Testing For Non-linearity In Balancing Item Of Balance Of Payments Accounts: The Case Of 20 Industrial Countries

advertisement

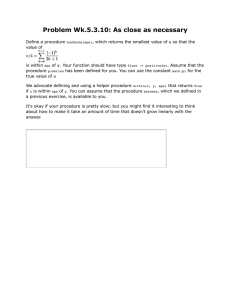

2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Testing for Non-linearity in Balancing Item of Balance of Payments Accounts: The Case of 20 Industrial Countries Tuck Cheong Tang* Monash University Malaysia Abstract This study is aimed to explore the non-linearity in balancing item of balance of payments accounts. A sample of 20 industrial countries is used. A battery of nonlinearity tests illustrates non-linearity in balancing item over 13 of 20 industrial countries. An immediate implication is that a special attention should be taken into account when studying the balancing item of balance of payments accounts due to its non-linearity in nature. JEL Classification: C22; F32 Keywords: Balancing item; Balance of payments accounts; Industrial Country; Non-linearity School of Business, Monash University Malaysia, 2 Jalan Kolej, Bandar Sunway, Petaling Jaya, Selangor Darul Ehsan 46150, Malaysia E-mail address: tang.tuck.cheong@buseco.monash.edu.my * I would like to thank Kian-Ping Lim for raising the motivation of testing the nonlinearity in balancing item of balance of payments accounts, and the sharing of knowledge of Nonlinear Toolkit as well. All remaining errors remain the responsibility of the author. June 24-26, 2007 Oxford University, UK 1 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Testing for Non-linearity in Balancing Item of Balance of Payments Accounts: The Case of 20 Industrial Countries 1. Introduction Broadly speaking, as cited in both empirical and theoretical literature the assumption of linearity is fundamentally rooted in modeling economic and financial time series. In this context, many researchers and policymakers have designed the fiscal and monetary policy via various linear modeling frameworks. With the recent development of nonlinearity literature both in empirical test and theoretical understanding, the assumption of linearity in financial time series and macroeconomic series as well are no longer valid given a fact that many theoretical macroeconomic models are highly non-linear (Ashely and Patterson 2000: 1). Clearly, as reinforced by Potter (1999), “Successful nonlinear time series modeling would improve forecasts an produce a richer notion of business cycle dynamics than linear time series models allow. For this to happen two conditions are necessary. First, economic time series must contain nonlinearities. Second, we need reliable statistical methods to summarize and understand these nonlinearities suitable for time series of the typical macroeconomic length”. Over the last decade, the insight that financial time series are characterized by non-linear behaviour has been gaining a widespread consideration. Hinich and Patterson (1985) have found empirical evidence of non-linearity in daily stock returns. Other study on stock market is from Panagiotidis (2005). Liew, Chong, and Lim (2003) have examined the linearity of real exchange rates for 11 Asian economies, and most of the cases nonlinearity is favoured. Other similar study is Lim, Hinich, and Liew (2003). In recent, several studies have been carried out in order to test whether macroeconomic time series are non-linear. For example, Ashley and Patterson (2000) have investigated the nonlinearity of the US real GNP, and the study finds persuasive evidence that the generating mechanism for this series is non-linear. On the other hand, using a battery of nonlinearity tests, Panagiotidis and Pelloni (2003) have documented that non-linearity is found in the German labour markets but this is not the case in the UK where in most cases the assumption of linearity is accepted. June 24-26, 2007 Oxford University, UK 2 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 This study contributes to the literature by exploring the non-linearity character in balancing item of balance of payments accounts via a battery of non-linearity tests. The sample covers a range of industrial countries. Broadly speaking, the balancing item is obtained simply by calculating the difference between total recorded credit transactions and total recorded debit transactions per time period (Brooks and Fausten 1998: 31). The net balance of errors (transactions are recorded incorrectly) and omissions (transactions are not recorded at all) constitute the balancing item (Fausten and Brooks 1996: 1303). Basically, double entry bookkeeping principle tells us that balance of payments accounts are constrained by the ‘adding up’ problem - total debit is not equal to total credit. As a result, a value so-called errors and omissions, is then added in order to validate this principle. From recent literature search, study in regard to the balancing item of balance of payments accounts becomes a significant area in international economics both from the perceptive of researchers and policymakers because of its implications. That is the size of balancing item indicates the reliability of balance of payments statistics. Moreover, a positive value of the balancing item does suggest a systematic over-reporting of debit transactions, or under-reporting of credit transactions and vice versa. In 1971, Duffy and Renton (1971) published their work on an analysis of the UK’s balancing item. With a vacuum exists in betweens, twenty six year later, Fausten and Brooks (1996), Tombazos (2003), and Fausten and Pickett (2004) have provided insight on studying the balancing item in Australia’s balance of payments accounts using various methodology. In addition, Tang (2005, 2006a, and 2006b) has empirically examined the economic factors that potentially contribute to the balancing item in Japan’s balance of payments accounts. In sum, the studies find that Japan’s balancing item is essentially due to timing errors. Interestingly, all the above-cited studies have been carried out under a strong assumption that the balancing item is linear, and it is best to be estimated under linear specification. However, if this assumption is not the case, the results of those studies may be interpreted with caution. Motivated by these events, detecting non-linear in balancing item is desired, and avoids the possibility of specification error. Eventually, the presence of non-linearity in balancing item should be taken into account by policymakers and researcher as well. June 24-26, 2007 Oxford University, UK 3 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Second section discusses the data and methods used in this study. The next section reports and discusses the results of non-linearity tests. The study has been concluded in Section 4. 2. Data and Methods Data The quarterly ‘errors and omission’ series used for this study are obtained from International Financial Statistics, International Monetary Fund. The 20 industrial countries have been selected due to data availability for a sufficient sample span. The countries are New Zealand (1980.1-2005.1), the US (1973.2-2005.2), the UK (1970.12005.2), Norway (1975.1-2005.2), Portugal (1975.1-2005.3), Iceland (1976.1-2005.1), Sweden (1975.1-2005.1), Greece (1976.1-2004.4), Finland (1975.1-2005.2), Ireland (1981.1-2005.2), Canada (1975.1-2005.3), Australia (1959.2-2005.2), Denmark (1981.12004.4), Japan (1977.1-2005.1), Netherlands (1976.1-2005.2), Germany (1971.1-2005.3), Austria (1970.1-2005.2), Italy (1970.1-2005.2), France (1975.1-2005.2), and Spain (1975.1-2005.3). These data are plotted in Appendix 1. They appear to be reasonably stationary over the sample period. The summary statistics are also illustrated in Table 1; interestingly, the distribution of balancing item is found to be normally distributed only for the case of Japan. Insert Table 1 here Methods A battery of statistical test for non-linearity can be used in order to indicate whether or not the generating mechanism of a time series is or is not linear. These tests are selected for two reasons. First, most of the existing nonlinearity tests have differing power against different classes of nonlinear processes and none dominates all others, as shown in various Monte Carlo simulations (see, for example, Ashley et al., 1986; Ashley and Patterson, 1989; Lee et al., 1993; Brock et al., 1991, 1996; Barnett et al., 1997; Patterson and Ashley, 2000). Second, the estimations can be carried out using the Nonlinear Toolkit provided by Patterson and Ashley (2000), and it has been used in the literature by June 24-26, 2007 Oxford University, UK 4 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Panagiotidis (2002, 2005), Panagiotidis and Pelloni (2003) and Ashley and Patterson (2006).1 It is important to note that the main objective is not to determine the precise nature of the nonlinearity but to determine whether or not nonlinearity exists in the full sample of the returns series under study. They are McLeod-Li test (McLeod and Li, 1983), Bicovariance test (Hinich, and Patterson, 1995), Tsay test (Tsay, 1986), Engle LM test (Engle, 1982), and BDS test (Brock, Dechert, and Scheinkman, 1996). All the tests work under the null hypothesis that the series under consideration is an i.i.d. (independently and identically distributed) process. Given that the null is i.i.d., and not linearity, the linear dependence has to be filtered out from the data, so that any rejection of the null of i.i.d. is due to nonlinear dependence. Those linear dependence is removed by fitting an AR(p) model. In brief, the procedure is follow. First, the study determines the pre-whitening model, AR(p). The values of p from 0 to 10 are considered and the one with the minimum SC is chosen. The “best” AR model for each series over the 20 industrial countries is not reported here but available from author upon request. Given the sample size is ranged between 96 and 195, which is available, the tests have been estimated using the bootstrap. For the bootstrap results, 1000 new samples are independently drawn from the empirical distribution of the pre-whitend data. Each new sample is used to calculate a value for the test statistic under the null hypothesis of serial independence. The obtained fraction of the 1000 test statistics, which exceeds the sample value of the test statistic from the original data, is then reported as the significance level at which the null hypothesis can be rejected. (Panagiotidis, 2002, p.5). This study does not detail the methodology behind the tests because it is well-documented in literature such as Ashley and Patterson (2000), and Panagiotidis (2002) as well. The non-linearity tests are computed via Nonlinear Toolkit (version 4.52) (http://ashleymac.econ.vt.edu/). The toolkit can be downloaded from Richard Ashley’s webpage at http://ashleymac.econ.vt.edu/ashleyhome.html, while instructions and interpretations of all the tests are given in chapter 3 of Patterson and Ashley (2000). 1 June 24-26, 2007 Oxford University, UK 5 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 3. Results For a meaningful interpretation, only the results of the ‘bootstrapped’ significance levels are reported as in Appendix 2. This is straightforward; rejection of linearity can be drawn based on the decision rule that p-value of less than 0.10 is obtained. Almost all bootstrapped p-values are zero of McLead-Li test, Bicovariance test, Engle test, and Tsay test for the case of Austria, Canada, France, Iceland, Ireland, Germany, New Zealand, Portugal, the UK, and the US, which the null hypothesis of linearity can be rejected, suggesting that some kind of hidden structure, non-linearity exists in balancing item. There is no evidence of nonlinearity is no evidence of nonlinearity for the case of Australia, and Japan under Tsay test. However, this is not the case under McLead-Li test, Bicovariance test, and Engle test (lag of 8 and 10 for Japan). On the other hand, the null hypothesis of linearity is accepted by the results of Bicovariance test and Tsay test for Greece, but McLead-Li and Engle test do not. For the case of Spain, Italy, and Sweden, in contrast, linearity is supported by the results of McLeod-Li test and Engle test, but Bicovariance test and Tsay test provide an opposite finding indicating some kind of hidden structure – non-linearity. All four non-linearity tests provide empirical evidence of linearity in the balancing item series at which the bootstrapped p-values are greater than 0.10 for the case of Finland, Netherlands, and Norway. Also, there is evidence of linearity in balancing item for Denmark, at least at 0.05 level. This inconsistency of nonlinearity tests is in line with Ashley and Patterson (2000) that, excluding the BDS test, the other tests are quite inconsistent in their power across the various alternatives considered (see, Ashley and Patterson, 2000, p.30). As documented in Ashley and Patterson (2000), the BDS test has relatively high power against all the alternatives, making it a reasonable choice as a “nonlinearity screening tests” for routine use. The results of BDS test, in significance level (p-value) are also reported in Appendix 2 (the second table). As indicated by the results of BDS test, the null hypothesis that the elements of balancing item are i.i.d. can be rejected in most cases (all dimensions and EPS) in the case of Austria, Australia, Denmark, France, Greece, Iceland, Germany, New Zealand, Portugal, the UK, and the US. For Finland, Netherlands, Norway, Spain and Sweden, most of the p-values are greater than 0.10 June 24-26, 2007 Oxford University, UK 6 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 indicating acceptance of the null hypothesis of linearity. However, mixture findings are found across the dimensions and EPS in regard to non-linearity of balancing item in balance of payments accounts of Canada, Ireland, Italy, and Japan. Generally speaking, this discrepancy may be contributed to different power of non-linearity tests as described in Ashley and Patterson, 2000). Overall, based on the results discussed in this section; linearity is found to be reasonably existed for the case of Denmark, Finland, Italy, Netherlands, Norway, Spain, and Sweden. To summarize, a battery of nonlinearity tests illustrates non-linearity in the balancing item over 13 of 20 industrial countries. 4. Concluding Remarks This study is aimed to explore the possible hidden structure, in particular non-linearity contained in the balancing item series of balance of payments accounts. This is applied to 20 selected industrial countries because of its sample span available. In this study, most of the balancing item in industrial countries’ balance of payments accounts would contradict the assumption of linearity. The overall results of the five nonlinearity tests illustrate non-linearity in the balancing item over 13 of 20 industrial countries. In other words, only Denmark, Finland, Italy, Netherlands, Norway, Spain, and Sweden would corroborate the assumption of linearity. An immediate implication of this finding is that the studies assume linearity of balancing item such as Duffy and Renton (1971) for the UK, Fausten and Brooks (1996), Tombazos (2003), and Fausten and Pickett (2004) for Australia, and Tang (2005, 2006a and 2006b) for Japan require further investigation before it can be generalized. No study is free from limitations. First, this study does not try to find what kind of nonlinear model is appropriate, and to implement a non-linear model in the series such as ARCH, GARCH, TAR, two state Markov, Quadratic models, and Cubic models. Second, this is worthwhile to identify the source of non-linearity in balancing item of balance of payments accounts. It may help to reduce the possible ‘errors and omissions’ in recording June 24-26, 2007 Oxford University, UK 7 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 both debit and credit side of external accounts – trade account and current account. However, further study is required in order to implement the above-stated drawbacks. References Ashley, R.A., D.M. Patterson, and M.J. Hinich (1986). A Diagnostic Test for Nonlinear Serial Dependence in Time Series Fitting Errors. Journal of Time Series Analysis 7 (3): 165-178. Ashley, R.A. and D.M. Patterson (1989). Linear Versus Nonlinear Macroeconomies: A Statistical Test. International Economic Review 30 (3): 685-704. Ashley, R. A., and D. M. Patterson (2000). Nonlinear Model Specification/Diagnostics: Insights from a Battery of Nonlinearity Tests. Economics Department Working Paper E99-05: 1-38, Virginia Tech, at http://ashleymac.econ.vt.edu/working_papers/E9905.pdf Ashley, R.A. and D.M. Patterson (2006). Evaluating the Effectiveness of State-Switching Time Series Models for U.S. Real Output. Journal of Business and Economic Statistics, forthcoming. Barnett, W.A., A.R. Gallant, M.J. Hinich, J. Jungeilges, D. Kaplan, and Jensen, M.J. (1997). A Single-Blind Controlled Competition among Tests for Nonlinearity and Chaos. Journal of Econometrics 82 (1): 157-192. Brock, W.A., W.D. Dechert, J.A. Scheinkman, and B. LeBaron, (1996) A Test for Independence based on the Correlation Dimension. Econometric Reviews 15 (3):197235. Brock, W.A., W. Dechert, and J. Scheinkman, (1996). A Test for Independence Based on the Correlation Dimension. Econometric Reviews 15 (3): 197-235. Brock, W.A., D.A. Hsieh, and B. LeBaron (1991). Nonlinear dynamics, chaos, and instability: statistical theory and economic evidence. Cambridge: MIT Press. Brooks, R, D., and D. K. Fausten (1998). Macroeconomics in the Open Economy, Addison Wesley Longman Australia Pty Limited, South Melbourne, Australia. Duffy, M., and A., Renton (1971). An Analysis of the UK Balancing Item. International Economic Review 12 (3): 448-464. Engle, R. F. (1982). Autoregressive Conditional Heteroskedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 50 (4): 987-1007. June 24-26, 2007 Oxford University, UK 8 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Fausten, D.K., and R. D. Brooks (1996). The Balancing Item in Australia’s Balance of Payments Accounts: An Impressionistic View. Applied Economics 28 (10): 13031311. Fausten, D. K., and, B. Pickett (2004). Errors & Omissions in the Reporting of Australia’s Cross-Border Transactions. Australian Economic Papers 43 (1): 101-115. Hinich, M., and D. M. Patterson (1995). Detecting Epochs of Transient Dependence in White Noise. Unpublished manuscript, University of Texas at Austin. Hinich, M., and D. M. Patterson (1985). Evidence of Nonlinearity in Daily Stock Returns. Journal of Business and Economic Statistics 3 (1): 69-77. Lee, T.H., H. White, and C.W.J. Granger (1993). Testing for Neglected Nonlinearity in Time Series Models: A Comparison of Neural Network Methods and Alternative Tests. Journal of Econometrics, 56 (3): 269-290. Liew, V.K.S., T.T.L. Chong, and K.P. Lim (2003). The Inadequacy of Linear Autoregressive Model for Real Exchange Rates: Empirical Evidence from Asian Economies. Applied Economics 35 (12): 1387-1392. Lim, K.P., M. Hinich, and V.K.S. Liew (2003). Episodic Non-Linearity and NonStationarity in ASEAN Exchange Rates Returns Series. Labuan Bulletin of International Business & Finance 1 (2): 79-93. McLeod, A. I., and W. K. Li (1983). Diagnostic Checking ARMA Time Series Models using Squared-Residual Autocorrelations. Journal of Time Series Analysis 4 (4): 269273. Patterson, D.M. and Ashley, R.A. (2000) A Nonlinear Time Series Workshop: A Toolkit for Detecting and Identifying Nonlinear Serial Dependence. Boston: Kluwer Academic Publishers. Panagiotidis, T., and G. Pelloni (2003). Testing for Non-Linearity in Labour Markets: The Case of Germany and the UK. Journal of Policy Modeling 25 (3): 275-286. Panagiotidis, T. (2002). Testing the Assumption of Linearity. Economics Bulletin 3 (29): 1-9. Panagiotidis, T. (2005). Market Capitalization and Efficiency. Does It Matter? Evidence from the Athens Stock Exchange. Applied Financial Economics 15 (10): 707-713. Potter, S.M. (1999). Nonlinear Time Series Modeling: An Introduction. Journal of Economic Surveys 13 (5): 505-528. June 24-26, 2007 Oxford University, UK 9 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Tombazos, C. G. (2003). New light on the ‘impressionistic view’ of the balancing item in Australia’s balance of payments accounts. Applied Economics 35 (12): 1369-1378. Tang, T. C. (2005). Does Exchange Rate Volatility Matter for the Balancing Item of Balance of Payments Accounts in Japan? An Empirical Note. RISEC, International Review of Economics and Business 52 (4): 581-590. Tang, T. C. (2006a). The Influences of Economic Openness on Japan’s Balancing Item: An Empirical Note. Applied Economics Letters 13 (1): 7-10. Tang, T. C. (2006b). Japan’s Balancing Item: Do Timing Errors Matter? Applied Economics Letters 13 (2): 81-87. Tsay, R. S.(1986). Nonlinearity Tests for Time Series. Biometrika 73 (2): 461-466. June 24-26, 2007 Oxford University, UK 10 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Appendix 1. Plot of Balancing Item of Balance of Payments Accounts for 20 Industrial Countries US (in US billion) Canada (in US million) 80 Australia (in US million) 8000 6000 40 Japan (in US billion) 800 2000 10 0 2000 0 -40 1000 -400 -2000 0 -1000 -10 -1200 -6000 -120 -8000 60 65 70 75 80 85 90 95 00 05 65 Denmark (in US million) 70 75 80 85 90 95 00 05 5000 4000 4000 3000 3000 2000 2000 1000 1000 0 0 -1000 -1000 -2000 -2000 -3000 -3000 70 75 80 85 90 95 60 65 00 05 80 85 90 95 00 05 -3000 60 65 France (in US million) 70 75 80 85 90 95 00 05 0 90 95 00 05 90 95 00 05 0 0 -400 00 05 00 05 00 05 -800 -20 -20 85 85 400 10 -1200 -30 80 80 800 -10 -10 75 75 30 10 70 70 Greece (in US million) 20 65 65 1200 40 60 60 Germany (in US billion) 50 -40 60 65 Ireland (in US million) 0 75 20 Iceland (in US million) 400 70 30 -4000 65 -20 Finland (in US million) 5000 60 -2000 -1600 60 6000 0 -800 -4000 -80 3000 400 4000 0 Austria (in US million) 20 70 75 80 85 90 95 00 05 -1600 60 Italy (in US million) 65 70 75 80 85 90 95 00 05 60 65 Netherlands (in US million) 6000 8000 12000 4000 4000 8000 2000 0 4000 70 75 80 85 90 95 Norway (in US million) 2000 1000 0 -1000 -400 0 -4000 0 -2000 -8000 -4000 -4000 -12000 -8000 -2000 -800 -3000 -4000 -1200 -1600 -6000 60 65 70 75 80 85 90 95 00 05 -16000 60 65 Portugal (in US million) 70 75 80 85 90 95 00 05 65 Spain (in US million) 3000 2000 -5000 -12000 60 70 75 80 85 90 95 00 05 -6000 60 65 70 Sweden (in US million) 2000 8000 1000 4000 75 80 85 90 95 00 05 UK (in US billion) 0 -1000 -4000 65 70 75 80 85 90 95 New Zealand (in US million) 30 3000 20 2000 10 1000 0 60 1000 0 0 0 -10 -1000 -1000 -20 -2000 -2000 -8000 -3000 -12000 -2000 -30 -3000 60 65 70 75 80 85 90 June 24-26, 2007 Oxford University, UK 95 00 05 60 65 70 75 80 85 90 95 00 05 -40 60 65 70 75 80 85 11 90 95 00 05 -3000 60 65 70 75 80 85 90 95 00 05 60 65 70 75 80 85 90 95 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Appendix 2. Summary of non-linearity tests on balancing item –bootstrapped p-values Country: Test: McLeod-Li test Using up to lag 4 Using up to lag 8 Using up to lag 12 Using up to lag 20 Using up to lag 24 Bicovariance test Using up to lag [.] Engle test Using up to lag 1 Using up to lag 2 Using up to lag 3 Using up to lag 4 Using up to lag 8 Using up to lag 10 Tsay test Continues… June 24-26, 2007 Oxford University, UK Austria Australia Canada Denmark Finland France Greece Iceland Ireland Italy 0.000 0.002 0.013 0.006 0.015 0.000 0.000 0.000 0.000 0.000 0.007 0.004 0.013 0.016 0.013 0.580 0.735 0.662 0.883 0.786 0.795 0.384 0.246 0.374 0.242 0.009 0.018 0.002 0.007 0.015 0.001 0.001 0.000 0.003 0.011 0.028 0.058 0.103 0.082 0.095 0.028 0.069 0.211 0.182 0.275 0.448 0.840 0.836 0.941 0.950 0.042 [7] 0.001 [8] 0.025 [8] 0.179 [6] 0.274 [6] 0.004 [6] 0.123 [6] 0.007 [6] 0.000 [6] 0.003 [7] 0.000 0.000 0.001 0.002 0.020 0.032 0.093 0.002 0.000 0.000 0.001 0.001 0.003 0.332 0.506 0.013 0.029 0.026 0.032 0.046 0.032 0.792 0.369 0.559 0.696 0.694 0.828 0.077 0.847 0.662 0.843 0.927 0.683 0.719 0.592 0.006 0.009 0.014 0.011 0.040 0.015 0.048 0.000 0.001 0.001 0.001 0.001 0.000 0.190 0.672 0.020 0.033 0.046 0.079 0.115 0.000 0.309 0.075 0.159 0.028 0.071 0.152 0.030 0.706 0.675 0.523 0.521 0.894 0.959 0.002 12 2007 Oxford Business & Economics Conference Country: Test: McLeod-Li test Using up to lag 4 Using up to lag 8 Using up to lag 12 Using up to lag 20 Using up to lag 24 Bicovariance test Using up to lag [.] Engle test Using up to lag 1 Using up to lag 2 Using up to lag 3 Using up to lag 4 Using up to lag 8 Using up to lag 10 Tsay test Continues… June 24-26, 2007 Oxford University, UK ISBN : 978-0-9742114-7-3 Germany Japan Netherlands Norway New Zealand Portugal Spain Sweden the UK the US 0.000 0.000 0.000 0.000 0.000 0.332 0.000 0.001 0.000 0.001 0.933 0.922 0.656 0.690 0.637 0.849 0.570 0.647 0.304 0.256 0.005 0.010 0.022 0.121 0.209 0.014 0.068 0.208 0.505 0.535 0.360 0.798 0.908 0.751 0.734 0.613 0.465 0.661 0.794 0.887 0.000 0.001 0.001 0.005 0.005 0.000 0.000 0.000 0.000 0.000 0.000 [7] 0.063 [6] 0.538 [7] 0.984 [6] 0.004 [6] 0.049 [6] 0.086 [6] 0.007 [6] 0.003 [7] 0.013 [7] 0.005 0.007 0.010 0.011 0.030 0.036 0.000 0.585 0.850 0.481 0.622 0.003 0.010 0.753 0.883 0.980 0.999 0.975 0.968 0.676 0.527 0.280 0.535 0.709 0.861 0.650 0.766 0.941 0.060 0.011 0.030 0.046 0.074 0.056 0.093 0.004 0.016 0.031 0.054 0.140 0.246 0.014 0.221 0.230 0.179 0.280 0.670 0.769 0.015 0.871 0.607 0.799 0.747 0.708 0.733 0.034 0.016 0.000 0.000 0.001 0.005 0.008 0.000 0.104 0.058 0.001 0.001 0.004 0.006 0.035 13 2007 Oxford Business & Economics Conference BDS test Dimension 2 3 4 Dimension 2 3 4 Dimension 2 3 4 Dimension 2 3 4 Dimension 2 3 4 Dimension 2 3 4 Dimension 2 3 4 June 24-26, 2007 Oxford University, UK Austria EPS=0.5 0.000 0.000 0.000 Denmark EPS=0.5 0.067 0.005 0.003 Greece EPS=0.5 0.001 0.000 0.000 Italy EPS=0.5 0.010 0.002 0.001 Netherlands EPS=0.5 0.147 0.004 0.010 Portugal EPS=0.5 0.441 0.040 0.012 the UK EPS=0.5 0.000 0.000 0.000 ISBN : 978-0-9742114-7-3 EPS= 1.0 0.000 0.000 0.000 EPS= 2.0 0.005 0.001 0.001 EPS= 1.0 0.158 0.032 0.008 EPS= 2.0 0.421 0.119 0.086 EPS= 1.0 0.002 0.000 0.000 EPS= 2.0 0.000 0.000 0.000 EPS= 1.0 0.194 0.054 0.010 EPS= 2.0 0.670 0.575 0.264 EPS= 1.0 0.519 0.174 0.127 EPS= 2.0 0.397 0.332 0.319 EPS= 1.0 0.114 0.005 0.001 EPS= 2.0 0.021 0.060 0.083 EPS= 1.0 0.000 0.000 0.000 EPS= 2.0 0.058 0.021 0.008 Australia EPS=0.5 0.000 0.000 0.000 Finland EPS=0.5 0.158 0.013 0.001 Iceland EPS=0.5 0.002 0.000 0.000 Germany EPS=0.5 0.000 0.000 0.000 Norway EPS=0.5 0.230 0.089 0.048 Spain EPS=0.5 0.968 0.616 0.056 the US EPS=0.5 0.000 0.000 0.000 EPS= 1.0 0.000 0.000 0.000 EPS= 2.0 0.004 0.000 0.000 EPS= 1.0 0.408 0.102 0.033 EPS= 2.0 0.235 0.250 0.283 EPS= 1.0 0.003 0.000 0.000 EPS= 2.0 0.212 0.041 0.024 EPS= 1.0 0.000 0.000 0.000 EPS= 2.0 0.001 0.000 0.000 EPS= 1.0 0.590 0.378 0.203 EPS= 2.0 0.791 0.634 0.580 EPS= 1.0 0.942 0.762 0.606 EPS= 2.0 0.329 0.202 0.107 EPS= 1.0 0.000 0.000 0.000 EPS= 2.0 0.076 0.016 0.000 14 Canada EPS=0.5 0.904 0.137 0.040 France EPS=0.5 0.000 0.000 0.000 Ireland EPS=0.5 0.290 0.123 0.094 Japan EPS=0.5 0.000 0.000 0.000 New Zealand EPS=0.5 0.017 0.006 0.013 Sweden EPS=0.5 0.306 0.028 0.016 EPS =1.0 0.659 0.075 0.023 EPS = 2.0 0.642 0.271 0.207 EPS =1.0 0.000 0.000 0.000 EPS = 2.0 0.031 0.031 0.039 EPS =1.0 0.284 0.105 0.034 EPS = 2.0 0.038 0.018 0.024 EPS =1.0 0.017 0.006 0.000 EPS = 2.0 0.268 0.289 0.264 EPS =1.0 0.003 0.000 0.000 EPS = 2.0 0.033 0.003 0.004 EPS =1.0 0.683 0.373 0.199 EPS = 2.0 0.128 0.120 0.161 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Table 1: Summary statistics on balancing item for 20 industrial countries (millions of U.S. dollars) the US 2873.3 3500 63660 -80530 21569.9 -0.3 5.6 37.9 0.0 373530 130 France Mean 0.3 Median 0.2 Maximum 20.5 Minimum -19.6 Std. Dev. 4.7 Skewness 0.1 Kurtosis 9.1 Jarque-Bera 188.4 Probability 0.0 Sum 36.4 Observations 122 Norway Mean -620.5 Median -306.0 Maximum 1633.0 Minimum -5634.0 Std. Dev. 1203.8 Skewness -1.7 Kurtosis 7.2 Jarque-Bera 138.4 Probability 0.0 Sum -70740 Observations 114 Mean Median Maximum Minimum Std. Dev. Skewness Kurtosis Jarque-Bera Probability Sum Observations June 24-26, 2007 Oxford University, UK Canada -218.0 -56.0 6932.0 -6658.0 2173.7 0.0 5.2 40.6 0.0 -42508.0 195 Germany 896.5 280 40180 -39230 9005.7 0.3 9.4 236.0 0.0 124620 139 Portugal 10.9 33.0 2425.0 -2009.0 656.5 -0.1 5.7 36.5 0.0 1343.0 123 Australia 7.6 31.5 758.0 -1212.0 331.1 -0.7 4.4 32.1 0.0 1393.0 184 Greece -33.2 -33.0 1130.0 -1472.0 366.3 -0.4 5.7 36.3 0.0 -3717.0 112 Spain -314.2 -316.0 1729.0 -2698.0 749.9 -0.2 4.5 12.1 0.0 -38642.0 123 15 Japan -119.8 0.0 16230 -18880 6156.5 0.0 3.9 3.8 0.15 -13540 113 Iceland -24.9 -7.0 262.0 -1413.0 150.1 -7.0 64.6 19457.7 0.0 -2918.0 117 Sweden -353.6 -185.0 6542.0 -7894.0 2186.1 -0.1 5.2 25.2 0.0 -42789 121 Austria 83.7 52.5 2682.0 -2055.0 687.7 0.5 6.3 68.0 0.0 11882.0 142 Ireland -27.2 23.5 5283.0 -4468.0 1400.3 0.1 6.9 62.4 0.0 -2664.0 98 the UK 1078.4 320 24930 -29670 7051.9 0.1 7.2 105.5 0.0 153130 142 Denmark Finland 10.6 -22.4 -84.0 -11.5 5174.0 4429.0 -2826.0 -3385.0 1085.3 1062.4 1.0 0.7 7.7 8.0 102.4 138.0 0.0 0.0 1021.0 -2728.0 96 122 Italy Netherlands -976.8 -463.2 -303.5 -23.0 5850.0 10814.0 -15473.0 -10281.0 2953.9 2774.1 -1.8 -0.1 7.9 6.4 217.6 73.9 0.0 0.0 -138706.0 -71334.0 142 154 New Zealand -10.3 0.0 2258.0 -2372.0 734.8 -0.4 4.6 13.3 0.0 -1039.0 101