed separately even if an officer works at your location multiple days within the pay period. Job #: This number is listed on both the timesheet and the payment invoice. These numbers must match between the timesheet and payment invoice. Total Hours Worked: This should match the amount of hours noted on the work order. Signature – Principal or Supervisor: The original must be signed and sent to Payroll, along with all timesheets and work orders listed on the form. Following is an example of what the form looks like: Section VII-7 Revised 7/27/15 Section VII-8 Revised 7/27/15