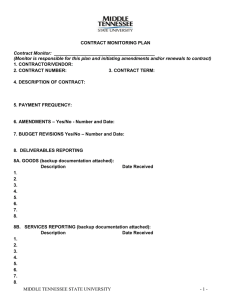

01-14

advertisement