Section VI

advertisement

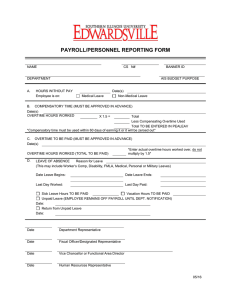

SECTION VI VERIFY KRONOS INPUT FOR PAYROLL PROCESS As an editor for the Kronos timekeeping system, you will need to monitor and edit the employee’s time records on a daily basis, input absence/attendance pay codes for both classified and certified as needed, and print all hourly (certified and classified) time card/sheets weekly for review and signature. To accomplish this task, you need to understand the District’s policies and regulations and the Fair Labor Standards Act regarding workday, workweek, pay week, overtime, and compensatory time. In addition, you need to have an understanding of how transfer codes and position numbers work to ensure that the time flows to the correct funding. A. EXEMPT VERSUS NON-EXEMPT STATUS The United States Department of Labor categorizes employees either as exempt or non-exempt for wage and hour issues. All classified personnel, except for Supervisors and Administrators, are considered non-exempt employees. Non-exempt employees are paid an hourly rate and are subject to the rules and regulations of the Fair Labor Standards Act. In order to comply with the regulations of the Fair Labor Standards Act, you must understand the following: 1. All non-exempt employees must record hours worked in the Kronos time clock except police officers. 2. If a non-exempt employee works over forty (40) hours of REG per week, the employee must be compensated at time and one-half, either through wages paid or compensatory time recorded. 3. Work that the employee does before or after scheduled hours, even without direct permission is compensable. Work performed at home for the District is also compensable. 4. A Classified employee cannot be paid in cash, nor be paid a stipend or ‘flat rate’. The employee must be paid his/her hourly rate. The hours must be recorded in Kronos. 5. A Classified employee cannot volunteer to do work that is of the same type as the employee’s job with the District without being paid and the hours recorded in Kronos unless the employee is volunteering in his/her own child’s school. 6. The Kronos time card/sheet is a record of the time worked by the employee. The time card/sheet must be signed by the employee and approved by the Administrator/Supervisor. Section VI-1 Revised 7/23/2015 B. WORKDAY The workday is the part of the day during which one works and is determined by the Superintendency. The defined working day may include lunch breaks and/or rest periods. B.1. Meal Breaks Each full-time employee is authorized a minimum uncompensated meal break of thirty (30) minutes and maximum of sixty (60) minutes, as scheduled by the appropriate Administrator/Supervisor. ‘Fulltime’ for a classified non-exempt employee is eight (8) hours per day or forty (40) hours per week, exclusive of meal breaks. Employees working less than eight (8) hours per day may be scheduled for a meal break at the discretion of the supervising administrator. If an employee works through his/her scheduled lunchtime due to circumstances beyond his/her control, the lunch break becomes compensable. If the employee is at lunch and is interrupted to perform District-related work, the employee is to clock back in. If they were not able to clock in, they need to fill out a ‘Kronos Punch Adjustment’ slip and turn it into the employee’s Kronos editor. They should also try to reschedule their lunch during that same workday so that they do not go over their scheduled hours for the day. The Kronos meal tiering rounding rules ensure that a full-time employee is compensated for meal breaks of twenty-two (22) minutes or less. (Refer to Section IX, page 8, Rounding to Nearest Quarter Hour). B.2. Rest Period Employees who work eight (8) hours per day shall be accorded two (2) separate fifteen (15) minute rest periods per day, one in the first half of the shift, and one in the second half of the shift. Employees who work fewer than eight (8) hours per day shall be accorded one (1) rest period as follows: 1. Any employee who works at least four (4) hours prior to a scheduled meal break shall be accorded a fifteen (15) minute rest period or ‘break’. 2. Any employee who works at least four (4) hours after a scheduled meal break shall be accorded a fifteen (15) minute rest period or ‘break’. 3. Any employee who works for (4) to six (6) hours per day and does not have a scheduled meal break shall be accorded a fifteen (15) minute rest period or ‘break’. Administrators/Supervisors will determine the rest period schedule. Section VI-2 Revised 7/23/2015 C. PAY WEEK VERSUS WORKWEEK There is a difference between pay week and workweek. The District’s pay week is determined by the Superintendency. The workweek is defined by the employee’s work schedule and may be different from the pay week. The District defines the regular workweek as Friday through Thursday. Overtime or compensatory time is automatically calculated in Kronos when the employee works over forty (40) hours in one workweek (Refer to Page 4). C.1. Pay Week The pay week for Mesa Public Schools is Friday at 12:00 a.m. through Thursday at 11:59 p.m. The hours recorded in Kronos for two (2) pay week periods will be rolled into payroll and paid. (An Employee Pay Schedule is available online at Payroll) For most employees in the District, the pay week is the same as the workweek. C.2. Workweek The normal workweek for classified employees shall be no more then forty (40) hours per week. No employee shall work more than forty (40) hours per week without authorization from a division superintendent. A workweek is defined by Fair Labor Standards Act as a “regularly recurring period of seven (7) consecutive twenty-four (24) hour periods.” The fixed and recurring one hundred sixty eight (168) hour workweek may begin on any day and at any hour of the day. After defining the workweek, the accumulated hours over forty (40) must be paid at one and one-half (1 ½) times the employee’s hourly rate. Our District permits alternative workweeks for individuals whose work schedules will allow for flexibility. The alternative workweek (9/80 schedule) is a flexible work schedule designed to work with the Clean Air Act and Travel Reduction Program. The 9/80 schedule is working eighty (80) hours in nine (9) days. The two-week period would include eight, 9-hour days, one, 8-hour day and one day off (TRD). Four (4) hours into the 8-hour day is the day divide and the starting time of the employee’s workweek. If your 8-hour day starts at 8:00 a.m., your day divide would be at 12:00 p.m. Your workweek for overtime calculations would be from 12:00 p.m. one week to 12:00 p.m. the next. Section VI-3 Revised 7/23/2015 D. OVERTIME AND COMPENSATORY TIME Any (REG) time worked in excess of forty (40) REG hours per week is considered overtime and requires the prior approval of the appropriate division assistant superintendent. Only in cases of emergency may approval be obtained after the fact. The request for late approval must be submitted on the first working day after the time is worked. Overtime shall be paid either in the form of monetary compensation or compensatory time off, as determined by the site administrator. Approval for overtime must be requested on a PARF. The PARF may be done for a single instance or as a blanket PARF to cover a specified number of hours over the course of a school year. The site administrator determines whether the employee’s hours over forty (40) defaults to overtime or compensatory time. The employee’s record is set up as overtime as the default unless a Kronos schedule form is submitted by you to the Payroll Department changing it to Comp Time (Forms are available online at Payroll). Once the default is set for each employee, all hours over forty will flow to the specified default. However, you can redirect the hours from the employee’s default by forcing the time (Refer to Section III, page 15, Forcing Overtime / Comp Time). When forcing, you must not take the total (REG) to below forty (40) hours. D.1. Overtime The Kronos Timekeeping System tracks time worked for the employees who use the system to clock in and out. When the employee has the default of overtime, the system automatically assigns the overtime (150) pay code to the hours worked over forty (40). The overtime (150) pay code will pay the hours at one and one-half (1 ½) times the employee’s hourly rate. To be paid for overtime, an employee must actually work over forty (40) hours during a week. If during the week an employee has holiday pay, sick leave, personal leave, vacation, etc., this does not count as “worked” hours. Absences paid or not paid are not considered worked hours. If an administrator determines they want an employee’s current week overtime hours to go to comp time, the hours may be changed by “Forcing” the hours (Refer to Section III, page 15, Forcing Overtime / Comp Time). If you do not get the hours changed to comp time before the current week is rolled into history, the employee would be paid, and the record would stand. You would not be able to have the employee docked and place the hours back into the comp accrual bucket. D.2. Compensatory Time Compensatory time may be earned in lieu of monetary compensation if an agreement or understanding has arrived between the supervisor and employee before the work is performed. The compensatory time must also have prior approval from the assistant superintendent of the respective division. Compensatory time will be earned under the same guidelines as overtime. The employee must actually work forty (40) hours during the week for compensatory time to be granted at the rate of one and onehalf (1 ½) hours for each hour of overtime worked. The maximum number of overtime hours for which compensatory time may be accumulated is 120 (80 hours worked). Compensatory hours accrued in one contract year must be used by December 31 of the following contract year. Compensatory time may not be used while on an extended contract or any other summer position. If the hours were added to the employee’s compensatory record and you wanted them paid, you would need to complete a Comp Time Reimbursement Form and send it to Payroll. Section VI-4 Revised 7/23/2015 E. PAY CODES FOR GENERATING PAY The majority of pay codes that we use in Kronos generate pay. When the pay code pays, the hours must be assigned to a position number for funding. You need to familiarize yourself with all of the pay codes, since it will be your responsibility to verify and ensure that each block of time associated with a pay code is directed to the correct position number for funding. E.1. Absence/Attendance Pay Codes All of the absence/attendance pay codes are defined in Section II. (Refer to Section II, page 2, Absence/Attendance Pay Codes.) E.2. Fifteen (15) Minute Break (pay code 15MIN) Upon approval by the appropriate Administrator/Supervisor, the afternoon breaks on Fridays may be scheduled fifteen (15) minutes prior to the end of an employee’s work shift. The employee will leave fifteen (15) minutes early but be paid as if they had completed the shift. The following conditions must be met in order for the employee to qualify. 1. The employee’s regularly scheduled Friday must be an eight (8) or nine (9) hour shift. During the summer, this practice may be applied to Thursday, if the employee’s regularly scheduled Thursday is a ten (10) hour day (a 4/10 schedule). When a holiday falls on Friday, this practice may be applied to an alternate day of the week, as determined by the Superintendency. For example, during Thanksgiving week, Wednesday may be treated as Friday. 2. The employee must work no less than their regularly scheduled shift, less fifteen (15) minutes. For an eight (8) hour shift, the employee must work at least seven (7) hours and forty-five (45) minutes. For a nine (9) hour shift, the employee must work at least eight (8) hours and forty-five (45) minutes. For a ten (10) hour shift, the employee must work at least nine (9) hours and forty-five (45) minutes (applies to summer schedule of a ten (10) hour shift on Thursday). If the employee is absent for any reason or for any part of the day, the minimum time worked requirement will not be met. Any break the employee may qualify for will be taken at their normal break time. The employee cannot use a break for the purpose of leaving work early in this instance. If an employee meets the criteria for leaving early, but is unable to leave due to a business need, they will still be compensated for the fifteen (15) minutes. Compensation may put the employee over forty (40) hours worked, and result in overtime paid or compensatory time earned. Employees who meet the criteria and leave work fifteen (15) minutes early should clock out at the time they leave. The Kronos editor will add the fifteen (15) minutes to the Kronos time record using the fifteen (15) minute (15MIN) pay code. Section VI-5 Revised 7/23/2015 E.3. Holidays (pay codes HO.A-HO.J and HOWRK) Holiday pay codes are mass entered from the Payroll Department into each employee’s record, if they are eligible for the holiday pay. Each employee’s holiday pay code is assigned according to his or her average daily hours and contract term. Twelve (12) month contract employees are paid for eighteen (18) holidays each fiscal year and will be assigned the holiday (HO.A) pay code. Nine (9) to eleven (11) month contract employees are paid for the holidays occurring during their work term that are scheduled for teachers in the approved school calendar. They will be assigned the holiday (HO.B), (HO.C), or (HO.D) pay codes depending on the length of their work term. All part-time employees (less than thirty (30) hours per week), working a minimum of eight (8) months, excluding substitutes and temporary employees, shall be paid for nine (9) holidays beginning their 6th year of continuous employment. This includes twelve (12) month part-time employees. The scheduled holidays and holiday pay codes are as follows: 6-8 Yrs (HO.E and HO.F) Days Veterans Day Thanksgiving Semester Break Presidents Spring Break April Break -1 -2 -2 -1 -2 -1 9-13 Yrs. (HO.G and HO.H) Days Veterans Day Thanksgiving Semester Break Presidents Spring Break April Break -1 -2 -4 -1 -2 -1 14 Yrs + (HO.I and HO.J) Labor Day Veterans Day Thanksgiving Semester Break Civil Rights Presidents Spring Break April Break Days -1 -1 -2 -4 -1 -1 -2 -1 The amount of holiday hours earned is determined by the employee’s average hours. If the average hours are 5.8 or 3.8 a day, the hours will be rounded to 6 or 4. Holidays will only be paid if the employee works the day before and after the holiday, unless the day before and/or after the holiday is a normal scheduled day off. Notify the Payroll Department during the current week if a holiday pay code appears on the record of an employee that you know should not be earning the holiday. If an employee is required to work on a day that is designated as a holiday for their work term, they will be compensated at time and one-half (1 ½) for all hours worked. The Kronos system automatically assigns the pay code (HOWRK) when the employee clocks in and out for their worked time on the holiday. The employee will also receive the holiday pay. E.4. Overtime (pay code 150) When an employee works over forty (40) hours during a week, the Kronos Timekeeping System automatically assigns the overtime (150) pay code to the hours worked over forty. The total hours assigned the overtime (150) pay code are then paid at one and one-half (1 ½) times the employee’s hourly rate. Section VI-6 Revised 7/23/2015 E.5. Regular Work Hours (pay code REG) The combination of a clock in and clock out on the employee’s record is considered a block of time and automatically assigns the pay code (REG). The worked hours accumulate in the (REG) pay code and are shown in the Time Editor on the bottom of the screen. If an employee forgets to clock in or clock out, the employee needs to fill out a ‘Kronos Punch Adjustment’ slip and submit it to you for editing. While editing the employee’s record, be sure to verify that all of the worked hours are directed to the correct transfer code or position number for funding. If an employee works over forty (40) hours in their workweek, Kronos automatically assigns the additional time to the default of either overtime (150) or compensatory time (COMP). E.6. Shift Differential (pay code REG2 and REG3) Shift differential is paid to those contract employees whose scheduled work shift is substantially different from the standard working hours. Substitutes, part-time, or temporary employees do not qualify for shift differential. The shift differential is paid when fifty-one percent (51%) of the worked hours fall in either the second shift or the third shift as defined by the Governing Board. The second shift (REG2) hours will fall between 2:00 p.m. and 12 midnight and pay thirtyfive cents (.35) more per hour. The third shift (REG3) hours will fall between 11:00 p.m. and 7:00 a.m. and pay fifty cents (.50) more per hour. The Kronos timekeeper system will automatically assign the shift differential (REG2) or (REG3) pay code to the hours when all of the criteria are met for each shift. Section VI-7 Revised 7/23/2015 F. POSITION NUMBERS FOR FUNDING PURPOSES All hours in the Kronos Timekeeper must be directed to the correct position numbers. If the time is not properly assigned, your budget will be affected. A position selection screen has been added in the Time Editor listing all of the position numbers and transfer codes assigned to each of your employees. Use the screen to select or view the correct position number when editing. F.1. The Position Number Select Screen The position number select screen is located within the Time Editor in Kronos. It can be accessed by using the edit, add, or insert function. (Refer to Section III, page 19, Viewing Available Positions) The information on the position select screen includes the six digit alpha-numeric position number, the three digit transfer code that correlates with the six digit position number, the start date and stop date, the funding sources, the average hours, and the hourly rate of each position. The position select screen gives you access to view all of the valid position numbers PARFed and set up in the system for the employees at your site. The information in the position select screen should help you to verify that either the six-digit alphanumeric position number or the three-digit transfer code, entered at the clock by the employee, is correct. F.2. Position Numbers and Transfer Codes When a PARF is generated to have an employee work a job at your site and have it funded through a specified account, a position number is assigned. The position number flows from the OBARS system to the Kronos system and becomes the default position number. All hours will flow to the default position number unless the editor redirects the time to other position numbers. If the employee has been hired for several jobs, the employee will have multiple position numbers. Since the Kronos system allows only one position number to be the default, the position number with the most hours will become the primary position and the Kronos default. When a part-time (less than 30 hours per week) employee has more than one position number, the employee will need to use the transfer button at the clock and enter a transfer code to direct the time to the other position numbers. When a contract employee (30 hours per week or more) has multiple positions that make-up their contract they do not use a transfer code, nor do they swipe in and out for changing positions. If a contract employee is working a position other than their regular contract, they will need to use the 3-digit transfer code. The transfer code is tied to the last two alpha characters of the position number. (Refer to Section IX, Position Codes for Classified Part-Time and Classified Job Master) Transfer punches need to be done using the button on the clock. When an employee is changing positions, they should not be swiping out and then waiting a minute or two then swiping back in. By using the transfer button at the clock, Kronos will insert an out punch and an in punch under the code used. If an employee has more than one job with the same 3-digit transfer code, the Kronos Editor will need to edit the code with the 6-digit alphanumeric code. When entering an absence other than Section VI-8 Revised 7/23/2015 unencumbering, you may redirect the time to another position or Kronos will automatically split the hours. F.3. Student Activities Transfer Code All employees who have a ‘regular’ position with the District will swipe all time worked through Kronos. When an employee works for a student activity function, the time must be transferred by using the three digit (777) code at the clock. The funding usually comes from student clubs monies or organizations. Make sure, when you are entering the student activity under the 777 code that you enter the correct account code on the edit screen. (Refer to Section III, page 17, Editing Student Activities Records) Employees who work ONLY in a position funded by student activities monies will not always be issued a badge and will not swipe their time through Kronos. Edit slips will need to be done for those without badges. All time worked by an employee will be gathered in Kronos and calculated for overtime. If the student activity puts the employee into overtime, it is very important that you monitor and redirect the overtime to the student activity position number for funding. (Refer to Section III, page, 15, Forcing Overtime / Comp Time) F.4. Rental Functions Transfer Codes District personnel, who work a rental activity that is not part of their regular shift, will continue to submit these hours on a Rental Payroll Form in addition to “swiping in” and entering the correct threedigit code at the clock. When any of your staff requests or submits a PARF for overtime (or additional hours beyond their contract hours) for a rental at your facility, give the employee the Student Activities/Rental form. Facility Assistants, Lead Custodians, Office Personnel, or any other employee who works overtime (or additional hours beyond their contract hours) for rental functions must clock in using the correct rental transfer code. There are two (2) possibilities. Rental Within the District (School to School, Department to School, Program to School) Rental Out of the District (Outside business or agency using the school facility) 760 773 The overtime/additional hours must continue to be turned in on the Student Activities/Rental form. Completing the form will ensure that the group renting your facility is billed properly and that your school’s civic center fund is reimbursed for the expense of the overtime. If the form is not submitted, the renter may not be charged for the hours worked. As with student activities, it is very important that overtime be directed to these rental codes. Further, for employees that have multiple overtime positions, you should use the position select screen to assign the full six (6) alphanumeric number. This will ensure the payroll programming will select and pay against the correct position number and account code. Section VI-9 Revised 7/23/2015