Three Dimensions : , , and

advertisement

Three Dimensions of Economic Crisis:

Theoretical, Empirical, and Policy

Analysis in Business Cycles

Prepared for IDEAs Conference on

Re-regulating global finance

in the light of the global crisis

April 10, 2008

Ping Chen

China Center for Economic Research at

Peking University, Beijing, China

Center for New Political Economy at

Fudan University, Shanghai, China

pchen@ccer.edu.cn

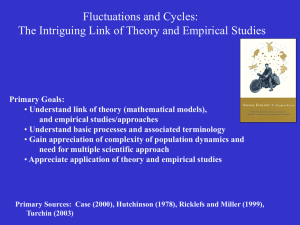

Nature of Business Cycles and

Economic Crisis

•

•

•

•

•

Exogenous school

Frisch (1933), Friedman & Schwartz(1963),

Lucas (1972), RBC, Black & Scholes (1973)

Endogenous school

Marx, Schumpeter, Hayek, von Mises, Keynes, Minsky,

• Natural experiments 》The Great Depression (1929-41),

Stock Market Crash (1987), Sub-Prime Crisis (2008-)

• Computational experiment 》Discovery of deterministic

color chaos (Chen 1996) > Endogenous nature

Operational Implications of

Exogenous/Endogenous divide

• Exogenous forces 》events driven by random

walk or white noise 》time series uncorrelated

》history does not matter! 》no

internal/historical constraints to government

policy!

• Endogenous forces 》events driven by

wavelets 》time series highly correlated 》

history does matter! 》strong

internal/historical constraints to government

policy!

Auto-Correlation Function for

Deterministic & Stochastic Time Series

Different auto-correlations for

Competing detrended time series

1

AC(n)

0.5

0

HPc

LLc

FDs

-0.5

-1

0

10

20

30

40

50

Equilibrium Illusion created by First-Differencing

(High Frequency Noise Amplifier 》Whitening

Filter) in Econometric Analysis

F D W h it e n in g F ilt e r

0.4

0.35

Freq Response R(f)

0.3

0.25

0.2

0.15

0.1

0.05

0

0

0.1

0.2

0.3

0.4

0.5

f

• Frequency response for the FD filter

• X(t) = FD[S(t)]=S(t+1)-S(t)

Evidence of Strange Attractor in Stock Market

Obtained by WGQ transform (Wigner transform + Gabor

space + Qian algorithm) Time-Varying Filter

FSPCOM Filter ed HP Cycles

0.3

0.2

0.2

0.1

0.1

X(t+T)

X(t+T)

FSPCOM Raw HP Cycl es

0.3

0

0

-0.1

-0.1

-0.2

-0.2

-0.3

-0.3

-0.3

-0.2

-0.1

0

X(t)

0.1

0.2

0.3

-0.3

-0.2

-0.1

0

X(t)

0.1

0.2

0.3

Stock Price Indexes (Standard & Poor 500)

Fractal dimension = 2.5

Variance of color chaos = 69 %

F

S

P

C

O

M

S

S

t

)

4

r

i

g

o

g

(

2

O

S

0

-

2

-

4

1

9

41

59

51

59

61

t

59

71

59

81

59

9

5

Economic diagnosis:

Exogenous(1973) vs. Endogenous events

P c H is t o ry o f F S P C O M H P C y c le s

20

Pc

15

O ilS h o c k

Pc (yrs)

S t o c k C ra s h

10

5

0

1965

1970

1975

1980

1985

External shock: frequency moved AFTER the shock

Internal instability: frequency moved BEFORE the shock

1990

Noise-Driven Cycles( Frisch 1933)vs.

Harmonic Brownian Motion

(Unlenbeck & Orstein, 1930)

• Wang & Unlenbeck (1945)

• Frisch model for American business

cycles,which would be damped in 5-20

years(Chen 1999,2004)!

Frisch model:Perpetual Motion Machine of

Second Type?

• Frisch was not the FIRST: G.E.Uhlenbeck and L.S. Ornstein, "On the

Theory of Brownian Motion," Physical Review, 36(3), 823-841 (1930).

• Frisch’s Informal conference paper: R. Frisch, “Propagation

Problems and Impulse Problems in Dynamic Economics”, in Economic

Essays in Honour of Gustav Cassel, George Allen & Unwin, London

(1933).

• Frisch's promised paper, "Changing harmonics studied from

the point of view of linear operators and erratic shocks,"

was advertised three times under the category "papers to

appear in early issues" in Econometrica, including Issue

No. 2, 3, and 4 of Volume I (April, July, and October 1933)

but never appeared in Econometrica since 1934.

• Frisch never mentioned a word about his prize-winning

model in his Nobel speech in 1969 (Frisch 1981).

The Principle of Large Numbers

for Positive Variables

More Micro Elements >

Less Macro Fluctuations

(Independent fluctuations may cancel out each other)

• SN=X1+X2+ . . . . . . +XN

• Relative Deviation (RD) =

Observed Relative Deviation 》 Implied Numbers

(Data Source: Fed. Reserve St. Louis)

Real Personal consumption:

• Real GDP:

0.15%

0.2 %

(800,000)

(500,000)

• Real Private Investment:

1.2%

(10,000)

• Dow Jones Industrial (1928-09):

• S&P 500 Index (1947-2009):

• NASDAQ (1971-2009):

1.4%

1.6%

2.0 %

(9000)

(5000)

(3000)

• Texas Crude Oil Price (1978-2008): 5.3 %

(400)

US Household & Firm Numbers in1980

and Their Capability in Generating RD

• Realistic Number and Potential Relative Deviations

Micro-Agents

Households

Corporations*

Public Companies

N

80.7(million)

2.9(million)

20,000

(%)

0.01

0.05

0.7

*Here, we count only those corporations with more than $100,000 in assets.

Economic Implications from

Principle of Large Numbers

• Household fluctuations contribute less than

10% of GDP fluctuations 》weak “micro

foundations” in business cycles

• Small firm fluctuations contribute only about

a quarter of GDP fluctuations

• Only public companies and giant

organizations may generate large fluctuations

in investment, which is 6-10 times larger than

GDP fluctuations 》meso foundations of

business cycles

Why Lucas is wrong about microfoundations

and rational expectations?

• MISTAKE I. Lucas critique also applies to Lucas theory when

relative prices move in pairs 》creates arbitrage opportunity

• Under rational choice between leisure and work, there is arbitrage

opportunity among mass

• Example: shock > wage DOWN > many workers choose leisure >

leisure price UP > some workers choose work instead > cancel out

the rational mass effect under “rational expectations”

• MISTAKE II. Lucas model of island economy with N agents 》

disguised model of representative agent 》system degree of

freedom =3 》individual degree of freedom is 3/N ~ 0!

• Counter example: Ideal Gas in physics, each particle has 6 degree

of freedom 》system with N particle has 6N degree of freedom

• Conclusion: equilibrium illusion of self-stabilizing market is created

by representative agent model in macro + FD whitening filter in

econometrics

Dan Gilligan, President of the PMA(Petroleum Marketers

Association) on Oil Price Manipulated by Financial Giants

• Did Speculation Fuel Oil Price Swings?? (CBS 60 Minutes, 01/12/2009)

•

http://www.cwpma.org/Template.php?-p=HomeNewsPopup&-d=News&-r=52.0

•

in 2000, Congress deregulated the futures market, granting exemptions for complicated

derivative investments called oil swaps, as well as electronic trading on private exchanges.

•

Volatility in price of oil per barrel within one year: $67↑ $147↓ $45; even jump $25 in one day!

•

Changes in demand & supply less than 5% 》Changes in price of oil larger than

100%

In mid-June - end of Nov. 2008,Congress investigation started > $70 billion

speculative capital left future market 》demand of oil dropped 5%》Price of oil

dropped more than 75% to $100

•

•

•

•

•

60%-70%of oil contracts in future market controlled by speculative capital

In past 5 years,capital poured into oil market by Hedge Funds and Big Investment Banks:

$13 billion ↑ $300 billions

Large players:Morgan Stanley, Goldman Sachs, Barclays, J.P. Morgan put hundred of

billions of dollars in oil future market, California pension fund. Harvard Endowment,

and large institutional investors

Smith Theorem and

Market Share Regulation

• Adam Smith Theorem: Division of labor is

limited by market extent 》danger of

monopolistic competition

• Hidden hypothesis in efficient market (invisible

hand) 》unlimited market extent

• Real market 》Limitation of market extent and

players 》Necessary of International anti-trust

law not only for merge & acquisition but also for

trading in financial market

• Disclose market positions in trading for big

players

Policy Implications for

Crisis Policy

• Traditional policy with “too big to fail”

• Take over failed companies by a bigger firm, such as

Citigroup and Bank of America 》prediction: Citigroup

and Bank of America would become worse

• Better competition policy under Principle of Large

Numbers

• Breaking up AIG, Citigroup into competing firms 》

improve chances of innovation and competition +

diversify risk of wrong decision

• Examples: China broke up China Airline into several

companies, Oligarchs in Russia

RD Behavior for Stochastic Models

Order

Mean

Variance

Brownian motion

Birth-Death

~ exp( rt )

~ exp( rt )

~ exp( 2rt ){e

RD

~e

2

t

2

2t

(1 e

1}

t 2

)

Random-Walk

t

t

~ e rt (e rt 1)

~

1

1

N0

t

• Random walk is damping over time

• Brownian motion is exploding over time

• Only the Birth-death process is stable in time >

resilient market of endogenous fluctuations

Source of Financial Instability:Nonlinear Trend &

Higher Moments in Birth-Death Process

• Option pricing model based on nonlinear birth-death

process f

t

[(a1 a1 ) ( a2 a2 ) 2 (a3 a3 ) 3 ] f ( t )

2

[a1 (a2 a2 ) 2 (3a3 2a3 ) 3 ] f ( t )

2

3

[a2 2 (3a3 a3 ) 3 ] f ( t )

3

4

3

a

f ( t )

3

4

[(a1 a1 ) (a2 a2 ) 2 (a3 a3 ) 3 ] 0,

• Stability condition:

• Under stability: finite first & second moment 》Ito 》

construct arbitrage portfolio 》Black-Scholes model

Crisis:Trend Collapse &

Divergence of Higher Moments

TED Spread(3个月欧洲美元与美国国债的息差)

基点

250

200

150

100

50

2008-4

2008-3

2008-2

2008-1

2007-12

2007-11

2007-10

2007-9

2007-8

2007-7

2007-6

2007-5

2007-4

2007-3

2007-2

2007-1

0

Dow Jones Industrial in Great Depression

Policy Constraints during Crisis

• International coordination

• Danger of trade protection, asymmetric investment, and

competitive devaluation

• Domestic constraints:

• Expansionary monetary policy 》danger of inflation,

devaluation, and capital flight

• Expansionary fiscal policy 》danger of new bad loans,

crowding out small & medium healthy firms

• Finding new source of growth 》structural adjustment 》

green economy

References

• Coase, R. H. The Firm, the market, and the Law, University

of Chicago Press, Chicago (1990), Coase, R. “Social Costs”

(1960).

• Frisch, R. "Propagation Problems and Impulse Problems in

Dynamic Economics," in Economic Essays in Honour of

Gustav Cassel, George Allen & Unwin, London (1933).

• Friedman, M. “The Case for Flexible Exchange Rates,” in M.

Friedman, Essays in Positive Economics, University of

Chicago Press, Chicago (1953).

• Friedman, M. and A.J. Schwartz, Monetary History of

United States, 1867-1960, Princeton University Press, NJ:

Princeton (1963).

• Lucas, R.E. Jr. "Expectations and the Neutrality of Money,"

Journal of Economic Theory, 4, 103-124 (1972).

• Minsky, H.P. Stabilizing an Unstable Economy, Yale

University Press, New Haven (1986).

References

• Chen, P. “Empirical and Theoretical Evidence of Economic Chaos,”

System Dynamics Review, Vol. 4, No. 1-2, 81-108 (1988).

• Chen, P. “A Random Walk or Color Chaos on the Stock Market? Time-Frequency Analysis of S&P Indexes,” Studies in Nonlinear

Dynamics & Econometrics , 1(2), 87-103 (1996).

• Chen, P. “Microfoundations of Macroeconomic Fluctuations and the

Laws of Probability Theory: the Principle of Large Numbers vs.

Rational Expectations Arbitrage,” Journal of Economic Behavior &

Organization, 49, 327-344 (2002).

• Chen, P. “Evolutionary Economic Dynamics: Persistent Business

Cycles, Disruptive Technology, and the Trade-Off between Stability

and Complexity,” in Kurt Dopfer ed., The Evolutionary Foundations of

Economics, Chapter 15, pp.472-505, Cambridge University Press,

Cambridge (2005).

• Chen, P. “Complexity of Transaction Costs and Evolution of

Corporate Governance,” Kyoto Economic Review, 76(2), 139-153

(2007).

• Chen, P. “Equilibrium Illusion, Economic Complexity, and

Evolutionary Foundation of Economic Analysis,” Evolutionary and

Institutional Economics Review, 5(1), 81-127 (2008).

• Schrödinger, E. What is Life? Cambridge University Press,

Cambridge (1948).