The Far-From-Elusive Quest For Growth: Economic Performance In Developing Countries, 1996-2008

advertisement

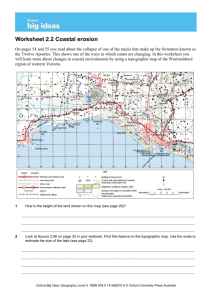

2009 Oxford Business & Economics Conference Program ISBN : 978-0-9742114-1-1 The Far-From-Elusive Quest for Growth: Economic Performance in Developing Countries, 1996-2008 Michael Crosswell Senior Economist U.S. Agency for International Development (USAID) Washington, D.C., USA mcrosswell@usaid.gov (202-647-2779) For presentation at the 2009 Oxford Business and Economics Conference; St. Hugh’s College, Oxford University, UK. June 24-26, 2009. Views are those of the author and do not reflect official USG positions. This paper is subject to ongoing revision and update as new data appear. June 24-26, 2009 St. Hugh’s College, Oxford University, Oxford, UK 2009 Oxford Business & Economics Conference Program ISBN : 978-0-9742114-1-1 The Far-From-Elusive Quest for Growth: Economic Performance in Developing Countries, 1996-2008 ABSTRACT This paper documents the much improved and largely positive economic performance of (113) developing countries from the mid-1990’s through 2008. Performance has been overwhelmingly positive in Asia and in the formerly communist countries. It is much improved and mostly positive in Africa – three out of four Africans live in countries that achieved significant economic progress during the first eight years of this century. The paper also looks at the widespread progress in economic freedom since 1995 and the significant links between economic freedom and economic growth. It concludes that for the 1996-2008 period, the quest for growth has been mostly successful and far from elusive, contrary to the pessimistic views expressed by Easterly (2002), Sachs (2005), and other critics. INTRODUCTION This paper looks at recent growth performance in developing countries, including most of those receiving foreign aid from the United States. Before getting to the data, consider some stylized facts that characterized discussion of growth in developing countries over the past decade: The developing world as a whole was seen as making reasonable progress – as reflected in average growth rates weighted by the size of economies. But, the averages concealed a sharp divergence between middle-income countries – many of which have indeed grown rapidly – and poor countries, which appear to have lagged seriously. Globalization was seen as benefiting the “haves” but not the “have-nots”. Viewed by region, Africa was seen as a failure at economic growth, and there was concern about economic growth in North Africa and the Middle East. Asia was seen as most successful followed by Latin America. The formerly Communist countries of Eastern Europe and the NIS were often portrayed as struggling to regain Cold War levels of national income. Over time the view was that since the mid-nineties, events had conspired against the developing world: The Asian financial crisis, the subsequent financial crises in Brazil, Russia, Turkey, and Argentina; the impacts of the war on terrorism; associated adverse trends in trade and investment; and the impacts of HIV/AIDS, the Tsunami, Avian Influenza, the lack of progress in the Doha Round, etc. There was some truth in each of these. But in many ways they misrepresented and understated the degree of success; where success was taking place; and experience in Africa in particular. June 24-26, 2009 St. Hugh’s College, Oxford University, Oxford, UK 1 2009 Oxford Business & Economics Conference Program ISBN : 978-0-9742114-1-1 This paper focuses mainly on growth in per capita income for developing countries during 19962006, and 2001-08. It includes comparisons across regions and comparisons with 1990-96.a In looking at these data, the focus is on how many countries in a region have done well or poorly, and secondarily on regional averages that are NOT weighted by GNP or population. (For businesses interested in market size and growth, it is obviously critical to weight growth rates by GNP. For donors interested in development progress across a range of aid recipients, large and small, unweighted averages are arguably more useful.) The benchmark for gauging success -- in the sense of satisfactory progress-- is average annual growth in per capita income of at least 2%. This can be justified from several different perspectives. First, it is close to the average historical growth rate in per capita income of the United States – arguably the most successful case of economic development ever. That rate is estimated at a surprisingly modest 1.7 to 2.2% annually since 1776. [USAID (2002)] Second, it is above the (weighted) average growth rate in per capita income of 1.8% for the “Major Advanced Economies” over the past two decades. [IMF (2007)]b Thus it is consistent with eventual convergence. Third, according to various estimates of the relationship between growth and poverty reduction, annual growth at 2 per cent on a per capita basis – if sustained – is broadly consistent with achieving the international development target of a 50% reduction in the share of the population in poverty over twenty-five years.[Dollar (2000), World Bank (2005), World Bank (2007)]c ECONOMIC PERFORMANCE The data support the first stylized fact – the developing world has indeed made progress overall in terms of economic growth. Real GDP per capita in emerging market and developing countries for 1996-06 grew at a (weighted) average rate of 4.4%, compared with less than 2% for the major advanced economies. [IMF (2007)]d Consider the second generalization – middle-income countries have done well, but low-income countries have not.e This was certainly true in the first half of the 1990’s, when the (unweighted) a See Table 1. The GDP growth data are from IMF (2008). Population growth rates are from IBRD (2008), with data through 2007. The “1996-06 growth rate” is the average annual growth rate that gets GDP per capita from its 1996 level to its 2006 level b Statistical Annex, Table 4. The corresponding table is not provided in more recent editions of World Economic Outlook. c The latter reports the average elasticity of poverty with respect to income growth at 1.3 for low-income countries. This implies that a 50% reduction in poverty can be achieved if income increases by 38.5%, or 1.31% annually over twenty-five years. Estimates of the elasticity of poverty with respect to income growth vary considerably depending on the country sample and time periods. d Figures for 1997 and 1998 are from earlier editions. Subsequent editions of the World Economic Outlook do not provide per capita growth rates for the major advanced economies. e We use the IBRD/DAC definition of low-income countries, reflecting a threshold of $935 per capita income in 2007. Figures cited are simple averages rather than weighted by GDP. The averages are for 44 low-income countries and 41 middle-income countries in Table 1, based on IBRD income thresholds and groupings for 1999 and June 24-26, 2009 2 St. Hugh’s College, Oxford University, Oxford, UK 2009 Oxford Business & Economics Conference Program ISBN : 978-0-9742114-1-1 average growth rate for middle-income countries was around 2.5%, compared with nearly zero for low-income countries. However, since the mid-1990’s growth has accelerated sharply in low-income countries. For 1996-2006 the same set of low-income countries grew at 1.7%, compared with 2.1% for middle-income countries. Moving forward to the 2001-08 period, average annual growth in both groups rose sharply -- to around 2.7% for low-income countries and 3.2% for middle-income countries. So, poor countries have done much better, both relative to earlier periods and relative to middle income countries.f Now consider growth performance in specific regions, initially focusing mainly on low-income countries for two reasons: they are perceived to have been least successful at growth; and it is in the low-income countries that most of global poverty (around 80%) is concentrated. In Africa – where the challenge of achieving economic growth was supposed to be most difficult – trends clearly improved. Looking at 33 low-income countries, the (unweighted) average growth rate improved significantly -- from -0.4% in the first part of the 1990s to 1.4% over the next decade.g The latter rate is “nothing to write home about”, but it at least signaled a shift from gradual decline to modest improvement. What is more striking is the number of countries where growth accelerated to meaningfully positive rates. In the first half of the 1990’s only six lowincome countries (out of 33) grew at annual rates of 2% or better. During 1996-2006 that number doubled, to 12. Some of the countries behind this improving trend included Ethiopia, Mali, Rwanda, Ghana, Nigeria, Mozambique, and Tanzania. For 2001-2008 the average growth rate rose further – to 2.3 % -- with seventeen low-income countries meeting or surpassing the 2% growth benchmark; and fifteen of these at or above 2.5%. Trends in seven middle-income countries in Africa were also largely positive, despite the impacts of HIV/AIDS. In particular, economic growth in South Africa accelerated sharply, from -0.7% in the first half of the 1990’s to 1.7% over the next decade, and 3.4% for 2001-08. Growth also accelerated sharply in Namibia, and remained strong in Botswana, Cape Verde and Mauritius. There are of course qualifiers, footnotes, and uncertainties behind all this, particularly in view of the current international economic crisis. But the major point – that growth performance in Africa during 1996-08 was not uniformly discouraging, but rather a mixed picture with significant positive features and trends – is one that is generally unappreciated even today in popular depictions of development progress in Africa. Considering both low (33) and middle2000. Accordingly, Angola and Indonesia are counted as low-income; and Djibouti and Papua New Guinea are counted as middle income. We exclude Togo, China, Taiwan, Hong Kong, Singapore, Myanmar, Syria, Iran, Libya, and Saudi Arabia as largely outsides the sphere of development cooperation; East Timor, Liberia and Somalia for data limitations; and Equatorial Guinea as an outlier in terms of unusually high growth rates. We also leave the formerly Communist countries in Europe and Eurasia outside this part of the discussion, owing to their accentuated pattern of decline and recovery during the 1990’s. f For 2001-08, we can drop Angola (11.7%) and Zimbabwe (-6.4%) as outliers without discernible effect on the average growth rates for African low-income countries, or for Africa more generally. g More specifically, the time periods for the regional discussions are 1990-96 and 1996-06. June 24-26, 2009 3 St. Hugh’s College, Oxford University, Oxford, UK 2009 Oxford Business & Economics Conference Program ISBN : 978-0-9742114-1-1 income (7) countries, the average growth rate has risen from -0.4% in the first half of the 1990s to 1.5% for 1996-06, and 2.5% for 2001-08. The number of countries at 2% or above has increased steadily from 8 to 16 to 23. Six other countries were above 1.5% -- within striking distance of the 2% threshold, and growing fast enough to make significant inroads in terms of poverty reduction. Turning to low-income Asia -- the region that accounts for the bulk of global poverty -- we see 1996-06 growth rates around 3 ½ to nearly 6 % for India, Bangladesh, and Vietnam, which collectively account for over 1.3 billion people, nearly twice the population of the 33 low-income African countries considered above. Growth for 1996-2006 was much slower but still positive in Pakistan (1.9%) and Indonesia (1.2%). However, for 2001-08 growth increased sharply to 3.6% for Pakistan and to over 4% for Indonesia. Growth rates in India, Bangladesh, and Vietnam also rose. These sorts of growth rates – if sustained -- imply major reductions in global poverty, given the large populations of these five countries – nearly 1.8 billion people in all. Again, the picture has been much more positive than commonly appreciated. For middle-income Asia the picture is broadly one of slowdown and then significant recovery for the countries involved in the Asian Financial Crisis. For 2001-08 growth was at around 3.3-5% in Sri Lanka, Philippines, Malaysia, Thailand and Korea. For the latter three (and Indonesia) these were well below their growth rates in the early 1990’s, but were nonetheless rapid by most standards. Looking at Latin America and the Caribbean, only Haiti and (until very recently) Nicaragua are low-income countries. Nicaragua achieved modest growth (2.3%) for 1996-2006. The more striking story is the disappointing track record on economic growth in the region overall. Out of twenty-two countries only ten managed growth at 2% or better for 1996-06. This was not much better than for Africa (45% versus 40%) and represented a decline from 1990-96, when eleven countries met that benchmark. For 2001-2008, the average growth rate for the region rose to 2.8% -- compared with 1.7% for 1996-06 -- with fifteen countries meeting or surpassing the 2% benchmark. In the Middle-East and North Africa only Yemen is a low-income country, and growth there has been persistently weak since 1990, with a decelerating trend. The picture is much more positive for middle-income countries. Egypt, Morocco, Jordan, Tunisia, and Turkey all achieved significant growth during 1996-06, with growth rates in the range of 2.5% to 3.7%. For 2001-08 these growth rates rose significantly – to a range of 3.3% to 5%. The formerly Communist countries of Europe and Eurasia need to be considered separately, because their growth pattern and performance has been dominated by the fall of the Iron Curtain and the transition from Communism. This resulted in steep declines in measured GDP in the first half of the 1990’s, at an average annual rate of over 6% for 28 mostly middle-income countries. Since the mid-1990s there has been a marked turnaround. For 1996-2006 the average June 24-26, 2009 St. Hugh’s College, Oxford University, Oxford, UK 4 2009 Oxford Business & Economics Conference Program ISBN : 978-0-9742114-1-1 growth rate was 5.7%. More remarkably, growth rates were above 2% in all twenty-eight countries, in most cases by wide margins. Further, this was not simply a rebound effect -- average growth accelerated to 6.9% for 2001-08. Again, there are qualifiers, footnotes, and uncertainties. But, in broad strokes this has been a remarkably positive picture. Putting this all together and focusing on 2001-2008, the growth picture was: Predominantly positive in Asia/Pacific. Among low- and middle-income countries (over 2 billion people, not counting China) only Nepal (1.3%) and Papua New Guinea (0.9%) evidenced weak growth performance. In the remaining countries growth ranged from 3.3% to 7.6%. The “Asian Miracles” did not grow as rapidly as in the first half of the 1990’s, but they nonetheless made significant progress. Overwhelmingly positive in the formerly Communist countries of Europe and Eurasia (400 million people). The slowest growth was in Macedonia, Kyrgyz Republic, and Hungary – just over 3.5%. Growth rates elsewhere were well above 4% in most cases. Increasingly positive in Sub-Saharan Africa (780 million people). Over half of low-income African countries showed growth in per capita income at 2% or better (17 out of 33), along with six out of seven middle-income countries, including South Africa, Namibia and Botswana. Together these twenty-three countries account for nearly 590 million people, compared with a total of almost 780 million. In other words, three out of four Africans (in our 40 country sample) live in a country that achieved at least moderate economic growth for 2001-08. Increasingly positive in Latin America (550 million people.) Along with the Asian Miracles, the middle-income countries of Latin America have both contributed to and been affected by instability in international financial markets. For 2001-08, fifteen out of twenty-two countries met or exceeded the 2 per cent benchmark, compared with only ten during 1996-06. Mostly positive in the relatively moderate Islamic countries of North Africa and the Middle East. (260 million people) For Morocco, Algeria, Tunisia, Egypt, Jordan, and Turkey per capita growth rates ranged from 3.2% (Algeria) to 5% for Turkey. Growth prospects remain unclear for Lebanon and dim for Yemen. Overall, of the more than 4 billion people in 113 countries covered by this discussion, over 90% live in countries that achieved satisfactory or better growth over the 2001-08 period. Of the remaining 10% -- about 394 million people – nearly one-half live in countries where growth was over 1.5%. June 24-26, 2009 St. Hugh’s College, Oxford University, Oxford, UK 5 2009 Oxford Business & Economics Conference Program ISBN : 978-0-9742114-1-1 The obvious and pressing question (in February 2009 as this paper is finalized) is whether this widespread economic growth was simply a product of favorable international economic trends, and therefore not fundamentally sustainable in the face of the current sharp international downturn; or whether it rested on more sustainable foundations of policy and institutional change. The next section of the paper aims to shed some light on this issue. ECONOMIC GROWTH AND ECONOMIC FREEDOM What lay behind this improved growth performance? For starters, economic freedom increased significantly in most developing countries, particularly the low-income developing countries and the formerly Communist countries of Europe and Eurasia.h For 30 low-income developing countries, mostly in Africa, economic freedom increased over the past decade in 24 (80%); stayed about the same in one country; declined by a small amount in four countries; and declined precipitously in Zimbabwe. The average score for this group rose from 4.9 in 1995 to 5.6 in 2006. (For reference, the average score for industrialized countries is about 7.7). For 14 formerly Communist countries, economic freedom significantly increased in every case – by at least one point and in seven cases by more than two points. The average score rose from 4.9 to 6.8. For 37 middle-income developing countries progress was more limited, as the average score increased from 6.2 to 6.6. Economic freedom increased in twenty-one countries; changed little if at all in nine countries; and declined in seven, including Philippines, Thailand, Malaysia, and Argentina. Increased controls in response to financial market crises most likely played a role in these latter trends. Further, statistical analysis indicates that levels and trends in economic freedom help explain variations in economic growth across countries. Taking regional location into account is also important. (See Table 2) We first look at the 1996-2006 growth rates and the 1995 and 2006 economic freedom scores. Regression analysis shows that the initial (1995) level of economic freedom together with the change in economic freedom over the 1995-2006 period explains 35% of the variation in growth rates among countries. Both explanatory variables are highly significant, and the coefficients indicate strong impacts of economic freedom on growth. In particular, a one point improvement in economic freedom over the decade added 1.7 percentage points to the predicted growth rate. h Gwartney (2008) provides economic freedom scores for a range of developing countries for 1995, 2000, and 2006, including eighty-one of the countries in Table 1. The discussion of trends is based on comparing the 1995 and 2006 scores. The Index of Economic Freedom covers seven areas of policies and institutions: the size of government; legal structure and security of property rights, access to sound money, freedom to trade with foreigners; regulation of capital and financial markets; regulation of labor markets; and freedom to operate and compete in business. A change of .25 points or less is considered negligible. June 24-26, 2009 6 St. Hugh’s College, Oxford University, Oxford, UK 2009 Oxford Business & Economics Conference Program ISBN : 978-0-9742114-1-1 Earlier discussion pointed out that the formerly Communist countries need to be considered separately, as high growth rates for these countries after 1995 in part reflected a rebound from steep declines during the early 1990s. At the same time, economic freedom scores improved sharply in those countries in the course of the transition from Communism. How much of the ostensible link between improvements in economic freedom and economic growth is due to this “transition” effect? Adding a dummy variable for the formerly Communist countries raises the explanatory power of the regression equation to 47%. Holding economic freedom variables constant, being a formerly Communist country in Europe/Eurasia adds about 2.5 percentage points to the expected growth rate. The economic freedom variables remain highly significant. The impact of improvements in economic freedom declines but remains strong – a one point increase in economic freedom adds about 1.1 percentage points to the predicted growth rate. Considering other regions by using additional dummy variables: Adding an Asia dummy variable raises the explanatory power of the equation to 50%, and the dummy variable is clearly significant.i Location in Asia adds about 1.3 percentage point to predicted growth. This would fit with the view of Asia as a relatively dynamic region in economic terms. The coefficients for the economic freedom variables and the E&E dummy remain about the same, and highly significant. Dummy variables for other regions are not statistically significant. For Africa this tends to substantiate claims of major improvements in Africa’s growth performance – a dummy variable for Africa has typically been highly significant with a negative coefficient in explaining growth for the 1980s and early 1990s. For Latin America, this is an improvement over results from several years ago, where a Western Hemisphere dummy variable was statistically significant and subtracted almost a full percentage point from predicted growth. More generally, except for Latin America the regression results are very close to those reported in previous versions of this paper, e.g. covering 1995-05 growth and 1995 and 2004 economic freedom scores. Focusing on economic growth for 2001-08 and considering the initial (2000) level of economic freedom as well as improvements up to 2006, these results hold up surprisingly well considering the brevity of the intervals and the lag in economic freedom scores: An equation including only the two economic freedom variables (initial level and change up to 2006) explains 23% of the variation in growth rates, with both variables highly significant. A one point improvement in economic freedom adds 1.8 percentage points to the predicted growth rate. i We consider Papua New Guinea as Pacific, but not Asia June 24-26, 2009 St. Hugh’s College, Oxford University, Oxford, UK 7 2009 Oxford Business & Economics Conference Program ISBN : 978-0-9742114-1-1 Adding a dummy variable for Europe and Eurasia improves the explanatory power of the equation to 38%, with all three variables significant. Location in E&E adds nearly 3 percentage points to predicted growth. The impact of a one point improvement in economic freedom falls to about 1 percentage point – still substantial. Adding a further dummy variable for Asia improves the explanatory power of the equation to 41%. The statistical significance of the Asian dummy variable holds up, and the other three variables remain significant, with little change in their coefficients. Location in Asia adds about 1.5 percentage points to the predicted growth rate. Dummy variables for other regions are not statistically significant. Again this suggests that for 2001-08 (as well as for 1996-2006), location in Africa does not handicap expected growth performance. CONCLUDING COMMENTS Critics of foreign aid have argued that there has been very limited progress in the developing world – particularly in terms of economic growth. Therefore, foreign aid has failed to promote development. The perception of very limited development progress formed during the 1990’s, particularly in response to widespread stagnation and decline in Africa. These perceptions have persisted to the present. On the right, Bill Easterly has written about “The Elusive Quest for Growth”, the result of failed approaches by donors and recipients. And on the left, Jeff Sachs has argued for massive increases in aid directed at poverty reduction, arguing that poor countries – particularly in Africa – are stuck in “poverty traps” and cannot achieve enough savings to grow without first reducing poverty. The pessimism about development performance and prospects was way overdrawn even in the mid-1990s – ignoring a significant number of emerging good performers in Africa (hence progress was demonstrably feasible in that region); and more importantly ignoring the major, widespread gains achieved in other regions of the world, particularly populous, low-income Asia. Even from the vantage point of the mid-1990s the development record since the 1960s was predominantly positive. [Crosswell (1998)] From the vantage point of 2008, perceptions of persistent stagnation have clearly failed to keep up with reality.j Economic performance of developing countries has been steadily improving and largely positive since the mid-1990s. By 2008, over 90 per cent of the people in the developing world (including over 75 per cent of Sub-Saharan Africans) lived in countries with significantly positive economic growth since the turn of the century. Furthermore, much of this improved performance can be explained by progress in economic freedom – i.e. policies and institutions supportive of private markets. It remains to be seen whether these encouraging trends will be sustained, particularly in view of the international financial crisis. In any case, for the 1996-2008 period, the quest for growth was predominantly successful and far from elusive. j Crosswell (2008) looks at a larger set of issues and indicators for the period from 1995 to the present. June 24-26, 2009 St. Hugh’s College, Oxford University, Oxford, UK 8 2009 Oxford Business & Economics Conference Program ISBN : 978-0-9742114-1-1 Crosswell, M. (1998). The development record and the effectiveness of foreign aid. USAID Discussion Paper, June 1998, reprinted in PRAXIS, The Fletcher Journal of Development Studies, Volume XV, 1999. http://fletcher.tufts.edu/praxos/archives/xv/Crosswell.pdf Crosswell, M. (2008). The development record and the effectiveness of foreign aid – update. 2008 Oxford Business and Economics Conference; St. Hugh’s College, Oxford University, UK. June 22-24, 2008. www.facultyforum.com/gcbe/ Dollar, D. & Kraay, A. (2000). Growth IS good for the poor. Policy Research Working Paper #2587, World Bank, 2000. Washington, D.C. Easterly, W. (2002). The elusive quest for growth. Cambridge, Mass. MIT Press. Gwartney, J. & Lawson, R. (2008) Economic freedom of the world: 2008 annual report. CATO Institute, Washington D.C. Available at www.freetheworld.com/release.html IBRD (2005) Pro-poor growth in the 1990s: lessons and insights from fourteen countries. The World Bank, Washington D.C. IBRD (2007). Global monitoring report 2007. The World Bank, Washington D.C. IBRD (2008). World development indicators 2008. The World Bank, Washington D.C. IMF (2007). World Economic Outlook, April 2007. International Monetary Fund, Washington D.C. Available at www.imf.org IMF (2008). World Economic Outlook, October 2008. International Monetary Fund, Washington D.C. Available at www.imf.org Sachs, J. & Associates (2005). Investing in development. Final Reports of the Millennium Development Project. www.unmillenniumproject.org. USAID (2002). Foreign aid in the national interest: promoting freedom, security, and opportunity. U.S. Agency for International Development, Washington D.C. December 2002. www.usaid.gov/policy/ June 24-26, 2009 St. Hugh’s College, Oxford University, Oxford, UK 9 2009 Oxford Business & Economics Conference Program ISBN : 978-0-9742114-1-1 Table 1: Economic Growth and Economic Freedom Total Pop. 2007 ((millions ) Per Capita Income 2007 (US$) Per Capita Income Growth Economic Freedom 199096 1995 199606 200108 Sub-Saharan AFR Burundi Congo, Dem. Guinea-Bissau Ethiopia Eritrea Malawi Sierra Leone Niger Rwanda Gambia 8.5 110 -5.1 -0.7 4.5 -1.9 -0.5 3.3 62.4 140 -9.4 -4.0 2.1 -2.3 4.5 3.8 -2.8 .. 4.5 3.5 1.7 200 1.3 79.1 220 4.8 230 -0.5 9.8 13.9 250 2.2 0.1 -3.0 2.5 5.8 260 -4.1 1.4 6.0 4.3 14.2 280 -2.3 320 -1.8 0.6 2.5 1.0 3.5 4.4 9.7 .. 3.3 1.7 320 -1.6 1.7 1.8 .. Madagascar 19.7 320 -2.8 21.4 320 0.0 0.6 5.3 4.5 Mozambique 0.9 5.9 Zimbabwe 13.4 340 30.9 340 0.4 3.7 -5.0 3.4 -6.4 4.7 5.1 Uganda Cent Africa Rep Tanzania .. 5.1 4.3 380 -2.5 400 -0.9 -0.3 3.1 -0.7 4.5 4.4 40.4 9.4 400 14.8 430 1.4 2.7 0.8 2.1 .. Burkina Faso 0.3 2.0 Mali 12.3 500 0.3 2.0 5.2 Chad Guinea 4.8 .. 10.8 540 -1.2 4.7 1.6 5.2 Benin 9.0 570 0.8 23.5 590 1.5 0.7 3.5 5.0 Ghana 1.2 2.5 Kenya 37.5 680 -1.0 0.4 5.4 Zambia 11.9 800 -2.6 1.6 1.6 3.4 Senegal 12.4 820 -0.7 1.7 840 0.8 0.9 1.6 2.0 4.8 3.1 19.3 910 -0.7 930 -1.2 4.5 -0.9 6.7 5.6 148.0 4.4 5.5 .. Mauritania Cote d'Ivoire Nigeria 4.7 5.6 4.7 .. 38.6 960 -0.1 2.6 2.0 1000 3.4 1.4 3.4 .. Cameroon 18.5 1050 -3.5 1.7 5.2 Djibouti 0.8 1090 -5.4 -0.3 1.3 2.1 Congo, Rep. 3.8 1540 0.9 4.8 1.9 3.9 4.7 Sudan Lesotho Cape Verde Angola Swaziland 4.0 2000 2006 5. 0 3. 7 4. 3 .. 5. 1 5. 1 5. 0 .. .. 4. 7 5. 0 4. 8 4. 2 .. 5. 7 .. 3. 9 6. 5 4. 7 6. 2 .. .. 5. 4 5. 7 4. 1 4. 2 .. 5. 8 .. 2. 4 6. 6 4. 9 6. 4 .. .. 5. 9 5. 1 5. 6 5. 9 6. 2 6. 5 5. 9 .. 5. 9 5. 5 .. .. 6. 0 5. 0 6. 0 7. 0 6. 7 7. 1 5. 5 .. 6. 0 5. 9 .. .. 5. 8 .. 4. 7 .. 0.5 2430 -1.8 2.5 .. .. 5. 6 .. 4. 3 .. 17.0 2560 -5.0 5.2 11.6 .. .. .. 1.1 2580 -0.3 0.4 1.6 .. .. .. June 24-26, 2009 St. Hugh’s College, Oxford University, Oxford, UK .. 10 2009 Oxford Business & Economics Conference Program Total Pop. 2007 ((millions ) Per Capita Income 2007 (US$) ISBN : 978-0-9742114-1-1 Per Capita Income Growth Economic Freedom 199096 199606 200108 1995 Namibia 2.1 3360 3.3 6.5 1.3 5450 1.4 3.9 2.3 Mauritius 3.4 3.0 7.3 47.6 5760 -0.7 6.3 5840 1.6 1.7 5.1 3.4 1.9 4.1 6.5 South Africa Botswana Populati on 2007 (millions) Per Capita Income 2007 (US$) Growth in Per Capita Income 199096 2000 6. 6 7. 3 7. 0 7. 4 2006 6. 7 7. 3 6. 9 6. 8 Economic Freedom 199606 200108 1995 2000 2006 Asia/Pacific Nepal Bangladesh Cambodia Lao PDR Vietnam Papua New Guinea. Pakistan India Sri Lanka 28.1 340 2.6 5.0 2.2 1.3 4.2 5.6 470 1.7 3.6 5.3 158.6 5.5 5.8 5.8 14.4 540 3.3 6.8 7.6 .. .. .. 5.9 580 3.6 4.4 5.3 .. .. .. 85.1 790 6.3 5.8 6.3 .. .. .. 6.3 850 5.6 -1.7 6.3 5.6 6.3 162.4 870 2.1 5.6 5.5 5.9 1123.3 950 3.6 1.9 4.9 0.9 3.6 6.4 5.6 6.3 6.6 19.9 1540 3.8 4.0 4.9 6.2 6.2 6.0 87.9 1620 3.3 7.2 7.0 6.5 1650 0.5 6.2 2.0 225.6 1.2 4.1 6.6 5.8 6.2 Thailand 63.8 3400 6.9 7.2 6.7 6.8 26.5 6540 6.8 1.8 2.1 4.7 Malaysia 3.9 7.4 6.6 6.7 48.5 19690 6.6 3.6 4.3 6.4 6.6 7.3 Haiti 9.6 560 -5.3 Nicaragua 5.6 980 0.2 Bolivia 9.5 1260 Guyana 0.7 1300 1.8 7.0 Honduras 7.1 1600 Philippines Indonesia Korea, South Latin America and Caribbean Paraguay Guatemala -0.9 2.3 -0.7 2.0 6.1 1.2 2.2 6.5 1.3 2.0 2.1 4.7 0.9 3.3 6.3 5.4 6.1 1670 0.6 -0.5 1.9 6.5 13.3 2440 1.1 1.5 6.7 6.9 2850 1.7 3.4 28.4 2920 3.1 1.2 2.2 1.6 4.8 7.0 Peru Ecuador 13.3 3080 0.6 2.0 3.3 6.0 Colombia 46.1 3250 1.3 3.8 5.5 3550 1.9 2.7 3.6 9.8 4.0 6.0 El Salvador Dominican Rep. June 24-26, 2009 St. Hugh’s College, Oxford University, Oxford, UK 6.3 5. 7 6. 6 6. 8 6. 1 6. 6 6. 2 6. 3 7. 3 7. 0 5. 7 5. 3 6. 6 5. 8 6. 7 6. 3 5. 6 7. 0 6. 2 7. 2 7. 4 7. 0 5. 6 5. 6 6. 1 11 2009 Oxford Business & Economics Conference Program Populati on 2007 (millions) Per Capita Income 2007 (US$) ISBN : 978-0-9742114-1-1 Growth in Per Capita Income 199096 199606 200108 1995 0.3 3.0 1.0 6.5 1.7 4.4 6.1 5.2 7.2 Jamaica 2.7 3710 2.4 Belize 0.3 3800 2.5 39.5 6050 5.0 3.3 5510 2.9 1.5 3.1 Argentina Panama Costa Rica Brazil Uruguay Venezuela Mexico Chile 6.7 4.5 5560 2.2 3.1 3.8 6.8 191.6 5910 1.1 2.5 4.5 3.3 6380 1.2 3.5 1.4 4.1 6.1 0.8 2.4 3.0 4.3 1.8 3.4 6.3 27.5 7320 0.6 105.3 8340 16.6 8350 0.3 6.6 Populati on 2007 (millions) Eastern Europe and Eurasia ` Tajikistan Kyrgyz Republic Uzbekistan Economic Freedom Per Capita Income 2007 (US$) 2.7 Growth in Per Capita Income 199096 7.5 2000 7. 3 5. 9 7. 2 7. 3 7. 4 6. 0 7. 0 5. 5 6. 3 7. 3 2006 7. 3 6. 6 5. 7 7. 0 7. 5 6. 2 6. 9 4. 5 6. 9 8. 0 Economic Freedom 199606 200108 1995 2000 2006 6.7 460 -18.8 5.9 6.8 .. .. .. 5.2 590 -10.2 3.2 3.6 .. .. .. 26.9 730 -5.1 3.5 5.5 .. .. .. Moldova 3.8 1260 -14.8 4.6 7.7 .. .. .. Mongolia 2.6 1290 -3.4 4.1 6.8 .. .. .. Turkmenistan 5.0 <1785 -10.9 10.4 11.9 .. .. .. Georgia 4.4 2120 -16.2 7.6 9.2 .. .. .. .. 5. 5 .. 7. 0 .. 8.6 2550 -14.5 11.0 16.3 .. Ukraine 46.4 2550 -12.8 5.5 8.1 3.9 Armenia 3.0 2640 -7.6 10.0 13.1 .. Albania 3.2 3290 0.2 5.1 5.0 4.5 Macedonia, FYR 2.0 3460 -4.2 2.1 3.6 .. .. 4. 7 .. 6. 0 .. Bosnia-Herz. 3.8 3790 5.1 .. .. .. Belarus 9.7 4220 n/a -6.4 8.7 8.3 9.4 .. Bulgaria 7.6 4590 -3.1 4.7 6.5 4.5 Serbia 8.2 4730 5.6 .. .. 6. 5 .. Kazakhstan 15.5 5060 n/a -7.0 4.8 .. 5. 1 .. 7.6 8.2 .. Romania 21.5 6150 -0.7 3.0 7.0 4.0 Russia 141.6 7560 5.4 7.4 4.1 Poland .. 5. 0 4. 9 6. 2 6. 3 6. 7 .. 6. 6 5. 9 6. 8 7. 2 7. 2 Azerbaijan 38.1 9840 -8.1 2.6 4.4 4.7 5.3 Lithuania 3.4 9920 -7.6 7.2 8.1 4.9 Latvia 2.3 9930 -7.3 8.5 8.4 4.9 June 24-26, 2009 St. Hugh’s College, Oxford University, Oxford, UK 12 2009 Oxford Business & Economics Conference Program Populati on 2007 (millions) Per Capita Income 2007 (US$) ISBN : 978-0-9742114-1-1 Growth in Per Capita Income Economic Freedom 199096 199606 200108 1995 4.4 10460 -3.3 4.1 4.8 4.3 Hungary Slovak Republic Estonia 10.1 11570 -1.7 4.7 3.7 6.4 5.4 11730 -1.4 4.3 6.7 5.5 1.3 13200 -3.4 8.0 6.9 5.6 Czech Republic 10.3 14450 -0.1 2.9 4.6 5.8 Slovenia 2.0 Middle East and North Africa 20960 0.1 4.1 4.2 5.0 0.9 3.3 .. 5.9 Croatia Yemen 22.4 870 1.0 Egypt 75.5 1580 1.7 1.4 3.1 Morocco 30.9 2250 0.9 2.7 3.7 5.8 5.7 2850 2.5 3.5 6.1 Tunisia 10.2 3200 0.9 2.5 3.7 3.9 6.2 Algeria 33.9 3620 2.3 3.2 3.7 Jordan 4.1 5770 -1.3 7.7 .. 73.9 8020 2.0 1.5 2.8 2.5 Turkey 5.0 5.7 Cyprus 0.8 24940 1.8 2.1 1.5 6.3 Lebanon 2000 6. 1 6. 7 6. 2 7. 5 6. 7 6. 0 2006 6. 4 7. 4 7. 5 7. 8 6. 8 6. 4 .. 6. 6 6. 0 7. 2 6. 3 4. 5 .. 5. 8 6. 3 .. 6. 8 6. 2 7. 1 6. 4 5. 6 .. 6. 4 7. 5 Table 2: Economic Growth and Economic Freedom -- Regression Results Regression Results -- Economic Growth and Economic Freedom Economic Growth 1996-06 Economic Growth Constant EF -- 1995 1 -3.92 (-2.81) 0.89 (3.85) 1.73 (6.76) 2 -3.71 (-2.94) 0.86 (4.11) 1.12 (4.13) 2.51 (4.32) 3 -3.54 (-2.87) 0.78 (3.80) 1.23 (4.59) 2.50 (4.42) EF -- 2000 June 24-26, 2009 St. Hugh’s College, Oxford University, Oxford, UK EF Change 1995-06 N = 81 E&E Dummy Asia Dummy Adjusted R-square 0.35 0.47 1.32 (2.31) 0.50 EF Change 13 2009 Oxford Business & Economics Conference Program 2001-08 ISBN : 978-0-9742114-1-1 2000-06 4 -2.75 (-1.63) 0.93 (3.41) 1.79 (4.35) 5 -2.42 (-1.59) 0.84 (3.37) 0.98 (2.37) 2.78 (4.45) 6 -2.39 (-1.61) 0.79 (3.28) 1.00 (2.49) 2.98 (4.85) June 24-26, 2009 St. Hugh’s College, Oxford University, Oxford, UK 0.23 0.38 1.46 (2.28) 0.41 14