Domestic And Global Impacts On Australian Manufacturing Prices:

advertisement

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

Domestic and Global impacts on Australian

manufacturing prices:

Ken Coutts (Cambridge) & Neville Norman (Melbourne)

Submitted for the 6 th GCBE Conference, Oxford, June 24 -6, 2009

Written and finalized 28 November, 2008

Corresponding author: n.norman@unimelb.edu.au

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

1

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

Abstract

With all the current interest in global transmission of economic influences, pricing linkages

have been relatively neglected. We assemble data on Australian producer prices with matched

cost data and the price of competing manufactured imports. We follow a similar approach we

used previously to analyse foreign and domestic competition for the UK manufacturing sector

and a variety of sub-sectors. Our results for Australian aggregate manufacturing are remarkably

similar to the earlier UK study and indicate that while imported prices have an influence on

domestic price setting; domestic unit cost movements dominate the explanation. The results are

striking. They are very relevant to understanding global economic influences on businesses and

they are not consistent with orthodox classical economic predictions.

Key words: price setting; global influences; trade and tariff analysis; econometric testing

JEL classification: C22;C32;C81;D43;F12;F14;L60

.

The purposes of this paper are: (a) to expound and sharply define the differences between

various approaches to industrial economics and especially the use of industrial economics in

international economic analysis; (b) to contrast methods and predictions of modern trade and

tariff analysis with their classical alternatives; (c) to present tests of how (or whether) modern

trade and tariff analysis is reliable and responsible in portraying global influences on business

decisions; and (d) to test by prediction analysis the forecasting ability of alternative economic

theories about global pricing influences. We have fresh and contemporary empirical research

to present that bears significantly on point (d) in this list.

A. Classical and Alternative Settings of Trade and Tariff Theory: The

Differences

While economics has progressed in many ways, the type of trade and tariff theory presented

in most textbooks and taught in most universities has not moved since the 1950s. Yet

alternative approaches have been available since the 1970s, including imperfect competition

models within the neo-classical tradition (Paul Krugman’s 2008 Nobel Prize may bring these

into greater prominence) and many more heterodox/alternative approaches. Rather than

diverting into complex theoretical specifications here, we are able, succinctly in tabular form,

as in Table A below, to explain the quite divergent approaches as between classical-orthodox

and alternative/behavioral/heterodox set-ups of trade and tariff analysis.

Table A: Central Features of Orthodox and Alternative Trade and Tariff Analyses

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

2

2009 Oxford Business & Economics Conference Program

Characteristic

ClassicalOrthodox

ISBN : 978-0-9742114-1-1

AlternativeModern

Temporal Set-up

One period/comparative

statics

Dynamic, multi-period

Product Structure

Homogeneous products

Differentiated, changing

products; new products

Substitutability between

home and overseas

products

Perfect; invariant

Imperfect; changing over

time

Business Operational

Objective

Maximize Profits

Various presumed goals,

including profit constraint,

sales maximization

Domestic competition form

Perfect competition

Oligopoly/imperfect

competition/quasi-monopoly

Information basis for

business decisions

Perfect information

Imperfect information: quasi

perfect in Krugman models

Driver variables

Tariffs, exchange rates,

world prices (e.g. oil prices)

Tariffs, exchange rates,

world prices (e.g. oil prices)

The conventional, orthodox models used in the trade and tariff literature include the core

trade models (comparative advantage: Ricardo, Hecksher-Ohlin), exchange rate set-ups (for

demonstrating the Marshall-Lerner condition); the Marshallian (Schuller-Barone) partial

model of tariff effects, effective protection analysis and formulae, the Law of One Price, and

the purchasing power parity approach. There is market-clearing equilibrium everywhere in a

fundamentally Walrasian set-up. The clearest and most direct exposition of these orthodox

models is in Corden (1971).

By contrast, in the alternative approaches, adjustment processes are endemic and incomplete,

decision-making errors are rife and recognized; productive capacity is slack and underused;

cost-based pricing is used as a device to handle the uncertain oligopolistic environment;

products are dynamically changing and in any snapshot of them they are differentiated (at

least in the minds of buyers). An extreme post-Keynesian alternative approach is presented in

Norman (1996) and is described in Brinkman (1999) as the core of non-orthodox

international economics relevant to trade policy analysis. This is partly because post

Keynesian economists have substantially overlooked this field.

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

3

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

In Coutts and Norman (2007: 1206-7) we describe the main differences between orthodox

and alternative trade and tariff approaches as follows:

“In standard trade and tariff theory, domestic firms simply match and adjust their

prices to the duty-corrected prices of imported goods; consequently, domestic

demand and cost conditions play no role whatever. Contrarily, cost-based pricing

theories emphasize the degree of market power and the discretion it confers on

firms, including domestic firms competing with foreign products, to set prices as a

mark-up on some (unit) cost base, with demand and the prices of competitors

playing a minor role, or none at all.

Most industrial-economic analyses of price-setting take no explicit account of

foreign competition (implicitly assuming that any rivals are domestic and that tariff,

exchange rate and world price changes are irrelevant); they tend to be static, giving

little basis for time-series analysis of actual pricing data. Nor do they harmonize

with cost-based pricing approaches. This is because they presuppose that demand

functions are known, whereas cost-based pricing is founded explicitly on the premise

of uncertain demand outcomes in the face of price-setting decisions.”

We now present a generic set-up that embodies both extremes as a prelude to fuller

understanding and empirical testing. If the orthodox approach fails these tests, then decades

of conventional economic theory and policy advice will have been misleading and potentially

damaging to the welfare improvements it purports to enhance. We find that this is precisely

the case.

Figure 1 is best read from the left. There is a set of products available from foreign sources

(f) (indexed {1,2,, … i, …n}) and a set available from domestic or home production (h) {1,2,

… j, … r} (r>n), of which the first n are matched with similarly-described foreign-sourced

products and the balance (r-n) are non-traded goods. Without necessarily assuming that the

home country is a price-taking ‘small’ country, the initial play can start with foreign prices

being given. Two sets of them are relevant to the home country: some enter in competition

with local production, and some enter are partly-processed ‘materials’. In our generic set-up,

labour costs, domestic demand pressure and forces impacting on domestic materials markets

can influence any and all of these prices.

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

4

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

Figure 1: The Setting: Formal Analysis

Determinants of

foreign prices

Pf1,

Pf2,

Ph1,

Ph2,

Pfi,

Phj,

Unit labour costs of

domestic industry activities

Domestic demand pressure

Pfn

Foreign

prices of

inputs into

home

industry

Phn,

Phn+1

Materials inputs used in

domestic industry activities

Phr

In all the main orthodox approaches, all of the right-hand boxes/influences in Figure 1 can be

discarded. The conventional models simply make all trade-competitive prices determined and

dictated by the (duty and exchange-rate-corrected) prices of the foreign goods. No domestic

demand or cost factors ever get to influence domestic prices in this extreme but dominant

version of the neo-classical approach.

To show how extreme (and limiting) the standard orthodox approach was, and remains today,

Norman (1996) produced an equally extreme heterodox alternative where NONE of the left

variables dominating the classical approach had any relevance and only the cost factors in the

top right box of Figure 1 determined domestic prices, despite the presence of global

competition.

B. Methods and Predictions of Alternative Trade and Tariff Analysis

Orthodox trade and tariff analysis relevant to price and quantity effects of trade policy uses

tools that hardly progress beyond conventional first-year micro-economics in most standard

economics courses in universities around the world: supply-and-demand determination of

competitive markets, with rising marginal costs adopted by profit-maximizing firms in a

comparative static setting where foreign competitive products are perfect substitutes. So what

is the alternative?

As there is little attention in the literature to alternative tariff analysis, we provide selected

extracts from Norman (1996) to show the approach adopted in a post-Keynesian alternative

specification. This simple structure will be found directly to support the central alternative

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

5

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

pricing approach that performs well in empirical analysis. Tariffs are applied to materials and

finished-goods imports of the home country, respectively. Analytically, the impacts of these

two types of protective policy are developed in turn. As the finished-product tariff diverts

demand towards locally-produced finished goods but does not affect materials prices1 or the

mark-up, the effect of finished-goods tariffs on domestic product prices is zero( as is the

price-tariff elasticity.) The rate of production in the finished goods sector is increased, in

accordance with the size of the tariff and a measure of demand substitutability. We then

suppose that a tariff is imposed on importable materials as well, and then consider a number

of implications and possible secondary responses or qualifications and extensions.

The prices of domestically-produced finished goods are given by a mark-up system, geared to

normalized unit production costs. To investigate the effect of imposing the tariff rates we

begin with the tariff rates set to zero. We get the results that when final goods-tariffs are

applied alone, final goods prices are insensitive to final-product tariffs and production

responds entirely to demand cross-effects2 , each being distinctly different from standard

theory results. When tariffs on materials inputs are imposed alone, whatever price effects

transmit to finished-goods arise through materials tariffs and costs exclusively. These price

effects tend to be small, given that (i) materials-good tariffs are typically smaller than finalgoods tariffs; and (ii) their fractional weight in all costs and a terms-of-trade effect each

further diminish the price effect.

Inspection of these pricing results will confirm why the price effects of protection in this

PKTP are normally small. These results are consistent with the findings of very heavily

constrained price effects of exchange rate changes and world price shocks that empirical

research has already confirmed, such as Norman (1975) and Isard (1978), and more recently

the Bank of England Economics Department (1993).

The general result is that, under the PKTP, the effect of protection on the prices of finished

products is small and arises entirely from materials tariffs, while the production effects

depend entirely on demand factors. In standard orthodox tariff theory the results are quite

obverse: product prices are fully (or mostly) reflected in finished-goods prices, and materials

tariffs never are, while production effects are entirely supply determined.3

1It

can be argued that the action of protecting the finished-goods sector might work to raise materials prices through

the increase in demand so created. But this is not likely if the home materials sector is price-constrained by more

homogeneous rival imports, which we do not rule out, or by internal pricing procedures, such as the Eastman-Stykolt

rule, where import-competing oligopolists decide strategically to match rival import prices.

2Here the cross-elasticity is exactly applicable, since p=0 and only cross-effects work on demand.

3See Corden (1971) for verification of this.

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

6

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

This striking contrast in results means that the alternative PKTP opens up a distinct and

different approach to analyzing commercial policy that does not merely replicate classical

predictions and implications.

C. ‘Responsible Economics’ and Objections to Alternative Theory

We can start with the notion of realism. Every theory, model or hypothesis is bound to

unrealistic, so we have an issue of type and degree. The best ways to make a dissenting claim

against orthodoxy is to protest that the operating assumptions are: (a) so absurdly unrealistic

that the analysis cannot possibly relate to the real-world circumstances to which it purports to

apply; and/or (b) the unrealistic premises of orthodoxy are so central to the analysis that they

bring down the orthodox analysis ab initio. In this are we can document both claims.

There is a substantial body of objection to orthodox trade and tariff analysis and especially

to its setting, operational assumptions and procedures. These are the main bases for objection,

and indirectly the central support for an unorthodox alterative being developed and used.

(a) Realism of the set-up: Armington (1969a: 159) argued that for purposes of any

responsible international economic analysis, "perfect competition and perfect substitution is

neither realistic nor attractive theoretically". Robinson (1971: 98-9) is adamant that "The

normal state is imperfect competition and capacity underutilization". Benson and Hartigan

(1983: 132) opine: "Clearly, real world markets are typically neither monopolized nor

perfectly competitive...It is surprising that international economists have failed to consider

the implications of oligopolistically interdependent market structures" Helpman and

Krugman (1989: 6) say it’s an elementary observation that "markets are nearly all imperfect

these days. Markets like computers, aircraft /Boeing are now normal.”

(b) Predictions or results are sensitive to and better more realistic operational premises:

Aw(1991: 202) supports Krugman and Helpman’s contention that "imperfect competition

leads to non standard impacts of trade policy (so) evaluation of trade policy should take

imperfect competition into account from the start." Lancaster (1980) explains intra-industry

among similar countries; Brander (1981) explains cross-hauling; Brander and Krugman

(1983) explain reciprocal dumping /cross hauling. "The only good reasons for challenging the

traditional approach is that it does not seem to do an adequate job of explaining the world,

and alternative approaches do better" (Helpman and Krugman (1985: 2))

Helpman and Krugman (1989: 185) list five "unusual results" (p. 185) and

unconventional results that can only come from breaking with the traditional

assumptions:

- protection can reduce the output of protected industries;

- an import subsidy can improve the terms of trade;

- an export subsidy can raise the profits of firms by more than the cost of the subsidy;

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

7

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

- a tariff can reduce domestic prices;

- protection can increase the profits or foreign forms as well as domestic firms.

Thus economists should be cautious in their predictions of policy effects" (Helpman and

"The standard practice has been to assume that competitive models give more or less the

correct predictions, needing only a little touching up to apply to the oligopolies that are

the concern of most actual trade policies. The theory surveyed here suggests otherwise.

The evaluation of trade policy should take imperfect competition into account from the

start." (Helpman and Krugman 1989: 185)

Panagariya (1981: 16) considers monopoly in domestic production in a 2-sector GE model,

whence "most of the standard results of the effects of tariffs remain valid only under very

restrictive conditions...an increase in the tariff rate may (cause) a fall in the domestic price of

the import good, even in the elastic range of the foreign offer curve." (p 16)

Markusen (1981: 550) shows that "the conventional wisdom regarding the pro-competitive

aspects of trade in only partly correct. If trade leads to a contraction in (monopolized)

production, it may be acting to drive the country further away from its welfare-maximising

production bundle."

Flam and Helpman (1987) show when tariff raises domestic profits and can increase

incentives for R&D, many traditional results fail, price probably rises, but more variety and

scale economies come from R&D".

"Free trade can never be optimal in imperfectly competitive industries" (Helpman and

Krugman (1985: 185) Brander and Spencer (1981: 386) demonstrate how a country has an

incentive to extract rent (the price-MC discrepancy) from a foreign imperfect competitor, using Dixit's

model of entry deterrence. They conceded this is a highly specific model of oligopolistic behaviour

(p. 385) Somewhat reluctantly, they say they are "not advocating the use of tariffs here.. (Their aim is

just to) understand a country may have incentives to use them."

Having set up the rival claims, we now turn to the evidence.

D. Testing Orthodox and Alternative Approaches

Tests of economic hypotheses can be by survey or numerical; analysis. In this area there is

both. Relevant survey findings are related in Coutts and Norman (2007): they do not favour

orthodoxy. The central test is the foreign price (or tariff) to domestic price elasticity, which is

orthodox theory is everywhere unity and in alternative models is either very low or zero, as in

the extreme post Keynesian model briefly outlined in this paper above.

On the numerical side, Isard (1977: 942-7) long ago established that the "law of one price"

(LOOP hereafter), equivalent to the orthodox price theory of tariff protection and full

exchange rate pass-through, hardly ever applied and should be categorically rejected. In

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

8

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

strongly language, supported by his analysis, he claims "students have been seduced by

visions of an imaginary world ... with homogeneous (products). In reality the law of one price

is flagrantly and systematically violated by empirical data." Isard accepts that basic

commodities will follow LOOP, but many manufactured products (he cites agricultural

machinery) diverge after foreign exchange movements and the disparity persists, especially

for disaggregated product categories. Because of short data spans (often annual for US

machinery prices) the analysis is very casual, but still impressionable - mostly over the short

span early 1968 to late 1975. These findings are similar to those reported in Norman (1975),

following similar findings by product category (differentiated machinery especially) in

Norman (1974), Appendix A especially. Isard's machinery product categories are internal

combustion engines; agricultural tilling machinery, office calculating machines, metalwork

machinery, pumps and forklift trucks. In the period June 1970 to June 1975, the German

DM/US$ ER went to 155, while the export price indexes went to 148, 123, 148, 142, 139 and

139, respectively.. he then turns to unit value import price data, and is aware of the

limitations of compositional shift (p 947) - went quarterly 1/68 to 1/75, because of handcopying limitations.

Aw (1991: 203) used an explicit imperfect competition framework and finds the price effects

of trade restriction through VER are positive by small.

Because British producer price data are so refined and distinguish between home sales and

exports, it is possible to study pricing relations very closely for the United Kingdom for

which there is some important recent work done by the Bank of England (Melliss 1993),

Martin (1997) and Coutts and Norman (2007). In every case the foreign price/tariff to home

price elasticity is very low, typically around 0.5-0.3.

We described in Coutts and Norman (2007: 1220-1) our UK econometric findings and their

relevance as follows:

“Our results detail considerable heterogeneity in price responses to global

competition between sectors, within manufacturing itself. Prediction, trade policy

and model specification needs to be sensitive to this finding. There is a pattern. We

have identified three broad categories of price adjustment for the later 1990s and

early 2000s:

(a) Sectors that produce mainly homogeneous products traded at international

prices. The chemicals and base metals sectors largely belong to this group. In

both sectors, the sterling prices of imported goods fell in line with exchange rate

appreciation between

1996 and 2000, and domestic prices fell substantially.

(b) Sectors in which international competitor prices fell in line with the exchange

rate rise, but in which domestic prices increased, or fell by modest amounts.

(c) Sectors whose competitor prices fell by only about 8% or less, while domestic

prices increased, or fell by only modest amounts.

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

9

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

An implication of these results is relevant to the transmission of inflation and (via

the terms of trade) to swings in aggregate demand. Although a floating exchange

rate will directly influence the prices of finished goods imported into domestic

markets, we find that the impact on competing domestic goods is rather small. An

important complementary development of this study will be to compare the price

responses of UK manufactured goods produced for export markets with those of

similar products within the EU market.

Explanations of the pricing decisions of manufacturing firms will remain defective

until trade and tariff theory incorporates partial price adjustment rather than import

price dominance as the normal circumstance, and unless and until industrial

economics admits any influence of global pricing forces. The message of our

findings is that price effects of global competition on domestic markets are normally

not dominant; they are often delayed and they differ between products, in each case

in contrast to the core postulates of standard trade and tariff theory.”

As a prelude to our findings we recall that, contrary to orthodox theory that in so many

ways presumes or implies that relative prices are everywhere rigid, huge and sustained

variations in relative prices are in evidence in Australia. As reported in Norman (2008):

The Australian PPI data show a striking picture of divergence in price movements

between products and sectors, over the period from 1983 to the end of 2007. The

Australian all-manufacturing PPI rose in the 18 years to December 2007 by 62 per

cent, clothing and footwear products PPIs by 29 per cent, petroleum refining and

coal products PPIs by 365 per cent, chemicals PPIs by 29 per cent, and scientific

equipment PPIs by 25 per cent, while electronic equipment PPIs fell by 85 per cent.

The data show persistent divergence in (relative) price movements, which is a

feature of most pricing structures captured by PPI data in many countries. Plainly,

there is no apparent convergence mechanism at work here.

To check the Australian scene, we assembled analogous data to that used in the UK study and

to run the tests. Based on a generic, general and generous version of the price formation

process as in Figure 1 above, we used the all-manufacturing Australian PPI for quarterly data

from March 1983 to December 2007, with matched import prices and unit costs. Our

econometric methods were similar to those used for the UK, involving both the EngelGranger two-step estimation procedure and an error-correction (ECM) procedure. We

describe the main result here in non-technical terms, with emphasis on the coefficient (which

is an elasticity in our log-log specifications) associated with the foreign price variables in

home-price subject variable specifications.

This is the central result:

the relevant foreign-to-domestic price elasticity is numerically lower and even better

determined (lower standard errors) than we found for the UK. When orthodox theory is

propounding that such a coefficient is everywhere unity, our preferred estimate is ). The

domestic–foreign price elasticity for Australian data in the period 1983–2007 is 0.20 for the

long-run auto regressive distributed lag procedure (ARDL). There is a stable relation between

the Australian producer price, normalized unit costs of production and competitive import

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

10

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

prices. As for our UK results, the dominant relationship is with domestic costs, with

competitive import prices playing a subsidiary role. This is exactly what alternative trade and

tariff theory predicts.

Another way to test this set of relationships between economic variables and the PPIs

is to compare prediction errors for the last three years, or 12 quarters, all-manufacturing PPIs,

from rival economic hypotheses. We test three hypotheses:

(1) the standard trade/tariff theory approach, embodied in the ‘law of one price’, using

adjacent import prices only;

(2) the cost based pricing approach, using only normal unit costs of domestic

manufacturing akin to the post-Keynesian extreme alternative; and

(3) a hybrid of both using regression analysis to determined the weights. It will be

evident from looking at the data that method (1) has nearly seven-fold the prediction

error of method (2), while the hybrid (3) has the smallest prediction error.

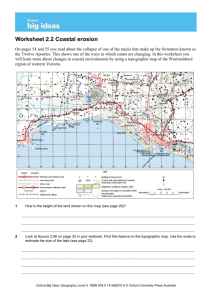

Figure 2 plots the behaviour for all-manufacturing output PPI with import prices of

manufacturing goods in the same statistical categories. It shows the spectacular ‘crocodile

jaws’ result for this relationship, a striking replay of our findings for the United Kingdom

when sterling strengthened in the period 1996–2001. Rather than converging as orthodox

theory leads one to expect, the home and foreign price series are getting further apart.

The message is that, while foreign prices clearly impact on domestic product price setting, the

relationship is far weaker and more indirect than simple economic theory is conveying to

policy-makers.

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

11

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

Figure 2 Australian and Imported Manufacturing Product Prices

5.4

Main data logs

5.2

log scale

5

4.8

4.6

4.4

4.2

M

ar

-8

3

M

ar

-8

4

M

ar

-8

5

M

ar

-8

6

M

ar

-8

7

M

ar

-8

8

M

ar

-8

9

M

ar

-9

0

M

ar

-9

1

M

ar

-9

2

M

ar

-9

3

M

ar

-9

4

M

ar

-9

5

M

ar

-9

6

M

ar

-9

7

M

ar

-9

8

M

ar

-9

9

M

ar

-0

0

M

ar

-0

1

M

ar

-0

2

M

ar

-0

3

M

ar

-0

4

M

ar

-0

5

M

ar

-0

6

M

ar

-0

7

4

PP

PMAT

PM

ULC

ULCN

The strikingly divergent form of figure 2 is an almost exact replica of what we found for the UK in

the later 1990s when the appreciation of sterling led to similar results. We show this in figure 3 for the

food, drink and tobacco sector.

Figure 3:U.K. Price Pairs - Food Drink Tobacco

120.0

100.0

80.0

60.0

40.0

20.0

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

Mar-98

Mar-96

Mar-94

Mar-92

Mar-90

Mar-88

Mar-86

Mar-84

Mar-82

Mar-80

Mar-78

Mar-76

Mar-74

0.0

12

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

E. Why has Alternative Global Pricing Analysis Not been accepted?

If the findings are so consistently in favour of the non-orthodox specifications, why the

resistance to making alternative approaches the orthodoxy?

One suspicion is that many economists are closet free traders and fear that heterodox

approaches will contract their policy preference predilections. With few exceptions, it is

difficult to substantiate these charges, valid as they may be.

A second, more verifiable explanation is that orthodox economists, much as they may dislike

protectionism, are exceptionally protectionist … of their own theoretical constructions. Here

are some examples: "To abandon the assumption of perfect competition must have very

destructive consequences for economic theory" (Hicks (1939), p. 83). Having urged

economists to incorporate imperfect competition into trade analysis as long ago as 1935

(Haberler (1936) born 1900, died 1995) in later writings seems to have regretted saying it. In

an impressive and completely neglected demonstration, Staelin (1976: 39) urges attention to

the pricing equation rather than making the models as "general" as possible. But, then he

laments, "Given the relative disarray of theories of imperfect competition, the use of

competitive models for both theoretical and empirical applications is hardly surprising."

A third explanation, without our own hands, is that alternative economists have failed in their

mission: first, by failing to embrace trade and tariff analysis as a subject; secondly, by

shunning econometrics as a method; and thirdly by being poor and ineffective advocates. We

throw put threes observations and assertions as challenges for discussion and action.

Where do we go from here?

The pointers for exposition and research concerning the effect of protection and policy implications

seem clear, even if they are substantially unheeded:

1. Recognize and reveal that what most economists (still) call "the" theory of protection is a very

special case, with industrial economics premises decried even by orthodox industrial economists,

predictions discredited by evidence and policy implications driven often by predilection.

2. Be open-minded about the industrial economic consequences of protection policy: theory

establishes a wide range of possibilities.

3. Determine more fully how industries the subjects of protection policy actually work.

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

13

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

F. Conclusion:

We have introduced fresh and contemporary findings about price formation in Australian

industry. Orthodox models and predictions of global influences on industrial pricing are

unrealistic and unreliable. Indeed their prediction errors are totally unacceptable. By contrast,

even crude alternative models are appealing and predict pleasingly. Our finds are in line with

our own and other previous work in the UK and with the main core of other empirical

evidence on price making in the face of global influences.

With relatively few exceptions, economists working in the field of trade protection are not

listening to the message that modern industrial economics, let alone alternative economics, is

delivering. In the absence of better empirical material, the predictions and policy pointers

which most economists will give to questions about protection will be both definite and

mostly wrong. Here lies the challenge, and opportunity, if we are to represented realistic

economics and genuinely help the understanding of global influences on businesses around

the world. We have sketched the way ahead.

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

14

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

References

Armington, Paul S. (1969a) A Theory of Demand for Products Distinguished by Place of Production, I.M.F.

Staff Papers, XVI, March, pp. 159-178.

Armington, Paul S. (1969b) The geographic Pattern of Trade and the Effect of Price Changes, I.M.F. Staff

Papers, XVI, July, pp. 179 - 201.

Aw, Bee-Yan (1991) Estimating the Effects of Quantitative Restrictions in Imperfectly Competitive Markets:

The Footwear Case, Ch 7 of Robert E. Baldwin (ed.) Empirical Studies of Commercial Policy, Chicago U. P.,

Chicago, pp. 201-213.

Barker, Terry (1977) International Trade and Economic Growth: An Alternative to the Neoclassical Approach,

Journal of International Economics, 1(2), pp. 153-172.

Benson, Bruce L. & James C. Hartigan (1983) Tariffs which lower Price in the Restricting Country, Journal of

International Economics, 15, pp. 117-133.

Brander, James (1981) Intra-Industry Trade in Identical Commodities, Journal of International Economics,

11(1), February, pp. 1-14.

Brander, James & Paul Krugman (1983) A 'Reciprocal Dumping' Model of International Trade, Journal of

International Economics, 15(4), pp. 313-321.

Brinkman, Henk-Jan (1999) Explaining Prices in the Global Eco0momy A Post-Keynesian Model, E Elgar,

Cheltenham

Coutts, K.J., Godley, W.A.H., Nordhaus, D. (1978) Industrial Pricing in the United Kingdom. Cambridge

University Press, Cambridge.

Coutts, K. J. and Norman, N. R. (2007) Global influences on U.K. manufacturing prices: 1970–2000’, European

Economic Review, 51, pp. 1205–21.

Flam, Harry and Elphanan Helpman (1987), Industrial Policy under Monopolistic Competition, Journal of

International Economics, 22 (1), pp.79-102.

Haberler, Gottfried (1936) The Theory of International Trade, Hodge, London.

Helpman, Elphanan & Paul Krugman (1985) Market Structure and Foreign Trade. Increasing Returns,

Imperfect Competition and the International Economy, Wheatsheaf, Brighton.

Helpman, Elphanan & Paul R. Krugman (1989) Trade Policy and Market Structure, M.I.T., Cambridge Mass.

Hirshleifer, J, Glazer, A and Hirshleifer, D. (2007) Price Theory and Applications, CUP, New York.

Hicks, John R. (1939) Value and Capital, OUP, Oxford.

Isard, P. (1977) How far can we push the ‘‘Law of One Price’’? American Economic Review 67, pp. 942–948.

Krugman, Paul R (1979) Increasing Returns, Monopolistic Competition, and International Trade, Journal of

International Economics, 9(4), pp. 469-479.

Krugman, Paul (1982) Trade in Differentiated Products and the Political Economy of Trade Liberalization, Ch 7

in J.N.Bhagwati (ed.), Import Competition and Response, NBER, Chicago, pp. 197-208.

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

15

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

Krugman, Paul R.(1990a) Industrial Organization and International Trade, Ch. 20 of Richard Schmalensee and

Robert D. Willig (eds.), Handbook of Industrial Organization, volume II, North-Holland, Amsterdam, pp. 1179

- 1223.

Krugman, Paul R.(1990b) Rethinking International Trade, M.I.T., Cambridge Mass.

Lancaster, Kelvin J. (1980) Intra-Industry Trade under Perfect Monopolistic Competition, Journal of

International Economics, 10 (2), pp. 151-175.

Martin, Stephen (1993) Advanced Industrial Economics, Blackwell, Oxford.

Martin, C (1997) Price Formation in an Open Economy: Theory and Evidence for the United Kingdom, 19511991, Economic Journal, 107, pp 1391-1404.

Melliss, C. (1993) Tradable and non-tradable prices in the United Kingdom and the European community. Bank

of England Quarterly Bulletin 33 (1), pp. 80–91.

Menon, J., 1995. Exchange rate pass-through. Journal of Economic Surveys 9, pp. 197–231.

Norman, Neville (1974) The Economic Effects of Tariffs on Industry, PhD dissertation, Cambridge

Norman, Neville R. (1996) A General Post Keynesian Theory of Protection, Journal of Post Keynesian

Economics, 18 (4) , pp. 509-531.

Norman, N.R., 1975. On the relationship between prices of home-produced and foreign commodities. Oxford

Economic Papers 27, 426–439.

Neville R. (2008) Producer Price Indexes: Properties, Problems and Potential Applications, The Australian

Economic Review, 41 (4), pp. 441–9.

Panagariya, Arvind (1981) Quantitative Restrictions in International trade under Monopoly", Journal of

International Economics, 11(1), pp.15-31.

Robinson, Joan (1971) Economic Heresies. Some Old-Fashioned Questions in Economic Theory, Macmillan,

London.

Staelin, Charles P. (1976) A General-Equilibrium Model of Tariffs in a Noncompetitive Economy, Journal of

International Economics, 6(1), pp. 39-63.

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

16

2009 Oxford Business & Economics Conference Program

ISBN : 978-0-9742114-1-1

Appendix: A Formal statement of trade and tariff theories

1. Subject Definition: We have domestic prices P, being either macro all-product price indexes or specific micro price

series, and world prices, W that are exogenously determined. Our interest is in how W bears on P, either directly, or through

exchange rates and tariffs, in which the "home" country can influence this “mapping of W into P”.

2. "Orthodox" International Economic Theory: Based on a very narrow view of industry economics, standard

international economic theories of pricing in response to world influences (LOOP), of exchange rates (PPP) and of tariffs

(FPTP) invoke or arrive at a one-to-one correspondence from W movements into P movements. It is essential to understand

why this is postulated, what this means, as a testable proposition, and what necessary or sufficient assumptions about

economic structure and behaviour produce this result.

As to meaning, if we are focussing on a product or small sector of the economy in which internationally-traded products are

significantly involved, then we mean that a given (percentage) movement in W, designated "w", produces a movement in the

affected series P which in percentage change terms can be written "p", such that p=w. (If foreign prices go up by 10%, then

value added (GDP), then the macro price series P will rise in the percent

-on effects

working through the economy. So "w” is the generator of relevant changes we study in international price relations: it is in

application an exogenously-given departure in (or from the trend of) world prices, or of exchange rates or tariff rates

As to assumptions for the model specifications, the standard set include (i) products that are identical (homogeneous) both

within the home sector and as compared with foreign products; (ii) perfect competition in the home sector, thus profitmaximisation, perfect information, rising marginal costs, long-run free entry and exit or firms; and (iii) no terms-of-trade

effects - the home country has no influence on W by varying what it buys from or sells into the world economy.

3. Examples of Orthodox Theory in Economic Analysis: The classic pure standard cases are found in the conventional

theory of import protective tariffs, such as the textbook "Marshallian" model, the general-equilibrium equivalent of this and

the "effective protection" approach. In these models, the "w" variable is represented by the tariff rate imposed, which in turn

is equal to the (percentage) increase in the world price of imports faced by domestic consumers when the standard

assumptions designated above are fully in place. Providing imports are not eliminated, P moves exactly in the percentage

change, w(=t). This result is so much embodied in standard approaches that economists (and their students or audience, in

public-policy discussions) seldom ever discuss it. The international price relation then becomes axiomatic without further

examination. For the reasons given below, this is intellectually unacceptable. For example, in standard expositions of the

effective rate of protection approach, which invokes standard assumptions entirely and without question, tariff rates are

inserted as price impacts from the beginning.

3. The Case for Alternative Theory: The industry economic assumptions on which the standard approaches are built are, in

general, both empirically unsupported and extremely significant in the generation of the pricing results obtained. Indeed, by

substituting the more realistic assumptions of imperfect product differentiation and imperfect competition and significant

scale economies, the impact on the predicted domestic price responses is dramatically changed. In fact, the extreme

alternatives of p=0 or p<0 cannot be ruled out (Helpman & Krugman 1985, Norman 1996)

4. Examples of Alternative Theory: Any departures from the standard assumption set produces immediately the result that

p w or p

-classical in approach but

they use imperfect substitution and imperfect competition; Krugman's model gives p=0, and various Keynesian approaches

consistently generate low values of p relative to w, which aligns neatly with nearly all the empirical work producing low

values of p relative to w (or t), including a massive amount of testing of the exchange-rate "pass-through" (Menon).

June 24-26, 2009

St. Hugh’s College, Oxford University, Oxford, UK

17