Thai capital after the Asian crisis Pasuk Phongpaichit and Chris Baker

advertisement

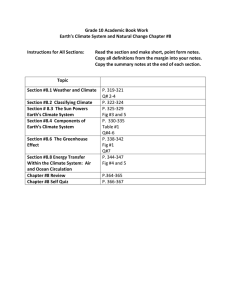

Thai capital after the Asian crisis Pasuk Phongpaichit and Chris Baker A Decade After, Bangkok, 12-14 July 2007 Thailand: postwar to crisis stable macro management US tutelage natural and human resources immigrant entrepreneurs competitive clientelism high savings and investment export orientation domestic family conglomerates 60 '000 baht at 1988 prices 50 40 30 20 real per capita GDP 10 0 2005 2000 1995 1990 1985 1980 1975 1970 1965 1960 1955 1950 Crisis macro IMF deflationary package (1 year) consumer stimulus baht at 1998 prices 8,000 7,000 6,000 private consumption 5,000 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Finance Collapse of credit culture Surgery on financial institutions Selective rescue Lift bar on foreign investment Regulation, prudence Big four survive Medium and small closed, sold, merged End of relationship banking 5-year shrinkage Fig I.5 Distribution of commercial bank lending, 1990-2006 8000 other overseas government consumer other commercial industry billion baht 6000 4000 2000 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Source: Bank of Thailand real sector No policy to rescue fire-sale of distressed assets hands-off debt restructuring lift equity restrictions in manufacturing selective protection of services Fig 1.1 Foreign direct investment, 1970-2006 10 5 9 8 4 % of GDP, right scale 6 3 % of gdp US$ billion 7 5 4 2 3 2 1 1 0 0 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 1972 1970 Source: Bank of Thailand FDI crisis decade vs boom decade: x 3 in US$ x5 in baht x2 as % of GDP export manufacturing finance construction-related (cement, steel) big retail property 1988: 122 of top 450 MNCs, 214 projects 2000: 248 of top 500 MNCs, 630 projects services Automotive industry pre-crisis post-crisis assemblers c. 12, mostly Thaimajority joint ventures main assemblers c. 100% MNC-owned first-tier (oem parts) c. 400 firms, mix of domestic, JV, and MNC firms 20 domestic groups, rest are MNCs and their international partners second-tier (components) c. 500 firms, mostly domestic fdi by MNC international partners suppliers mostly domestic fdi by specialists from Japan, US, Europe 150 Fig 3.1 Number of hypermarket outlets, 1995-2006 24 23 125 20 100 49 19 44 Carrefour 17 40 Big C 75 36 15 Tesco 33 11 50 29 6 25 19 7 20 9 23 20 52 5 1995 1996 60 33 11 6 2 75 43 2 0 70 12 14 17 1997 1998 1999 24 2000 2001 2002 2003 2004 2005 2006 Source: Nipon et al., 2002 and corporate websites. Companies Quarter of companies de-listed from exchange Quarter of top 50 corporate groups slid to bottom ranks Quarter of top 220 corporate groups disappeared Win or lose? Sector and structure Sector manufacturing partner secondary finance Structure “authoritarian conglomerate” (unreformed kongsi, absolute patriarch, little/no outside professional management, bank-dependent, non-transparent) Impacts Concentration Export dependence Capital market Social development Concentration By MNC buyout/expansion three mega-retail chains two mobile phone suppliers etc. ‘Few winners, many losers’ effect merger of steel firms top five banks liquor/beer etc Fig 1.5 Top 150 business groups by assets, 2000 1,250 750 500 250 150 125 100 75 50 0 25 billion baht 1,000 Source: Suehiro database export dependence Recovery through exports currency depreciated companies reorient to export to replace home market Almost all growth attributable to exports Large and growing share by MNCs Trade:GDP up from 90 to 150% growth accounting 1999 2000 2001 2002 2003 exports 5.0 10.1 -2.6 7.3 4.2 consumption 2.3 2.7 2.1 2.7 3.5 -0.7 1.1 0.2 1.3 2.3 GDP 4.4 4.8 2.1 5.4 6.7 export % 113 210 * 135 63 investment Source: Peter Warr, 2005: 30 100% Fig I. 11 Export shares by sector, 1985-2006 tech-based industry 75% process industry 50% labour-intensive industry resource-based industry 25% other agriculture 0% 2006 2005 2004 2003 2001 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 Fig I.10 Trade as percent of GDP, 1995-2006 80 Exports % of GDP 70 60 50 40 Imports 30 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 capital market Decline in savings and investment credit promotion to boost consumption rising household debt, lower household savings Banks shrink lending to business reorient to consumer Stockmarket no substitute small, radically affected by speculative i/n flows political manipulation values do not reflect company performance Fig I.8 Gross national savings, 1994-2005 40 30 % of GDP Business 20 Government 10 Households 0 1994 Source : NESDB 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Fig I.9 Gross domestic investment, 1994-2005 40 % of GDP 30 public 20 private 10 0 1994 Source: NESDB 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Fig I.5 Distribution of commercial bank lending, 1990-2006 8000 other overseas government consumer other commercial industry billion baht 6000 4000 2000 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Source: Bank of Thailand social pattern 26% urban informal 15% 41% white collar agriculture 8% formal industrial 10% other Thank you